Source: Cointelegraph

Original: “U.S. Congress Repeals IRS Broker Reporting Rule, But DeFi Regulatory Challenges Remain”

The decentralized finance (DeFi) industry breathed a sigh of relief as Congress eased reporting obligations, but how legislators will regulate DeFi remains unresolved.

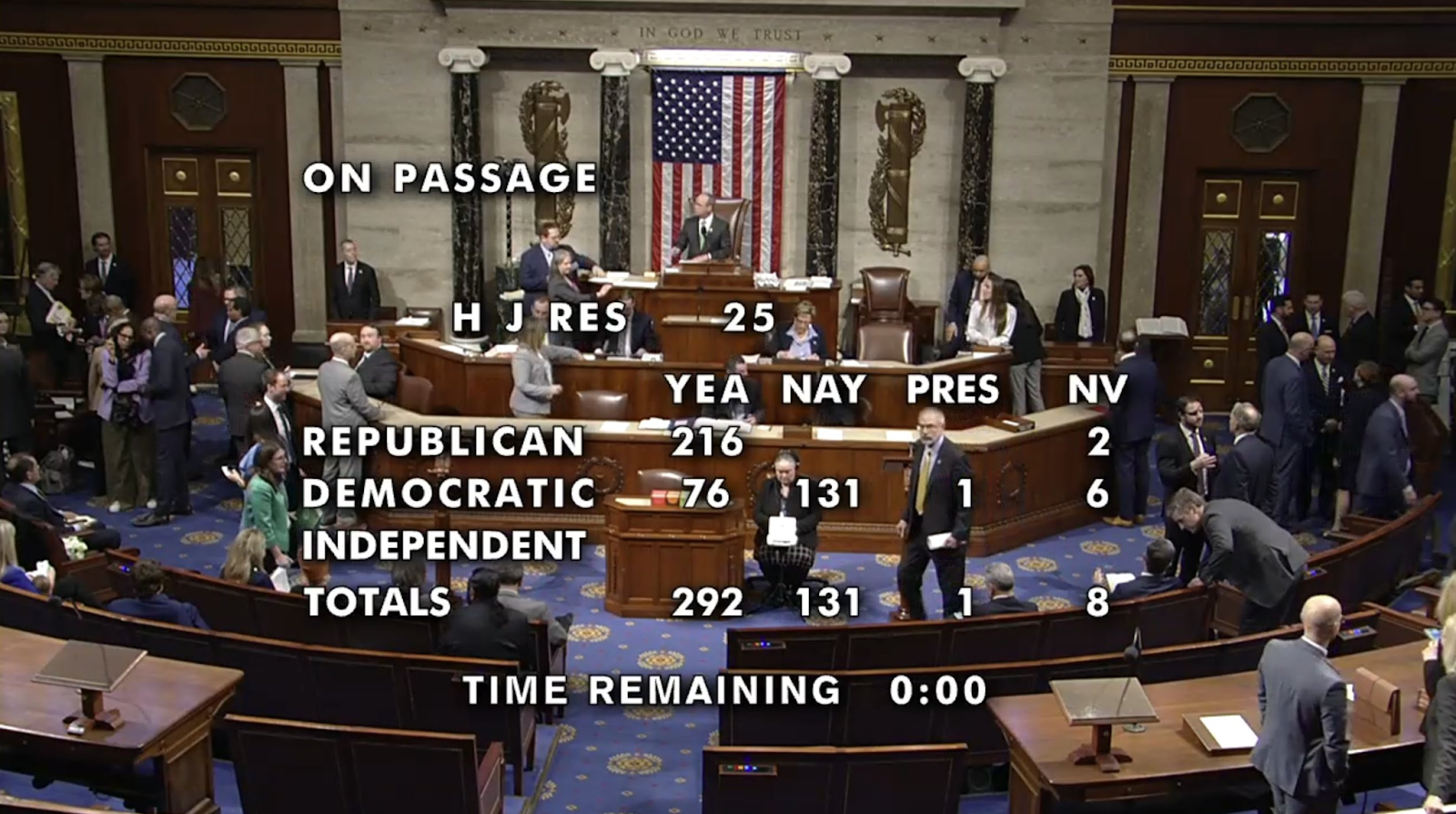

On March 12, the House voted to reject a rule requiring DeFi protocols to report total cryptocurrency sales revenue and taxpayer information to the Internal Revenue Service (IRS).

This rule, issued by the IRS in December 2024, was set to take effect in 2027. Major industry lobbying groups argued that the rule was overly burdensome and exceeded the agency's authority.

The White House has expressed support for the bill, with the President prepared to sign it upon delivery. However, DeFi observers point out that the industry has yet to strike a balance between privacy and regulation.

Bipartisan voting to repeal the rule Source: Decentralized Education Fund

Concerns About Privacy in IRS DeFi Regulations

The cryptocurrency industry quickly praised the House vote. Marta Belcher, chair of the Filecoin Foundation, stated that blocking this rule is particularly important for user privacy protection.

She told Cointelegraph, “It is crucial to protect people's ability to conduct anonymous transactions directly through open-source code (such as smart contracts and decentralized exchanges), just as people can transact directly with cash.”

Privacy issues are at the core of the cryptocurrency industry's opposition to the rule, with industry observers claiming that the rule is unsuitable for its purpose and infringes on user privacy.

Bill Hughes, senior advisor and director of global regulatory affairs at Consensys Software, wrote in December 2024, “The trading front end would have to track and report user activity - including Americans and non-Americans. And it applies to the sale of every type of digital asset - including non-fungible tokens (NFTs) and even stablecoins.”

The Blockchain Association (a major cryptocurrency industry lobbying group) stated that the rule "violates the privacy rights of individuals using decentralized technology" and would push decentralized finance overseas.

Although the rule has currently been halted, there are still no fixed privacy guidelines - Vivek Raman, CEO of Etherealize, stated that this is what the industry needs to move forward.

“We need to establish a clear framework for blockchain-based privacy while maintaining (Know Your Customer/Anti-Money Laundering) requirements,” he told Cointelegraph.

Raman indicated that certain transaction and customer data need to remain confidential, “We need guidance on what privacy can look like.”

How to Regulate Decentralized Finance?

The cryptocurrency space has long sought a balance between user privacy needs and regulatory requirements for anti-money laundering and Know Your Customer.

One issue lies in the technology itself - if a network is created by many and not controlled by a single entity, who should the government contact?

According to Raman, “It is difficult to issue a 1099 form or fulfill broker-dealer responsibilities for a decentralized protocol that is not controlled by anyone! Companies can certainly become [broker-dealers], but the software is not designed for (broker-dealer) rules.”

Chainalysis suggests that DeFi developers can and have been proactively collaborating with regulators, just as some protocols froze funds after the catastrophic $285,000,000 hack at KuCoin.

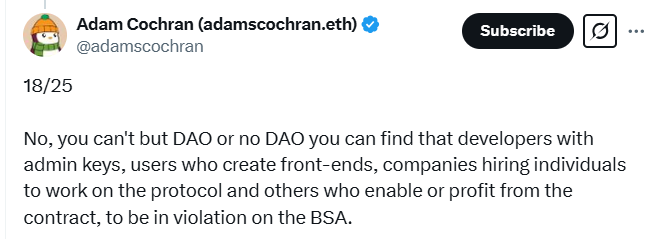

Adam Cochran, partner and advisor at Cinneamhain Ventures, stated that if a protocol is used for criminal activity, regulators could impose certain pressure points on each protocol:

Source: Adam Cochran

However, these specific cases do not constitute a comprehensive regulatory framework that both the industry and investor protection agencies can reference.

In this regard, the crypto analytics firm Chainalysis stated in 2020 that regulators may need to develop regulations for the DeFi space while considering decentralized reporting limitations.

Raman suggested that a possible solution is zero-knowledge proofs, which allow users to confirm certain data without disclosing it.

He is optimistic about regulators finding ways to oversee the space while maintaining user privacy: "I believe we will see a positive-sum environment where decentralized finance and compliance coexist."

The Long-Awaited Cryptocurrency Regulatory Framework

The President has taken some supportive measures for cryptocurrency through executive orders and by appointing pro-cryptocurrency individuals to lead government departments - the most recent being the establishment of a strategic Bitcoin reserve.

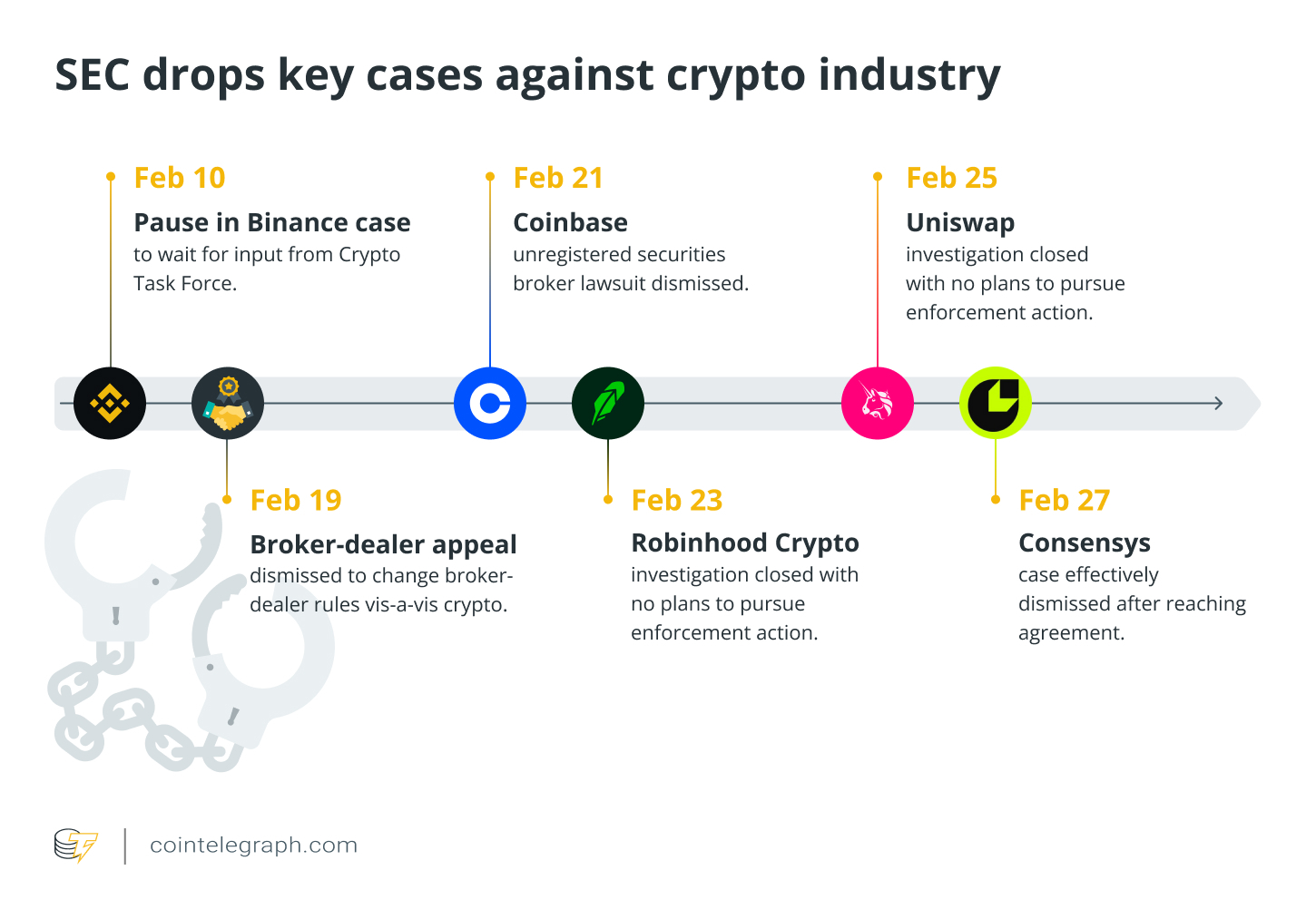

Major financial regulatory agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have withdrawn some high-profile enforcement cases against cryptocurrency companies.

While notable, the big fish the cryptocurrency industry is waiting for is the circulating cryptocurrency regulatory framework and stablecoin bill in Congress, which would provide the industry with the safeguards it claims it needs to thrive.

On March 13, the Senate Banking Committee approved the GENIUS Act (stablecoin bill), bringing it closer to a full Senate vote.

The crypto framework bill FIT 21 was initially introduced during the 2024 legislative session but ultimately failed in the Senate. However, in February, House Financial Services Committee Chairman French Hill indicated that he expects the bill to pass in this session with only "moderate modifications."

But even if FIT 21 passes quickly, regulation of decentralized finance may still be far off. The bill would exclude decentralized finance from the oversight of the SEC and CFTC but would also establish a working group to study 12 key areas related to decentralized finance.

This study will seek to understand the risks and benefits of decentralized finance and ultimately propose regulatory recommendations.

Related Articles: Meta Antitrust Case May Affect Its AI Development Process

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。