对于Portal而言,支持一家新公司有一个简单的关键标准:该资产十年之后是否依然具有价值?在本文中,我们将以对Quip Network的投资为例,说明我们是如何发现机会、建立信仰、并投资的。

本文介绍了我们对量子加密的投资理念以及我们的信仰:在当前市场上,Quip是最有可能将链上经济带入后量子时代的方案,上行空间巨大。

文章主要覆盖以下板块:

1.不,并不为时过早

2.后量子时代,到底是什么?

3.加密×量子:防御性vs. 进攻性机会

4. 为什么量子领域的投资理念如此困难?

5. 一个“好”方案应具备什么?

6. Quip:为什么它是这个正确的方案

1.不,并不为时过早

关于量子技术对比特币风险的讨论和热点文章,最近并不少见,且理所当然,因为一个简单的数学问题:大约有350万枚比特币没有找回,其中包括中本聪的约110万枚,换言之,存在近3000亿美元的经济利益,驱动量子计算机的研究加速。

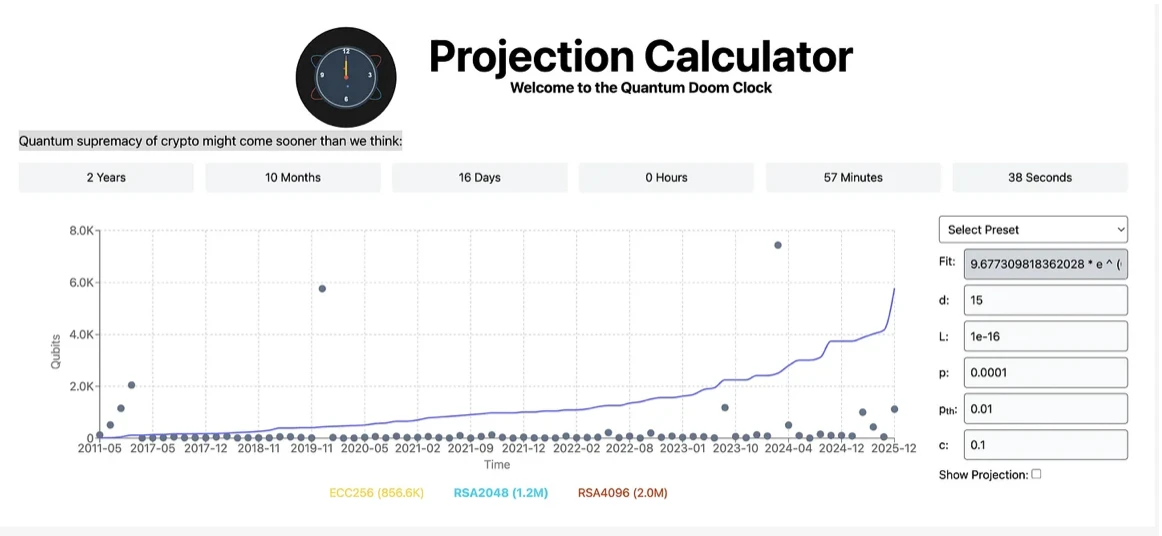

在下图的“量子末日时钟”里,Quip绘制出自2017年以来,量子比特(qubit)的增长趋势图,并据该图预测:首次具有商业可行性的量子加密攻击会发生在2027 年至2028 年之间。

Quip Network: 量子末日时钟

跳出加密领域,IBM的CEO预测在未来3-5年内,量子领域会出现“重大突破”。ChatGPT估计量子技术对银行系统的威胁将于2027到2032年之间变成现实,多方消息也都敦促金融机构在2030年之前迁移至后量子加密系统。

进展正在加速,这一点从仅2025年一年关于量子计算的头条新闻密度增加便可见一斑:

•微软发布Majorana 1芯片— 采用拓扑量子比特技术提升错误对抗能力和系统可扩展性。

•IBM的4,158 量子比特系统– 该系统连接了三个1386量子比特的芯片,确立量子比特数目的新里程碑。

•亚马逊的Ocelot 芯片—开发出“猫态量子比特”,最高可将量子计算错误降低90%。

•D-Wave的“量子优势”– 在20 分钟内解决一个材料科学难题,而经典超级计算机需要近百万年才能完成。

•加州理工学院的量子网络–构建了一个多比特的量子网络原型,推动安全量子通信。

•谷歌的Willow芯片– 该芯片具有105个量子比特,可指数级地降低错误,完成一台超级计算机需花10000 亿亿亿年才能完成的任务。

•牛津大学的分布式量子计算– 将两个独立处理器连接为一个系统,助力分布式量子计算。

有些人也许认为,既然量子攻击预计会发生在2027到2030年间,那威胁就还有2-5年之遥。但是关键在于:不能在风暴过后才修筑防洪闸。链上和链下的金融基础设施都需要在第一个具有商业可行性的量子攻击到来之前,就具备抗量子攻击的能力。

可用于准备的时间= 距离量子攻击发生的时间- 实施变更所需的时间。

即使目前已经存在一台能够摧毁你全部投资的量子计算机的概率只有5%,其中的金融风险也值得此时此刻就主动防御。

2.后量子时代,到底是什么?

我从2021年起就着迷于量子计算。当时我写了一篇科普文章—《量子到底有什么大不了的?》—来探索它的潜力、应用场景以及风投布局。

如今,量子计算领域已经取得了显著的进展。因此我又写了最新的续篇——《六大即将被量子计算彻底改变的产业》,并结合具体实例来帮助更清晰地阐述量子将如何推动各个关键行业中的范式转变。

太长不看版如下:

3.加密×量子:防御性vs. 进攻性机会

在量子计算可能影响的上述行业中,有些属于“防御性”,而另一些则是“进攻性”。我们来做个定义。

•防御性机会:因“损失厌恶”而产生——也即担心量子计算会威胁到链上/加密资产,或银行中持有的链下/金融资产的安全。

上述行业的例子包括加密和金融服务/银行业(部分)。

•进攻性机会:来自量子计算在提升收入、扩展产品/服务、推动创新方面的潜力。

行业例子包括金融服务、经济规划、物流和材料科学。

这是不是意味着,加密技术和量子计算的唯一交集只是安全性?

格局更大些。诚然,只要去中心化金融(DeFi)仍是加密领域的主要应用,那么后量子安全性就将成为标配——是任何协议都不可妥协的基础设施。这意味着,仅“抗量子安全”本身,就关系着加密领域2.7 万亿美元的总体可触达市场(TAM)。

但潜力远远不止于此。加密的核心价值之一在于其能快速启动由共享资源构成的去中心化网络—— 比如DePIN(去中心化物理基础设施网络)允许那些无法与大型科技企业竞争购买英伟达芯片的人和团队,使用GPUs。

而随着量子计算机的出现,这种资源集中的趋势只会更糟糕——因为量子计算机极其稀缺,且价格高昂(例如,IBM 的Quantum System One 目前成本约1500万美元)。虽然量子计算机的价格会逐渐下降,但可以肯定,就短期而言,大多数公司都无法拥有自己的量子计算机,搭载量子处理器的个人设备更是遥不可及。不过话说回来,大多数企业也不需要拥有一台量子计算机——它们的很多模拟/任务都是“运行一次即完成”。

因此我们提出了“主动性”加密x量子理念:想象一个量子DePIN网络,它聚合了IBM、亚马逊、微软、IonQ、Rigetti 等大厂的多余量子算力。尽管这些公司目前提供按需付费的云服务,但一个去中心化的量子网络可以释放出更多的可能性:

•一个有代币激励机制的量子版Zapier 或Hugging Face—以众包方式开发模块化工具和工作流,用于量子任务的设计与执行。

•一个服务网络,可以提供比纯经典计算服务更好、更快的能力。

•更高效的任务共享机制,适用于通常按小时或天提供租赁服务给邻近客户的量子算力厂商。

这不只是“资源访问”的问题—它关乎全球范围内的协调、性能、以及可组合性。

总结一下,加密与量子时代的交集带来的是“双重机会”:

•防御性机会:来自价值2.7 万亿美元规模的链上资产对抗量子攻击的安全性需求。

•进攻性机会:创建去中心化网络,让大众利用量子计算的“生产力”与“营收增长”潜力。

Quip Network涵盖了整个机会空间——从防御性机会开始,逐步扩展到进攻性机会。它的目标是将链上经济带入后量子时代,先为协议、托管商和钱包提供最原生且无缝的后量子保护,逐步演进为一个去中心化的量子计算网络——你可以称之为量子DePIN。

4. 为什么量子领域的投资理念如此困难?

在深入分析前,我想分享一下我们找到Quip 的过程。量子计算是到目前为止,我们从构建投资理念到找到合适团队和投资方法,花费时间最长的领域。

许多Portal的朋友和家人都知道,从2024 年6 月起,我们就一直在寻求下注“量子投资理念”的机会。我们查遍了互联网上的各大会议(推荐这个网站,是我找到最全的聚合器),还为此跨洲飞行参加一些活动。

寻找量子加密的初创公司充满挑战,因为:

•大多数量子计算会议几乎与加密领域毫无交集;

•在寥寥无几的的“量子x 密码学”会议—如Oxford PQCrypto—中,大多数参与者和演讲嘉宾是纯学术研究者,对创业或加密毫无兴趣。事实上,在密码学家社区中依然存在成见,视加密为欺诈;

•在极极其少数对加密感兴趣的密码学家中,所提出的构想也多是偏技术层面的“功能”,而非可落地的“产品”。

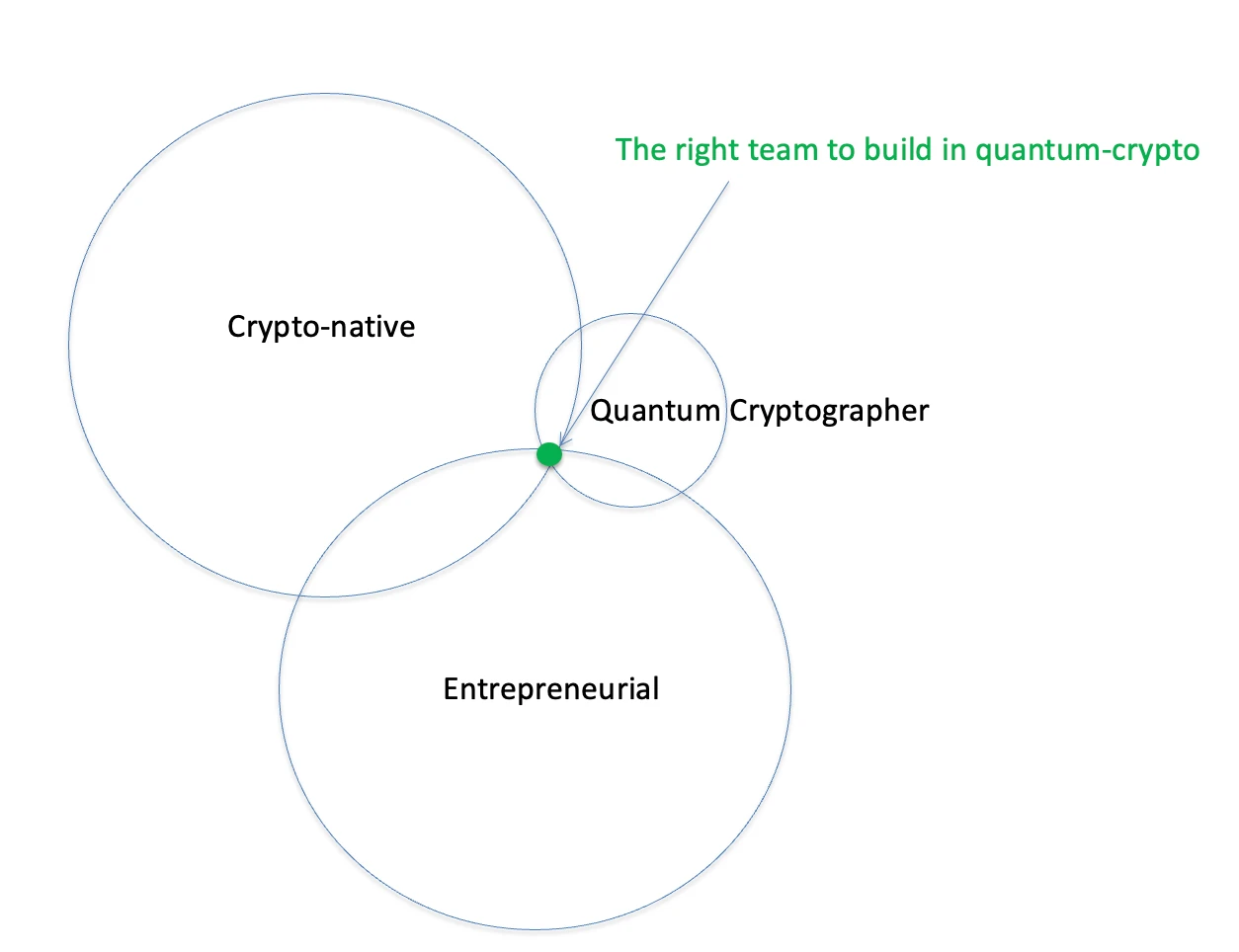

一个量子加密初创企业,不是一夜之间就能组建的:团队必须精确地位于以下领域的交叉点:

(1)来自加密原生

(2)是量子密码学的学术专家

(3)具有企业家精神

即使是有限的人才池里,我们也很难对Quip 之前的6–7个量子加密项目建立信仰。Quip之前的大多数项目都试图构建一个后量子L1链,并指望用户抛弃他们最爱的链而转向一条全新的链——在我看来,这就像是要求用户永远住进核避难所一样荒谬。

5. 一个“好”方案应具备什么?

要解决问题,我们需要先理解问题。当前阻碍后量子方案落地的关键障碍是:

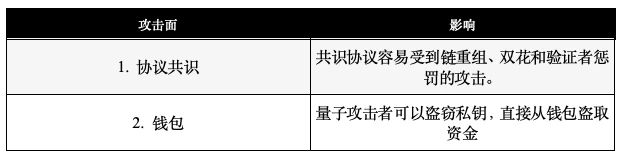

1. 归责问题

由于钱包和协议/链都存在量子攻击面,因此一旦用户资金因量子攻击而遭受损失,双方可以相互指责。每一方都想要替罪羊,从而可以甩锅说“不是我的问题”。

2.激励问题

为什么Solana(或任何L1)不自己做?因为矿工和验证者没有动力承担抗量子算法所带来的额外计算和存储成本。此外,90%的用户都对量子攻击者而言不具有吸引力,但剩下的10%的用户却掌握了70%的资产。协议/链没有动力将保证大户安全的成本强行摊给小户。因此,抗量子安全必须是模块化且经济合理的。

3.惯性问题

Vitalik在博客中提到把硬分叉作为最后手段,并警告不要分散对其他核心研究方向的关注。我们都见过推动一个EIP 要花多长时间。人们往往是被动反应,但是当不得不做出反应时,往往为时过晚。

4.中立性问题

即使某个协议自己实现了后量子安全,他们也很少有动力去保证与其他链的后量子安全性标准之间的互操作性。

因此将Web3带入后量子世界的理想解决方案应具备以下特征:

1.可信中立&互操作性:能与任何协议、链或钱包集成;

2.可归责:协议和钱包能将后量子安全升级外包给该第三方—但不需要验证者承担成本或责任;

3.无缝集成:对用户体验的影响极小;该方案应当与协议原生集成而不需要资产桥或迁移;

4.足够去中心化:拥有坚实的安全预算和分布式基础设施的网络;

5.超越Web3:要抓住进攻性机会,与量子计算厂商合作将是最主要的优势。

6. QUIP就是这个理想的解决方案

Quip Network 提供—到目前为止—最现实的落地方案,适用于所有利益方—散户、机构、协议、钱包等等。

其核心技术是量子单位互联路径(QUIP:Quantum Unit Interlock Pathway),能在未来的转账操作上附加一个后量子公钥,作为安全签名。它可以与任何协议或钱包原生集成,以实现用户资产的安全性升级,而不影响用户体验(无需桥或迁移链上资产、无需更换公/私钥),也不会稀释协议的TVL。

未来——进攻性的机会——在于QUIP演进为一个量子DePIN 网络,提供一个类似量子“应用商店”的平台,汇集常见应用,并与各量子计算服务商集成,从而支持诸如以下场景:

•最短向量搜索:用于诸如物流、金融套利等多元领域;

•AI 学习、哈希加速:可应用于更高效的比特币挖矿和数据索引;

•真随机数生成:用于各类型的蒙特卡洛模拟。

更重要的是,QUIP的团队让我们无比兴奋:Colton —密码学专家、YC毕业的创业者,曾在多家估值达9至10 位数的公司担任CMO、CEO 和COO;Carback博士—— 资深密码学家和连续创业者,在隐私保护和抗量子系统方面拥有深厚专业知识;以及他们的顾问大卫·乔姆(David Chaum)博士—— 被广泛认为是“加密货币之父”。

我们经常被问到:投资后,最早期判断项目能否成功的信号是什么?答案毫无疑问:执行速度和迭代速度。仅仅几个月时间,Quip 就已经做到:

•在10+ 条顶级公链上非原生上线(正在进行原生集成)

•与多家领先的L1洽谈,争取支持原生集成的生态基金

•测试网已上线:vault.quip.network

•等候名单突破2000+ 用户,承诺的TVL 达到8 位数规模

•正与管理11 位数加密资产的托管机构进行POC 测试

•与多家Web2 顶级量子计算公司积极洽谈合作

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。