Author: Gyro Finance

In the consensus of the crypto circle, institutions do not always mean glamour and foresight. In fact, they may just be the top players in the game of "harvesting leeks."

This time, it seems that DWF has once again gotten into trouble, and the source of the matter leads back to Binance.

On May 9th, The Wall Street Journal published an in-depth report on Binance, conducting related investigations through interviews with Binance employees, documents, emails, and other industry participants. The report pointed out that despite Binance's expansion of its market surveillance team and the hiring of over ten investigators from Bank of America and hedge fund Citadel to address the SEC investigation in 2022, Binance secretly ignored the improper trades it discovered and even dismissed the investigation team. In short, they did not solve the problem but got rid of the people who raised the issue.

The improper trades mentioned in the article directly pointed to the market maker DWF. The investigation team found that VIP clients, who are customers on Binance with monthly trading volumes exceeding $100 million, were involved in pump and dump and wash trading, which is explicitly prohibited by Binance's terms and conditions. From the data, DWF played a significant role in this, conducting $300 million worth of wash trading in 2023 and manipulating the prices of over 6 tokens including YGG, CFX, MASK, ACH, and FET.

After discovering the issue, Binance's surveillance team submitted a report recommending the banning of DWF Labs in late September last year. However, the final result was that Binance believed there was insufficient evidence of market manipulation, and just a week after the report was submitted, the head of the investigation team was dismissed.

The report quickly sparked widespread discussion in the market. DWF immediately responded, stating that "many of the allegations recently reported in the media are unfounded and distorted the facts. DWF Labs upholds the highest standards of integrity, transparency, and ethics, and we are committed to supporting over 700 partners in the entire crypto ecosystem."

Binance co-founder He Yi also responded to this, stating that Binance has always had a strict market supervision framework for market makers and does not target any funds, directly pointing out that the competition between market makers does not involve the trading platform. To ensure fair trading, relevant situations will be truthfully reported to regulatory authorities.

Binance clarification, He Yi's response, Source: X Platform

Regardless of the truth of this incident, when it comes to DWF, in the hierarchy of market makers, it can already be described as "infamous."

Compared to other long-standing market makers, DWF has not been in the market for a long time. According to the official website, DWF Labs is a subsidiary of Digital Wave Finance, claiming to be a leading multi-stage Web3 investment company and ecosystem partner, founded in 2018. However, detailed information shows that the DWF Labs domain was registered on May 30, 2022, and its true emergence was in 2023.

In 2023, DWF attracted attention in the bear market with its high-frequency investment operations averaging 5 times per month. Subsequently, its founder frequently flaunted supercars, shifting the industry's focus to this investment institution and market maker that was not particularly prominent in scale. From the data, DWF's footprint has been established. According to the founder's disclosure, DWF Labs has invested in over 740 projects, and the number of investment projects has increased significantly since November 2023. The official website describes DWF as one of the world's largest high-frequency cryptocurrency trading entities, conducting spot and derivative market trading on over 60 exchanges.

From a business model perspective, although it appears similar to other investment market makers, DWF extends its business to investment. DWF Labs' Executive Founder Andrei Grachev admitted early on that DWF is also an investment company, stating, "We usually invest in SAFT before and during the seed stage. If the token is already listed and tradable, we will also invest according to the unlocking schedule and lock-up period or in batches. In addition to investments, we also provide additional support, such as public relations, marketing, and fundraising."

This undoubtedly sparked controversy.

Market makers participating in project investments make it difficult to avoid market manipulation to some extent, and DWF's habit of transferring project tokens to exchanges for sale directly confirms this.

In April last year, Twitter user Nay pointed out that through on-chain data analysis, DWF Labs' token inflow and outflow almost always matched the time and dollar amounts, indicating that these were not loans and therefore not standard market maker transactions. DWF Labs' trading pattern involved either purchasing stablecoins of $50,000 to $100,000 daily or making large transactions of up to $5 million per trade, then depositing all (or almost all) funds on centralized exchanges.

These operations directly affected the market to achieve effective cashing out. From a business model perspective, DWF's main source of profit is to buy low with discounts or to sell investments and market-making services to project parties as a whole, which is consistent with the three key businesses disclosed by DWF—liquid token investment, locked token investment, and market-making services. Some industry insiders believe that DWF's investments have fundamentally departed from the scope of investment and belong to over-the-counter trading.

This is not an unfounded claim. As an example, on August 6th last year, as an investor, DWF successively released favorable decisions regarding YGG, DODO, and C98, causing the prices of these tokens to soar rapidly, with YGG even rising by 50%. Later that evening, DWF transferred 3.649 million YGG tokens (valued at $0.61) to Binance, earning over a million dollars in profit. After DWF's sell-off, the prices of the three tokens plummeted, with YGG dropping by 70%. Overall, this was a typical market manipulation by a market maker.

Similar trends for all three tokens, Source: Public Information

These operations frequently occur in the tokens that DWF invests in and makes markets for. In an article exposing DWF by The Block last year, it was described how DWF Labs employees used the previous token price surge chart as a demonstration during business promotion. One of the founders of DWF Labs, Andrei Grachev, would even ask clients about the desired percentage increase and price of the token. In some project investments, DWF's investment logic differs from that of general investment institutions, focusing not on technology or team expertise, but on projects that can rise based on information, such as when DWF invested $60 million in EOS Network last year, which had been struggling for years.

In addition to pump and dump trading, DWF also appears to engage in false advertising of investment amounts. Nay pointed out that when DWF publicly announced an investment amount of over $150 million, only $65 million in on-chain transaction data was found, suspecting that DWF used the project's name to sell at a discount and used prepayment to profit from delta hedging.

Due to various shady operations, DWF has almost been boycotted by all its peers.

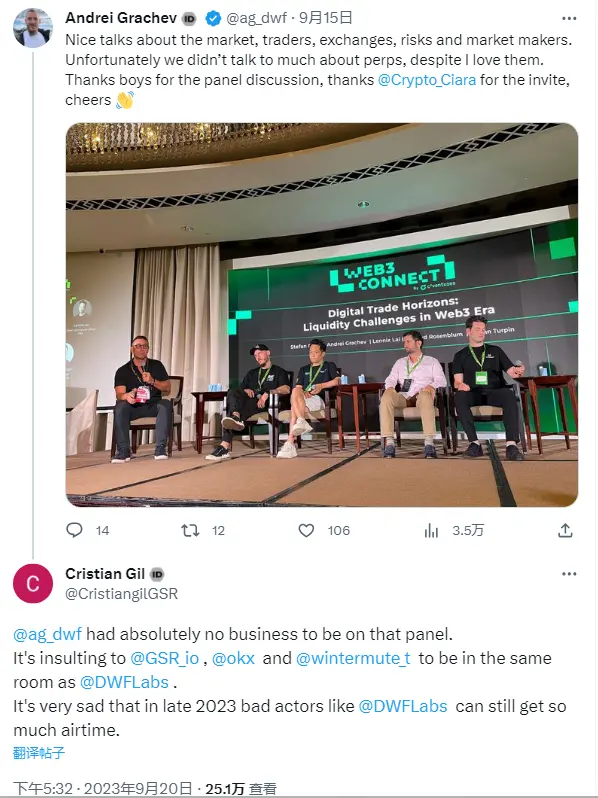

At last year's Token2049 conference, market makers DWF Labs, GSR, Wintermute, and OKX were on stage for a discussion. In a photo shared by market maker GSR, the picture of DWF Labs co-founder Andrei Grachev was directly cropped out. GSR also publicly stated, "DWF Labs is absolutely not qualified to join the roundtable discussion. It is an insult for GSR, Wintermute, and OKX to be in the same room as DWF Labs." In response to this statement, Wintermute CEO Evgeny Gaevoy expressed his support by liking the post.

Industry peers quarreling on the spot, Source: Public Information

In response to this incident, DWF's founder showed a disdainful attitude, even mocking the other party on the Pionex platform. "I never thought you would be so afraid of us. Yes, we are stronger than you in technology, trading, and business expansion. You actually started cooperating with competitors and complained like a child, defaming us."

In fact, if we delve into the founding team of DWF, it is not difficult to find their previous history.

Founder Andrei Grachev entered the crypto field in 2017 after being a founder in the logistics industry, and later became the head of Huobi Russia in 2019. While in this position, he was allegedly involved in the $4 billion cryptocurrency Ponzi scheme OneCoin and made promises to list OneCoin at the time. Prior to this, Grachev also led a project called Export.online, according to LinkedIn, Andrei Grachev was the CEO of the organization, and Vladimir Perov was the CTO. Investors mentioned that Grachev misappropriated customer assets amounting to $157,000 in this project.

Subsequently, Grachev left Huobi and co-founded the predecessor of DWF, VRM.trade, with Vladimir Demin, claiming that the trading volume could reach $10-20 billion, but this information remains unverifiable. There are also rumors in the market that Huobi let him go due to distrust of Grachev's abilities and integrity.

In response to various doubts from the outside world, DWF has clarified multiple times, stating that they never manipulate the market and will sell appropriately during the unlocking period. Some of DWF's partners have also claimed to have had a pleasant cooperation with DWF, with no issues regarding token price manipulation. However, based on actual performance, the market still harbors suspicions about DWF.

Overall, in comparison to the traditional world, the combination of market making and investment is clearly a false proposition, undoubtedly violating securities laws. However, in the crypto field, such behavior, apart from raising questions, does not cause much uproar. Ultimately, the crypto industry is driven by price increases, and the behavior of market makers is everywhere. Sometimes, users even hope for a strong market maker to maintain control for the long term. Even with pump and dump, from the project's perspective, clearing out excess tokens and gaining funds from the price increase is clearly a benefit. This three-way involvement, each with its own hidden agenda, naturally persists in this unique crypto field.

In this context, it is no surprise that the Chairman of the SEC mentioned in an interview that due to the lack of protection from securities laws, the crypto market is a hotbed of fraud, and investors do not receive important disclosure information. However, on the other hand, if regulation becomes more detailed, it is difficult to answer whether ordinary investors will gain more protection or lose more opportunities. In conclusion, being cautious, conducting thorough investigations, and maintaining caution in the face of potential market manipulation are the qualities that investors should possess.

Returning to this event, currently, both Binance and DWF have not been affected by the information and are operating normally. According to Rootdata, as of May 10th, DWF Labs has made 33 investments in the past year, with 6 investments in April alone, including projects such as LazyBear, Klaytn, Scallop, Shiba Inu, Tevaera, and NuLink.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。