The world is bustling, all for profit; the world is often moving, all for profit! Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of cryptocurrency market trends, striving to convey the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreen!

Let's return to the recent market trends, especially for contract users, the grasp of the oscillating market and the timing of entry, many people's judgments still lack a certain degree of maturity. Especially in the recent articles preparing everyone to enter the market, many friends blindly rushed in without asking whether Lao Cui was bullish or bearish. Today's focus is on the recent trends and the overall judgment. Almost all recent hot news has already been shared with everyone by Lao Cui, so let's start with the big picture to help everyone comprehensively judge the recent trends. Many coin friends attribute the retracement trend in the coin circle to policy guidance, which Lao Cui thinks is too one-sided. Lao Cui has already mentioned before the growth that it will not break through the high point and still remains within the range of the oscillating market.

Why did Lao Cui make this judgment? A big part of the reason is the recent capital flow issue in the coin circle; currently, the place where the most funds are flowing into in the entire financial market is definitely gold, energy, and even the ability to absorb large quantities of commodities, which is far higher than the coin circle market. Everyone needs to understand one thing, the underlying logic, although the coin circle maintains the mystery of future technology and new concepts emerge endlessly every year, such as the recent NFT, and even the previously mentioned coin mixer, including this year's dark horse SOL and a series of beautiful visions. Learning from history, the overall concept maintenance cycle of new coins each year basically does not exceed 6-12 months, these collectively known as hot coins, once the trend passes, they can hardly escape historical judgment.

Lao Cui generally does not recommend too much for hot coins, these are not within the normal vision of investors. The bright prospects of hot coins have also trapped many spot users, blindly pursuing hundredfold or even thousandfold coins, ultimately losing the ability to invest. No matter how powerful the concept is, the coin circle ultimately belongs to the investment market. As long as it is an investment market, it will follow the logic of the financial market. And its operating logic will also follow the law of human nature. Under this logic, Lao Cui will not blindly be bullish, or even bearish. This is also why when there is a downturn, Lao Cui will remind everyone not to think that the depth will be particularly deep. The most basic way to judge is that the development of the coin circle is currently looking better. (At least compared to the previous bull market, we have the help of traditional funds)

Take a simple example, Hong Kong is currently preparing for the listing of a Bitcoin fund index, and the listing speed far exceeds everyone's imagination (Lao Cui mentioned this to everyone last month), ordinary investors do not need to know the inside story. I just need to understand one thing, the listing in the US must have benefits, which will attract people to this market in the future. This is absolutely good news for the entire coin circle, as only the US and we have trading venues in Asia and even the whole world. At least it allows traditional capital in Asia to have a direct way to enter the coin circle. Reflected in the coin circle, it will at least attract a certain amount of funds. The listing is absolutely beneficial for investors and tax authorities, it may be delayed, but the final result will definitely be successful. This also includes the Fed's interest rate cut, which is currently claimed to be delayed, and there is still no news about the listing of Ethereum, and the only Bitcoin halving is still ten days away.

Delay does not mean it will not happen, the key is to see the results, and the final landing in the coin circle will definitely maintain a growth trend, so there is definitely a bullish attitude towards the big picture. It's just that due to the more eye-catching performance of other markets recently, it has somewhat impacted the coin circle, so in the short term, without major positive news coming, it is difficult to attract the blessing of large funds. The coin circle still belongs to investment in the future, and the risk is far higher than other markets. The entry of traditional capital must consider this risk. Since we have determined that it is difficult to break through the high point in the short term, the final judgment is on the depth, and the depth is easier to judge, that is, there is no large amount of capital withdrawal, and everyone generally still has a positive view of the coin circle market. Based on the above, the overall trend is still bullish, so the depth will not be too deep, this is the trend of the entire direction.

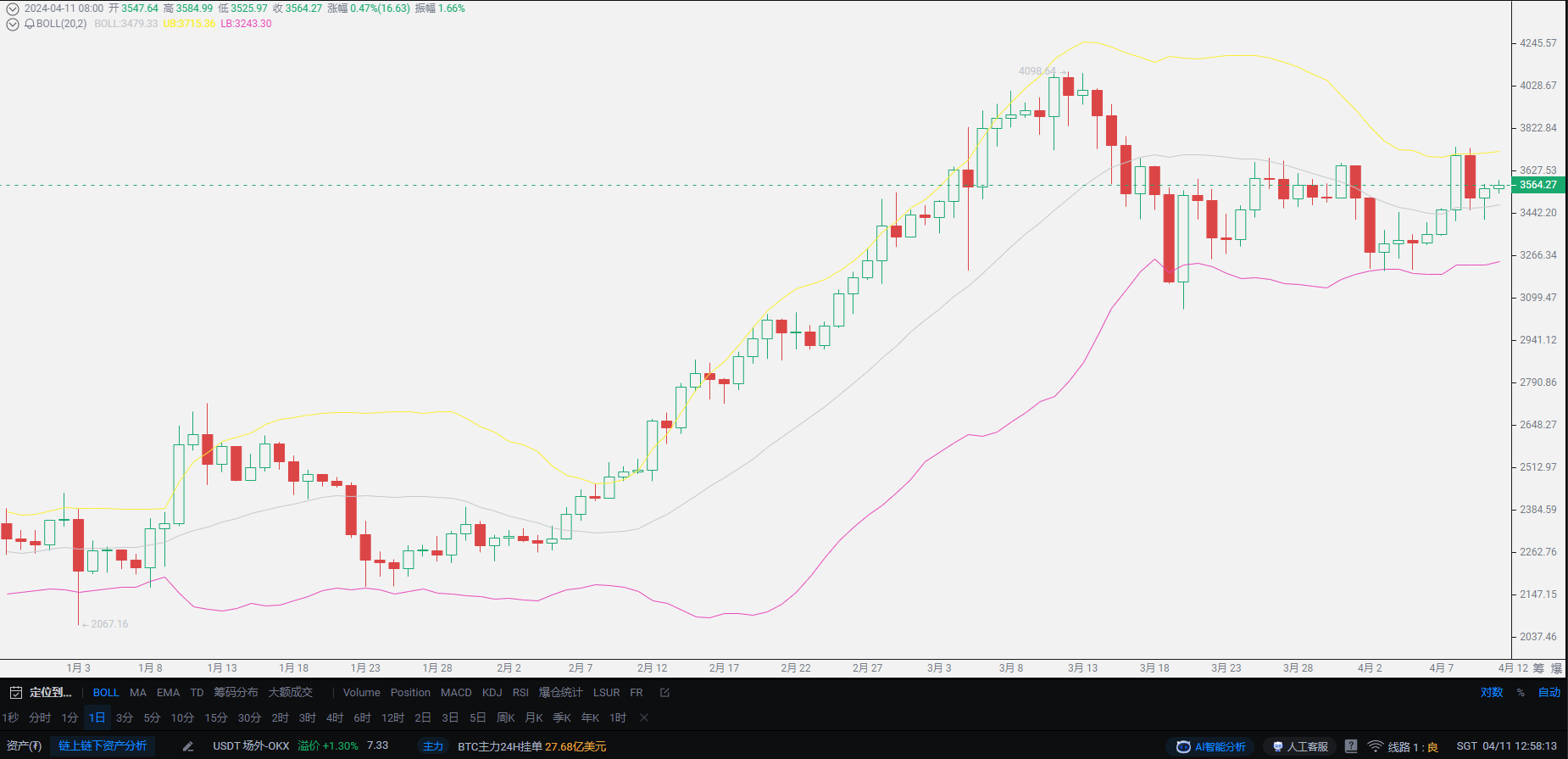

After discussing the big picture, the way to judge the short-term is easier to grasp. Ethereum has not fallen below the 3000 level many times, and the high point is currently at 4000, the entire fluctuation will not exceed 1000 points, and Bitcoin is the same, the entire fluctuation is maintained around 10,000 points. In the short term, the fluctuation is between 1000 points for Ethereum and 10,000 points for Bitcoin, spot users can still enter this market as long as there is profit. The form of short-term fluctuations is not necessarily only suitable for contract users, indeed the recent market fluctuations have allowed contract users to make a lot of profit, and spot users can also make a profit, although the profit is smaller. Currently, in the short term, after reaching the high point, an effective retracement trend will form, the only unfriendly point is that it will not move unilaterally, many coin friends see a decline and go short, often at a high point. You must be patient, the current way of trading is not necessary to incur losses, with proper position control, it is possible to make a profit. Especially for spot users, recently, I have seen too many friends choosing to abandon their principal at the cost of exiting.

If you do not grasp the timing of entry well in this market, you can choose to wait and find a low point to enter. If you are really worried about the entry point, you can private message Lao Cui. In the article, it is indeed impossible to give everyone specific positions, to avoid creating a marketing nature. In summary, the overall trend of the entire coin circle is that before the three elements arrive, it will still revolve around the oscillating market, and the oscillating market will not give everyone too much time to act. At least before next week, everyone should be prepared to wait for the bull market to come. In the short term, it is currently in a state of rising and retracing, and the depth will reach and then rise. If you are not good at grasping the entry point in the short term, consult Lao Cui! (I won't charge you) Finally, I would like to remind everyone that major fluctuations may be imminent!

Lao Cui's message: Investment is like playing chess, a master can see five steps, seven steps, or even a dozen steps ahead, while a low-level player can only see two or three steps, the high-level player considers the overall situation, plans for the general trend, does not focus on every move, but aims to win the game in the end, while the low-level player fights for every inch, frequently switches between long and short positions, only fighting for short-term gains, and frequently ends up in trouble.

Original article created by public account: Lao Cui Shuo Bi. If there is any infringement, please contact the author to delete.

This material is for learning and reference only, and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。