Regardless of right or wrong, CZ is indeed one of the most faithful believers in Bitcoin in the industry, and this faith has allowed us to witness the exaggerated speed of a company from zero to global number one. As the most important infrastructure for cryptocurrencies, CZ has temporarily completed his mission, but Binance has not.

By Zhang Wen

A fine of 4.3 billion US dollars is the largest fine in the history of Chinese entrepreneurship, without exception.

The only amount that can be compared with this is the 18.2 billion RMB fine imposed on Alibaba two years ago, which is "only" 65% of the world's largest cryptocurrency exchange Binance. Even in the global internet giants, the 4.3 billion US dollar fine is among the largest in history.

From recording a video in front of his Shanghai company six years ago to introducing Binance, to using a 4.3 billion US dollar fine to resign and step down to ensure the operation of Binance, founder Zhao Changpeng has taken only six years to, with the blessing of the cryptocurrency boom, turn Binance into the world's largest cryptocurrency exchange platform with 1.5 billion users and thousands of employees worldwide, making it one of the most successful companies to go global.

This is also destined to be recorded in the history of science and the internet, with two top influential companies in the two most dynamic and most watched fields of science and the internet, OpenAI and Binance, founded by CZ, resigning for different reasons.

The six years of the CZ era are also six years of booming development and wealth explosion in the crypto world, and Binance's role in it, especially in boosting industry confidence during the bear market, cannot be underestimated.

Now that regulations are in place, regardless of Binance's future, we still want to record the six years of Binance, the right choices made by CZ and co-founder He Yi at the right time, and the combination of favorable timing, geographical advantage, and human harmony in the background of the main Bitcoin bull market. This may be the greatest six years of Chinese entrepreneurship.

CZ early entrepreneurial video screenshot

The "Cryptocurrency Iron Triangle" and the Birth of Binance

In 2014, Zhao Changpeng was just a Canadian technology returnee, serving as the CTO of the cryptocurrency market website Blockchain.info. Once, He Yi was hosting an event for OKCoin in Hangzhou, and CZ was a guest. After listening to CZ's sharing, He Yi greatly appreciated his talent and asked for his WeChat contact after the event.

Later, He Yi wanted to advertise for OKCoin on Blockchain.info and asked CZ for a discount, but CZ told He Yi, "We don't offer discounts for our ads." Being rejected made He Yi even more impressed with CZ. He Yi believed that he did not let personal feelings affect his decision-making and had a high level of professionalism. He then introduced CZ to Xu Mingxing and brought him into OKCoin.

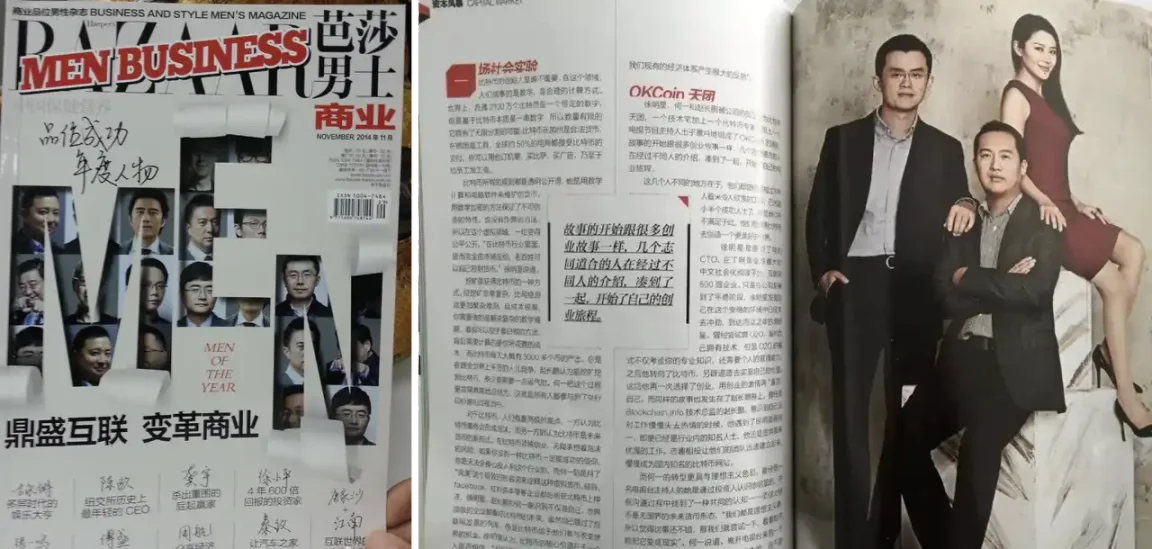

After joining the company, CZ did a great job. In addition to being responsible for the basic infrastructure, custody, and security of on-chain transactions, CZ managed the development of all products. Because of his good English, CZ was also responsible for promoting the overseas market. This is how the "Cryptocurrency Iron Triangle" that resonated throughout the cryptocurrency industry in 2014 was formed.

The "Cryptocurrency Iron Triangle" featured in the high-end magazine "Fashion Bazaar"

Of course, in hindsight, this triangle was not as "iron" as it seemed. In the startup world, there is never room for two tigers on one mountain. Both CZ and Xu Mingxing had technical backgrounds, and the two often had differences in decision-making logic and cultural background.

At the end of 2014, CZ and his former employer Blockchain.info signed an agreement for OKCoin to operate the Bitcoin.com domain for 5 years, during which all advertising revenue from the website would belong to OKCoin. However, due to poor operational results, OKCoin wanted to terminate the cooperation early.

But Roger Ver, known as the "Bitcoin Jesus" and the owner of Bitcoin.com, believed that OKCoin should pay compensation on a monthly basis, leading to several months of economic disputes between the two parties.

To Xu Mingxing's surprise, CZ took a strong stance in favor of Roger Ver during this dispute, accusing OKCoin of violating professional ethics and forging his signature for bank transfers. Subsequently, OKCoin immediately issued a statement accusing CZ of not only forging contracts but also fabricating lies to attack OKCoin.

In the end, this war of words led to CZ being fired by OKCoin. And as the person who recommended CZ to join the company, He Yi was also caught in the middle of this controversy and found himself in a difficult position. In the second half of 2015, He Yi quietly bid farewell to OKCoin.

After leaving OKCoin, He Yi chose to join a company with a market value of 20 billion RMB at the time. In June 2017, CZ officially established Binance. In July 2017, Binance launched its own platform token BNB at an issuance price of 1 yuan. However, shortly after its launch, BNB fell below the issuance price, with one BNB worth only 50 cents. At the time, Binance was "criticized severely." He Yi later recalled that it was the most stressful period for CZ, during which he lost 10 kilograms in three weeks.

Two months after the founding of Binance, He Yi decided to bid farewell to the company and start from scratch as the CMO, working with CZ to build Binance. After the news of He Yi joining Binance was announced, the price of BNB rose, and the trading volume of BNB and the newly launched BTM token on the platform immediately surged, pushing the trading volume into the global top 10.

He Yi also brought his experience in operating live broadcasts to Binance, where he gave away coins and cars, seemingly straightforward but effective in attracting a significant amount of traffic to Binance. On August 22, Binance hosted a live broadcast with Justin Sun, discussing the TRON project. During the live broadcast, a TRON purchase event was launched, and within 53 seconds, 500 million TRON tokens were sold, making TRON the "first ICO project" of the second half of 2017.

On August 25, Binance signed an investment memorandum with Sequoia China. The memorandum stipulated that Sequoia China would invest approximately 60 million RMB in Binance's Series A financing, accounting for 10.7% of the shares, and also agreed to provide a bridge loan of approximately 30 million RMB to Binance's Japanese subsidiary. Binance's valuation soared to 500 million RMB.

The "94 Crisis" - Binance Completes the "Overtaking on a Bend"

Just as Binance's development was unstoppable, the arrival of "94" directly poured cold water on the entire cryptocurrency industry, including Binance. On September 4, 2017, the government's seven ministries and commissions announced a crackdown on the chaos in the cryptocurrency industry, declaring a halt to all token issuance and financing activities, including ICOs. With this news, Bitcoin plummeted, and everyone thought that cryptocurrencies were finished.

For Binance, however, "94" was a rare opportunity for "overtaking." Binance had only been doing coin-to-coin trading, and the company's servers were registered overseas. CZ himself was a foreign national, so taking an international route became a natural choice: "Since China cannot do it for the time being, we decisively withdrew from the Chinese market and focused on international business."

What impressed many investors at the time was Binance's "market price refund" to Chinese investors.

According to regulations, if the issuance price was one yuan, then only one yuan would be refunded during the refund, returning the principal to the investors. However, Binance decided to refund based on the market price of BNB. After a round of price increases, the price of BNB remained around 6 yuan after "94," and many projects involved ETH, so Binance also refunded based on the market price of ETH, which cost the company a significant amount of money. Although Binance suffered losses, it gained the trust of the industry.

Afterward, while Binance continued to promote itself on social media under pressure, it also took the lead in Japan, filling the gap left by domestic trading platforms. For a time, a large number of users from domestic platforms such as OKCoin and Huobi flocked to Binance, and Binance once again began to surge ahead.

On December 15, 2017, Binance, which had been established for six months, announced its operational data: top three in global trading volume, 24-hour trading volume exceeding 21 billion US dollars, and a 100% increase in BNB market value. On December 18, Binance's daily trading volume exceeded 30 billion US dollars, making it the world's number one cryptocurrency exchange platform. On the 19th, Binance's user base surpassed 2 million, and then in less than a month, it soared to 5 million.

On January 10, 2018, Binance's trading volume exceeded 10 billion US dollars; in February, CZ appeared on the cover of Forbes magazine.

Of course, Binance also faced challenges. On the night of March 7, 2018, Binance was hacked, and many users found that the tokens in their accounts had been traded at market prices for Bitcoin, causing the prices of most tokens to plummet. After triggering panic selling, the hacker used the stolen accounts to buy Bitcoin and then a token called VIA, causing the price of VIA to skyrocket more than 110 times in a short period, leading to a more than 10% drop in the price of Bitcoin within an hour.

After the incident, Binance was criticized for "guarding the thief and blaming the hacker."

At the end of 2017, Binance's financing negotiations with Sequoia China broke down, leading to a year-long dispute between CZ and Sequoia. In 2018, Sequoia Capital applied for an injunction in the Hong Kong High Court, prohibiting Zhao Changpeng and other investors from negotiating. After the Hong Kong High Court rejected the injunction, on May 7, 2018, Zhao Changpeng publicly challenged Sequoia Capital on Twitter, stating that all projects listed on Binance in the future would need to disclose whether they had direct or indirect connections with Sequoia Capital.

CZ's tough stance once again significantly increased Binance's visibility in the crypto community. In 2018, according to statistics from Benzinga, which tracked the Baidu search volume, media coverage, and fan base of cryptocurrency exchange founders, Binance's name consistently ranked first, with exposure far exceeding that of its competitors.

After the "94 Incident," due to regulatory pressure in various countries and the high discrimination from Western media, many domestic exchanges began to downplay their "Chinese elements" in order to continue their business. With Binance's expansion overseas, He Yi gradually stepped back, and CZ took the forefront.

At that time, the blockchain industry's infrastructure and ecosystem were not yet mature, but Binance decided to experiment in various aspects of the industry, including upstream, midstream, and downstream.

Upstream, Binance Labs was established, initially focusing on industry investments, but later also attracting traditional financial capital. In the midstream, Binance Smart Chain was launched, providing a more encrypted native space for projects. In an interview in 2018, Ella, who was in charge of Binance Labs at the time, revealed the launch plan for BSC. There were also extensions in the downstream, such as Binance Info and charity initiatives.

In 2018, Binance also made an acquisition, purchasing Trust Wallet.

This was Binance's first public acquisition. He Yi recalled that when they first found Trust Wallet, the team was already planning to launch a token, so their initial impression was not very good. However, after using and experiencing the product, He Yi quickly decided to have another conversation with them. In August, Binance announced the acquisition of Trust Wallet.

CZ was very excited about the acquisition of Trust Wallet. At the time, he posted a series of tweets on Twitter, claiming that the next generation of mobile wallets was about to begin and likening Trust Wallet to an "unpolished diamond," indicating that Binance planned to expand its wallet solution and integrate it into its services. Trust Wallet is now the leading wallet in terms of market share.

2019 - A Turning Point for Binance

Looking back, 2019 may have been a turning point in Binance's six-year history. In this year, Binance broke away from the consumption war with many exchanges and began to gradually distance itself from its peers.

Many people believe that Binance's breakthrough in 2019 was achieved through its innovative IEO model. In January 2019, leveraging its overseas advantages, Binance announced the relaunch of Launchpad, leading the way in the IEO journey. The first project was Bittorrent (BTT) by Justin Sun, which was sold out in less than 13 minutes.

In hindsight, the Bittorrent project may not have much to talk about, but at that time, in a period of no fluctuations and hope, the impact of a project that surged 20 times upon listing on the market was immeasurable.

In fact, Binance proved to be the most successful player in the IEO space, not only attracting attention but also drawing users away from other platforms. Seeing Binance's breakthrough, Huobi and OKCoin immediately joined the "IEO Club."

However, the ultimate breakthrough for Binance was not solely due to the new IEO model, as by May and even the end of the year, the "big three" were still fiercely competing for the contract market. CZ's confidence did not only come from the victory of IEO. In 2019, Binance's efficiency and progress in all aspects could be described as "terrifying."

After igniting the IEO trend in January 2019, Binance then launched Binance Smart Chain (now BNB Chain) in February; in May, the first DeFi project on the chain, CRED, was launched, and Binance entered the derivatives market with leverage and contract trading; in June, Binance Labs announced the incubation of 13 new projects; in July, Binance.us was established; in September, Binance successively launched BUSD, financial products, and staking platforms; in December, Binance acquired JEX and launched Binance Cloud, as well as the landmark event - investment in FTX.

In the midst of a freezing market, Binance pursued multiple business lines and tried every means to increase trading volume and attract capital. This year, Binance's business progress gradually reflected in the company's profits.

On September 19, 2019, Zhao Changpeng announced on Twitter that the total trading volume of Binance's platforms in the past 24 hours was approximately 71.2 billion RMB, stating that this was just a small step for Binance.

Someone calculated Binance's profits based on the fiat value of BNB destroyed in the third quarter of 2019. Even as cryptocurrency market trading declined, Binance's profits continued to increase, by around $10 million more compared to the second quarter.

By its third anniversary, Binance had become the platform with the largest trading volume in the industry, and the total value of Binance's platform token BNB exceeded 2.4 billion US dollars. (*Based on the proportion of platform token repurchases and destruction)

Within three years, Binance had built its own ecosystem, with over 10 full acquisitions and more than 20 investments, with the total investment and acquisition amount expected to exceed 500 million US dollars. The acquisition of the industry's largest market data platform, CoinMarketCap, in April 2020 alone was reported to be worth 400 million US dollars. In the first quarter of 2020, the total investment and financing amount in the blockchain industry was approximately 800 million US dollars, meaning that Binance's acquisition accounted for half of the industry's total investment and financing in the first quarter.

At the same time, Binance faced increasing controversies. Known for its high-level approach overseas, Binance also adopted a strategy of using attractive female figures, and co-founder He Yi was almost engaged in daily social media disputes with "friendly competitors."

The bigger controversy was on the business front. In the previous year, Binance also ventured into leverage, a practice it had previously criticized, and combined with the aforementioned acquisition of the industry's largest market data platform, CoinMarketCap, this "athlete acquiring the referee" behavior led to more people starting to denounce Binance.

FTX's collapse led to Binance becoming the first target of regulation

After FTX's bankruptcy and the cryptocurrency crash last year, lawsuits and various cases against trading platforms have continued to increase, and naturally, Binance has become the first target of regulation.

In fact, the first to focus on Binance may have been the US Department of Justice. According to Reuters, the US Department of Justice's investigation into Binance began in 2018, covering allegations of unlicensed money transfers, money laundering, and violations of criminal sanctions.

In 2019, Binance was banned in the United States for regulatory reasons. In response, Binance and other investors established Binance.US. In May 2021, Bloomberg reported that Binance was under investigation by the US Department of Justice and the Internal Revenue Service for money laundering and tax evasion. In December 2022, Binance's US entity, Binance.US, announced the acquisition of Voyager Digital's assets for $10.2 billion. This transaction was canceled in April 2023, with Binance.US citing a "hostile and uncertain regulatory environment."

At the end of 2022, there were internal disagreements among US Department of Justice prosecutors about whether to bring criminal charges, including money laundering, against Binance. Some prosecutors believed they had enough evidence to bring criminal charges against Binance executives, including CZ, while others felt more time was needed to review additional evidence. Additionally, sources said that Department of Justice officials had discussed possible plea agreements with Binance's lawyers.

The outcome for Binance today is also driven by the Department of Justice. On November 21, according to Bloomberg, the US Department of Justice is seeking over $4 billion in fines from Binance as part of a proposed settlement following several years of investigation. Today, Binance announced a settlement with the US Department of Justice, the Commodity Futures Trading Commission, the Office of Foreign Assets Control, and the Financial Crimes Enforcement Network regarding historical registration, compliance, and sanctions issues. The settlement marks the company's acknowledgment of past criminal compliance violations and indicates that it will use this as an opportunity to lay the foundation for the next 50 years of development. The US agencies' settlement does not accuse Binance of misappropriating user funds or market manipulation.

In addition to the lawsuits from the Department of Justice, Binance was also sued by the US Securities and Exchange Commission (SEC) for alleged violations of securities trading rules. In June 2022, the SEC launched an investigation into Binance to determine whether the company's 2017 BNB token ICO constituted an illegal sale of securities.

The SEC accused Binance and CZ of illegally promoting cryptographic asset securities to US investors and issuing and selling cryptographic asset securities and other investment plans multiple times through unregistered online trading platforms on Binance.com and Binance.US. Through this, Binance and CZ made billions of dollars in profits while exposing investors' assets to significant risks.

In contrast to the SEC, the US Commodity Futures Trading Commission (CFTC) has been using various means to take action against Binance to compete for regulatory authority over cryptocurrencies. The CFTC obtained chat records between CZ and employees and used them to file a lawsuit against Binance. On March 27, 2023, the CFTC released court documents mentioning several segments of chat records about CZ using the Signal messaging app, including his conversations with Binance employees, US customers, and more. The chat records also mentioned CZ giving instructions to employees to use Signal for communication about "US sanctions."

The next day, CZ responded to the CFTC's lawsuit on the official website, expressing disappointment that Binance had been cooperating with the CFTC for over two years and stating, "Upon preliminary review, the lawsuit appears to contain incomplete factual statements, and we disagree with the description of many issues," including compliance technology, the ban on US user access, cooperation and transparency with law enforcement, registration and licensing, and trading.

Despite CZ repeatedly emphasizing Binance's focus on compliance, Binance has also applied to the court several times to dismiss the CFTC's lawsuit. However, this tug-of-war came to a conclusion today, with CFTC Chairman Rostin Behnam stating at a press conference on Tuesday that Binance's actions "undermined the foundation of a safe and sound financial market" and that the CFTC had imposed a $1.35 billion trading fee on Binance, the largest fine in the CFTC's history.

CZ's era comes to an end

November 22, 2023, a historic day, especially when it comes to Binance's history. After the news broke, "Big Sister" responded to messages in various communities, stabilizing emotions, and even participating in discussions in inactive groups, continuing her role as a customer service representative.

In order to reach a settlement, CZ set aside the achievements of his six years of entrepreneurship in exchange for a stable future for Binance. The settlement also signifies Binance's acknowledgment of past criminal compliance violations and indicates that it will use this as an opportunity to lay the foundation for the next 50 years of development.

At the same time, CZ completed a "heroic sacrifice," officially becoming a part of Binance's history, admitting to money laundering and violating US sanctions, and stepping down as CEO of Binance, with a sentencing hearing scheduled for February next year.

The new CEO of Binance will be Richard Teng, the former head of global regional markets at the company. In an open letter, CZ pointed out that Richard Teng, with his thirty years of experience in financial services and regulation, will lead Binance into the next growth stage, ensuring the company's development in security, transparency, compliance, and growth. He will continue to provide consulting services to the team and plans to engage in passive investments in areas such as blockchain, Web3, DeFi, artificial intelligence, and biotechnology after a brief rest.

Super Jun once recalled a past event, where many years ago he attended a blockchain conference and met some industry leaders. During the event, a young man voluntarily offered to take a photo for him. That young man was CZ.

Regardless of right or wrong, CZ is indeed one of the most faithful believers in Bitcoin in the industry, and this faith has allowed us to witness a company's exaggerated speed from zero to global number one. As the most important infrastructure for cryptocurrencies, CZ has completed his mission, but Binance has not.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。