Everyone is still "intoxicated" by the high point of 2021; but the altcoin season of this bull market seems to be out of reach.

Author: Distilled

Translation: DeepTechFlow

Introduction

For the past two years, I have been fully focused on the altcoin market. However, there has always been a question in the market: the long-awaited "altcoin season" similar to 2021 has not yet appeared.

Here, I will explain the reasons and provide advice to optimize your altcoin strategy.

Let's first define "altcoin season". Definition: when altcoins outperform Bitcoin ($BTC) and prices soar across the board.

This is a period of vigorous development in the altcoin market, filled with euphoria. It can be imagined as a rising tide lifting all boats.

This is what a strong altcoin season can do, boosting almost every sector. What is the driving force? It is the influx of a large amount of liquidity into the market.

Tracking the Flow of Liquidity

Historically, the sources of this liquidity mainly come from:

New inflows of funds from retail investors, flowing through centralized exchanges

Liquidity flowing from Bitcoin on centralized exchanges (CEX) to altcoins

Then, the liquidity slides down the market value ladder and extends further along the risk curve. OGs are very familiar with this dynamic, often referring to it as the "path to the altcoin season".

Lalapalooza Effect

The path to the altcoin season in 2021 was clear, but now it's gone. I believe the reasons are multifaceted, the result of several factors coming together.

Individually, each variable is not enough to produce a significant change, but when combined and pointing in the same direction, the effect is enormous. Renowned investor Charlie Munger described this effect as the Lalapalooza effect.

So what are the combined effects here? I see several, and will do my best to explain them.

1. Too Many Projects

The market is filled with liquidity, but extreme project saturation makes it unbearable, imagine more boats in the ocean than waves.

Only specific sectors like artificial intelligence (AI) or the SOL ecosystem truly feel the wave of the "altcoin season".

What used to be a rising tide lifting all boats has turned into a selective rotation game, similar to the PvP nature of "Hunger Games".

2. Token Dilution: Hidden Brake

Token dilution, especially from token unlocks, has hindered the 2021-style altcoin season.

This often overlooked factor has absorbed a large amount of organic inflows, and no matter how good the technology is, if supply exceeds demand, prices are difficult to rise.

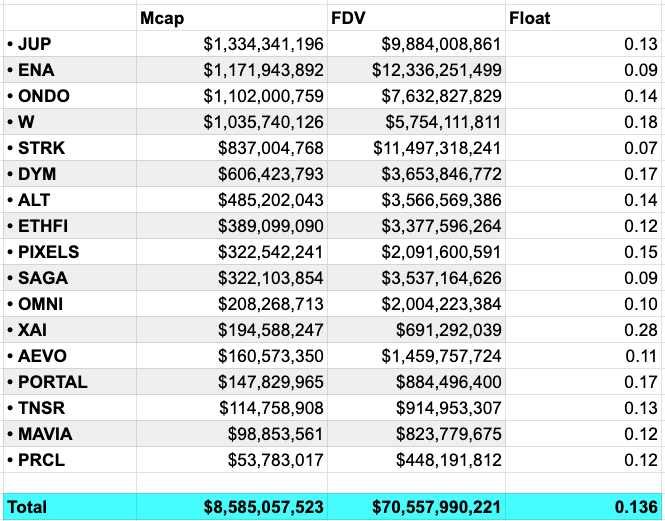

Investors recently conducted a sampling survey of major projects released so far in 2024. The average circulation of these projects is about 14%, with waiting unlocked funds reaching $70 billion.

What happens when market oversaturation is combined with excess supply? The answer is: the conditions for the altcoin season become difficult.

3. Double-Edged Adoption

The increase in TradFi adoption is a double-edged sword. On one hand, it increases the credibility of cryptocurrencies, but on the other hand, it brings more talent to the crypto space.

More talent may seem beneficial, but it actually increases market efficiency. If more smart people turn to cryptocurrencies, it becomes harder to find an edge.

4. Bitcoin ETF: A New Dynamic

The approval of Bitcoin ETFs has changed the game for altcoins. Before ETFs, the main channel for acquiring Bitcoin was through centralized exchanges.

This was good news for altcoins, as investors could easily switch from Bitcoin to try out altcoins.

This time, the people buying Bitcoin are different.

People buying Bitcoin through ETFs face a more complex path to enter the altcoin market.

5. Perfect Storm: Covid-19 Effect

Why was 2021 so remarkable for altcoins? This is largely due to the unique environment.

With lockdowns in place, there was a particularly high flow of funds and time spent interacting online.

This created the perfect conditions for attracting retail investors to cryptocurrencies, and considering the rarity of these conditions, it is reasonable to view 2021 as an outlier.

Everyone is still "intoxicated" by the high point of 2021; but the altcoin season of this bull market seems to be out of reach.

Conclusion

Review of this Article

The altcoin market has shifted from a general rising tide to a rotation game.

With more smart people in the market, finding an edge requires more effort.

Project saturation, along with a large excess of token supply, is consuming liquidity.

The traditional path to the altcoin season has been disrupted, mainly due to Bitcoin ETFs.

Practical Advice

This article covers a lot, so let's make it actionable:

Focus on fully diluted valuation (FDV) and saturation rate.

Keep a close eye on the development of ETFs and heavy institutional involvement in the industry, such as RWA. In the coming years, these may present different, potentially more favorable opportunities.

When the market is flooded with altcoins, don't just look at the dollar value. Comparing the valuation of altcoins to Bitcoin ($BTC) is important. Holding assets with higher risk and lower returns is meaningless. Evaluating the performance of altcoins relative to Bitcoin can provide a clearer strength indicator.

Work hard for your edge. It's not just about increasing assets, it also involves enhancing your knowledge, skills, and network.

There are many opportunities in the cryptocurrency market, but they require more effort and new perspectives. Market changes quickly, and success favors those who can adapt quickly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。