○/Author: Lao Li Mortar

This Week's Research Report Directory:

I. Preview of Key Events in Macro-Economic Data and the Cryptocurrency Market for the Week;

II. Review of Key News in the Cryptocurrency Industry;

III. Community Interaction and Sharing;

IV. Important Events, Data, and Interpretation;

V. Institutional Perspectives and Overseas Views;

VI. Top Gainers in the Cryptocurrency Market and Selection of Community Hot Coins from Last Week;

VII. Attention to Project Token Unlocking and Negative Data;

VIII. Top Gainers in Cryptocurrency Market Concept Sectors;

IX. Overview of Global Market Macro Analysis;

X. Future Market Analysis.

I. Preview of Key Events in Macro-Economic Data and the Cryptocurrency Market for the Week:

March 11 (Monday): Japan's Q4 GDP, US February New York Fed 1-Year Inflation Expectations; US President Biden submits the 2025 budget proposal to Congress; Daylight Saving Time begins, US stock market opening and closing, pre-market and after-hours trading will start one hour earlier. Shuffle will conduct SHFL LBP public offering.

March 12 (Tuesday): US February CPI;

March 13 (Wednesday): Eurozone January Industrial Output YoY; Ethereum Dencun mainnet upgrade is expected to take place at 21:55; Aevo will conduct an airdrop;

March 14 (Thursday): US Initial Jobless Claims for the week, US February PPI, US February Retail Sales;

March 15 (Friday): US February Manufacturing Output MoM, US February Industrial Output MoM, Preliminary March University of Michigan Consumer Sentiment Index; ETHGlobal London will launch;

March 16 (Saturday): 1.11 billion ARB will be unlocked, accounting for 87.2% of the circulating supply;

March 17 (Sunday): Russia holds presidential elections.

II. Review of Key News in the Cryptocurrency Industry (Exclusive Compilation):

Data Aspect:

Recent data in the cryptocurrency market has shown a series of notable changes. Grayscale's GBTC saw an outflow of $494 million yesterday, causing the Bitcoin holdings to drop below 400,000 BTC, indicating the dynamic nature of capital flows in the market. The Federal Reserve's balance sheet has also changed, dropping to around $7.5 trillion, reflecting changes in the macroeconomic environment. In addition, data shows that the cryptocurrency trading volume in the Asian market currently accounts for about 70%, which is very similar to the situation during the Bitcoin bull market in 2021, indicating the important position of the Asian market in global cryptocurrency trading.

Project and Platform Aspect:

This week, tokens worth $26.3 billion will be unlocked, and ARB will also unlock 1.11 billion tokens, which will have a certain impact on market supply. Uniswap is about to launch its v4 version, which will provide traders with more flexibility and choices. This update may further drive the activity and development of the cryptocurrency market. With the continuous advancement of technology and the maturation of the market, we can expect to see more innovative projects and platforms emerge, providing investors with more opportunities.

Macro Policy and Regulatory Aspect:

The US Treasury Department has once again proposed new cryptocurrency tax rules, which will impose higher requirements on market compliance and transparency. Meanwhile, the lawsuit filed by Coinbase against the US Securities and Exchange Commission (SEC) for refusing to establish clear cryptocurrency rules has also attracted market attention, indicating the uncertainty of the regulatory environment. However, Federal Reserve Chairman Powell has indicated that it may be appropriate to cut interest rates at some point this year, which may have a certain impact on the cryptocurrency market and bring new investment opportunities for investors.

Institutional Research Reports and Perspectives:

Major financial institutions and experts have diverse views on the cryptocurrency market. Coinbase's report points out that although Bitcoin has reached new all-time highs, it may face short-term resistance, reminding investors to be cautious about market fluctuations. Institutions such as Bernstein hold an optimistic attitude, expecting Bitcoin to reach $150,000 this year. Meanwhile, firms like Fidelity and Cathie Wood have also expressed long-term optimism about the cryptocurrency market. However, economists have pointed out the possibility of rising US unemployment and economic recession, which may bring certain pressure to the cryptocurrency market. Overall, institutional research reports and perspectives provide multi-faceted market analysis, helping investors better understand market dynamics and risks.

III. Community Interaction and Sharing:

Today, a community member mentioned that as the market rises, the long/short ratio decreases. This phenomenon is actually easy to understand. Simply put, the long/short ratio decreases only when the long positions decrease and the short positions increase. Therefore, it is easy to conclude that:

During the rise of BTC, although the strength of long positions may continue to increase, the strength of short positions has not completely disappeared. Some speculators may choose to short BTC at high levels to speculate on a pullback. In this case, the number of short contracts may not significantly decrease with the rise in the market, and may even increase. Therefore, even as the price of BTC continues to rise, the long/short ratio may show a downward trend due to the presence of short positions.

On the other hand, during the rise in BTC price, long speculators may start to worry about a market pullback or reversal, and may choose to sell long contracts. This behavior may also cause the long/short ratio to decrease during the market's rise.

By the way, the long/short ratio we often discuss is the ratio of the number of long and short positions, not the total volume comparison, which can be well understood in this way.

IV. Important Events, Data, and Interpretation:

Regarding the Ethereum Dencun upgrade.

We have verified that the Ethereum Dencun upgrade will be activated on the mainnet at 21:55 on March 13, with a block height of 269568.

The Ethereum network's Dencun upgrade is the first step in becoming a more suitable database for L2 chains. This upgrade allows Ethereum to store data more efficiently and cheaply. As a database, the improvement of Ethereum allows L2 users to almost not pay transaction fees, which may attract more people to use it. This upgrade can also support millions of users on L2 chains, making Ethereum a better distributed database and expanding the overall market for Ethereum.

We have provided detailed introductions to this upgrade in previous special reports. In summary, the Cancun upgrade is named after the location of the Ethereum developers' conference, the city of Cancun in Mexico. The Cancun upgrade is a re-expansion upgrade of the Ethereum main chain, aimed at enhancing network scalability, practicality, and security. The Cancun upgrade includes five EIP protocols, with the key core being EIP-4844, which introduces the Blob concept and a multi-dimensional fee market. The Cancun upgrade, originally planned for the second half of last year, has been delayed and is expected to take place on March 13. Potential trading opportunities brought about by the Cancun upgrade include ETH itself, OP in L2 projects, RUNE in cross-chain bridge sectors, and FIL in L2 decentralized storage network sectors.

Regarding MicroStrategy's Bitcoin holdings floating profit exceeding 100%.

We believe that as a staunch holder of Bitcoin, MicroStrategy's large-scale Bitcoin holdings have always been widely watched by the market. Recently, with Bitcoin's price surpassing $71,500, the value of MicroStrategy's Bitcoin holdings has also reached a staggering $13.799 billion. This number not only demonstrates MicroStrategy's strategic vision in the cryptocurrency field, but also reflects the strong momentum of BTC.

From our perspective, MicroStrategy's floating profit exceeding 100% not only proves the correctness of MicroStrategy's investment decisions, but also highlights the appreciation potential of Bitcoin as an asset. However, this floating profit figure also reflects the volatility of the Bitcoin market. With the rise in price, the value of MicroStrategy's holdings continues to rise, but it also comes with potential risks. If they choose to take profits and sell their holdings, the market may experience a significant decline, and BTC still carries a high level of risk. Although MicroStrategy's floating profit is remarkable, careful consideration of the overall market trend and one's own risk tolerance is still necessary when making decisions.

In terms of market impact, MicroStrategy's Bitcoin holdings undoubtedly play a role in stabilizing market confidence. As a well-known company, its large-scale holding of Bitcoin and the positive signals it sends to the market help attract more institutions and investors into the cryptocurrency field. In addition, MicroStrategy's floating profit also provides a reference for other investors, further enhancing the market's optimistic sentiment.

In summary, the overall market sentiment is positive, but there is also the potential for MicroStrategy to sell, which could lead to a risk of BTC pullback.

V. Institutional Perspectives and Overseas Views:

Overview: Global investment firm Bernstein predicts that the price of Bitcoin will reach $150,000, as newly approved ETFs will attract a large influx of funds. A report from Coinbase indicates that despite facing short-term resistance, the US spot Bitcoin ETF continues to support its demand. Rumors of policy adjustments by the Bank of Japan affecting the Asian market have also had an impact on Bitcoin. The founder of CryptoQuant believes that institutional capital inflows have resulted in a relatively small adjustment in this BTC bull market cycle. Bitcoin News data shows that Monday saw a surge in Bitcoin, as rumors of the Bank of Japan potentially easing policies, the last bastion against ultra-low interest rates, shook the Asian market. Some Asian stock indices fell, with the Nikkei and ASX indices in Japan and Australia dropping by 2%, amid reports that the Bank of Japan may raise interest rates this month. This would be the first rate hike by the Bank of Japan since 2007. In addition, the Bank of Japan may abandon its bond purchase program after ending its negative interest rate policy. Analysts have long warned that the Bank of Japan is a major source of uncertainty for traditional and cryptocurrency markets. The potential unwinding of the Bank of Japan's supportive liquidity stance and the resulting strengthening of the yen could jeopardize yen carry trades, which could reinforce the risk appetite rebound in financial markets, including tech stocks and cryptocurrencies, that has lasted for a year.

The founder of CryptoQuant posted that due to institutional capital inflows, the current BTC bull market cycle has only experienced a small adjustment so far.

According to Bitcoin News data, since the launch of the spot Bitcoin ETF, the average net inflow of funds on Monday was $302 million, making it the most bullish day of the week for Bitcoin.

Cathie Wood, CEO of ARK Invest, recently announced that Bitcoin will surpass the $1 million mark by the expected year of 2030, which is her company's previous bull market timetable. This updated price target is the result of new institutional participation and significant regulatory milestones, particularly the approval of the first spot Bitcoin exchange-traded fund (ETF) in the United States. Wood stated that the launch of spot ETFs marks a significant turning point, signaling broader acceptance of Bitcoin and its integration into the traditional financial system. The approval by the US Securities and Exchange Commission and the subsequent record-breaking performance of these ETFs have accelerated the appreciation timetable for Bitcoin.

Jeff Ren, a partner at OKX Ventures, shared many profound insights for entrepreneurial projects when invited to attend the Ecosystem Growth Summit hosted by Gitcoin and Electric Capital. According to Jeff Ren, while traditional tech companies emphasize the potential market size and technical background when financing, investing in crypto projects focuses more on the innovation, narrative, and market positioning of the crypto project. However, for early-stage projects focused on innovation, the process of going from 0 to 1 is painful. In addition, most crypto projects currently revolve around tokens, so it is necessary to consider the utility of tokens and their connection to business growth in order to achieve better development for the project. It is not advisable for crypto projects to start financing only when the market changes, but rather to plan ahead and clarify the demand in order to better respond to the rapidly changing market environment. In an industry experiencing explosive growth, higher project valuations are not necessarily better, and attention should be paid to other aspects beyond valuation, such as project governance.

A report released by JPMorgan on Thursday showed that, according to one indicator, Bitcoin is more popular than gold in investors' portfolios, thanks to its continuously reaching new highs. As a mainstream cryptocurrency, Bitcoin has long been compared to gold, with some considering it a digital version of gold. On the surface, the proportion of gold in investment portfolios should be higher than that of Bitcoin, as an estimated $3.3 trillion is invested in gold. JPMorgan stated that when comparing these two assets in nominal terms, Bitcoin's allocation seems lower, as its market value is only $1.3 trillion. Therefore, theoretically, the value of Bitcoin can still rise by 153% to reach the value level of gold. However, this calculation overlooks an important factor, which is risk. Analysts stated that it is unrealistic to expect Bitcoin to match gold in nominal terms in investors' portfolios, as Bitcoin's volatility is about 3.7 times higher than that of gold. In other words, if cryptocurrencies are indeed seen as a digital analogy to gold, investors would consider its volatility and give it a smaller weight in their investment portfolios. According to the report, if this is the case, the total value of Bitcoin will not exceed $900 billion, and its price should hover around $45,000, rather than the current nearly $67,000. Therefore, from the perspective of volatility adjustment, Bitcoin has already taken up a larger position than gold in investors' portfolios.

K33 Research analysis indicates that the recent outflow of GBTC may be net neutral for the market, and next week the outflow of GBTC funds is expected to decrease. Over the past week, Grayscale's outflow of funds has accelerated, coinciding with Gemini Earn's announcement of a tentative settlement with Genesis, aiming to repay creditors in kind. The personal inclination is that most of the recent outflow of GBTC has been net neutral for the market (selling GBTC shares -> buying spot BTC). K33 Research estimates that as of March 7th, Genesis still has 10.4 million GBTC available for sale. This estimate is based on the average daily outflow of GBTC from February 1st to February 13th, plus the daily excess outflow from February 14th to the present. Based on the outflow rate, all Gemini/Genesis flows should be cleared by this weekend. If K33 Research's assumption is correct, next week Grayscale's GBTC should see outflows trending towards the levels of early February, and daily net flows may quickly hinder sentiment from turning positive to negative.

The amount of Bitcoin held by Tesla has once again become a topic of discussion in the crypto community. The crypto data analysis platform Arkham recently added a feature to track Tesla's Bitcoin wallet on its dashboard, showing a balance of 11,509 BTC, about 1,789 BTC more than the reported balance of 9,720 BTC. It is reported that Tesla's schedule for holding and selling Bitcoin is as follows: February 2021: purchased $1.5 billion worth of Bitcoin; March 2021: sold 4,320 Bitcoin; 2022: sold 29,160 Bitcoin; 2023: the balance of 9,720 BTC has not changed.

The Bitcoin volatility index T3 has surged to its highest level since the collapse of FTX, indicating that the cryptocurrency market should be prepared for more Bitcoin volatility. BI analysts Eric Balchunas and Athanasios Psarofagis wrote in a report that Bitcoin ETF investors may be the strongest proponents of the asset and are unlikely to exit during fund withdrawals. ETFs are used as small "hot sauce" allocations to core investment portfolios, meaning that investors have a greater tolerance for volatility. The analysts added that Cathie Wood's ARK Innovation ETF also exhibits similar dynamics.

Andrew Kang, co-founder of Mechanism Capital, posted on social media that some trading methods are suitable for PvP market conditions but not for PvE market conditions. He advised against focusing excessively on high funding rates or only rising prices in a bull market, as funding rates may continue to rise and shorts may not be sustainable. He also noted that fund rotation is different from before, as new entrants to the market will not diversify their investments like old cryptocurrency traders; they will pick their favorite meme coins and continue to buy them with their salaries every day/week. He warned that traders who short meme coins due to rotation will eventually be eliminated from the market.

Nate Geraci, president of ETF Store, stated on X platform that in the past 2 months, the total flow of 9 new spot Bitcoin ETFs has exceeded the total flow of all physical gold ETFs in the past 5 years, amounting to nearly $100 billion in assets under management.

Capital Market Analysis suggests that the upward trend in the cryptocurrency market may be linked to positive stock market sentiment and broader risk appetite. The resurgence of meme coins in the market indicates irrational risk-taking behavior, similar to certain areas of the stock market. Market participants believe that a significant pullback after Bitcoin reaches new highs is normal profit-taking, as almost all Bitcoin investors are currently making money. This also reflects the volatile nature of Bitcoin, as past cycles have shown that Bitcoin can surge by 1000% in a year but also lose nearly three-quarters of its value. Ayesha Kiani, COO of the cryptocurrency hedge fund MNNC Group, stated that after Bitcoin reaches new highs, there is often a large-scale sell-off, so some market adjustments are expected.

Bitcoin's daily trading volume has surpassed $46 billion, reaching its highest level since 2021.

Coinbase, once a major holder of Bitcoin, has significantly reduced its reserves. According to Glassnode data, after huge outflows on February 19th and March 1st (each outflow was about $1 billion), Coinbase has slipped to become the third largest holder of Bitcoin. Since March 2020, Coinbase's Bitcoin reserves have decreased by about 633,000 coins. Although it previously held over 1 million coins, it has now dropped to about 369,000 coins.

VI. Last Week's Top Gainers in the Crypto Market and Community Hot Coins Selection:

In the past week, the rise of altcoins has been remarkable. Among them, AIOZ has shown particularly strong performance, with its price doubling and demonstrating its market potential and investors' optimism about its future prospects. Additionally, ZRX and RSS3 have also shown strong growth, with gains ranging from 125% to 130%, indicating the activity and popularity of these coins in the market. Furthermore, coins such as DNT, MIR, and PHB have also achieved significant gains, around 80%, further enriching the market's diversified investment choices. The gains of these coins rank among the top in the market, reflecting the continuous switching and rotation of current market hotspots. It is advisable to continue monitoring these potential trading opportunities. However, as market hotspots change frequently, it is important to remain calm and rational while seizing opportunities and to manage risks to avoid blindly following the crowd. Keeping an eye on market dynamics and staying informed about project developments and market reactions will help make wiser decisions.

The following are the hot coins discussed in the DC community, with the following selections for reference only and not constituting trading advice:

EOS Foundation CEO Yves La Rose announced on social media that EOS will close its inflation mechanism in the future; about 818 million EOS tokens will be newly minted; the supply limit of EOS will be set at 2 billion tokens; new minted tokens will be released over a period of time, with a large release at the beginning, gradually decreasing over time (following a logarithmic curve). This is to dilute the holdings of inactive holders and reward those who remain active.

VII. Negative Data Focus on Project Token Unlocks:

Token Unlocks data shows that this week, tokens such as ARB, APT, and APE will undergo one-time large unlocks, totaling $2.63 billion in value. Among them:

Arbitrum (ARB) will unlock 1.11 billion tokens on the evening of March 16th, worth about $2.32 billion, accounting for 76.62% of the circulating supply.

Aptos (APT) will unlock 24.84 million tokens on the morning of March 13th, worth about $329 million, accounting for 6.73% of the circulating supply.

ApeCoin (APE) will unlock 15.6 million tokens on the morning of March 17th, worth about $35.57 million, accounting for 2.55% of the circulating supply.

CyberConnect (CYBER) will unlock 886,000 tokens on the afternoon of March 15th, worth about $10.51 million, accounting for 5.98% of the circulating supply.

Flow (FLOW) will unlock 2.6 million tokens on the morning of March 16th, worth about $3.62 million, accounting for 0.17% of the circulating supply.

Moonbeam (GLMR) will unlock 3.04 million tokens on the morning of March 16th, worth about $1.49 million, accounting for 0.36% of the circulating supply.

Euler (EUL) will unlock 86,900 tokens on the evening of March 14th, worth about $591,000, accounting for 0.47% of the circulating supply.

This week, a series of tokens may experience negative effects due to unlocks. Token unlocks often mean a large influx of chips into the market, which may trigger price adjustments. It is advisable to avoid participating in spot trading of these tokens at this stage, or seek short opportunities to avoid potential pullbacks. It is worth noting that the unlock magnitude of ARB tokens is relatively large, and its price fluctuations may be more severe. Controlling positions to cope with potential market fluctuations is recommended.

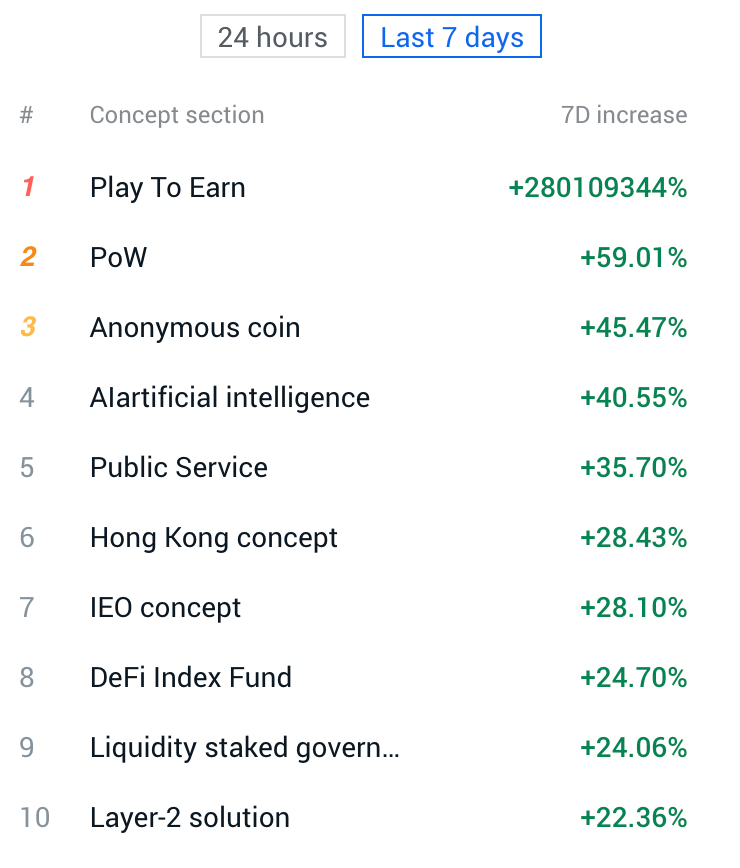

Last week, we conducted in-depth analysis and research on the specific performance of concept sectors. Based on the data of price changes, it is evident that sectors such as Play To Earn, PoW, Anonymous Coins, AI Artificial Intelligence, and Public Services have shown particularly strong performance in the past seven days. The strong rise of the Play To Earn sector reflects the market's recognition and pursuit of the gaming economic model. Its unique incentive mechanism has attracted a large number of users to participate, thereby driving the rise of related coins. The PoW sector also performed well, possibly due to the recent overall warming of the cryptocurrency market and the continued support of miners for the PoW mechanism. The rise of the Anonymous Coins sector is also worth noting. With the popularity of cryptocurrencies and increased regulation, anonymous coins have been favored by some users for their unique privacy protection features, leading to price increases. The strong performance of the AI Artificial Intelligence sector reflects the market's long-term optimism about AI technology and its application prospects in various fields. In summary, the strong performance of the above-mentioned sectors not only reflects the market's hotspots and trends but also provides clues for speculative opportunities. However, while paying attention to the sectors to which coins with larger gains belong, it is also important to control risks and avoid blindly chasing highs. In the future, we will continue to monitor the trends of these sectors and their rotation relationships.

IX. Global Market Macro Analysis Overview:

Last week, the US stock market failed to continue its upward trend, with major indices experiencing declines. The S&P 500 Index, Nasdaq Index, and Dow Jones Industrial Average all recorded varying degrees of declines, ending a five-week streak of gains. The Nasdaq Index's decline of over 1% indicates weakness in the technology sector. Large-cap tech stocks were under pressure, with stocks of companies such as Apple, Microsoft, and Netflix experiencing declines, while Meta became one of the few tech stocks to rise.

Meanwhile, the A-share market showed a different trend. The Shanghai Composite Index rose slightly, but the ChiNext Index saw a slight decline. Northbound funds showed a net outflow, indicating cautious sentiment from foreign investors towards the A-share market. In terms of sectors, cyclical industries such as petroleum and non-ferrous metals performed well, while consumer sectors such as real estate, catering, and tourism performed poorly. This divergence reflects the market's preference for different industries in terms of capital allocation.

In the Hong Kong stock market, the Hang Seng Index led the decline, with both the Hang Seng Index and the Hang Seng China Enterprises Index experiencing declines. The raw materials and public utilities sectors became bright spots in the Hong Kong stock market, while the real estate and consumer discretionary sectors showed weakness. This difference reflects the risk-return characteristics of different industries in the Hong Kong stock market.

This week, the market will see the release of a series of important economic data. The release of the US CPI for February will draw attention to market expectations of Fed rate hikes. In addition, data such as the New York Fed's one-year inflation expectations and the University of Michigan Consumer Confidence Index will provide important clues about future economic trends for investors.

It is worth noting that starting from this Sunday, the North American region will enter daylight saving time, which means that the opening times of related financial markets will be adjusted. Commodity markets such as gold, silver, and crude oil, as well as the US stock market, will open earlier. Starting from March 11th, gold, silver, and crude oil will open at 6:00 AM Beijing time, and the US stock market will open at 9:30 PM Beijing time, which may affect investors' trading strategies.

X. Future Market Judgment:

After breaking through the previous high of $69,000 last week, BTC continued to surpass the $70,000 mark, reaching as high as $72,800 this week, setting consecutive new highs. According to our previous prediction, if it faced pressure at $69,000, it would pull back to around $63,100-$58,100. In reality, the lowest point last week was $59,000, a significant pullback of $10,000. Following the previous viewpoint, if it breaks through $69,000, there will be no reference resistance above, entering a vacuum zone, looking towards higher emotional highs, perhaps much higher or perhaps not as high as imagined.

At this stage, due to the historical new high, there is no specific technical point for the upper resistance. FOMO may continue for a long time or may end quickly. The Fibonacci extension resistance is around $89,450 near the 138.2% level and around $102,080 near the 161.8% level, which can be used as a reference. It is also important to consider potential pullbacks. The short-term support is at $67,000 and $59,000, while the medium-term strong support refers to the starting point of this FOMO sentiment around $50,525 and the high point of $48,000-$49,000 before the ETF landing.

Follow us: Lao Li Mortar

March 11, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。