Original Author: Crypto Research

Original Translation: Luffy, Foresight News

In the rapidly developing investment world, diversification has always been a key strategy to reduce risk and increase returns. With the emergence of cryptocurrencies, especially Bitcoin, investors have found a new asset class to add to their investment portfolios. This article delves into the impact of incorporating Bitcoin into traditional 60/40 stock and bond investment portfolios.

By analyzing various digital indicators in detail, we explore how different levels of Bitcoin allocation affect the overall performance, risk, and return of the investment portfolio. From gradually increasing holdings to substantial inclusion in the portfolio, we reveal the subtle relationship between risk and return in the context of Bitcoin investment.

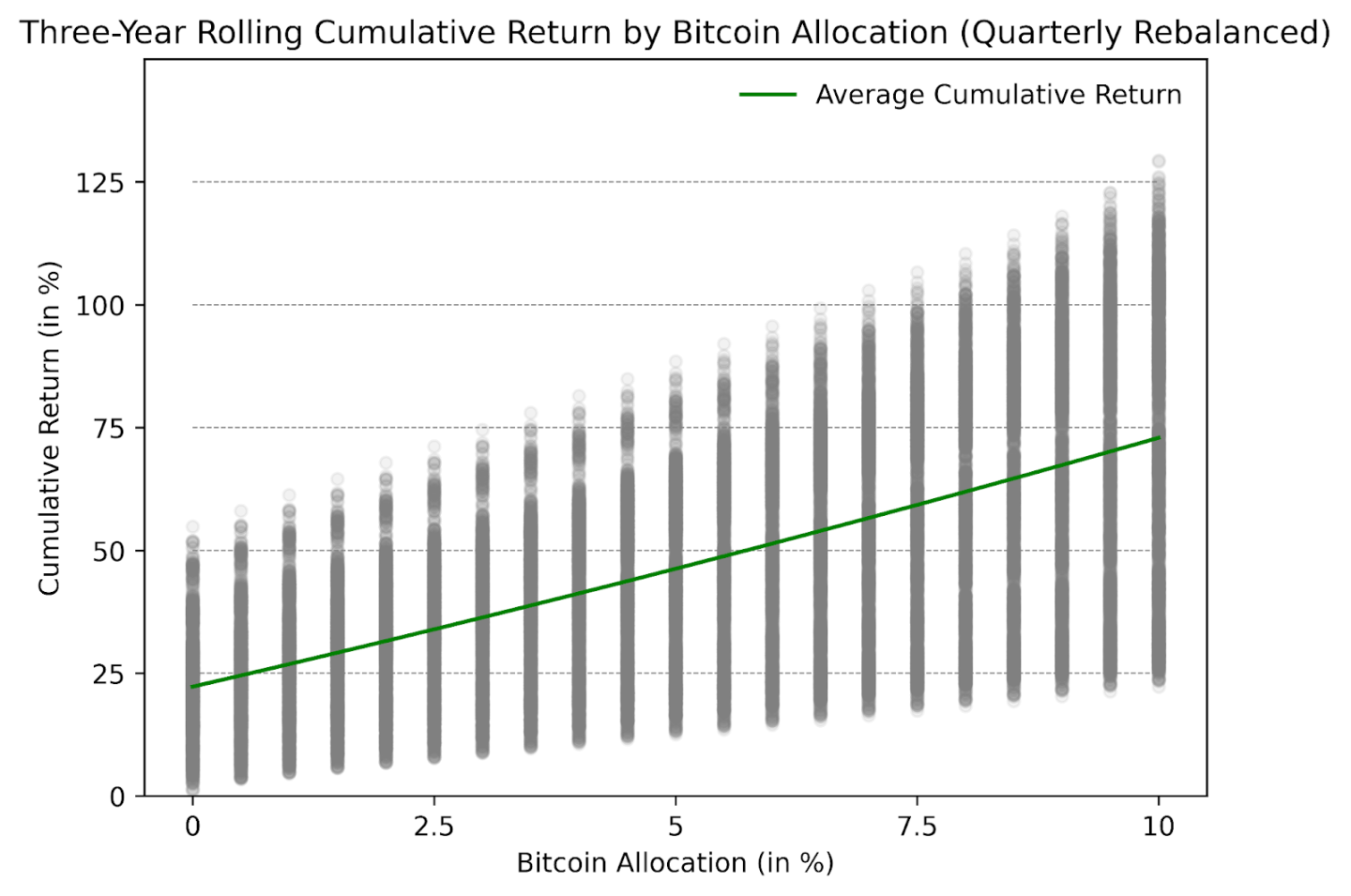

The following figure on the left side of the text shows the situation when no Bitcoin is included in the investment portfolio, and the subsequent columns show the situation as Bitcoin holdings are gradually increased (up to 10%). These lines do not represent changes over time, but rather indicate how much Bitcoin you hold. It is noteworthy that based on historical data, the more Bitcoin you allocate, the higher the return.

Figure 1: Three-year rolling cumulative return on Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

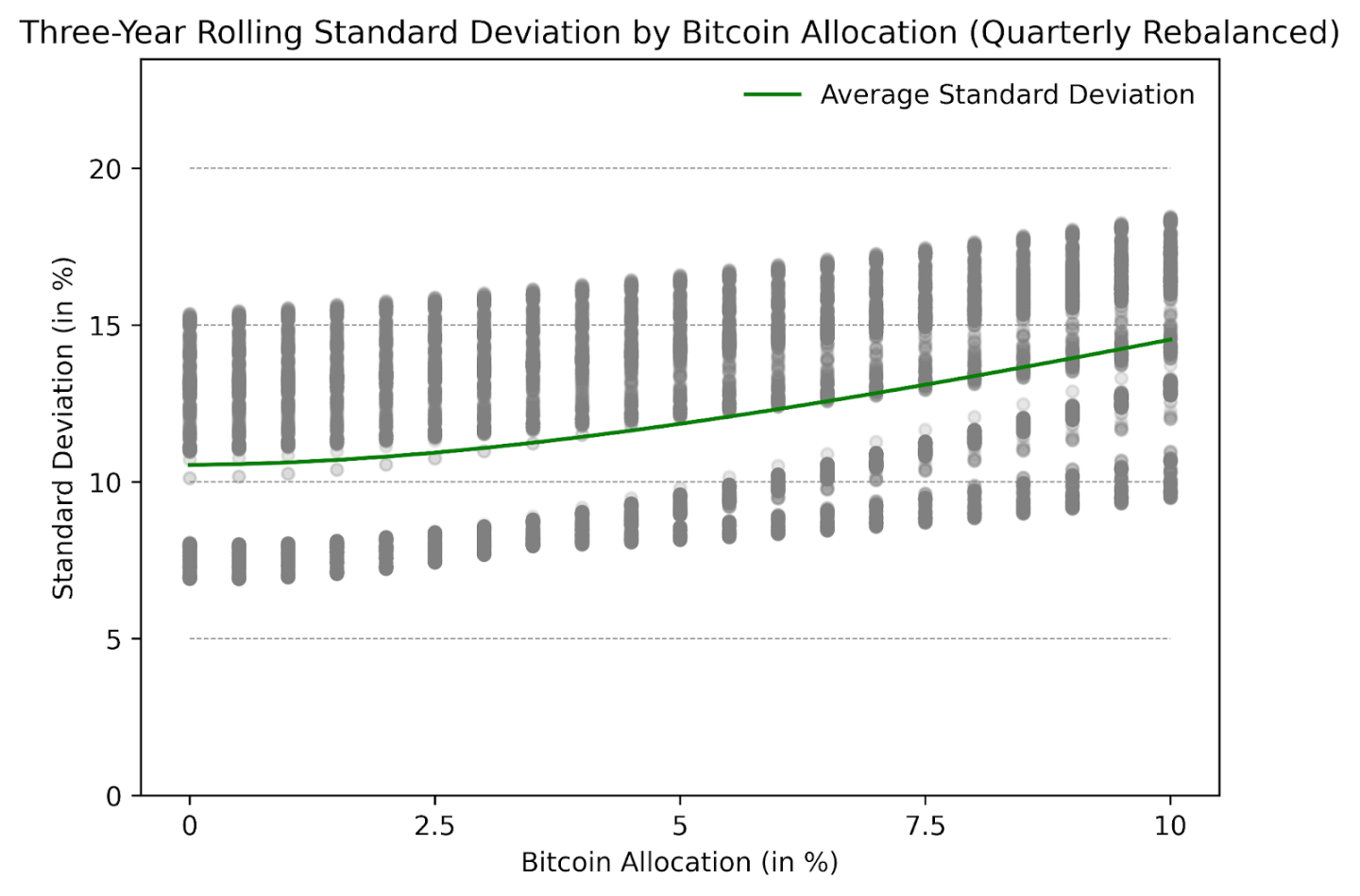

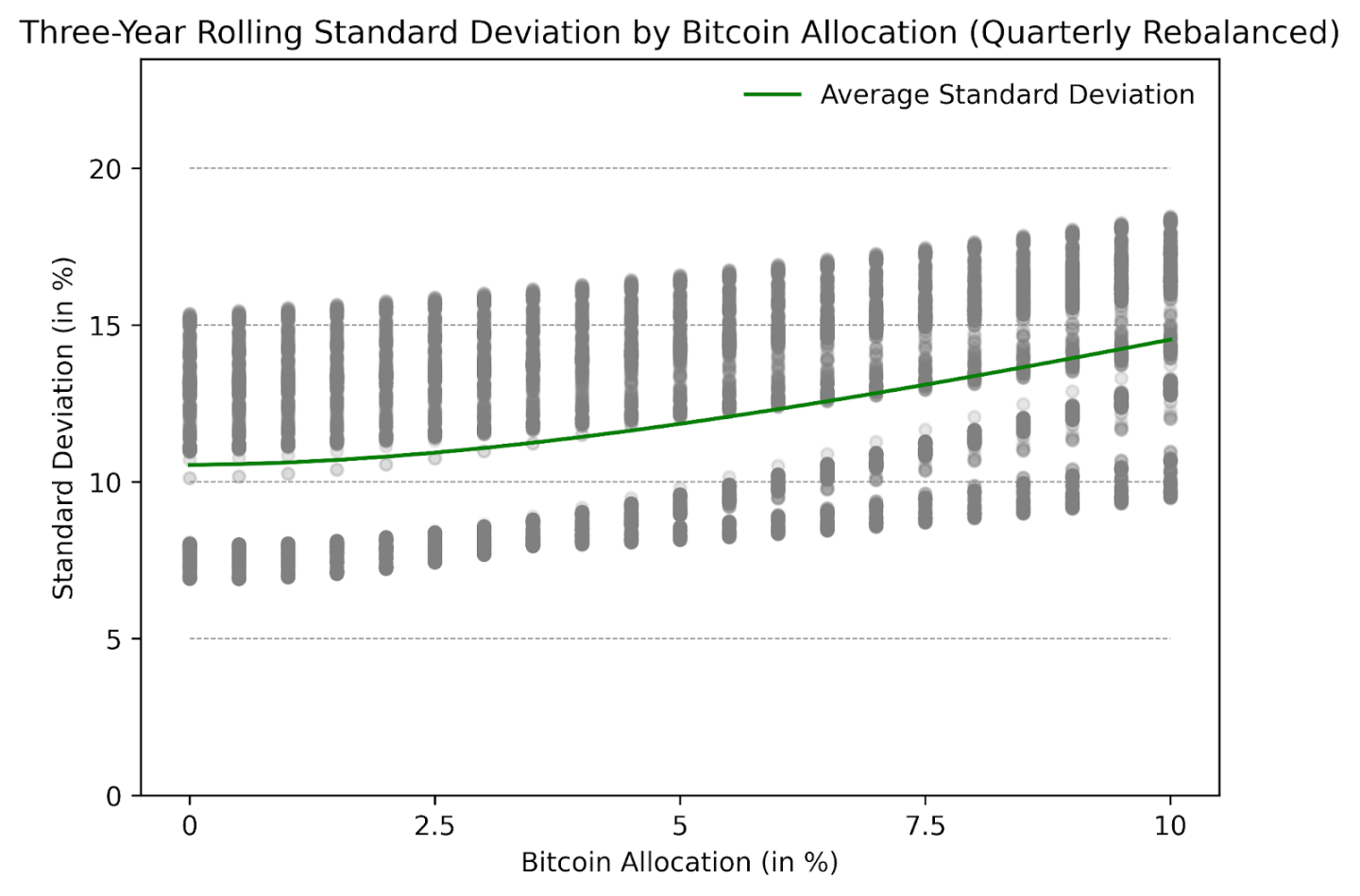

While adding Bitcoin to a 60/40 stock and bond investment portfolio can increase cumulative returns, there is a catch: it may also increase uncertainty and risk. Figure 2 shows the change in volatility after allocating Bitcoin. Although the risk increases, it does not increase in a linear fashion. Instead, the line has a curvature. This means that if you only add a small amount of Bitcoin, such as between 0.5% and 2%, it will not significantly increase your investment risk. However, as you add more Bitcoin, things quickly become unpredictable.

Figure 2: Three-year rolling standard deviation of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

In Figure 3, we combine the information from Figure 1 to examine the Sharpe ratio of the investment portfolio. The shape of this figure is very interesting: initially, it rises rapidly, then tends to stabilize as you allocate more Bitcoin to the investment. This chart indicates that adding some Bitcoin to your investment usually means you will get more return to compensate for the risk you take. But there's no such thing as a free lunch: once you start adding more and more Bitcoin, especially around 5% of the total investment, the increase in risk becomes more apparent than the benefits. Therefore, allocating a small amount of Bitcoin may be helpful, but beyond a certain point, the cost of allocating more Bitcoin is a significant increase in risk. Based on historical returns and mean-variance optimization, the optimal allocation of Bitcoin to the investment portfolio is between 3% and 5%.

Figure 3: Three-year rolling Sharpe ratio of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

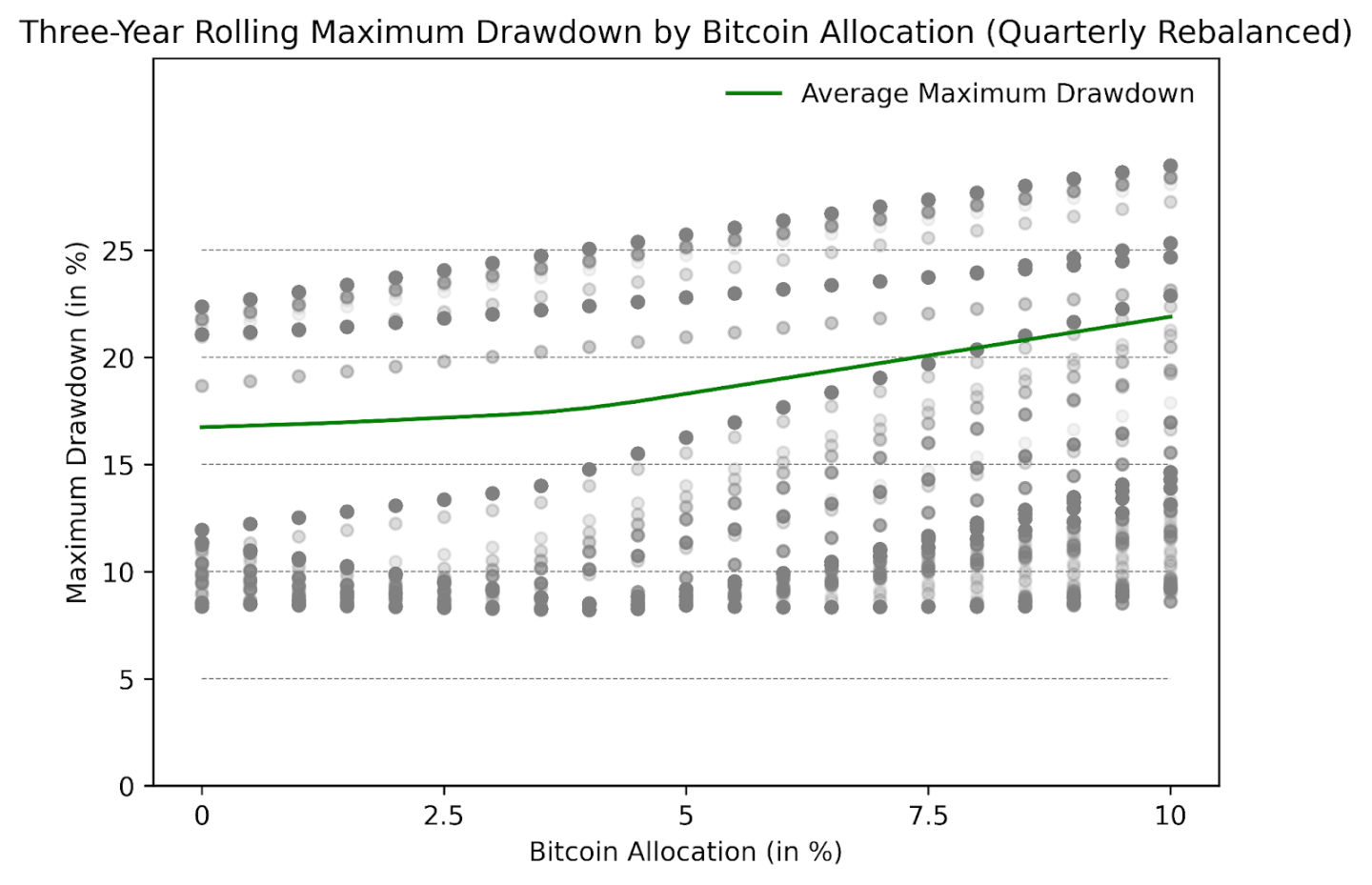

Figure 4 shows how different amounts of Bitcoin affect the "maximum drawdown" of the investment value. Similar to the Sharpe ratio, the green line on the chart indicates that allocating a small amount of Bitcoin (e.g., 0.5% to 4.5%) in a 60/40 stock and bond investment portfolio will not have a significant impact on the maximum drawdown over three years. If the allocation exceeds 5%, the impact on the maximum drawdown will start to increase significantly. For institutional investors with a lower risk appetite, from the perspective of risk adjustment and maximum drawdown, keeping Bitcoin holdings at 5% or below of the total investment may be the best choice.

Figure 4: Three-year rolling maximum drawdown of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

In conclusion, exploring Bitcoin as part of a diversified investment portfolio reveals the delicate balance between risk and return. The results presented through various data emphasize the potential to increase cumulative returns by strategically increasing Bitcoin holdings, accompanied by an increase in volatility. Based on historical data and mean-variance optimization, the best strategy is to allocate 3% to 5% of the total investment to Bitcoin.

Beyond this threshold, the risk-return trade-off becomes unfavorable, highlighting the importance of caution and informed decision-making when incorporating Bitcoin into investment strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。