On the evening of January 17th at 20:00, the AICoin editor combined the US dollar index, chip distribution chart, and other tools in the PRO member group to deeply decode the trend of Bitcoin spot ETF and provide trading strategies for the future market. The specifics are as follows:

Conclusion: There may be significant downward pressure on short-term market trends, but the long-term outlook is optimistic.

I. Review of the ETF Launch Process

- The first piece of news was in October 2023, when there were rumors online that the SEC had approved BlackRock's Bitcoin ETF application, causing a surge and then a denial followed by a pullback.

- Before the ETF was approved, the SEC mistakenly tweeted about the approval of the ETF.

- The ETF was officially approved as scheduled.

Looking back, it can be observed that the authorities continuously used news to test the market's expectations: news release, denial of false news, and then the drama of the actual occurrence of the news as originally reported was played out once again.

Therefore, after the expectations were met, BTC did not experience a significant increase because some large institutions must have had some inside information, and the expectations had already been consumed in advance.

As shared with everyone before, after the approval of the Bitcoin spot ETF, if the market does not surge, then there will likely be a wave of pullback, which is currently the stage we are in.

II. What other news should we pay attention to after the ETF is approved?

The market size of the ETF The reason we are so concerned about the ETF is that it opens up a new investment channel for traditional financial traders. With new funds entering the market, there will be upward momentum.

Actions of Grayscale Grayscale's ETF-related applications have also been approved, successfully converting GBTC to an ETF, and at the same time becoming the largest BTC ETF institution in terms of scale. According to the Grayscale holdings indicator, it is evident that the recent holdings are continuously decreasing, while the premium rate is continuously increasing.

This indicates that there are more participants in the secondary market, but Grayscale is reducing its holdings. Because ordinary people can only trade in the secondary market, but Grayscale's authorized participants, which are the initial institutions and large holders, can actively reduce their holdings.

There have also been ongoing related market news.

Additionally, an important piece of information is that Grayscale's ETF has a very high fee! A 1.5% fee, compared to BlackRock's 0.25%, the high fee rate may also lead some users to switch to other ETFs.

Here, there may be some confusion among people, as this seems to be negative news, why is the editor confident about the future market?

The answer is simple, because the ETF door has been opened, more players will enter the crypto market, so it is a long-term positive. But in the short term, because Grayscale's original position is large, Grayscale's selling pressure will have a significant impact on the market in the short term.

Furthermore, in the long term, there is also the expectation of Bitcoin halving.

Everyone can take a look at Bitcoin's performance last year, which basically outperformed most risk assets. Here, we can directly look at the introduction of BlackRock's ETF. BlackRock has compiled Bitcoin's performance from 2013 to 2023, and it can be seen that Bitcoin has been leading in terms of annual returns for most of the time, with cumulative returns and annualized returns far ahead.

Therefore, after the ETF is approved, we need to continue to pay attention to the growth rate of various ETFs and the subsequent actions of Grayscale, the big brother.

III. How to explore trading opportunities in the future market

(A) Pay attention to the macro environment

First, we need to pay attention to the macro environment, focusing on the US dollar index. Usually, macroeconomic data such as CPI and non-farm payrolls will be reflected in interest rate hikes, and interest rate hikes will be reflected in the US dollar index.

The data shows that the 40-day moving average of the US dollar index has crossed the death cross, which means the US dollar is strengthening, so BTC will weaken. Therefore, currently BTC has not yet recovered from the previous decline and is in a period of consolidation and oscillation.

At the same time, we can see that the signals are quite dense recently, indicating that there is currently intense competition for direction, and we need to continue to pay attention to the future changes in the market.

(B) Determine the support and resistance levels and the timing of entry and exit

In the case of expected weakness in BTC, how do we determine the pressure and support levels in order to choose the timing of entry? Here, we need to use the second tool, the chip distribution chart.

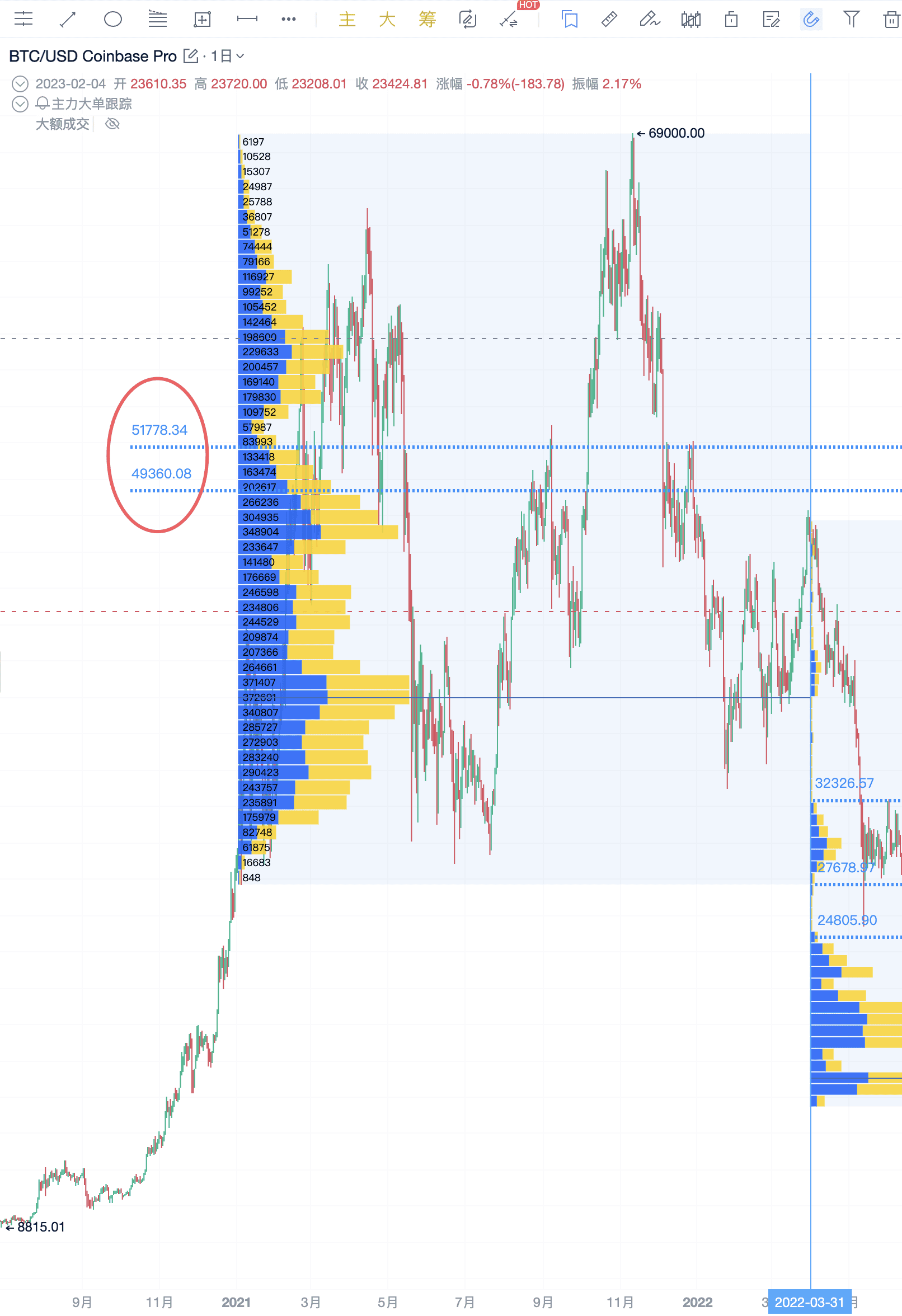

Many people may look at the chip distribution chart on a relatively short time frame, but the reference significance of the chip distribution chart on a short time frame is generally not significant because of the short time and small data volume. Therefore, when using the chip distribution chart, we must use a longer time frame, such as 4 hours or 1 day.

On the daily time frame, from March 2022 to February 2023, it is evident that several gaps in the chip distribution chart are important pressure and support levels from last year's market, namely 25,000, 28,000, and 32,000.

Usually, gaps are places where rapid surges or declines occur, and these places generally trap many people. The institutions will not easily let retail investors escape, and will repeatedly test the corresponding positions until the traders really release the chips, only then will the institutions move in the direction they want. Taking the position of 25,000 as an example.

In the image, it is evident that the price tested twice before accelerating upwards. Those who gave up their chips below had few opportunities to get on board last year.

Now let's look at the recent situation, where we divide it into two parts: one part is to look at the resistance above, and the other part is to look at the support below.

To look at the resistance, we need to look at the history, and look at the data from the last bull market.

It can be seen that the first resistance level is around 49,000, which has been tested, and the price has now pulled back. The second resistance level is around 52,000. If the first resistance level is broken through, this position should be monitored.

For the support, we look at recent data:

Around 40,000 is a support level. If it falls below 40,000, there is a high probability of a decline; if it does not fall below 40,000, there is a high probability of a rebound.

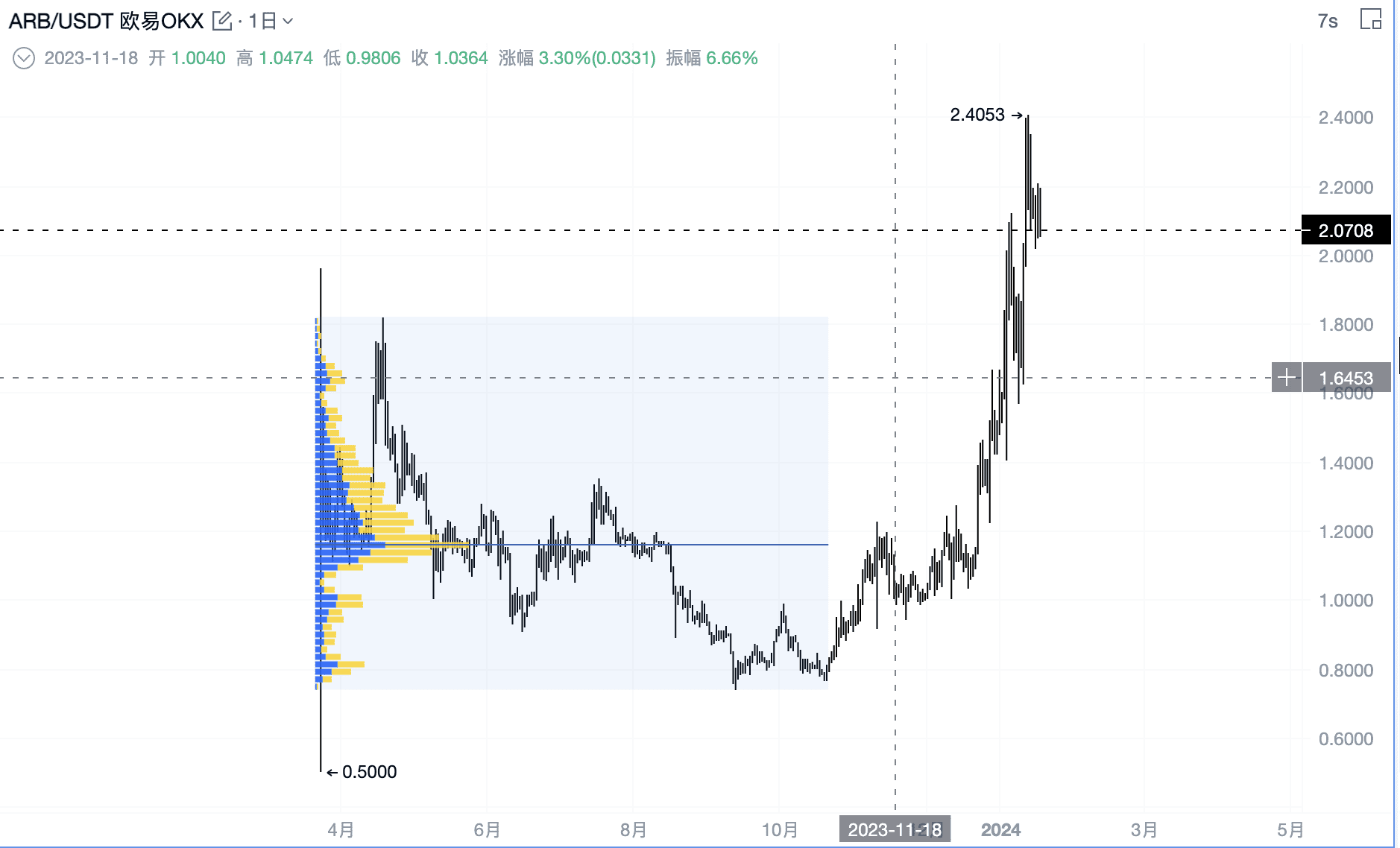

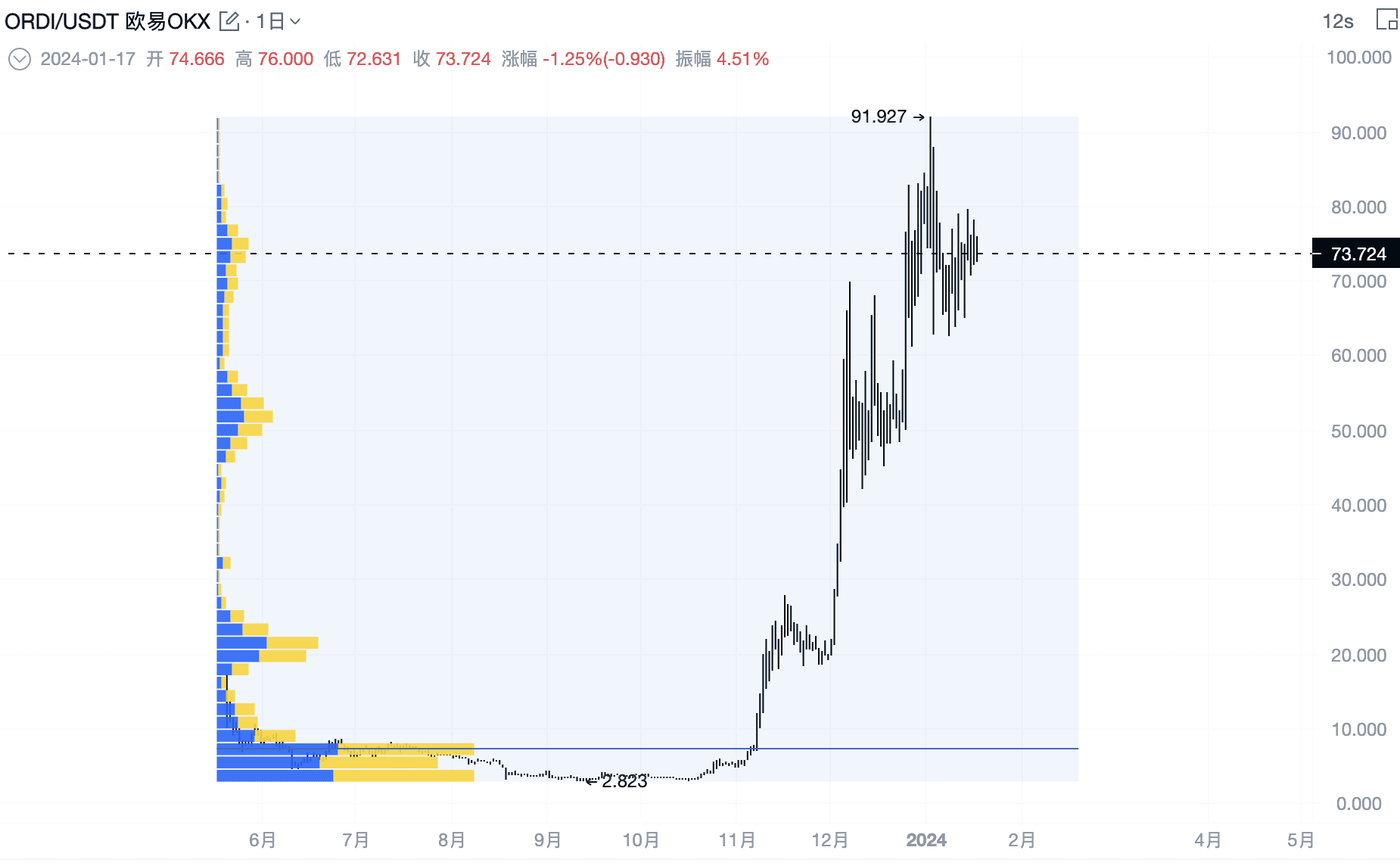

Currently, the main analysis is on BTC, but chip distribution is also very effective on many other currencies, so we won't go into detail below, but will provide a few images for everyone to get a feel for it.

Analysis of chip distribution at key points is very important. Once key positions are found, operations can be flexibly chosen. For example, if BTC has not broken through 40,000 and is in a oscillating market, we can profit from oscillating indicators.

Our 30-minute super wave long strategy points are very good. If the market falls below 40,000, we need to consider a trend reversal approach, stop the oscillating strategy, and follow the trend.

Setting alerts while the market is in motion is essential for tracking the market. Everyone can set alerts for the key points and indicators used.

In addition, using multiple methods and indicators for market analysis is very comfortable. A multi-dimensional view of the market can improve the win rate.

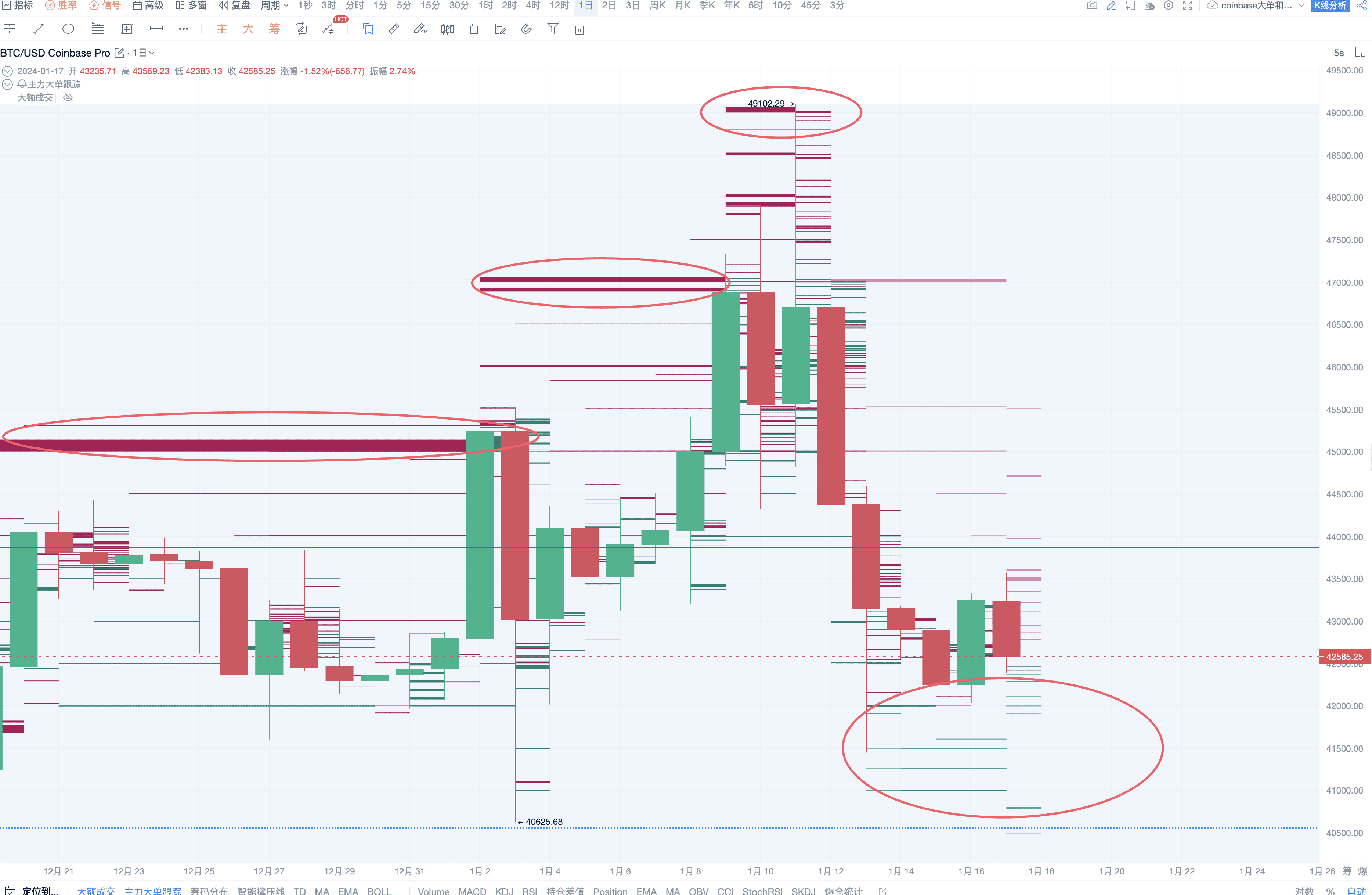

Finally, I would like to recommend the Main Force Large Order Indicator, which is also our unique feature. While chip distribution focuses on long-term pressure and support levels in the market, the main force large order focuses on the real-time actions of the main force.

I recommend everyone to pay more attention to Coinbase BTC spot, as Coinbase is a compliant exchange and also the custodian exchange for many ETFs. As shown in the image below, these orders are very good pressure and support levels.

Note the short-term pullback risk, grasp the long-term positive trend, find the right positions, and enter the market at the right time. Wishing everyone a successful trading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。