Original Author: 0xsmac

Original Compilation: Deep Tide TechFlow

Introduction

In this article, the author 0xsmac delves into the current cyclical position of the cryptocurrency market and questions the effectiveness of "collective wisdom" in financial market decision-making. The article reviews the market changes since the collapse of FTX in 2022 and predicts future market trends by comparing the price movements of Bitcoin and Ethereum. In addition, the author discusses the potential impact of ETF approval, institutional capital inflows, and changes in the cryptocurrency market structure on the market, providing a perspective for a deep understanding of the cryptocurrency market.

Main Content

I tend to think that collective wisdom is mostly a joke. Of course, collective wisdom is important in some things, but there are too many examples that show human behavior is irrational (especially when it comes to money) or does not understand their experience of cognitive bias. More specifically, I am referring to groups of people with overconfidence/irrational tendencies.

For example, financial market participants.

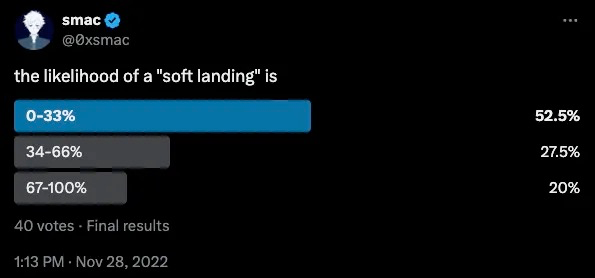

After the collapse of FTX in November 2022 and the 30% drop of QQQ from its all-time high, I was curious about people's views on the possibility of a "soft landing." Needless to say, only one-fifth of people are quite certain that we will achieve this goal.

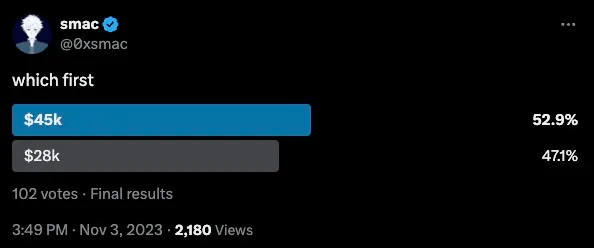

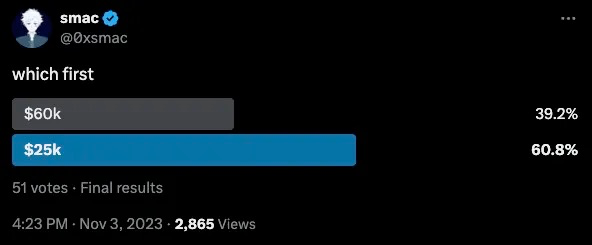

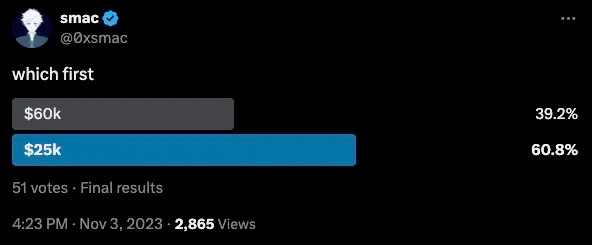

A year later, the price of Bitcoin has doubled (about $35,000), and is undeniably on an upward trend. I was curious about people's feelings once again. I usually use such polls to assess positioning. This is just one data point, but I found that most people's answers are what they hope will happen—especially on Twitter. Therefore, it's not surprising that only half of the people think that the likelihood of a 30% price increase is greater than a 20% decrease.

Fewer people expect the price to continue to rise.

For many reasons, at that time, I was very confident that the targets of $45,000 and $60,000 would be achieved. Now, I have low confidence in short-term price action and to some extent, I am not confident about what will happen in the next six months. But many people have been asking "Which stage of the cycle are we in now?" This is a somewhat complex question, which implies some things that I am not sure are necessarily correct. But anyway, I will share my feelings so that when I am inevitably asked this question again, I can refer directly to this article.

The general view seems to be that we are in the middle of the cycle. Interestingly, the most common response I heard was the fifth or sixth round. Even if this is true, it seems a bit like an evasive answer to me. This is what you say when you have no opinion and want to remain neutral. It may be true, but if I thought so, I wouldn't write this article either.

So, which stage of the cycle are we in now, which round are we in, has it already ended, or have we come back? Let me start from another tweet in November 2022.

I mentioned this to illustrate that in "this cycle," price and time are two very different concepts. If we look at these separately, from a time perspective, we are about 70 weeks into the bull market. I would say this actually overestimates the true length of this run, because I can count on two hands the number of people who were truly bullish in November and December last year. If I were very generous, I would say that most people began to realize what was happening sometime in the late first quarter to early second quarter of last year. So we can say it has been over 12 months.

From a price perspective, Bitcoin has risen about 3 times from the bottom, and Ethereum has risen 2.5 times from the bottom. I feel that those who have experienced multiple cryptocurrency cycles believe that we are closer to the end rather than the beginning. This is largely because this time it did not follow the script they are used to.

We wrote about this dynamic in the annual letter…

In previous cryptocurrency cycles, as capital moved outside the risk and speculation curve, it showed a logical flow of BTC → ETH → cryptocurrency assets (for risk and token investment). Market participants believed in a new narrative, which usually revolved around the fundamental transformation enabled by cryptocurrency, creating a wave of new believers who either converted for life or exited after the price fell.

This cycle (so far) is very different, and many of those who previously had heuristic are slow or unwilling to adapt. Frankly, this unwillingness has led to self-deception. We are all human, so we cannot help but look around and evaluate ourselves (our assets) in relative terms—when our assets have risen 3-5 times, we are not satisfied because something we don't like has skyrocketed 10-20 times. Especially if what we don't like has skyrocketed 10-20 times. In my opinion, this is why many people feel that we are either in the middle or crucial part of the latter half of the cycle. They are on the sidelines, watching, like Solana going from less than $10 to over $200. They see meme coins skyrocketing 100-1000 times and scream inside.

"This is not the right order!"

"Why hasn't my assets risen like this?"

"This shouldn't be happening now!"

Things did not develop as they hoped. So this is not to say that they might be wrong, but rather the irrational behavior of the market. Or the cycle is compressing, or financial nihilism is being pushed to the extreme. I do not rule out all of these scenarios, but there seems to be little introspection.

To add some background, I know that junior personnel from other funds recommended SOL at less than $30, but they were repeatedly rejected and ignored. Months later, look at how many people rushed to buy locked FTX tokens at higher prices, it's ridiculous.

All of this is to illustrate that people's collective experience of the market's rise will affect their perception of the stage we are in. Entering this cycle, most people are overly focused on the Ethereum ecosystem and insufficiently focused on other things. This positioning distorts the overall perception of this cycle for cryptocurrency and distracts many people from evaluating our actual situation.

So, let's weigh the arguments on both ends: are we closer to the early stage or the late stage of this cycle?

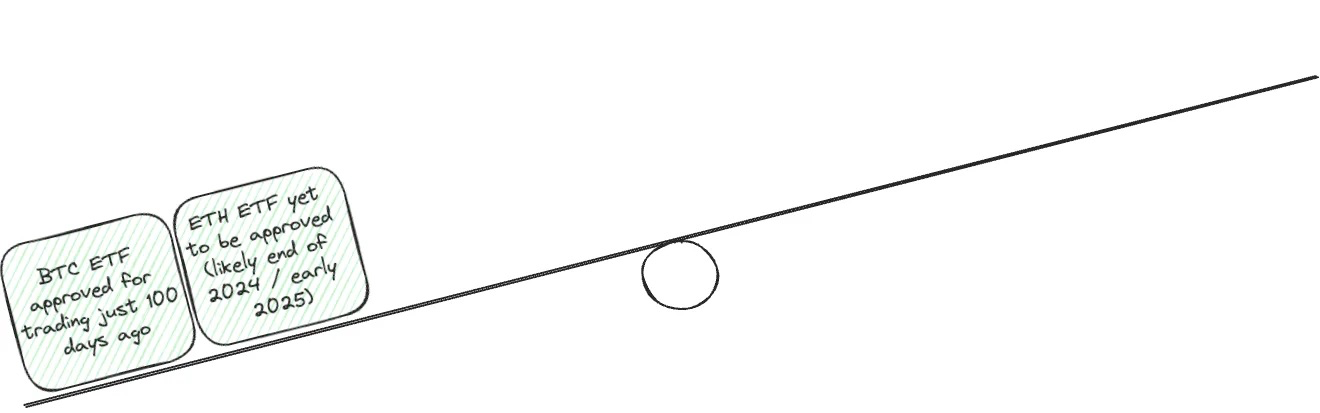

Only 100 days away from the approval of the Bitcoin ETF trading.

Ethereum ETF has not been approved yet (possibly by the end of 2024/early 2025).

I have made numerous comments and tweets about the structure of the cryptocurrency market and its importance, and although it is a boring concept, it actually has a significant impact. It may be a bit exaggerated, but I think it's somewhat similar to the tectonic plates of the Earth—huge, slow-moving parts of the market. It's hard to feel how drastic these changes will be at the moment, and what impact they will have. But imagine being in the cryptocurrency space for over 8, 9, or 10 years and witnessing the important moment of the approval of the Bitcoin ETF.

The massive influx of new institutional capital now has a legitimate way to enter this asset class, with initial capital inflows far exceeding market expectations, and then you announce the top about 100 days after the Bitcoin ETF is approved. But the market is forward-looking! Now the ETFs have been approved, and the funds are flowing!

Yes, the market does look forward. But they are not omnipotent. Their view of the ETF fund inflow is actually wrong. People who understand cryptocurrencies do not know how traditional market structures work, and people who understand traditional market structures rarely have time to engage with cryptocurrencies. The approval of an ETF for ETH is inevitable, and in my view, the time gap between the approval of BTC and the approval of ETH is actually very healthy. It allows some time for digestion, education, and a clear mandate after the election. The changes in the cryptocurrency market structure should not be underestimated.

Bitcoin has just maintained a continuous rise for 7 months.

Bitcoin did not provide an entry opportunity: out of 21 weeks from mid-October last year to early March this year, 16 weeks were green.

Bitcoin has actually been rising for a year and a half. Before April, out of the past 15 months, 12 months were green, and for a period from mid-October last year to early March this year, out of 21 weeks, 16 weeks were green. This is indeed relentless. However, to be fair, few people were prepared for what we saw in the first half of 2023. Would it be surprising if we maintained a range for a while? No, I don't think so. But in terms of market trends, it feels like there is still some post-traumatic stress disorder after the last shakeout.

I also increasingly feel that the conversation I am having now is similar to the one at the end of 2022/beginning of 2023, except that Bitcoin is now around $60,000 instead of $18,000. Of course, they are not exactly the same, but the doubts mainly revolve around: we have risen a lot, there is no new narrative driving us further up, and meme coins have gone crazy.

But in my view, these are not the real reasons why we should be in a downturn.

The BTC ETF has not yet entered offline trading centers.

13Fs are constantly being submitted.

Well, now we are going to get into some technical content about banks. When I say that access to the ETF has not yet entered offline trading centers, I mean that advisors do not have the incentive to recommend this product to their clients.

Advisors' recommended trades are classified as "solicited" and "unsolicited." A solicited trade is a trade recommended by a broker to a client ("You should buy ABC"), while an unsolicited trade is a trade brought to the broker by the client ("I want to buy XYZ"). The main difference here is that only solicited trades pay a commission.

As of now, no brokerage firm allows the BTC ETF to be included in client portfolios. This means that these advisors have no incentive to recommend these products to their clients. But it's only a matter of time—all these firms are in some kind of waiting mode, and when one firm takes action, the others will quickly follow suit.

13Fs are also being continuously submitted. An important point that Eric Balchunas pointed out a week or two ago is that IBIT reported about 60 holders (with more reports to be added), but they only account for about 0.4% of the total shares. This means "most are small fish, but there are a lot of them." So far, an advisor in Kansas has invested $20 million in Fidelity's BTC ETF, accounting for 5% of their portfolio.

The last halving had a substantial impact on supply (currently 94% in circulation).

Unprecedented new token supply entering the market.

To be honest, these two clichés seem to be repeated in every cycle. But in any case, they are worth noting—Bitcoin now has about 94% of its supply in circulation, and the recent halving may be the last meaningful one. On the other hand, the market continues to be flooded with new token supply—new L2s, the Solana ecosystem, bridges, LRTs, SocialFi, arbitrage trading. The examples are numerous, and the total FDV of these projects is both shocking and imaginative. As with every cycle, most tokens will tend towards zero as insiders unlock and sell. Although there have been enough articles and discussions about this.

The halving has just occurred.

Google Trends data.

Coinbase app store ranking (currently at 270th).

The halving has indeed just occurred, reducing the supply, plain and simple. Personally, I don't think these last two reasons are very convincing on their own, but they are interesting in contrast to what people think our position is. If we look at recognized Google Trends data for BTC, ETH, SOL, NFT, and others, we will find a commonality.

We are far from reaching the highs seen in the real bull market period of the past.

The same goes for the ranking of the Coinbase app store (currently at 270th). I will soon discuss the controversial issue of retail participation, but it can be said with certainty that there is still a lot of room for growth in the use of native cryptocurrency applications.

AI narratives saved the market.

Unemployment rates will only rise.

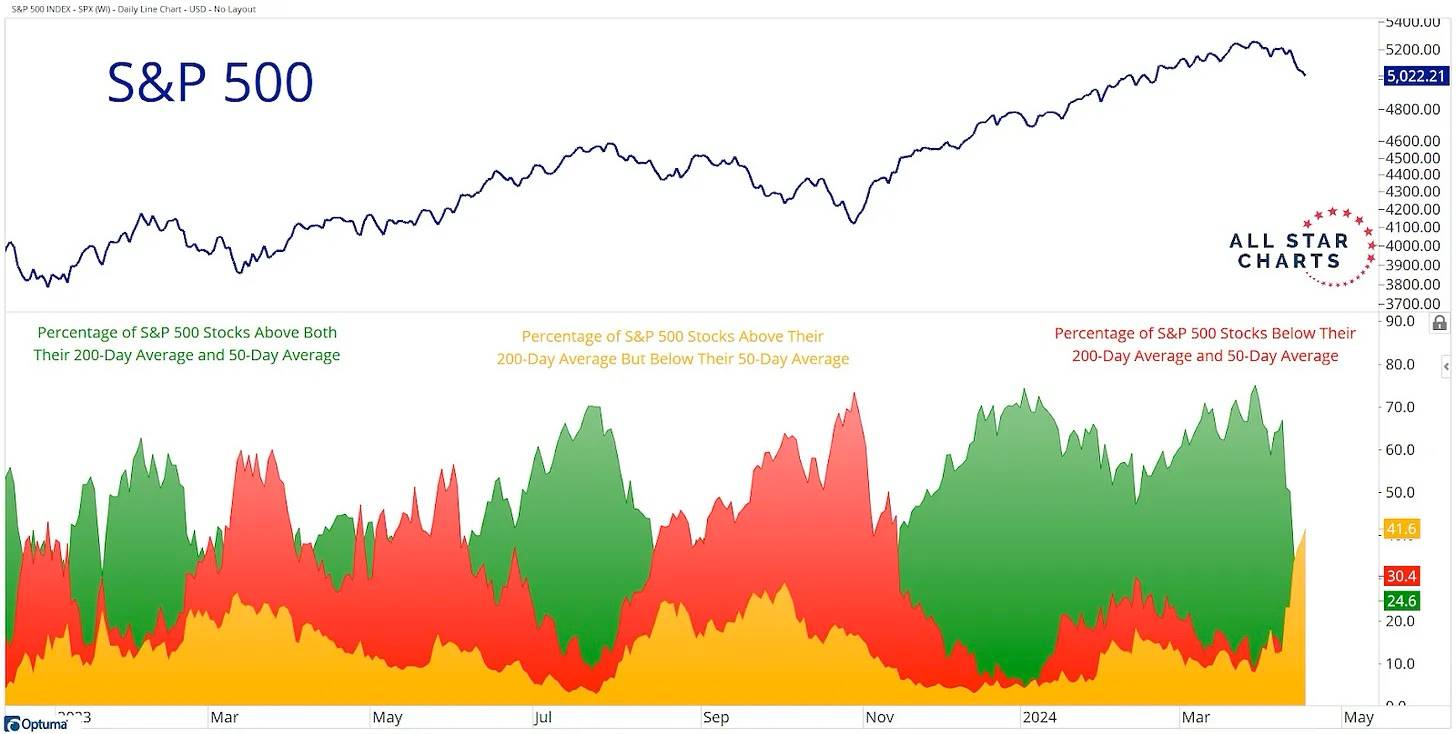

Traditional financial market breadth is weakening.

I am willing to believe that AI narratives saved the traditional financial market in the fourth quarter of 2022 and the first quarter of 2023. If ChatGPT had not been released at that time, perhaps the traditional market would have been very difficult, instead of finding solace in a new paradigm of innovation. But you can't prove a counterfactual, so we have to deal with the situation today. Indeed, we have seen an incredibly strong labor market, and unemployment rates will only rise. The traditional market is experiencing a decline in overall breadth, and that is a fact.

The main insight here is that the percentage of stocks that are above the 200-day moving average but below the 50-day moving average has significantly increased (currently over 40%).

I believe we have not yet seen the staggering rise that comes after breaking new highs. I have been publicly bullish for a long time, when people were trying to convince me that it would take a long time to recover from the damage in 2022. Now, those same people are trying to tell me that we can't go up anymore. This doesn't mean they are wrong this time, but the evidence I read today suggests that we still have a lot of room to go up.

I also believe that the delay of the Ethereum ETF is beneficial for extending this cycle, both in terms of time and price. This is another counterfactual, but I think if it were approved in May, it would be too close to the approval of Bitcoin. Market participants have short attention spans, and squeezing these approvals and subsequent product trading together would lead to internal competition. How big of an impact it will have, who can say. But as the only crypto ETF, it is very important to provide some space for BTC funds to continue to flow in. This is just an appetizer. ETH ETFs will have their time to shine, and in fact, the performance of BTC will be their best marketing campaign. The new generation of managers are being forced to face the asset class of Bitcoin. They can no longer sneer at Bitcoin, and if their performance is inferior to their competitors who have exposure to BTC, they need answers. Saying that BTC is a scam is no longer a reasonable viewpoint.

This is what a healthy market looks like. An asset is undervalued, and then slowly rises as more and more people realize that they cannot buy this asset at a lower price. There will be a period of consolidation as the market digests, and then the asset will continue to rise. If you are still bullish, then a blow-off top is not what you want to see.

This time is different

A frightening combination of words. Of course, you can occasionally mutter to yourself, or confide in a close friend about the possibilities you have been dreaming of. But to present this viewpoint in public? Be prepared for criticism.

We have all been in this situation. Someone mutters these words, and we parrot them in front of them, pretending to be clever, sarcastic. Criticizing them on Twitter. Calling them foolish. Suggesting that this must be their first experience of a bull market cycle, as if that were important.

Unless you are here, you do indeed somewhat believe that there will be one time when things will be different.

If you say so and are wrong, everyone will laugh at you, calling you a fool for thinking it would be different. No big deal. These people hardly have independent viewpoints, so why expect them to have a different reaction?

But if you see enough evidence to suggest that it might be different, and you do nothing… then who is the real fool?

Capital inflows are growing, but where are they flowing to?

The biggest unresolved question in my mind is to what extent these passive capital flows will ultimately move onto the chain. The less interesting crypto version is that BTC is held as a small part of institutional capital portfolios as a new asset class, and everything else is an internet subculture. But it is undeniable that it is difficult to determine the extent to which the inflow of ETF funds will directly or indirectly flow onto the chain. You might think—Smac, you're so stupid, no one buys IBIT and does anything with their on-chain BTC. Of course, that's true today, but that's not the point. We all know that the wealth effect is real in crypto, and ETFs will be an appetizer for some. The question is about the scale, and in my view, we may not have a good answer in the near term. But we can try to find directional clues.

If we look at the activity of stablecoins, we can see some compelling data. It can be seen below that November last year was the first time in about 18 months that the supply of stablecoins turned positive. The continued net capital inflow of stablecoins suggests that we are much earlier in the cycle than people think. This is especially evident given the dramatic inflow in the previous cycle.

We can also observe the total supply of stablecoins on exchanges, which has decreased by more than half from its peak to its trough, but is now clearly beginning to trend upwards.

The most difficult thing to translate is whether and how this activity is moving onto the chain. Keep an open mind about this, but below are the total number of active addresses (blue line) and stablecoins on exchanges. Depending on your own feelings, you may draw many conclusions from this, but my understanding is:

During the last bull market, we saw a surge in the number of new active addresses, but it has remained relatively stable since the third quarter of 2021, indicating a sign that retail activity has not yet returned.

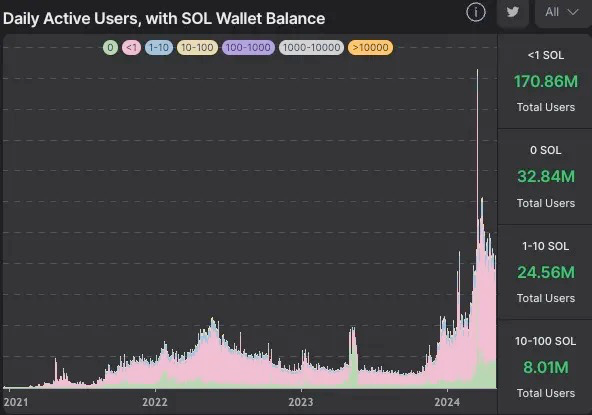

It is also worth acknowledging here that retail activity is likely taking place through Solana. It is clear that activity there has significantly increased over the past 6-9 months, and I personally expect this trend to continue.

SOL with DAU of 0 or less than 1 is not worth paying attention to (source: hellomoon).

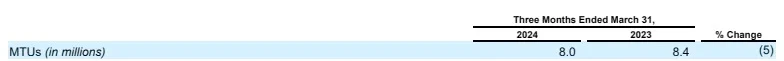

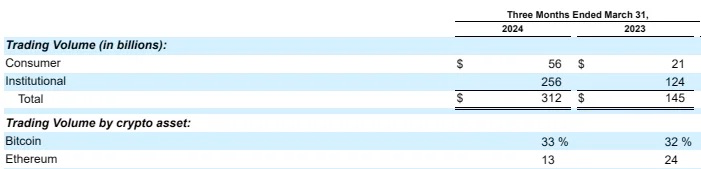

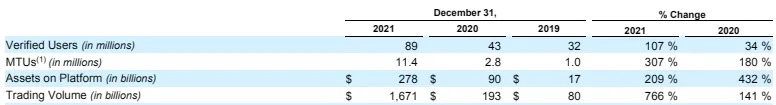

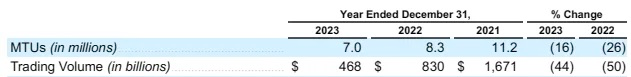

So what about more on-chain data? From Coinbase's 10-Q last week, we actually saw monthly transacting users (MTUs) decrease from 8.4 million to 8 million. But both retail and institutional trading volumes have more than doubled. Interestingly, while the trading volume share of BTC remains unchanged, the share of ETH has significantly decreased, which may indicate an increased demand for a wider range of crypto assets (i.e., altcoins) in the future, which is also very healthy in the long run, as a broader distribution in crypto assets is the ideal end state. Haters and losers will say that everything in crypto is empty, and people have just come to the ultimate state of super gambling. I would say this indicates that there are more interesting early projects/protocols worth exploring.

Q1 2024

Q1 2024

How does this compare to what we have seen from Coinbase users in the past few years? First, we are still more than 40% below the peak of 11.4 million MTUs in 2021, and lower than the levels at the end of 2022. For all the discussions about meme and retail transformation, I just can't see a credible argument that this is happening on a large scale. Is this happening on a small scale for users who are very familiar with cryptocurrencies? Of course, this once again shows that people are trapped in the crypto bubble and are missing the bigger picture. If you log into Twitter and take the discourse there as gospel, you will have a bad time.

End of 2021

End of 2023

The last point I want to make here is about altcoins outside of BTC and ETH. As early crypto investors, we clearly believe that this space will continue to grow, not just for major currencies. The most straightforward way to measure this activity is to use TOTAL3, which tracks the top 150 altcoins outside of BTC and ETH. I find it insightful to observe the cycles we have seen from peak to trough in the past. Looking at the cycles in 2017 and the recent one, it is clear that the relative upside potential is being compressed (although it is still astronomical), and as the space expands, we expect this to happen. With a larger base, rapid growth is intuitively more difficult. But even with enough room left for further compression, I don't think enough people realize that there is still a lot of room for significant upside potential. TOTAL3 is only $640 billion, which may sound like a large number, but it is almost negligible in the macro plan of the financial markets. If we believe this is a space that will reach $10 trillion in the next 24 months, with BTC accounting for 40%-50% of that, there is still a lot of value to be created.

2017-18

2020-21

2024-25?

I personally don't think this will be dominated by memecoins, and I find some people very much in disagreement. Memecoins have their value and will continue to be an important part of crypto (and even traditional finance), but I am also optimistic that we are seeing a new wave of mature founders. They are deeply thinking about solving real problems and focusing on results over a decade. We are interested in working with these types of founders.

I believe we are still in the early stages of this cycle. I guess we have gone about 1/3 of the way. Despite many people thinking it's all about memecoins, there are other things going on and being built. SocialFi is starting to see more innovation, ERC-404 has not been fully explored, DePIN is gaining acceptance outside the crypto community, RWAs are slowly penetrating onto the chain, and we are seeing more attempts to explore how distributed systems affect the "real" world. We are continuously adding new papers to our public database, and are always happy to talk to builders at the strange, novel, and ambitious intersections.

Despite the many flaws in this field, I remain very optimistic about this space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。