As a senior figure in the currency circle, I have always been committed to providing helpful advice to everyone, hoping that everyone will take fewer detours and make fewer mistakes in this market. Although I am earnest, the road to investment still needs to be explored by oneself, and learning is endless. The experience gained is the real wealth!

Strength does not need to be overly displayed, the key is to gain more recognition from others. In the investment road, it is more important to do well than to prove one's own strength to others. Whether it's a donkey or a horse, you'll know once you take it out for a walk.

I am a warrior striving to protect the "leeks" in the currency circle, and I wish my fans to achieve financial freedom in 2024. Let's cheer together!

Currency Circle Academician: Bitcoin (BTC) latest market analysis as of 2024.5.10:

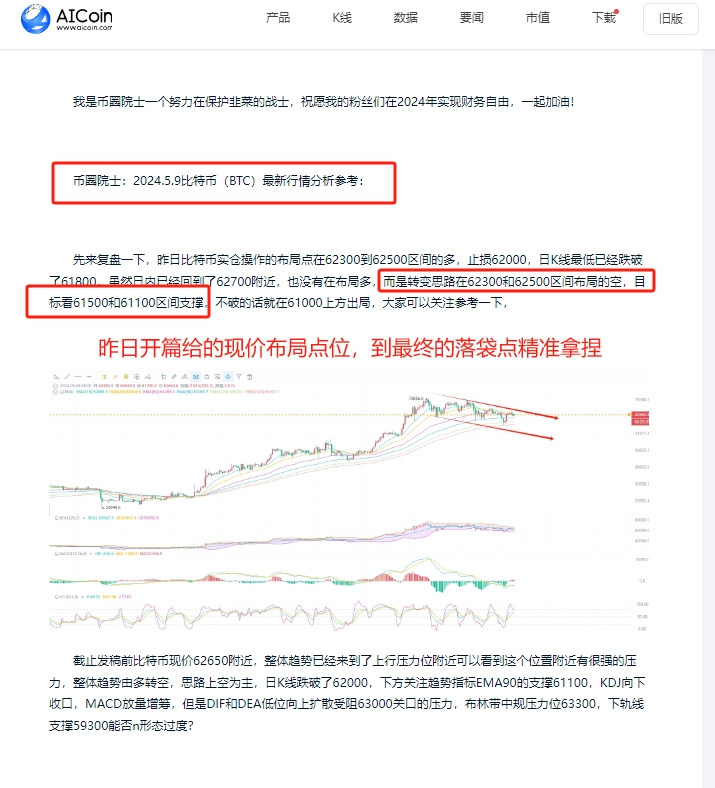

Yesterday, Bitcoin opened with a short position layout in the 62500 to 62300 range, targeting 61000 and successfully gained 1700 points. After taking profit at 61000 in the early morning yesterday, I switched to long position and only closed at 62500 after zero o'clock, gaining a total of 3200 points. This kind of spot position is always more resolute than being timid afterwards. Many fans have made profits by following this short position wave, and I am very grateful for everyone's trust and support for finding the Currency Circle Academician.

As of the time of writing, Bitcoin's spot price is near 62000, and the daily K-line virtually broke the support of the 61000 EMA trend indicator, dropping to around 60600. For two consecutive days, the daily K-line support points are at 61000 trend indicators, indicating that this position support is effective. KDJ is converging inward and may be blocked, is it possible to reverse the upward trend? MACD volume increases, DIF and DEA's original short position has turned into upward divergence, the upper pressure level of the Bollinger Band is at 63100, and the lower support is at 59000. Overall, there is a strong bearish trend. At this time, being blocked at 61000 will likely lead to sideways correction. If the upper side does not break 63300, the bulls will not open positions, and the weekend's sideways correction may occur.

A very long positive line appeared on the four-hour K-line, directly breaking through the 62100 pressure level of the EMA15, and was blocked at the highest point of 62700. KDJ's upward expansion indicates that there is still room for the K-line to move upward. In addition, with the shrinking volume and increased capital, the short-term trend is relatively strong. The K-line is blocked at the 62500 pressure level of the Bollinger Band. Although it broke the middle rail pressure level once, the overall trend is still bearish and has not reversed. Prepare for both possibilities in terms of strategy.

Super short-term trend layout:

Pay attention to the 63000 to 63300 range and short if it does not break, consider exiting in the 62500 to 62000 range, leaving some positions, and look at the support in the 61000 to 61500 range. Stop loss at 400 points.

Pay attention to breaking the 63000 to 63300 range and follow the trend. Consider exiting at the trend exchange point of 64000 to 64500, and after reaching a stable period, it is safe to close the position. This position is near the trend exchange point of a large timeframe, and new long and short signals will appear, so it is not too late to enter the market again. Stop loss at 400 points.

Super short-term trend layout:

- Long position entry point at 61500 to 61800 range, consider exiting at the 62500 and 63000 range, stop loss at 300 points.

Specific operational strategies are mainly based on market data. For more information, please consult the author. The article is published with a delay and is recommended for reference only. All risks are at your own.

This article is exclusively provided by the Currency Circle Academician and represents the Academician's exclusive viewpoint. There is in-depth research on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of article publication, the above viewpoints and suggestions are not real-time and are for reference only. All risks are at your own. Reprinting should indicate the source. Reasonably control your position and do not overexpose or fully expose your position. The Academician also hopes that investors understand that the market is always right. If you are wrong, you should summarize your own problems and not let the expected profits slip away. There is no need to be smarter than the market in investment. When the trend comes, follow it; when there is no trend, observe and be patient. Wait until the trend becomes clear before taking action. Tomorrow's success comes from today's choices. Heaven rewards hard work, earth rewards kindness, people reward sincerity, business rewards trust, industry rewards precision, and art rewards heart. Gains and losses are all in the blink of an eye. Develop the habit of strictly setting stop-loss and take-profit for each trade. The Currency Circle Academician wishes you a pleasant investment!

Friendly reminder: The above content is created by the author only on the public account. The advertisements at the end of the article and in the comment section are not related to the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。