Zhao Changpeng faces a maximum of 18 months in prison, and Binance has not yet reached a settlement with the U.S. Securities and Exchange Commission (SEC).

By: Shuqing

Source: Wall Street News

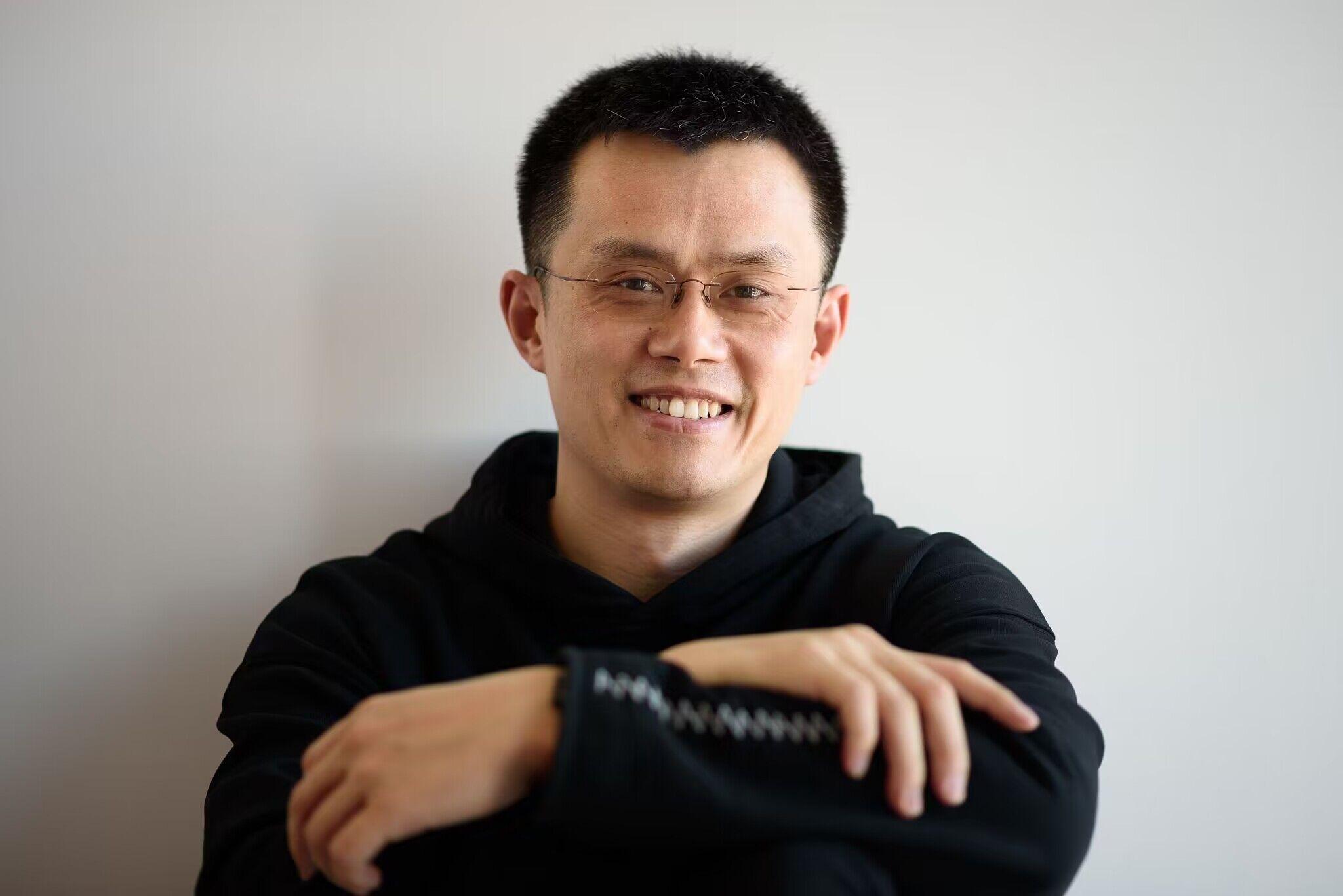

The CEO of the world's largest cryptocurrency exchange Binance, Zhao Changpeng, has resigned from his position and admitted to violating U.S. anti-money laundering laws. This compromise may allow Binance to continue operating.

Media reports citing court records stated that Zhao Changpeng appeared in a federal court in Seattle on Tuesday and entered a plea. Prosecutors accused Binance of facilitating transactions for sanctioned organizations and encouraging U.S. users to conceal their locations to avoid money laundering charges.

Binance admitted guilt and agreed to pay a total of $4.3 billion, including the amount reached in a civil settlement with the U.S. Commodity Futures Trading Commission (CFTC). However, as of now, Binance has not reached a settlement with the U.S. Securities and Exchange Commission (SEC).

Court records also show that Zhao Changpeng agreed to pay a criminal fine of $50 million, although this amount may be reduced based on the separate civil fine he agreed to pay. Zhao Changpeng's plea agreement has not been made public.

"I made a mistake, and I must take responsibility," Zhao Changpeng wrote on the social media platform X (formerly Twitter), "This is the best for our community, Binance, and myself."

According to federal sentencing guidelines, Zhao Changpeng faces a maximum of 18 months and a minimum of 10-12 months in prison, and he will be sentenced later.

Just a few weeks ago, a jury found FTX founder Sam Bankman-Fried (SBF) guilty of 7 counts of fraud and conspiracy, potentially facing life imprisonment. Will his longtime rival Zhao Changpeng also end up in prison? Will the two richest individuals in cryptocurrency history become friends behind bars?

According to CoinDesk data, Binance's native token Binance Coin dropped by 5.3% to $242, while the largest cryptocurrency Bitcoin fell by 1.5% during the same period.

In a statement, Binance acknowledged that it lacked necessary compliance controls in the past, but this settlement signifies its acceptance of responsibility. Due to the legal troubles, Binance has laid off a large number of employees this year, and top executives have fled.

Knowingly Illegal, Intentionally Illegal

Prosecutors accused Binance of facilitating transactions for sanctioned organizations and encouraging U.S. users to conceal their locations to avoid money laundering charges.

Prosecutors stated that Binance knew it had millions of U.S. users as early as 2018 but did not establish a plan to detect money laundering or violations of sanctions. Prosecutors claimed that from January 2018 to May 2022, Binance processed transactions worth $899 million between U.S. individuals and individuals believed to be located in Iran.

Prosecutors claimed that Zhao knew he had many U.S. customers, and in a chat in September 2019, he wrote, "Although the law seems to prohibit this, I have accumulated so many U.S. users, 'asking for forgiveness is better than permission.'"

"Using new technology to break the law will not make you a disruptor. It will make you a criminal," said Attorney General Merrick Garland.

The transactions allowed Zhao to retain a majority stake in Binance, although he will be unable to hold executive positions in the company. Justice Department officials stated that he is not eligible to return to the company.

Binance has not yet reached an agreement with the SEC, posing a potential threat to Zhao Changpeng

Insiders stated that for several months, the Justice Department and Binance have been working to reach an agreement. Zhao Changpeng recently hired a new chief lawyer, William A. Burck of the U.S. law firm Quinn Emanuel Urquhart & Sullivan, to represent him in court, with Gibson Dunn & Crutcher representing Binance.

Insiders stated that Binance and Zhao Changpeng have not yet reached a settlement with the U.S. Securities and Exchange Commission (SEC). The SEC sued Binance and Zhao Changpeng in June, accusing them of violating the U.S. Investor Protection Act. Top cryptocurrency exchanges, including Binance, have decided to sue the SEC, believing they can prove that cryptocurrencies are not a type of investment regulated by the SEC.

According to previous media reports, the Justice Department's investigation focused on Binance's anti-money laundering detection and prevention plan, and whether the plan allowed individuals from sanctioned countries such as Iran and Russia to trade on the exchange with U.S. individuals.

Insiders stated that another agreement resolves a civil lawsuit brought earlier this year by the U.S. Commodity Futures Trading Commission (CFTC) against Binance and Zhao. The $4.3 billion that Binance must pay includes amounts for settling CFTC claims and claims from Treasury Department agencies.

Will Zhao Changpeng go to prison?

In theory, violating the Bank Secrecy Act, which requires financial institutions to take measures to prevent and suppress money laundering activities, carries a maximum sentence of 5 years in prison. Zhao Changpeng, who admitted to violating this law, may also face 5 years in prison, but several signs indicate that he may not receive the maximum penalty.

First, as a condition of the agreement, Zhao Changpeng is now prohibited from holding executive positions at Binance but will be allowed to retain a majority stake in the company.

Media believe that the Justice Department's concession indicates an official willingness to accommodate Zhao Changpeng to some extent in order to achieve a historic settlement with Binance. While federal prosecutors may not decide how long Zhao Changpeng will spend in prison, they do have the ability to influence sentencing.

Although Justice Department sources told the media on Tuesday that they plan to impose an 18-month sentence on Zhao Changpeng, this does not guarantee that he will definitely go to prison. In similar criminal cases related to cryptocurrency and money laundering in the past, prosecutors have requested harsh sentences, but these requests have been rejected.

Furthermore, Zhao Changpeng's future plans apparently do not include serving a sentence, at least publicly. Zhao Changpeng stated on X on Tuesday that he plans to take some vacations in the coming months, "passively invest in blockchain, DeFi, artificial intelligence, and biotechnology startups," and may become a mentor to some entrepreneurs.

Even if Zhao Changpeng is somehow sentenced to prison, those hoping for a reunion with his longtime rival SBF in prison may be disappointed.

According to legal advisor Christopher Zoukis, federal inmates sentenced to 10 years or less are placed in the lowest security level federal prisons, which provide dormitory-style accommodations and relatively good quality of life for non-violent offenders. Even if Zhao Changpeng receives the worst sentence, he would be sent to such a place. SBF may serve decades in a medium-security level federal prison.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。