Author: Paul Veradittakit, Partner at Pantera Capital

Translator: 0xjs@Golden Finance

Key Points:

- Morpho is surpassing traditional protocols like Compound, changing the DeFi landscape, and demonstrating the power of its innovative lending model.

- Initially utilizing Morpho Optimizers for direct peer-to-peer credit lines, Morpho has now expanded to include Morpho Blue, which adopts a pool-to-pool model, combining the best of both worlds to enhance efficiency.

- Both models address the inefficiency issues of traditional pool-based systems, such as underutilized capital. Morpho Optimizers optimize direct matching between lenders and borrowers, while Morpho Blue provides an independent lending pool with a higher loan-to-value ratio.

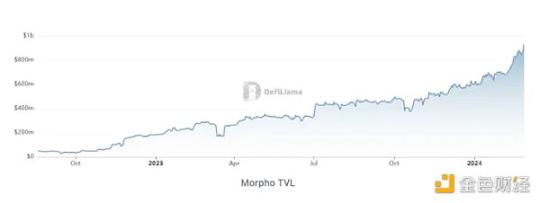

- The total lending value of Morpho has reached a significant milestone, with Morpho Blue quickly catching up and accounting for a large portion of Morpho's total locked value (TVL) in a short period.

Introduction

DeFi is fundamentally changing the way we think about financial services by breaking through traditional banking and lending structures. Among the various protocols on Ethereum, Morpho stands out, recently surpassing Compound in total lending value. This achievement not only highlights the effectiveness of Morpho's innovative lending model but also signifies a broader transformation in the digital asset management within the entire DeFi space. Initially known for its peer-to-peer lending through Morpho Optimizers, Morpho has further developed with the introduction of Morpho Blue, which enhances traditional pool-based lending systems to provide more efficient and adaptable financial solutions.

Overview of the Current DeFi Landscape

DeFi is built on modern financial structures, introducing blockchain-based solutions that redefine the acquisition and provision of credit. Platforms like Aave and Compound dominate this industry, facilitating billions of dollars in transactions through dynamic lending models. Users deposit digital assets into public pools, from which others can borrow, creating a vibrant ecosystem that maintains liquidity and actively exchanges assets.

Despite its success, the traditional pool-based lending model has its drawbacks, particularly in terms of capital efficiency. A significant portion of deposited assets remains idle, generating no returns and leading to inefficiencies within the system.

Morpho directly addresses these inefficiency issues through its peer-to-peer (P2P) lending model. By directly matching lenders and borrowers, Morpho not only optimizes capital utilization but also increases the interest rates offered to both parties. Its system overlays a matching engine on existing protocols like Aave and Compound, allowing users to enjoy the benefits of established pools and potential direct matching advantages. If direct matching is not feasible, users can still benefit from the liquidity of the underlying pool, ensuring that Morpho retains the fundamental advantages of the pool-based model while innovating its functionality.

The Rise of Morpho

As Morpho's total lending value climbed to $903 million, surpassing Compound's $865 million, it achieved a significant milestone. This victory not only reflects the protocol's ability to enhance the lending experience but also indicates a growing demand within the ecosystem for more direct financial interactions.

Initially, this growth was driven by Morpho Optimizers, with the first version of Morpho built on top of Aave and Compound, aiming to address the inefficiency issues of these platforms by creating peer-to-peer credit lines between capital providers and borrowers.

However, the newer product, Morpho Blue, has quickly caught up, accounting for 40% of Morpho's total locked value (TVL) in just three months. Morpho Blue adopts a pool-to-pool model similar to Aave and Compound but in a more efficient manner, characterized by an independent lending pool with a higher loan-to-value ratio and greater utilization.

Impact and Future Insights

The rise of Morpho has far-reaching implications. With the rise of P2P lending, we may see the DeFi financial market transition to a more competitive and efficient state. However, this evolution will require the industry to address new challenges, such as managing the complexity of peer-to-peer interactions and ensuring robust security measures against potential risks. Morpho Blue aims to address the vulnerabilities and inefficiencies of the current pooled lending model, serving as a simple, immutable primitive that separates core lending protocols from risk management and user experience layers, creating an open market for risk and product management. With its permissionless market creation and customizable risk profiles, Morpho Blue provides a flexible alternative to the one-size-fits-all model in Aave and Compound. Over time, as Morpho Blue continues to expand its influence and reshape the decentralized finance landscape, Morpho Optimizers will be phased out.

Founders of Morpho

The helm of Morpho Labs is led by co-founders Paul Frambot and Merlin Egalite, whose combined expertise is propelling the platform to new heights. Paul has a background in blockchain and distributed systems from École Polytechnique, while Merlin is an experienced software developer from CentraleSupélec. Together, they are driving Morpho to become a secure, open, and flexible lending protocol.

Conclusion

The success of Morpho vividly illustrates the dynamic nature of DeFi and its potential for continuous innovation. By challenging established financial models and introducing more efficient solutions, Morpho is thriving and paving the way for a new era of DeFi. Looking ahead, the continued development of DeFi platforms like Morpho will undoubtedly contribute to shaping the future financial landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。