Author: Jaleel

With many assets and chaos, the Runes ecosystem is currently in the Cambrian period.

In the week before the halving, the overall market in the currency circle was not doing well, but the Bitcoin ecosystem has been heating up since entering April, with gas prices rising, showing signs of a third wave of Bitcoin rising. Especially during the launch of the Runes protocol on the mainnet, the community's enthusiasm surged, actively preparing for wallet splitting, UTXO splitting, and testing the entire forging process, hoping to seize the opportunity.

However, with the launch of the Runes mainnet after the Bitcoin halving, project parties rushed to grab the top positions of the runes, causing gas prices to soar to unbelievable heights. With such high forging costs, most people chose to wait and see, while the concept of NFT runes that had previously rushed ahead, such as Runestone and RSIC, saw their prices plummet. "Don't know what to buy, don't know what to play," became the voice of these prepared community members, and the market seemed a bit confused.

"We are in a relatively chaotic and confused period, and there is no widespread consensus yet." BTC ecosystem observer and player 0xSea said in an interview with BlockBeats, which truly reflects the current situation of the Runes ecosystem.

Expected Controversy

Looking back at the issuance protocols in the Bitcoin ecosystem, from Brc20's ORDI to Arc20's ATOM, the overall popularity and liquidity of the protocol are driven by the dragon and assets. "First is First" has always been the slogan of the Bitcoin ecosystem, so the dragon head is generally the first coin deployed by the protocol. However, in the case of Runes, this investment theorem briefly failed.

Casey hardcoded his deployed 0th rune "UNCOMMON•GOODS" in the Runes protocol, which was directly written into the code. Starting from Bitcoin block height 840,000, this "genesis rune" can be forged unlimitedly, with one forged for each transaction, and its forging window will last for four years, until the next Bitcoin halving. During these four years, although the quantity of "UNCOMMON•GOODS" continues to increase, its market value decreases due to dilution, thus deeply binding the genesis rune and the Runes protocol.

"From this mechanism, it can be seen that Casey hopes that the genesis rune and the Runes protocol will be a game that can be played for at least four years." 0xSea told BlockBeats.

Excessive Character Length, Lack of Distinctiveness

Meme veterans are very concerned about distinctiveness, but the current length of the runes has reduced the distinctiveness of memes.

In Casey's Runes design, the maximum length of the rune name is set to 26 characters, which actually reduces the distinctiveness of memes. It is worth noting that although the "UNCOMMON•GOODS" hardcoded by Casey is not subject to this rule, the "•" separator is not counted in the total number of characters. This is to increase the distinctiveness of the ticker, such as "WO•YAO•DISS•YOU".

Current Names of Runes Assets

In short, after the activation of the "runes" at block height 840,000, all tickers with 13-26 characters can be deployed immediately, but "ZZZZZZZZZZZZ" is the first 12-character ticker that can be deployed. These 12-character tickers will gradually unlock between blocks 840,000 and 857,500, unlocking one character shorter ticker every 17,500 blocks.

The next halving is expected to occur in February 2028, when the block height will reach 1,050,000. During the next halving period, there will be a total of 210,000 blocks, which will be divided into approximately 12 update cycles, each containing approximately 17,500 blocks, completing approximately every three to four months. Therefore, from now until the next halving in four years, every 17,500 blocks, the number of characters in the ticker will decrease until it reaches one character.

Therefore, for veteran players accustomed to four characters, such as $PEPE, they will have to wait for about three years to see the unlocking of such short tickers.

Sea believes that Casey designed this gradual decrease in ticker rules to continuously attract the industry and community's attention to Runes as the number of characters slowly decreases, maintaining intermittent but enduring interest in Runes. "By 2027, when the ticker is reduced to the minimum number of characters, we expect to see a peak of attention."

Veteran Players Find Runes Boring

"BRC20 veteran players will feel that Runes is not innovative in terms of gameplay and is quite boring," Sea told BlockBeats. "Whether it's Fair Launch, airdrops, grabbing BRC20, or mining ARC20 based on hash POW, everyone has already played through it, and Runes has not brought much novelty. In the absence of new ideas, unless there are obvious wealth effects to be foreseen, players' interest may quickly fade and become weak."

Although Runes has made some technical improvements—such as simplifying the two transactions required for BRC20 into one, reducing the threshold and cost for players—this improvement has already been achieved by ARC20.

After comparing various protocols in the Bitcoin ecosystem, KOL scientist Box also believes that Runes has not made a major breakthrough in technology.

Early OTC merchants and market makers of Ordinals were blunt in stating: "Casey borrowed the ideas of the Atomicals protocol from start to finish without mentioning a word."

On an emotional level, Sea agrees with Ordinals, believing that the so-called innovation of Runes is actually very limited, mainly relying on Casey's personal influence and catering to the empty sentiment of the Western community, to reap the fruits of victory from BRC-20 and Atomicals.

Sea believes that BRC-20 represents innovation from 0 to 1, albeit somewhat rough; while Runes is the culmination of the optimization faction, mainly catering to the Western community's empty demand for BRC-20, but has not brought about paradigm innovation. In comparison, Atomicals represents true paradigm innovation, not just minor optimizations. After all, when Arthur began writing Atomicals in February last year, BRC-20 had not yet appeared.

Although Sea points out the limited innovation of the Runes protocol, he also believes that a protocol becoming a "standard" does not necessarily require a breakthrough innovation; market choice is the decisive factor. "In fact, it's like Tencent in the Internet industry, many of the products they have done over the past decade are not original (including WeChat), they are all about optimization + micro-innovation."

What are the speculative logics for Runes?

Although the highly anticipated Runes protocol has sparked a lot of controversy in terms of innovation and protocol gameplay, for most users entering the currency circle, profit is the primary concern. They are not concerned about how innovative Runes is, but rather which Runes protocol targets are suitable for speculation.

Moreover, disagreements create more profit potential. Although many early Runes projects have not yet conducted airdrops, with the recent decrease in gas fees, most project parties' airdrops are already on the way. Apart from the well-known Runestone and RSIC, what other speculative logics will the Runes protocol have?

Runestones: A New Favorite for Swing Traders

After the snapshot was completed at block 840,269, every user holding Runestone NFT received 889,806 DOG•GO•TO•THE•MOON (Rune #3). Following the snapshot, the floor price of Runestone plummeted to 0.032 BTC, with a staggering 24-hour drop of 59.5%. At the time of writing, the floor price of Runestone has further dropped to 0.029 BTC.

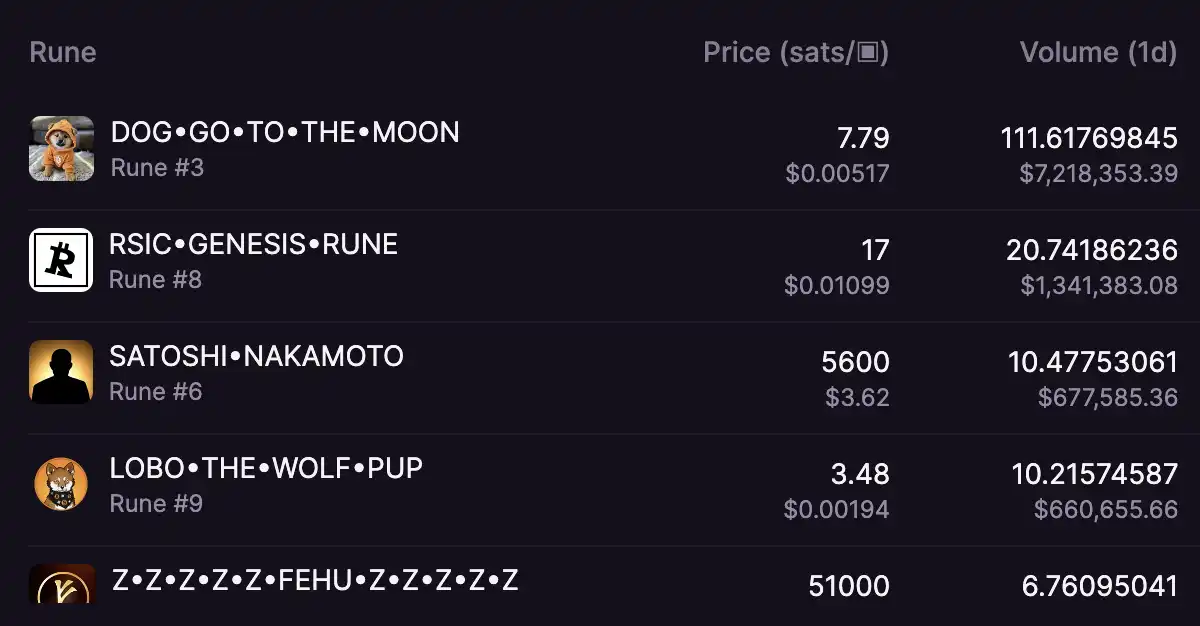

Despite the continuous decline in the price of Runestone, the meme coin DOG, airdropped with Runestone, has been on the rise since its airdrop on April 24. According to Magic Eden's data, the current unit price of DOG•GO•TO•THE•MOON is 7.79 sats, with a 24-hour trading volume of 111 BTC, surpassing other Runes assets and temporarily ranking first in the Runes ecosystem.

At the same time, the total market value of DOG•GO•TO•THE•MOON has reached 500 million USD, and the combined market value of Runestone and DOG is close to the historical peak of Runestone.

After the airdrop, Runestone seems to have become an empty shell, with some of its liquidity shifting to DOG. This change raises a question: does this "shell" still have value?

Sea commented, "Regarding this issue, the Runestone team has already considered it, which is why the founder, Leonidas, has always emphasized the issuance of three tokens, with DOG being just one of them." The current price has dropped to below 0.02 USD, and it may even fall below 0.01 USD, as it seems to have little practical use in the short term. However, the situation may change in the coming months. If in October, the project announces the details of the airdrop of the second token, this may re-attract the market's attention and drive the price up.

In this light, Runestone may be one of the assets extremely suitable for swing trading in the current Runes ecosystem, which of course poses a certain challenge to holders in terms of information acquisition and processing.

On the other hand, RSIC's price drop after the airdrop is relatively small, which can be attributed to its stronger mining attributes. Unlike Runestone, RSIC takes a snapshot based on the holding block time, so even if sold, the previously held block time still belongs to the original owner. "Even though the details of the second season of RSIC have not been announced, the currently held blocks are being calculated for points, which is very likely," Sea told BlockBeats.

Degen Meme Culture in Bitcoin

In essence, the tokens on the Runes protocol are all memes. Therefore, in addition to the Runestone and RSIC factions of Runes, there are many meme coins that have been launched in a completely fair manner and carry native Bitcoin elements, indicating significant alpha opportunities.

Fairness is one of the core values of memes. If a meme reserves too much share for itself, the community usually does not support it. A true "fair launch" means that no funds are reserved for founders or early investors, ensuring that all participants have an equal opportunity.

Moreover, distinctiveness is also a key factor for the success of memes. For example, the highly distinctive puppets and wizards on BRC-20 saw a significant increase in market value before the launch of Runes. Now, the runes they deployed and airdropped are PUPS•WORLD•PEACE (Rune #13) and MAGIC•INTERNET•MONEY (Rune #17), respectively. For example, PEPE•WIT•HONKERS, Sea particularly appreciates the representation of the Pepe element in Runes, mentioning that "the Pepe image, from early comics to various widely circulated memes in the internet community, has a strong influence, reaching millions or even tens of millions of audiences."

"There's also The ticker is elsa, which was the only project I went to invest in on the first day of Runes going online," Sea said. Elsa is the name of the dog of Bitcoin OG Hal Finney, who was the first recipient of a Bitcoin transaction from Satoshi Nakamoto, receiving 10 BTC. Hal Finney passed away in 2014 due to health issues, and his status in the community cannot be ignored, adding deep historical significance to related memes. After all, in the Bitcoin ecosystem, elements related to Bitcoin naturally become more popular.

Hal Finney and his dog, image source: Internet

In addition, the epic Bitcoin NFT project Blob, which was acquired for 33.3 BTC in an auction from ViaBTC for the fourth Bitcoin halving block, is also worth paying attention to. Its elements such as laser eyes, rare intelligence, and halving represent the pure elements of Bitcoin.

According to Magic Eden's data, the floor price of Blob has risen by over 55% in the past 24 hours, reaching 0.0543 BTC.

Recently, the co-founder of the Bitcoin NFT project Blob, and the current 6th-ranked contributor to the Ordinals protocol, @Elocremarc, is currently developing "recursive runes," and it is expected that Blob will also take action in the Runes ecosystem in the future.

In a conversation with BlockBeats, Sea also expressed expectations for Blob in the Runes ecosystem: "If Blob launches coins in the future and operates well, I think it will be an excellent meme, especially since the current Runes memes are still lacking. But this is just my speculation, and I estimate that there is a 30% chance of Blob launching coins."

Will Runes Have Product Narratives?

Initially, most people's impression of the Bitcoin ecosystem was that it was all memes, but after a year of development, the market has seen more, including Bitcoin's second layer and lending.

Runes will be the same. Initially, it seems to be only related to memes, but over time, especially when viewed on an annual basis, it is definitely more than just memes. BlockBeats has also observed that Bitcoin lending protocols have already been warming up on Runes.

One prominent example is Shell Finance, a trustless lending protocol built on top of the Bitcoin Layer1. Leveraging PSBT and DLC technology, Shell Finance has achieved a trustless environment for lending and liquidation processes. The protocol consists of two core modules: the first is the issuance of synthetic stablecoin asset $BTCx, anchored to the value of $BTC; the second is a lending protocol that supports the use of various runic assets (including Ordinals, Runes, Atomicals, Stamp, etc.) as collateral to borrow $BTCx.

Currently, Shell Finance is distributing its NFT whitelist, Darkman, across various Bitcoin NFT asset communities, and Darkman holders will also have the opportunity to receive airdrops of Runes tokens released by Shell Finance in the future.

In a conversation with BlockBeats, Shell Finance revealed that they will use token launches on the Runes protocol to complete the core construction of the community, as well as the cold start of the product and liquidity.

"Our approach is as follows: first, we choose to conduct functional testing (FT), as we are a lending project focused on practical landing. For a lending project, we mainly need two things: first, qualified users; second, necessary liquidity. In order to let potential users understand us, we did not carry out large-scale promotion in Q2, but adopted a productized mechanism by taking asset snapshots for specific asset holders. Therefore, users holding our FT are actually active users of these assets and are the target users we will focus on in the future," explained Shell Finance about their market strategy and product positioning.

When Shell Finance's main product (MP) launch is completed, they have actually built the core of the community. This strategy is not only to establish a solid user base but also to ensure the sustainability of product development and long-term market participation.

In addition to the speculative logics of the three types of Runes protocols mentioned above (swing trading Runestones, Bitcoin degen meme, and long-term product narratives), there are also some consensus opportunities in the market, including "projects launched by ordinals og; well-known projects on Ethereum or other chains, such as Prometheus; projects that can introduce Solana liquidity in the future," as mentioned by 0xWizard. These will not be elaborated one by one.

At present, after the completion of the Runestone airdrop, both in terms of liquidity and floor price, Runestone and its airdropped DOG•GO•TO•THE•MOON still temporarily rank first, but there is also the possibility of being "overtaken on the bend" in the long term. BlockBeats will continue to track the subsequent development of the Runes protocol.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。