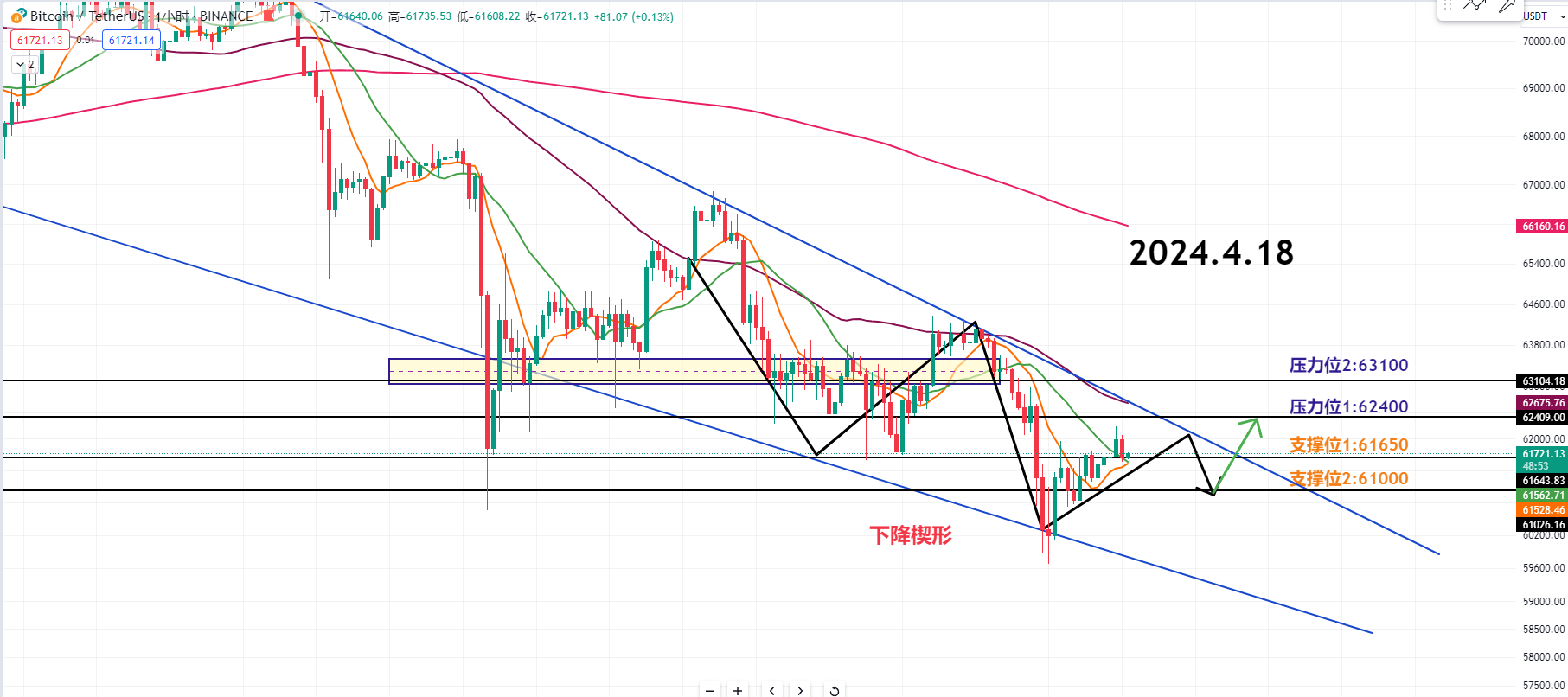

BTC 1-hour Chart:

Bitcoin halving is only 2 days away. After yesterday's adjustment, it is currently rebounding. Due to the intensified selling pressure before the halving and the impact of macroeconomic unfavorable factors such as the delay in interest rate cuts hinted by Powell, the market is in a disadvantageous position.

The master has mentioned in previous articles and videos that this halving is different from the past, and many investors are also maintaining a cautious attitude.

The current rebound should not be simply viewed as a true uptrend. I believe everyone should pay attention to the trend in the descending wedge and observe whether it can hold the support of further decline.

If the upper resistance of the descending wedge is broken at the end of the day, it can be preliminarily determined as a signal of trend reversal and maintain the view of rebound.

The first intraday resistance level to watch is 62400, and the second resistance level is 63100. When the price breaks the first resistance, there is a high probability of retesting 63000, which will be the turning point above the descending wedge.

However, from the current market conditions, it is not a unilateral uptrend. The rebound phase often comes with adjustments. Therefore, near the first resistance level, the possibility of a breakthrough is small. The master believes that a further short-term adjustment is more likely to occur.

The first intraday support level to watch is 61650, and the second support level is 61000. It may currently adjust to the first support level, and the maximum adjustment range can be seen at the second support. If it falls below the second support level, my bearish view will be higher, possibly continuing to the final part of the descending wedge.

In the short term, we can expect a rebound near the first support level and consider it as a smaller stop-loss range. In today's trading, we can observe the price dynamics within the descending wedge range and flexibly manage long and short positions.

Finally, the master believes that it is not advisable to hold long-term positions in the current market environment. Even if the market rebounds, a larger adjustment may follow, so taking profits in a timely manner when profitable is a better strategy.

Given that many institutions and investors remain cautious in the face of uncertainty, if you currently have plans to enter the market, the master suggests engaging in short-term operations.

4.18 Master's Short-term Pending Orders:

BTC:

Long position first entry reference: 61650, second entry reference 61000, target 62400-63000

Short position first entry reference: 63100, second entry reference 62400, target 61650-61000

This content is exclusively planned and published by Master Chen (WeChat Official Account: 币神师爷陈). If you need to understand more real-time investment strategies, untangling, spot contract trading techniques, operational skills, and knowledge of candlesticks, you can add Master Chen for learning and communication, hoping to help you find what you want in the cryptocurrency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates on macro analysis articles across the web, technical indicator analysis of mainstream coins and altcoins, and spot mid-to-long-term replay price prediction videos.

Gentle reminder: Only the column official account (as shown in the image above) is written by Master Chen. The end of the article and other advertisements in the comments section are unrelated to the author. Please carefully distinguish between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。