Author: Frank, PANews

Editor's Note:

Public chain is the soil for the growth of blockchain technology. In the process of the development and progress of blockchain technology, the innovation and evolution of public chain technology have played an indelible role. From Bitcoin to Ethereum, it has brought a new version of smart contracts to the encrypted world; from Ethereum to new public chains like Solana, it has opened up the possibility of Web3 moving towards large-scale applications. In each bull market, there are outstanding new public chains that emerge as the benchmark of the bull market and the cradle of technological innovation. In order to have a deeper understanding of the entire crypto world, PANews has launched a series of articles called "New Narrative of Public Chains," exploring the new narrative and potential of various public chains, including their latest developments, technological changes, and market potential.

In the past month, the market performance of Fantom's governance token FTM has been particularly outstanding among many public chains. It has risen from $0.42 on February 24 to a high of $1.23 on March 21, nearly tripling in value. Amidst the wave of numerous memes, achieving such market performance is indeed remarkable.

"Today, my confidence in Fantom is 100 times stronger than in 2019. The team is 100 times stronger than before. The financial situation is 250 times stronger than before. Our technology stack has increased in speed by 160 times and has become more optimized. If you think Fantom will go to zero or disappear into the sea of irrelevant blockchain projects, I am willing to take the opposite bet." Andre Cronje, known as the DeFi father, expressed his confidence in Fantom once again on Twitter. Despite several withdrawals, AC remains as steadfast as ever in his confidence in Fantom. AC's confidence may stem from Fantom's newly released technology, Sonic, on March 25. According to the official introduction by Fantom, "The Fantom team has been working hard to build our new technology, Sonic, over the past two years, which is the most scalable and secure blockchain technology to date. Compared to Opera's 200 TPS, Sonic can process 2,000 TPS at sub-second speeds, which is a huge improvement." Sonic technology may become one of Fantom's main narratives in the coming years.

With AC's promotion, Fantom is emerging from the quagmire of the multichain event. In this bull market, through the analysis of Fantom's recent developments, the upcoming Sonic upgrade, the construction of the meme coin ecosystem, and AC's return, PANews believes that these elements may lead to Fantom's comeback in this bull market.

Sonic Upgrade Becomes the Highlight of Fantom

The Sonic upgrade is undoubtedly the current focus of Fantom's narrative. On March 25, Fantom founder Michael Kong released the first part of Sonic in a blog post. This blog post introduced the performance upgrade content related to Fantom Sonic and a series of governance proposals. The introduction of Fantom Sonic shows that it can achieve a TPS increase of more than 10 times. As seen in the past, the original story of the rise of public chains is related to performance, which has been reflected in previous star public chains such as Solana and Avalanche.

For Fantom, the technical aspect is obviously the current main narrative. Both the Fantom Foundation and AC have been vigorously promoting the performance advantages of Sonic recently. In summary, the main performance improvement of Sonic lies in the enhancement of efficiency. By combining Directed Acyclic Graph (DAG) and Byzantine Fault Tolerance (BFT), Fantom has achieved a consensus mechanism without centralized leaders. Compared to Fantom's existing Opera chain, Sonic's performance has seen a huge improvement.

Andre Cronje made a significant comparison between EVM and FVM on Twitter:

The basic Ethereum Virtual Machine (EVM) has an upper limit of about 200 TPS, which can be increased by up to 40 TPS through optimistic parallelism (with foresight), for a total maximum of 240 TPS.

The basic Fantom Virtual Machine (FVM) has an upper limit of about 30,000 TPS, which can be increased by up to 4,500 TPS through brute force parallelism (bad), for a total maximum of 34,500 TPS.

So, how can we understand the changes brought about by this technology? We can use a simple analogy to explain:

Imagine you are running a fast-food restaurant (Ethereum main chain), and customers (transactions) are queuing up to place orders and pick up their food. To improve service efficiency, you come up with two solutions:

Parallel EVM: It's like adding multiple order windows and kitchens inside the fast-food restaurant, allowing multiple employees to serve customers simultaneously. Each order window and kitchen can work independently, but they are still within the same fast-food restaurant, following the same rules and processes. By processing customer orders in parallel, the service speed and customer satisfaction of the fast-food restaurant are improved.

Sonic: The working principle of Sonic is similar to introducing a highly optimized central kitchen that can produce a large amount of standardized food in a short time and then distribute it quickly to various branches (Layer 1 and Layer 2). This central kitchen (Sonic) uses advanced equipment and processes, capable of producing food at an extremely high speed and efficiency, far exceeding the production capacity of a single fast-food restaurant or branch.

If the technology can be implemented as planned, it may bring more new projects and users to the Fantom ecosystem. To this end, the Fantom Foundation has also proposed expanding and accelerating the Sonic Labs funding program (Sonic Labs is an entrepreneurial accelerator program launched by Fantom in February this year, aimed at promoting innovation within its new Sonic technology stack. The program will select up to five projects, each of which will receive 1 million FTM (approximately $294,000) in funding, technical support, joint marketing, and mentor guidance). They also stated that a series of user reward activities will be launched, and the new chain is expected to be launched in late summer or early autumn this year.

Can Officially Promoted Meme Coins Replicate the Legend of Solana?

The meme coin ecosystem has become a battleground for public chains in this bull market, and it seems that those who have memes will dominate. Recently, the Fantom Foundation retweeted an introduction to the meme coin $sGOAT. Within just one day of its launch, $sGOAT has become the meme coin with the most holders on Fantom (over 1,000 holders). Combined with some of the official content about upgrades, including performance improvements and reduced gas fees, Fantom has created a soil suitable for the growth of the meme ecosystem. It specifically compared itself to Solana during the introduction. In addition, with the official active retweeting of meme information, Fantom's interest in memes is much greater than before.

Fantom Foundation retweeted the introduction of the meme coin $sGOAT

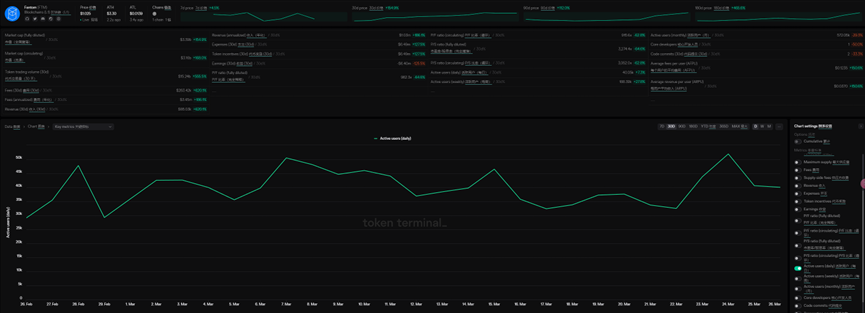

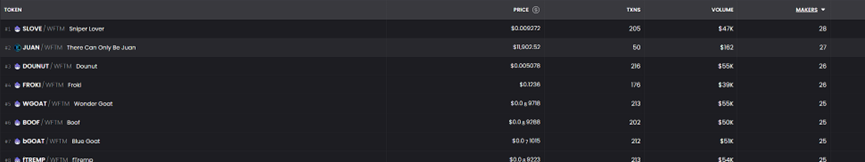

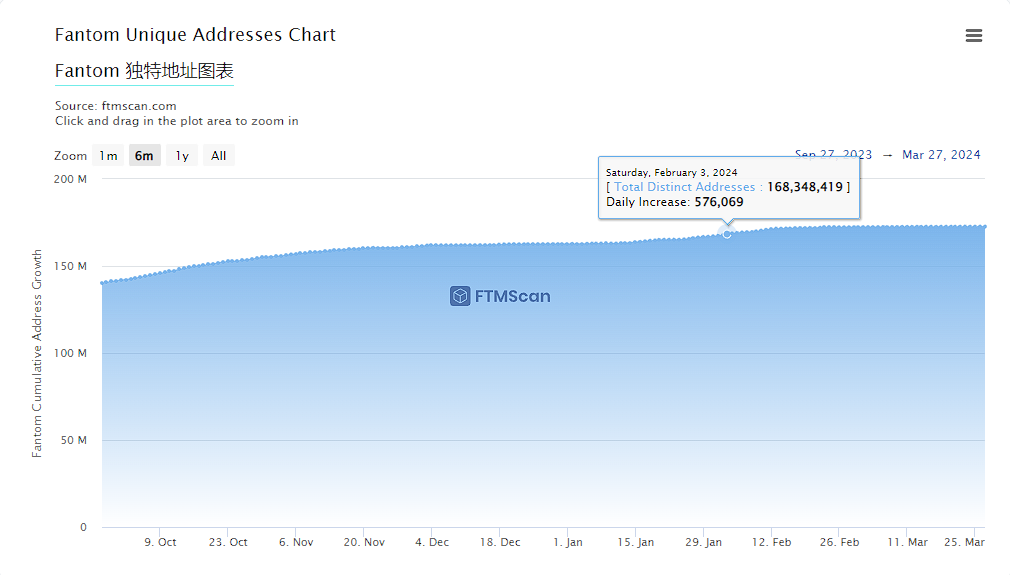

However, the outbreak of meme coins often represents the result of a thriving ecosystem. The number of projects in the Fantom ecosystem is currently 254, and in February 2024, it once experienced a surge in new addresses, with a peak of 570,000 new addresses in a single day. But in the recent official actions, the daily increase in addresses is only a few thousand. The daily issuance of meme coins is also around 100, and the average number of holders is only between 20 and 30 people. According to data from tokenterminal, the average daily active users on Fantom in the past month is about 50,000. Overall, the activity of the ecosystem still lags behind that of public chains such as Ethereum and Solana.

Fortunately, Fantom may still have an ace up its sleeve to drive the activity of the meme coin market. That is the return of Andre Cronje, AC was a controversial figure in the crypto world, and his influence should not be underestimated. In March 2022, AC announced his departure from Fantom, causing YFI to drop by 10% and FTM to drop by 20%. However, in November 2022, after AC announced his return to Fantom, FTM once again rose by 44%. Now, AC is once again active on Twitter, starting to promote Fantom, similar to the effect of Solana's founder promoting meme coins. If the DeFi father AC starts promoting meme coins, it may have a different effect.

Or Join Forces with Frax to Restore the DeFi Ecosystem

The biggest challenge for the reboot may still be the aftermath of the Multichain event, in which Fantom's ecosystem suffered losses accounting for about one-third of the total losses, approximately $65 million. Recently, the Fantom Foundation applied to the court for the liquidation of the Multichain Foundation to help recover and distribute lost or frozen assets. Even so, there are still a large number of complaints in the comments section of AC and the Fantom Foundation's tweets about the losses caused by the Multichain event. Since the Multichain event, Fantom's on-chain TVL has rapidly declined from an average of $200 million to around $70 million, and it has only recovered to a peak of $150 million.

Among the 254 projects listed in Fantom's ecosystem, there are 118 DeFi projects, accounting for nearly half. The revival of the DeFi ecosystem may be the top priority for Fantom.

On March 28, Fantom announced the progress of a new round of financing for Sonic, with the first participating angel investor being the founder of FraxFinance. Collaboration with Frax may find new paths for the revival of DeFi on Fantom. However, the extent of their cooperation still needs to be observed.

Currently, there is a growing demand for high-performance, scalable blockchain infrastructure. If Fantom Sonic can achieve its high-performance, scalable goals and establish an active, diverse ecosystem, it has the potential to become a significant participant in the blockchain infrastructure field.

Facing Strong Competitors, the Comeback is Uncertain

In the Layer1 track where Fantom is located, there are strong competitors such as Ethereum and Solana.

Fantom has adopted a highly targeted marketing strategy against these two ecosystem competitors. First, it leverages its performance advantage to target parallel EVM on Ethereum. AC stated on Twitter, "Parallel technology can't even rank in the top three of Fantom's technological improvements."

As for Solana, a stronger competitor, Fantom focuses on criticizing the performance stability of Solana. In a report on Fantom's first-quarter performance in 2024, retweeted by the Fantom Foundation, it emphasized that Fantom has been running normally 99.9% of the time since its launch, while as a comparison, Solana's multiple downtime incidents were highlighted as the main target of criticism.

However, Fantom also faces many uncertainties. Although AC's return has brought some activity to Fantom, his repeated withdrawals and comebacks in the past may also become an uncertainty for Fantom. Any major changes in team members or mistakes in key decisions could have a negative impact on the project's development and community confidence.

Furthermore, Fantom Sonic has not undergone performance verification, and its performance advantages are currently based on testing environments. Given that the upgrade is still incomplete, its technical implementation still needs to withstand the test of actual applications and large-scale transactions. In April 2023, AC stated that Fantom plans to launch its own crypto bank and planned to launch it that year. To this day, there has been no further news on this matter.

The intense competition in the blockchain infrastructure field and the changing industry narrative structure are the biggest market pressures for Fantom in this bull market. As the industry evolves, it has become an undeniable fact that relying solely on performance metrics as the main narrative is unlikely to gain much recognition. Perhaps Fantom has never lacked narratives, and achieving the vision of these narratives may be more recognized by the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。