Author: ZHEV

Translation: Ladyfinger, Blockbeats

Editor's note: Today, as the DeFi field rapidly expands, the Solana blockchain, with its high-performance architecture and innovative technology, is becoming a new hotspot for decentralized applications. However, with the surge in economic activity, Solana's fee market and the issue of maximum extractable value (MEV) are gradually becoming the focus of community attention.

This article delves into the design of Solana's fee market, the challenges it faces, and the potential impact of MEV on its ecosystem, while also comparing it with Ethereum's related experiences and strategies. We have invited technical expert Zhev, who has previously provided in-depth technical explanations of AMM and other DeFi primitives on his own sub-stack, to provide us with unique insights into the future of Solana's fee market and MEV. Through this article, we will understand how Solana is addressing the growing MEV challenge while maintaining its high-performance advantage and explore the possible development direction of its fee market.

Introduction

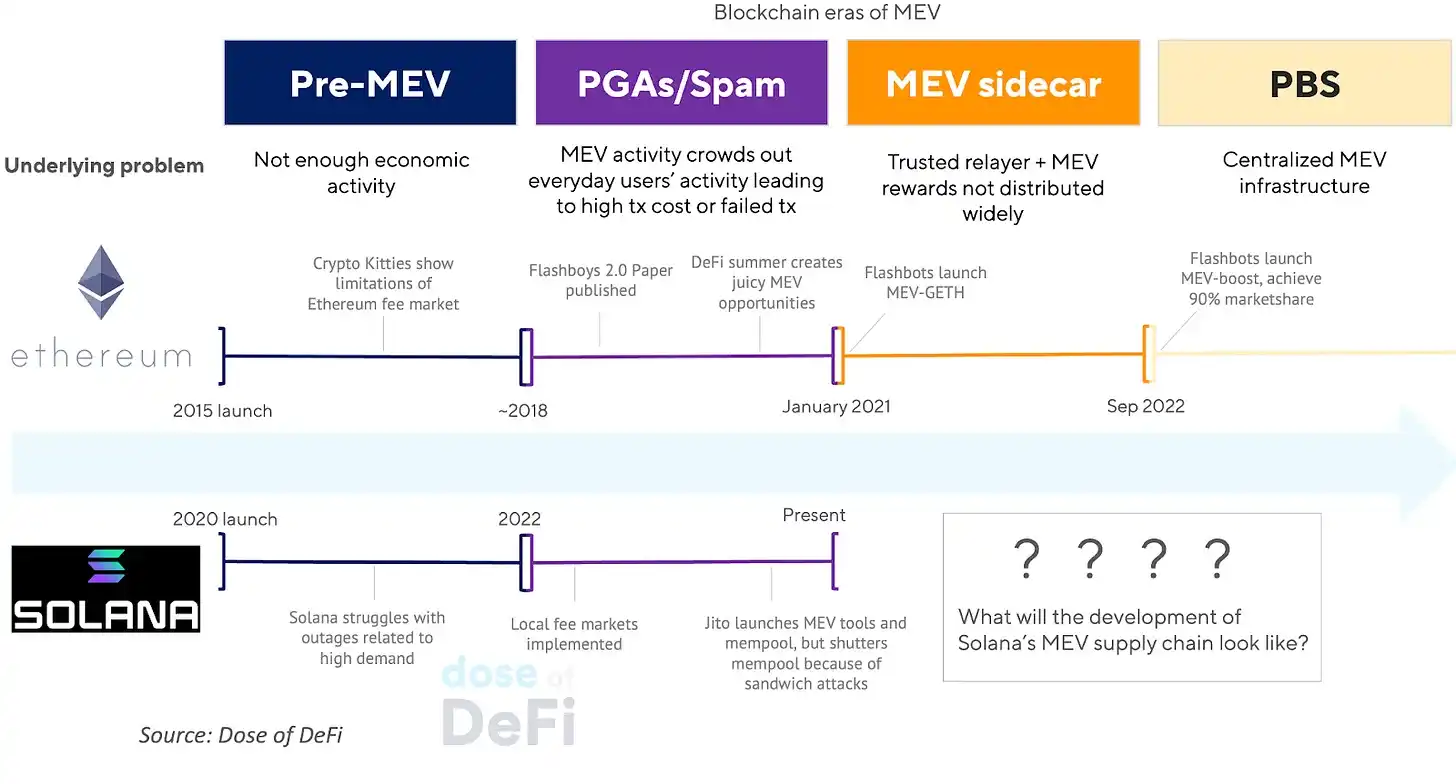

The rise of Solana has expanded the DeFi field. We have been observing from a distance, but have never provided a new perspective. However, the fervent activity on Solana in the past few months has provided us with a new opportunity to observe its position in the market and how it may develop. Zhev has previously written technical explanations about AMM and other DeFi primitives on his own sub-stack. This month, we collaborated with him to conduct an in-depth study of Solana's fee market. MEV has already dominated the fee market discussion on Ethereum, and as Zhev discusses below, it will soon dominate on Solana as well.

Transaction fees are necessary to support the most basic activities on the blockchain, as they validate users' transactions and include them in a block. The main purpose of these fees is to prevent spam; it is also part of the subsidy paid to validators to build/validate blocks. In a sense, these network fees are similar to rent; users pay fees to access a limited commodity at each time unit. The commodity here is "block space," that is, the space on the block.

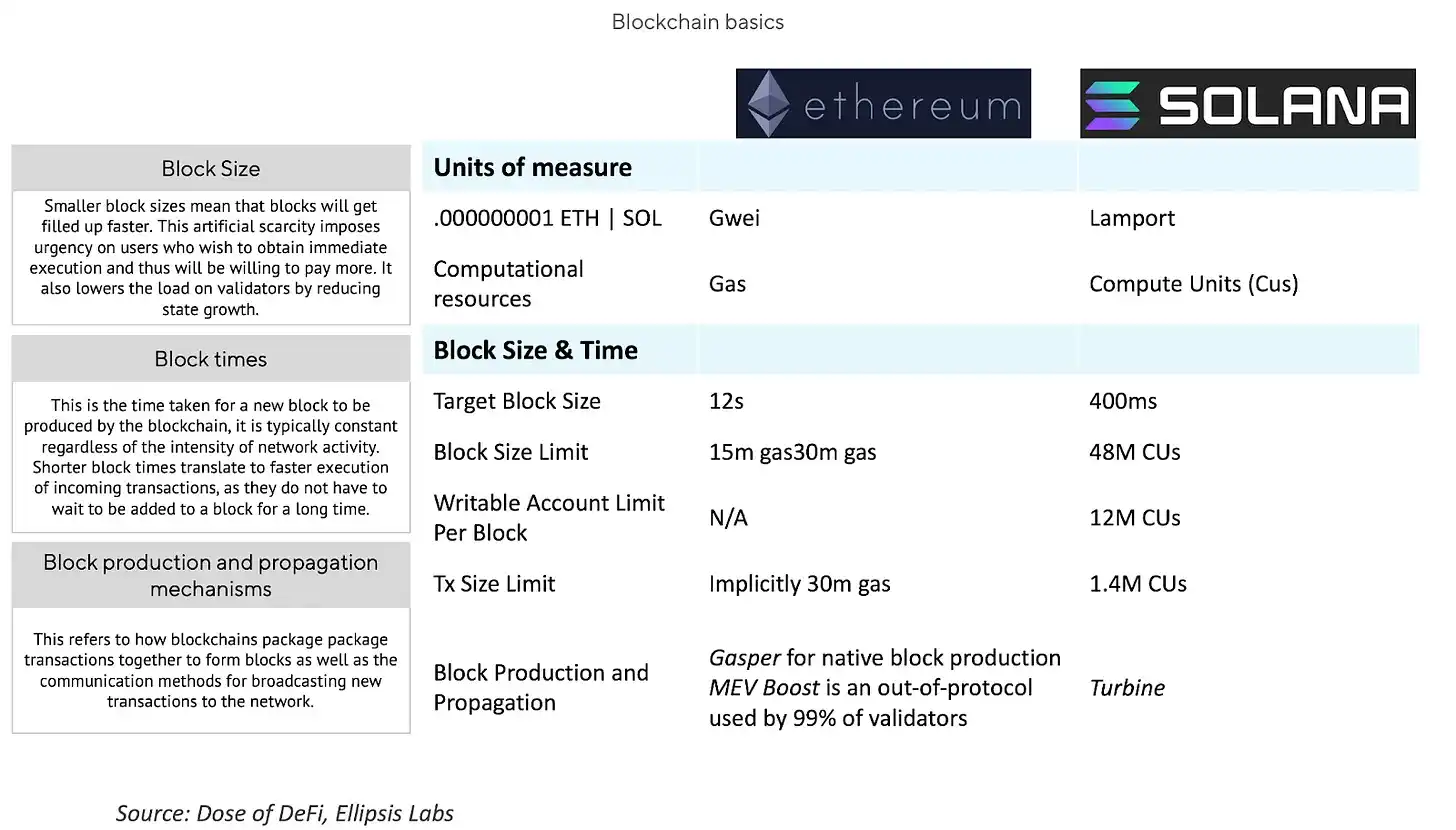

Here, we evaluate the block space on the two largest smart contract blockchains, Ethereum and Solana. As we delve deeper, we understand that the fee market is designed both within the protocol and organically from the ground up, allowing validators to leverage their access to block space.

Solana's fee market is optimized for high performance and aims to avoid the problems that have arisen in the Ethereum approach. However, despite the fact that Solana's market may ultimately be more efficient than Ethereum's, it still needs to undergo a MEV revolution similar to its peers (validators beginning to leverage their privileged positions). Solana does not need to take the Ethereum route of proposal builder separation (PBS), but it needs to determine a comprehensive approach to stabilize its fee market in the long term.

Basics of Block Space Valuation

Before we delve deeper, let's try to understand how the value of block space is roughly determined.

There are both technical and social aspects (essentially the coordination of the various parties that give value to the blockchain). From a technical perspective, the blockchain can adjust block size, block time, and block production and propagation mechanisms. The chart below provides a more detailed description and compares the methods of Ethereum and Solana.

The social aspect refers to the coordination of blockchain stakeholders to achieve the technical and financial goals of the chain. It can also be seen as the social status of the blockchain, which, while subjective, is an important measure. Social pressure and the establishment of a specific culture to solve problems are as effective as Solana and Ethereum have established such a culture. Recent examples of discussions around the social layer include debates about increasing Ethereum's gas limit and the issuance amount per epoch, as well as the recent closure of Jito's mempool on Solana.

Now, let's examine and compare the fee markets of Ethereum and Solana in more detail.

Summary of Ethereum's Fee Market

Ethereum's popularity is mainly attributed to its execution environment: the Ethereum Virtual Machine (EVM), which makes smart contracts possible. Another factor is Ethereum's permissionless nature, which has generated various innovative applications in multiple cycles: the ICO boom of 2017-2018, the DeFi Summer of 2020, and the NFT frenzy of 2021-2022. The continued existence of these applications has created value for validators, who provide block space for these activities.

Shortly after the surge in economic activity on Ethereum, miners (this was a few years before the transition to PoS) began exploring how to insert their own transactions when arbitrage opportunities arose, given their position as block proposers.

Phil Daian was the first to document this activity. He first documented this activity (now known as MEV) in his groundbreaking paper "Flash Boys 2.0" in 2019. At that time, Ethereum's fee market only allowed higher gas prices as an incentive for transaction inclusion. These priority gas auctions (PGAs) clogged the Ethereum network and raised gas prices until Flashbots (co-founded by Daian) was introduced. This created a market for miners to be paid transaction inclusion fees by searchers, who are on-chain arbitrage traders. Ethereum researchers subsequently realized that MEV extraction may be more powerful than on-chain fees.

The most significant change in Ethereum's fee market may be EIP-1559, which created a base fee (dynamically determined per period, to prevent spam, and burned) and a priority fee (used to indicate urgency or preference and paid to block proposers for transaction inclusion). An important point is that "priority fee" is functionally different from "tip." The former ensures inclusion and is mediated by the underlying chain, while the latter ensures ordering and inclusion and is mediated by the fee market.

Ethereum's approach has been evolving; see our in-depth research on MEV from last fall. This has occurred through a combination of the social layer, which attempts to decentralize a centralized MEV industry, and the technical layer, where MEV has now become a key part of the technical roadmap (Vitalik refers to this part of the roadmap as "The Scourge").

Mechanism of Solana's Fee Market

Solana has taken a radically different approach in blockchain architecture, especially in terms of scalability.

Some notable innovations of Solana include:

No general memory pool: In Solana, transactions are directly forwarded from the initiating client to the Leader responsible for generating the current block, eliminating the need for a memory pool. This theoretically reduces the confirmation latency of transactions, but in practice, due to "jitter" (i.e., the different processing times experienced by different validators when processing transactions or blocks), this is not always the case.

State isolation: The lack of a memory pool extension makes transactions on its dApps more independent of each other. This approach is similar to the concept of "adding more lanes to divert traffic"; different types of transactions on Solana must follow specific "paths" from the user to the Leader to be added to a block.

Parallel execution: Solana can process non-overlapping transactions in the same block simultaneously. This is due to two factors:

- Solana's block production is (roughly) continuous, as the Leader is expected to add transactions to the block upon receiving them.

- Slot Leaders are fixed, as they are pre-scheduled in a queue, and these Leaders are also responsible for continuously producing four blocks.

These two factors, combined with Solana's state isolation, enable transactions to be "multithreaded." This means that transactions in the current epoch are scheduled by the Leader to be confirmed roughly at the same time (provided that transactions in the same thread do not change the same state) in the same way and at the same time.

Solana's Fee Market: Cheaper ≠ Better

The network fees on Solana are typically very low (although they have risen recently due to increased demand). In contrast to Ethereum, Solana has a static base fee measured in lamports. Then, its priority fee is measured in micro-lamports per computational unit requested.

This means that while fees algorithmically scale with complexity and demand on the EVM, the SVM only needs to increase its priority fee through simple demand. The non-dynamic nature of this technical issue is detailed here, but the key point is that pricing demand statically in the face of fluctuating demand and a deterministic commodity supply is not ideal.

Solana's Fee Market: The Inevitability of MEV

Solana's social consensus considers its low fees as its unique advantage compared to other blockchains. This approach invites spam, so some are calling for increased fees or the implementation of dynamic base fees during periods of high activity (similar to EIP-1559).

Solana's current approach is to implement localized fee markets to address increased demand. With state isolation, the network can easily identify "hotspots" or states experiencing a surge in demand. This hotspot approach allows the blockchain to algorithmically price transactions in high-demand states higher than those with less demand. This approach is similar to the role of block builders on Ethereum, which is completed by schedulers who help place transactions in consecutive blocks based on priority fees.

As part of implementing a localized fee market, Solana has built an on-chain scheduler that locally schedules transactions to execute based on a first-in, first-out algorithm. Transactions are continuously streamed to slot Leaders and then sorted based on the tips they provide.

The algorithm also requires slot Leaders to share the shards they are building with some of the nodes they are connected to, based on the latter's stake. However, as mentioned earlier, this process is disrupted by jitter. Specifically, scheduler jitter (due to Solana randomly assigning incoming transactions to execution threads) and network jitter (from P2P relay delays from incoming transactions and shards).

This "jitter" leads to uncertain transaction ordering on Solana, making block space auctions economically viable. In other words, whenever there is jitter, validators have an economic incentive to insert or reorder transactions. For users, this means MEV leakage, and for validators, it means MEV profits.

Solana vs. Ethereum

A quick review of MEV on Ethereum: before Flashbots on Ethereum, MEV activities crowded out regular blockchain activities and pushed up gas prices for all users through PGAs. On Solana, fees do not skyrocket because it lacks shared state and a global minimum price like Ethereum, but during periods of increased activity, regular users find it difficult to complete transactions on Solana. Flashbots released MEV-GETH to handle PGAs, creating a separate channel for MEV value outside the on-chain fee mechanism. In the case of Solana, Jito introduced a similar product for validators, providing them with a pseudo-memory pool and a customized scheduler to prioritize transactions in the most advantageous way. Jito's memory pool was attractive to users, providing them with a guarantee of inclusion (i.e., their MEV being extracted).

While it was a popular product, Jito's memory pool faced social pressure last month and was shut down. This may be for the same reason that over 20% of Ethereum transactions are run through private memory pools: users are tired of sandwich attacks. Spam is once again the only mechanism (probabilistically) to guarantee execution time-sensitive transactions on Solana. The lack of an efficient block space bidding mechanism leads to uncertainty during periods of high demand.

As transactions on Solana now stream directly to slot Leaders and the priority model has been disrupted, topology (and the resulting latency) is a critical component of time-sensitive transactions that users will consider.

The topology of users in the network can be understood as how "far" they are from the Leader, depending on their stake weight and/or the stake weight of the nodes they are connected to. Therefore, rational agents will seek to be connected to nodes that already control high-value interests, leading to centralization.

As a short-term consequence of spam, Solana is now so congested that it is almost unusable for less savvy users due to transaction failures. Therefore, addressing the long-term consequences (centralization of co-location and network stake) becomes even more important.

A More Rational Market Structure?

Solana's initial design philosophy centered around eliminating user friction and allowing the validation network to meet demand in any way. What they overlooked is that markets are most effective when they operate with a certain level of determinism. Fee markets provide a way to democratize inclusivity by requiring users to pay more for their transactions, shifting the problem from a topological perspective to an incentive-based one.

While this changes the user experience, accepting fee markets, especially their relationship with MEV, is the best way forward for Solana and its users. It can be said that providing a cost-intensive packet method while maintaining the integrity of the chain is much better than having no method at all.

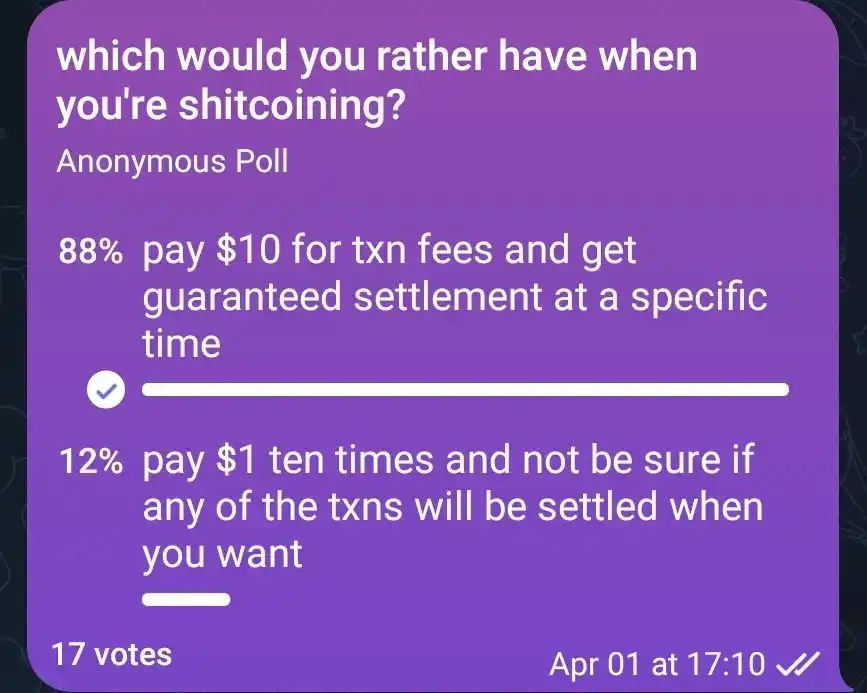

In fact, on-chain activities are almost always time-sensitive, especially when agents seek to extract value with little or no economic cost. Highly deterministic execution is better than cheap probabilistic execution.

(Although the sample size is small, it is still the case!!)

The specialization of the fee market allows bargaining and auctions for block space to occur at a higher level, far from consensus and execution. Therefore, validators can fulfill their duties without having to worry about optimizing the best outcome for accumulated block space value.

The Upcoming MEV Revolution on Solana

Solana is currently in a chain-wide discussion about how its fee market should be restructured (a question Ethereum has been pondering for years but has yet to resolve).

Solana has not yet undergone the necessary MEV transformation. While the recent increase in on-chain activity has attracted MEV participants like Jito and Ellipsis to start building MEV infrastructure, major validators have not crossed that threshold to start running their own Solana MEV strategies. In stark contrast, all major staking providers on Ethereum are running MEV. The Solana validator community is not as adversarial as the Ethereum community, so, to prioritize the end-user experience, both parties have reached a handshake agreement not to extract MEV (so far).

This situation will not last; the social layer cannot monitor behavior indefinitely. Blockchains must operate in an environment of self-interested actors. Solana's performance may be better than Ethereum's, as it can address some MEV issues without the severe constraints of decentralization like Ethereum. However, it still has to answer some thorny questions, such as whether it should allow all staked SOL to receive MEV rewards, as Ethereum has achieved through MEV boost?

To address Solana's congestion issues, we have been exploring some minimal mechanisms. These mechanisms include dynamic fee structures, upcoming modifications to the on-chain scheduler specification, interest-based restrictions, and other application-level optimizations. Progress is happening quickly. The CEO of Jito recently admitted that "a small group of operators/searchers are sandwiching private mempools."

MEV is a sign of economic growth, and therefore, it is inevitable. In fact, even Bitcoin, whose simplicity is often touted as its greatest feature, has begun to undergo a reshaping after the rise of Ordinals and economic activity. Choosing to ignore solutions is because of negative externalities (such as in the case of Jito) does not eliminate said externalities; it only leads to an uncoordinated market.

The social layer is an effective tool to prevent predatory behavior, but it can only last for a very short time. Ethereum is experiencing a deficiency in the social layer, with the rise of time games, a strategy where block proposers intentionally delay the release of their blocks for as long as possible to maximize MEV capture. This weakens the security of the chain but makes economic sense from the validators' perspective. Shame can only last for a while, but protocol research is the only long-term solution.

It is too early to say what Solana's MEV supply chain will look like in a few years. But one thing we can be sure of now is that the majority of value will be captured by a large number of validators.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。