In recent days, the most eye-catching event is undoubtedly the strong price surge of BRC20 ecosystem tokens. With the listing of Bitcoin Inscriptions Sats on Binance on December 12th, its market value doubled on the same day, and its price surged over 330% in seven days. In addition to Sats, other Inscriptions ecosystem tokens such as Rats, SNHT, MAXI, and BEAR have also experienced a wave of increases. Many believe that this is the second spring of BRC20, especially as ORDIs broke through the $1 billion market value threshold in the first week of December, achieving an important milestone and providing holders with an impressive 850% monthly return. At the same time, Ordinals Inscriptions cumulative fee income has exceeded $140 million.

With the hot trend of Bitcoin chain-based tokens, the first decentralized exchange on the chain, Orders.Exchange, will start a free airdrop activity on Gate.io Startup on December 20th. With the groundwork laid by this wave of token price increases, this timing is undoubtedly very favorable. Today, let's learn about Orders.Exchange and whether the RDEX token has specific investment potential, as well as how to participate in the free airdrop activity.

What is Orders.Exchange?

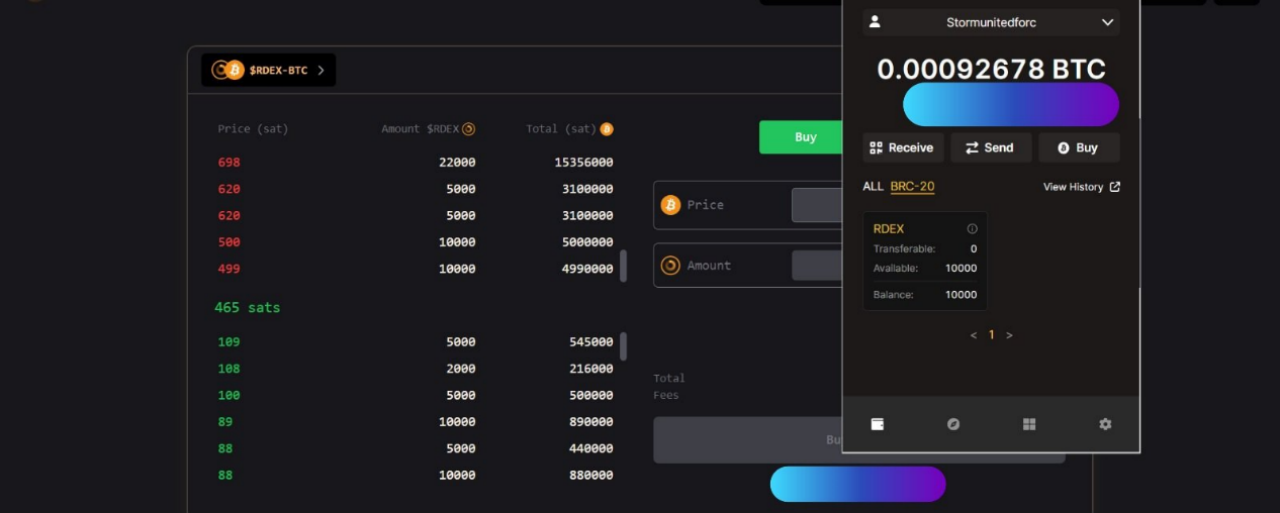

Orders.Exchange is a new force in the Bitcoin ecosystem. Orders is the first DEX that operates entirely on the Bitcoin network, with its order book running entirely on the Bitcoin network. Orders aims to witness a trustless ORDERBOOK DEX, liquidity pool, SWAP DEX, and LaunchPad, fully leveraging the potential of Bitcoin Layer 1, supported by the Ordinals protocol, PSBT technology, Bitcoin script, and the revolutionary Nostr protocol.

Orders not only has a chain-based order book trading system but also has created efficient liquidity pools. The application of PSBT technology improves trading efficiency and security, enabling Orders to conduct complex transactions, opening up possibilities for a more interconnected and efficient Bitcoin DeFi ecosystem.

The highlights of Orders are as follows:

- Orders cleverly adopts blur's NFT gameplay, presenting a chain-based DEX system for the currently complex and difficult-to-trade BRC20 tokens.

- Orders combines liquidity mining, order book, and trading mechanisms (Ask&Bid) to interconnect the internal structure of the DEX platform, creating a comprehensive platform.

- In the interconnection structure of the Bitcoin ecosystem and Orders ecosystem, the project token RDEX token has practical application value, and even the simplest trading pair currently has excellent liquidity.

- Orders has a simple and user-friendly interface, similar to blur's gameplay, making it easy to use for both new users and players familiar with blur.

- The development team behind Orders consists of international members with rich experience in Bitcoin development, who have experienced the DeFi era based on Ethereum and witnessed the rise of many excellent projects. It is said that they are early contributors from the MVC blockchain and have been deeply involved in Bitcoin sidechains. The design of Orders' PSBT liquidity pool, compatibility with MVC and Nostr protocols, etc., all demonstrate the team's strong technical capabilities.

Currently, Orders has landed its first liquidity pool. With the vigorous development of the Bitcoin chain ecosystem, it has practical landing scenarios and usage demands. Other infrastructure is also gradually being completed. Let's take a look at Orders' upcoming plans: 2023Q4:

- NOSTR protocol release (already released)

- Launch of RDEX token on CEX

- Support for more wallets to meet the diverse needs of more users

2024Q1:

- Launch of LaunchPad and Inscribe functions to expand the user base of orders, meet the needs of more users, and expand the use of RDEX tokens as the first practical tool for BRC20 tokens

- Support for the buying and selling orders of Ordinals NFTs, enhancing the platform's capabilities, meeting the trading needs of different users, and improving trading efficiency

- Comprehensive support for MVC-Ordinals, providing comprehensive support for the MVC-ORD plan, aiming to explore new possibilities in the BTC-Fi environment. This phase aims to strengthen Orders as a multifunctional platform for centralized financial activities, focusing mainly on the Bitcoin ecosystem. In addition, this phase aims to address the major pain points of high fees and low transaction speeds on the Bitcoin mainnet

- Launch of a cross-chain bridge for seamless exchange of Ordinals assets between the Bitcoin mainnet and its second layer, MVC

Subsequent to 2024: Expand partnerships and establish an interconnected DEX network. Utilize the Nostr protocol to expand partnerships and seek cooperation with well-known DEXs (such as OKX and Unisat) to achieve interoperability. Through integration with the Nostr protocol, BRC20 token and Ordinals NFT orders can circulate between different DEXs. This allows orders created on a single platform to be executed on other exchanges, improving trading efficiency.

Orders product manager Sam said in an interview, "We serve our users in three main aspects: improving trading efficiency, focusing on user costs, and increasing token utility. In addition, we are also focusing on how to solve the problems of high transaction costs and slow speeds through layer 2 solutions. We hope that our tokens are not just a medium of exchange, but have a wider range of uses, such as paying fees, serving as a threshold for the launch platform, and providing holding discounts." Orders' future plans will support more features, such as support for other protocols and the addition of inscribing features, to create a more complete and comprehensive ecosystem.

Token Economics

RDEX token is the platform token of Orders, mainly used to reward early users of Orders and incentivize users providing liquidity. RDEX token has no initial issuance or private placement and was all created for free in the early stages. It can currently be purchased directly on Orders, Unisat, and OKX wallets.

Total supply: 100,000,000 (100 million) tokens, format: BRC-20

The allocation is as follows:

- 45%: Liquidity rewards

- 40%: Rewards to early users through various airdrop activities

- 10%: Team and early contributors

- 4%: CEX and order liquidity

- 1%: Initial RDEX liquidity pool

Related economic scenarios of RDEX token:

- Transaction fees generated by BID orders will be used to repurchase RDEX tokens listed on the order. The exchange and burning will occur at a frequency of once every 48 blocks.

- RDEX tokens may be used to pay platform service fees (in progress)

- RDEX tokens can be used as an entry threshold for LaunchPad (in progress)

- Holding RDEX tokens may provide fee discounts (in progress)

62,500 RDEX tokens are used as liquidity pool rewards daily

From its economic model, the acquisition of RDEX tokens mainly consists of two parts: early participation rewards and liquidity participation rewards. Since the early participation rewards have ended, to obtain more RDEX tokens, users can actively participate in the liquidity pool to earn rewards.

Orders' PSBT liquidity pool is the first liquidity pool solution developed independently by Orders, based on the Bitcoin native network, with features such as risk-free, decentralized, and fully based on the BTC mainnet. The liquidity added by users will always remain in their wallets before being used and will be under the absolute control of the users. After being used, it will be transferred to a multi-signature address managed jointly by the user and the exchange, to be released by the user.

Orders will use a statistical interval of every 144 blocks, and the total value of liquidity used within the interval divided by the total value of a single user's liquidity will determine the user's liquidity usage rate, and RDEX tokens will be distributed as rewards based on this rate. 62,500 RDEX tokens will be linearly released daily for rewards. It is worth noting that adding liquidity on Orders and earning RDEX tokens after releasing liquidity can earn rewards, but if not claimed for more than 3 days, the rewards will decrease daily starting from the fourth day until they reach zero.

Orders will use the transaction fees generated by BID orders of BRC20 token trading pairs (excluding RDEX tokens) on the previous day to repurchase and burn the RDEX tokens listed on Orders, achieving a deflationary model. In order to keep the Orders Pool in a healthy operational state in the long term, the RDEX tokens for the pool rewards will be unlocked in a linear release mode. The RDEX token release plan is as follows:

Initial liquidity pool amount: 1,000,000

RDEX token liquidity reward amount: 45,000,000

Linear release months: 24

Monthly release amount: 1,875,000

Daily release amount: 62,500

Airdrop Information

Opening time: December 20, 2023, 16:00 - December 21, 2023, 16:00 (UTC+8) (treated equally within 24 hours)

Trading starts: December 21, 2023, 20:00 (UTC+8)

The trading pair opened for this event is: RDEX/USDT

Subscription price: 0 USDT (free)

Total subscription amount: 193,548.387 RDEX

Unlocking method: 100% unlocked

Participation conditions: Each verified user can only subscribe once.

Conclusion

From an objective perspective, Orders has attracted attention as the first DEX built on Bitcoin for Bitcoin. Over the past month of observation, the project has successfully transitioned from beta to the official version, and the execution and completion of the Roadmap have been largely realized. The project's biggest highlight is its practicality, as it not only has a strong demand as a DEX, but its token RDEX also has utility and usage value, making it meaningful.

The IEO free airdrop event in cooperation with Gate is not to be missed. Whether it's to potentially benefit from the BRC20 market background after obtaining the tokens, or to participate in continuously earning token rewards through liquidity, both options seem favorable at the moment. However, the project's risk point may still lie in token distribution, as there is a risk of dumping in the future, so everyone needs to make investment choices carefully.

Related link: https://app.trendx.tech/projects/2ab96b9fe98ac1bb44c7ecf1725728d04e43c42d3f3389033ed39559d9a6129f

Official website: https://www.orders.exchange/

Official Twitter: https://twitter.com/orders_exchange

Follow Us

TrendX is an AI-driven one-stop platform for Web3 trend tracking and intelligent trading, using large language models and AI technology to find market trends and seamlessly integrate with intelligent trading. It is committed to becoming the next generation AI trading platform for the future 1 billion users to enter Web3, find hotspots, observe trends, make primary investments, and engage in secondary trading.

Website: https://app.trendx.tech/

Twitter: https://twitter.com/TrendX_tech

🔴Investment carries risks, and the project is for reference only. Please bear the risks on your own🔴

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。