The post-halving Bitcoin market has what kind of imagination space

Author: Plain Language Blockchain (Compilation)

With the continuous changes in the "atypical bear market" and the narrative of "halving" that has never faded in the crypto world, on April 20, 2024, the block reward is about to decrease from 6.25 BTC to 3.125 BTC.

Everything in the past is just a prologue. As one of the most important narratives in the crypto industry, "Bitcoin halving" has always been a good medicine to boost market confidence. Now that the bull market seems within reach, will this halving cycle rhyme with the previous ones?

01

Historical cycle of halving

For the crypto industry, each halving is a grand event, especially the first two halving cycles of Bitcoin, which saw astonishing gains of tens of times. (In the short term, after the first two halvings, there was a short-term decline accompanied by the exhaustion of bullish factors, but after the adjustment was completed, a long-term uptrend emerged).

However, starting from the third halving in 2020, due to the significant increase in the number of industry practitioners, market attention, and the improvement of supporting infrastructure compared to before, Bitcoin is no longer a niche product limited to the geek community, and has begun to interact with more external factors.

In summary:

Before the first two halvings (2012, from 50BTC to 25BTC; 2016, from 25BTC to 12.5BTC), geeks in the industry were more concerned about the potential of Bitcoin as electronic cash;

During the third halving (2020, from 12.5BTC to 6.25BTC), the focus on Bitcoin shifted to its properties as a payment tool, sparking a series of debates (the subsequent BCH fork was almost the top trend in the industry);

And in the fourth halving cycle (2024, from 6.25BTC to 3.125BTC), with the approval of Bitcoin spot ETF, Bitcoin has become an alternative asset, and the focus has shifted to the layout of traditional institutions and capital.

So compared to the first two halvings, the heat of the third halving of Bitcoin was unprecedented. At the same time, the overall global political and economic environment also affected its performance during the third halving:

Under the influence of macro factors, from March 12 to March 13, 2020, two months before the halving on May 11, Bitcoin plummeted from $7,600 to $5,500 and then further down to $3,600, evaporating a total market value of $55 billion, causing over 20 billion RMB in liquidation, accurately achieving "price halving."

However, after the halving in May, the DeFi Summer initiated a new round of bull market cycle, and Bitcoin surged to $60,000, nearly 20 times higher than the lowest point before the halving.

Overall, according to the law of historical halving cycles, from a traditional perspective, the price of Bitcoin during halving will return to half of the price of the previous bull market. Just last month, the price of Bitcoin returned to the price of the previous bull market, exceeding $60,000, and even breaking through $71,000.

So, will a new major bull market cycle be initiated after the halving? Can it achieve an increase of more than 10 times in the current volume?

02

New variables in the Bitcoin ecosystem

However, at the same time, with Bitcoin having gone through three halvings, the block reward reduced to 6.25, and the mined quantity exceeding 19 million, many situations and things have come to a time when they need to be rethought from a new perspective.

Especially in this round of Bitcoin halving, there have been some new variables worth paying attention to in the entire industry and Bitcoin itself compared to the previous halvings.

(1) Transaction fee income

According to the halving rule of Bitcoin, the block reward started at 50 BTC, and it halves every four years. It has already halved three times to 6.25 BTC, and the next halving will be in 2024. This will continue until 2140 when Bitcoin will no longer have block rewards;

Transaction fees, on the other hand, will always exist. Therefore, with each round of halving, the block reward will gradually decrease and approach zero, making the income of block producers very singular, relying solely on transaction fee rewards.

Since 2023, the Bitcoin ecosystem, especially the prosperity of BRC20, has sparked a new wave of "BitcoinFi," reaching a new peak in the trading activity within the Bitcoin ecosystem, thereby boosting the surge in Bitcoin's transaction fee income.

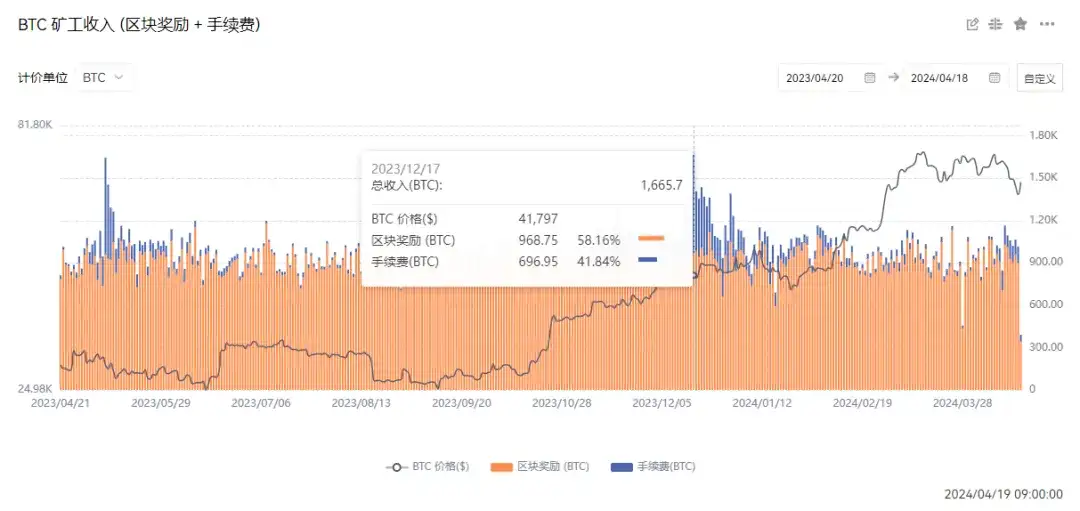

Image source: https://www.oklink.com

The BTC mining transaction fee income on December 17, 2023, reached a near 5-year high of 696.95 BTC (about $19.08 million), accounting for over 40% of the total daily income of miners.

(2) Approval of Bitcoin spot ETF, and the development of the Bitcoin ecosystem

A. Inscription craze

At the end of 2023, the "inscription craze" was ignited. On the basis of the existing Bitcoin segregated witness and other expansions, the Ordinals protocol and BRC20 protocol successfully opened the door to the Bitcoin ecosystem, propelling the rise of the Bitcoin ecosystem. For details, please see: "What is the 'inscription' that everyone is focusing on? Considered a vulnerability by core developers, will it go to zero?"

Due to the craze for inscriptions, everyone has started to shift their attention from Ethereum to Bitcoin, especially institutions, which have begun to invest in the layout of Bitcoin ecosystem infrastructure, with a sense of Bitcoin Summer descending.

B. Bitcoin Layer 2

Recently, Bitcoin Layer 2 solutions such as BEVM and BOB have completed financing ranging from millions to tens of millions. In addition, the recent launch of Nervos' RGB++ and Seal's minting has led to a surge in interest in CKB, which is involved in Bitcoin Layer 2.

There are various Bitcoin Layer 2 solutions on the market, which can be broadly categorized into four types: Bitcoin sidechains, UTXO + client validation, Roullp, and Taproot Consensus. For more details, please see: A Comprehensive Review of Popular Bitcoin Layer 2 Solutions (Part 1), A Comprehensive Review of Popular Bitcoin Layer 2 Solutions (Part 2)

C. Rune Craze

In the days leading up to the Bitcoin halving, the Bitcoin ecosystem has been ablaze with activities related to ordinals and runes.

Ordinals, introduced by @rodarmor in January 2023, have increased the amount of data that can be stored on the blockchain, thus promoting runes. This has sparked a series of innovations using the system, such as BRC-20 and runes, with the differences between them outlined in the table below.

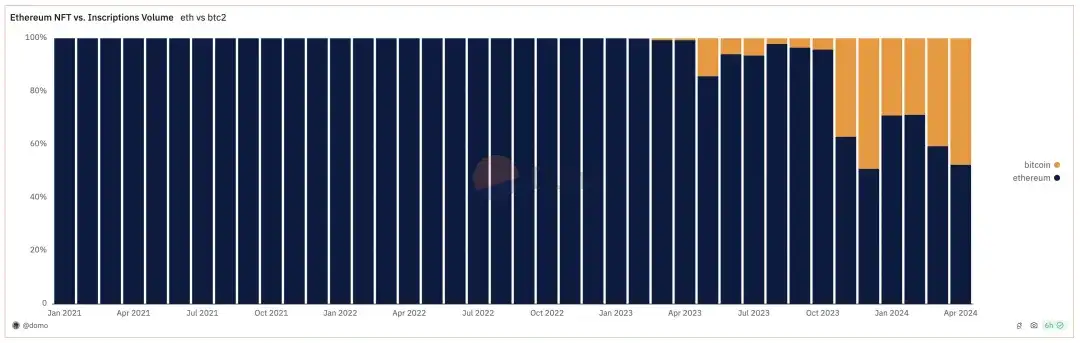

With the Bitcoin halving and the launch of the rune protocol, the trading volume of ordinals has grown exponentially. It is worth noting that in the past month, Bitcoin's trading volume has almost been on par with Ethereum, with OKX and MagicEden being the main markets.

Source: https://dune.com

The most well-known NFT collections on ordinals include NodeMonkes, BitcoinPuppets, and QuantumCatsXYZ. In addition to having strong community support, the holders of these collections have received various airdrops, some of which have been of significant value, creating a wealth effect for the ordinal/rune ecosystem. Similar to WIF, this has created a loyal community, helping to drive the story development more strongly. Therefore, the market is currently very excited about the rune protocol.

D. Bitcoin Spot ETF

In the early hours of January 11, 2024, the U.S. Securities and Exchange Commission (SEC) simultaneously approved 11 Bitcoin spot ETFs. The significance of Bitcoin spot ETFs mainly lies in two aspects:

First, it increases accessibility and popularity. As a regulated financial product, Bitcoin ETFs provide a way for a wider range of investors to access Bitcoin.

Second, it gains regulatory approval, enhancing market acceptance, and helps them to operate in the cryptocurrency industry.

For more details, please see: Historic Moment! Approval of Bitcoin Spot ETF Opens a New Chapter for the Crypto Industry

What impact does the approval of Bitcoin spot ETFs have on the Bitcoin ecosystem?

The approval of spot ETFs undoubtedly provides a "reassurance pill" for the entire cryptocurrency industry, including the Bitcoin ecosystem. The future of Bitcoin assets may become more stable, with reduced volatility.

In simple terms, during periods of high volatility, bear market crashes often hinder the development of ecosystem projects, leading to reduced funding and talent loss.

As a native asset of the Bitcoin ecosystem, a steadily rising Bitcoin price is beneficial for ecosystem development, avoiding the impact of extreme market conditions on ecosystem development.

Overall, the approval of spot ETFs can give the Bitcoin ecosystem more confidence to develop and gain more recognition. For more details, please see: Bitcoin ETF Approval Leads to a Decline? The Future Direction is Not as Simple as We Thought

03

After the fourth halving, what's next for Bitcoin?

As early as the lunar new year when the price of Bitcoin surpassed $40,000, institutions and many others had already made predictions for the price of Bitcoin, with most predicting $90,000: How do people view Bitcoin in 2024?

B. Bitcoin Layer 2

Subsequently, by the end of February, Bitcoin surged past $53,000, $54,000, $55,000, and even reached a high of over $64,000, setting a new high since December 2021. The market sentiment seems to gradually be returning to a bull market. Aim for a new high in 2024? What "bull market engines" has Bitcoin brought forth?

Summarizing the various events in the crypto market that have impacted the price of Bitcoin, such as the continuous eruption of the Bitcoin ecosystem and the approval of spot ETFs, is the halving a positive or negative factor? Can it bring about a bigger bull market in the future? Blockchain enthusiasts have already made predictions: New historical high of 450,000 CNY per BTC! Will Bitcoin halving lead to a crash or a bull market?

Meanwhile, ECOINOMETRICS predicted last week that if Bitcoin were to follow a similar growth trajectory after the halving as in previous cycles, we could see the price of Bitcoin ranging between $140,000 and $4.5 million per coin.

04

Conclusion

Less than 24 hours away from the Bitcoin halving, this may be the first (or second) time that the majority of industry practitioners and investors have personally witnessed and experienced the "grand event" of the Bitcoin halving. How do you think the upcoming halving and the direction of Bitcoin and this cycle will unfold? Your comments and discussions are welcome.

Source: https://mp.weixin.qq.com/s/7PckVSPlxTMjAteIrYOOwg

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。