Bitcoin halving triggers price fluctuations, while power law regularity and persistent high core service inflation constitute market uncertainty.

Author: ECOINOMETRICS

Translation: Plain Blockchain

Where will Bitcoin go after halving? Bitcoin is one week away from its fourth halving. So, according to the usual four-year cycle, it's time to speculate. Has halving been priced in, or not?

As far as I know, it hasn't. The ultimate narrative might be something like this:

Only X bitcoins are mined each day, and the demand from ETF alone exceeds X bitcoins per day. After halving, we will drop to X/2, which is shocking…

I think this narrative has not been fully substantiated so far. Therefore, I believe "not priced in" is the correct conclusion. So let's dream a little.

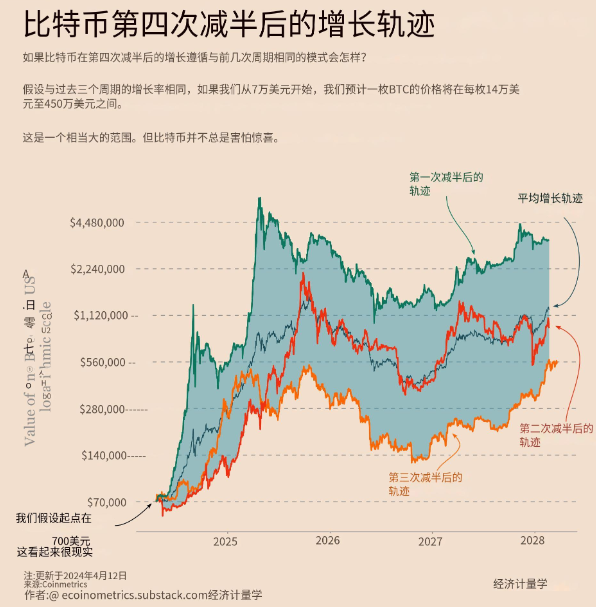

As I write this, the price of Bitcoin is $70,000 per coin. It may stay at this level before halving. If Bitcoin is to follow a similar post-halving growth trajectory as in previous cycles, we could see the price of Bitcoin ranging from $140,000 to $4.5 million per coin.

This is indeed a quite wide range, but the key is that the lower limit is in the six-figure range…

We will update the chart below on this page daily to show the actual post-halving trajectory.

1. Power Law Regularity in Bitcoin ETF

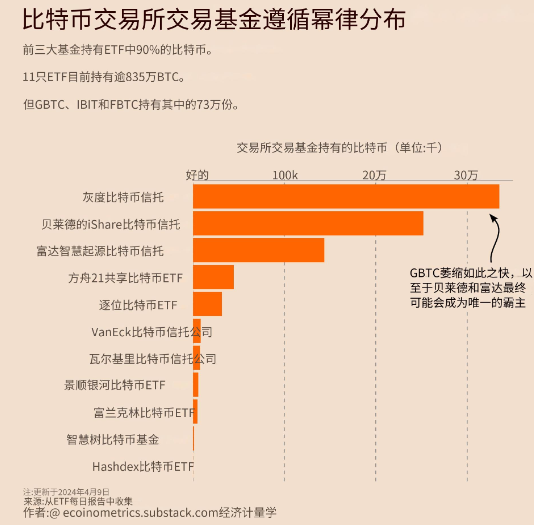

Here's an observation: 90% of the bitcoins held in ETFs are held by 30% of the ETFs.

We have 11 ETFs holding approximately 835,000 bitcoins. Among them, three ETFs, GBTC (Grayscale), IBIT (Blackstone Group), and FBTC (Fidelity Investments), collectively hold 730,000 bitcoins.

This doesn't fully adhere to the 80/20 rule, but it's very close. As Grayscale continues to reduce, we may reach a situation where two ETFs control 80% of the bitcoins held by the funds. It's just a matter of time.

Power law regularity is everywhere.

2. Sticky Inflation

This week, we welcomed the highly anticipated March CPI (Consumer Price Index) inflation data. Inflation remains unbelievably high. But this is not surprising.

What do you want me to say?

If you've been reading this newsletter every week, you may be tired of me repeatedly talking about the same thing about inflation. But since most people are just starting to realize this, let me repeat it again…

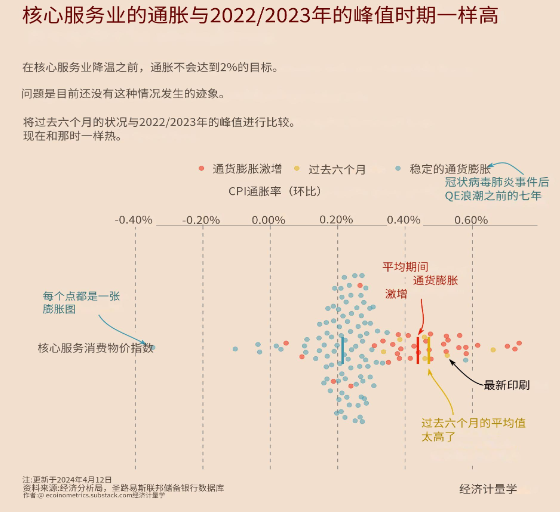

The issue lies in core services. They have been a problem for the past six months. The other parts of the CPI are generally cooling down. Or at least we can say they have transitioned back to pre-pandemic patterns.

But core services, which account for a large part of the US economy, have not transitioned back. The distribution of core services' monthly inflation has not changed since the surge in 2022/2023. This is clearly different from the inflation pattern before the pandemic.

In this situation, do not expect inflation to reach the 2% target.

Source: https://ecoinometrics.substack.com/p/where-is-bitcoin-going-after-the?utm_source=%2Finbox&utm_medium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。