Source: Cointelegraph

Original: “Ripple Celebrates SEC's Decision Not to Appeal, but Cryptocurrency Regulatory Rules Remain Unclear”

Ripple welcomes the U.S. Securities and Exchange Commission (SEC)'s decision not to appeal against the company, but this offers limited help for legal certainty in the cryptocurrency industry.

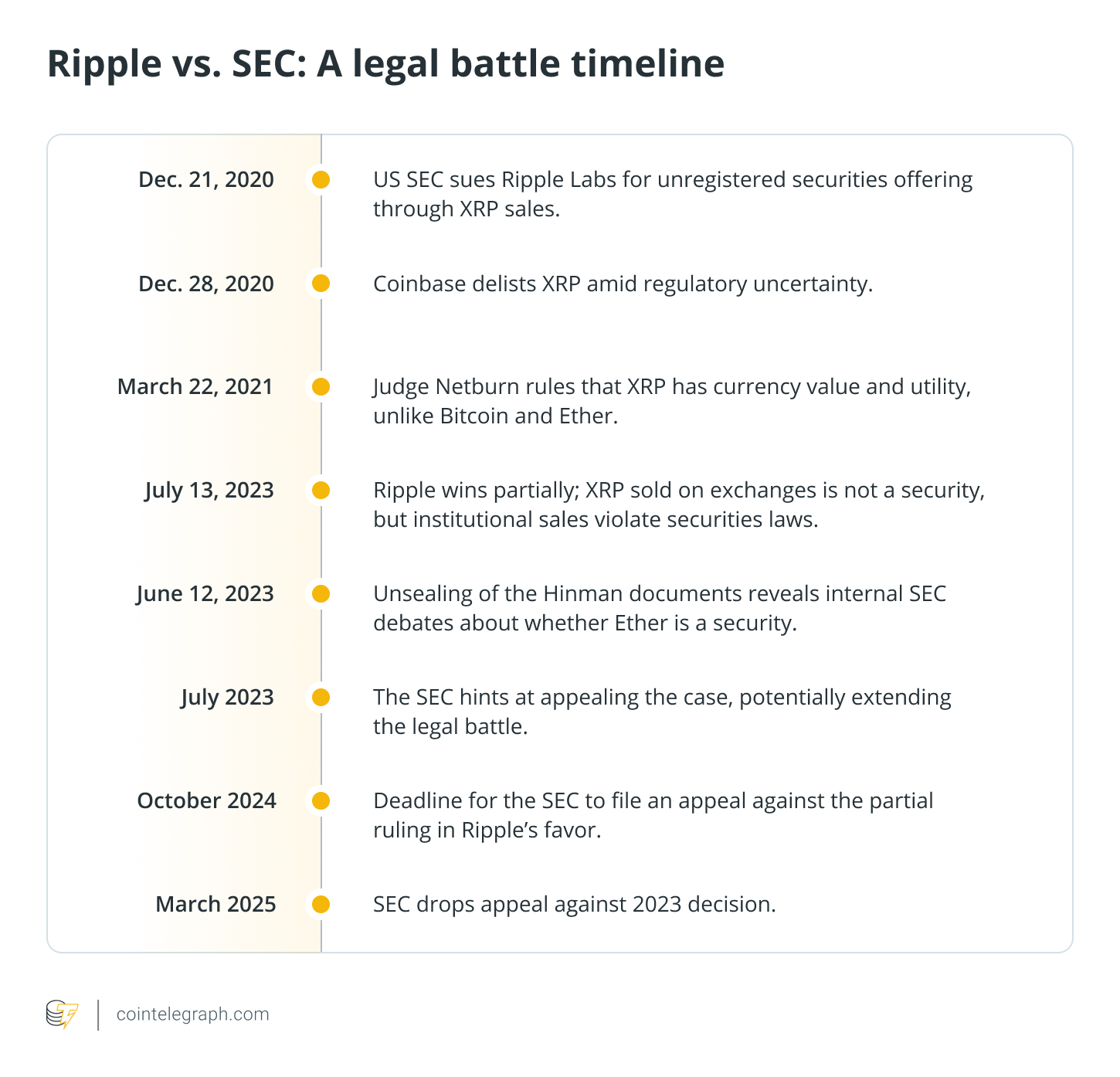

The U.S. financial regulator has evidently abandoned its appeal against Ripple, the issuer of XRP. Industry insiders view this case as a typical example of regulatory overreach under the leadership of current SEC Chair Gary Gensler.

Ripple CEO Brad Garlinghouse stated that this decision "provides significant certainty for Ripple," and although the case is effectively over, the company still needs to address some outstanding issues with the SEC. "We now have the initiative to decide how to move forward."

Ripple's Chief Legal Officer Stuart Alderoty remarked on the X platform: "Today, Ripple is stronger than ever. This landmark case sets a precedent for the domestic cryptocurrency industry."

While Ripple and the entire cryptocurrency industry view this as a significant victory, the SEC's decision has not established a legal precedent, and the "regulatory guardrails" that the industry has been calling for remain undefined.

Impact of the Ripple Case on Legislation and Precedents

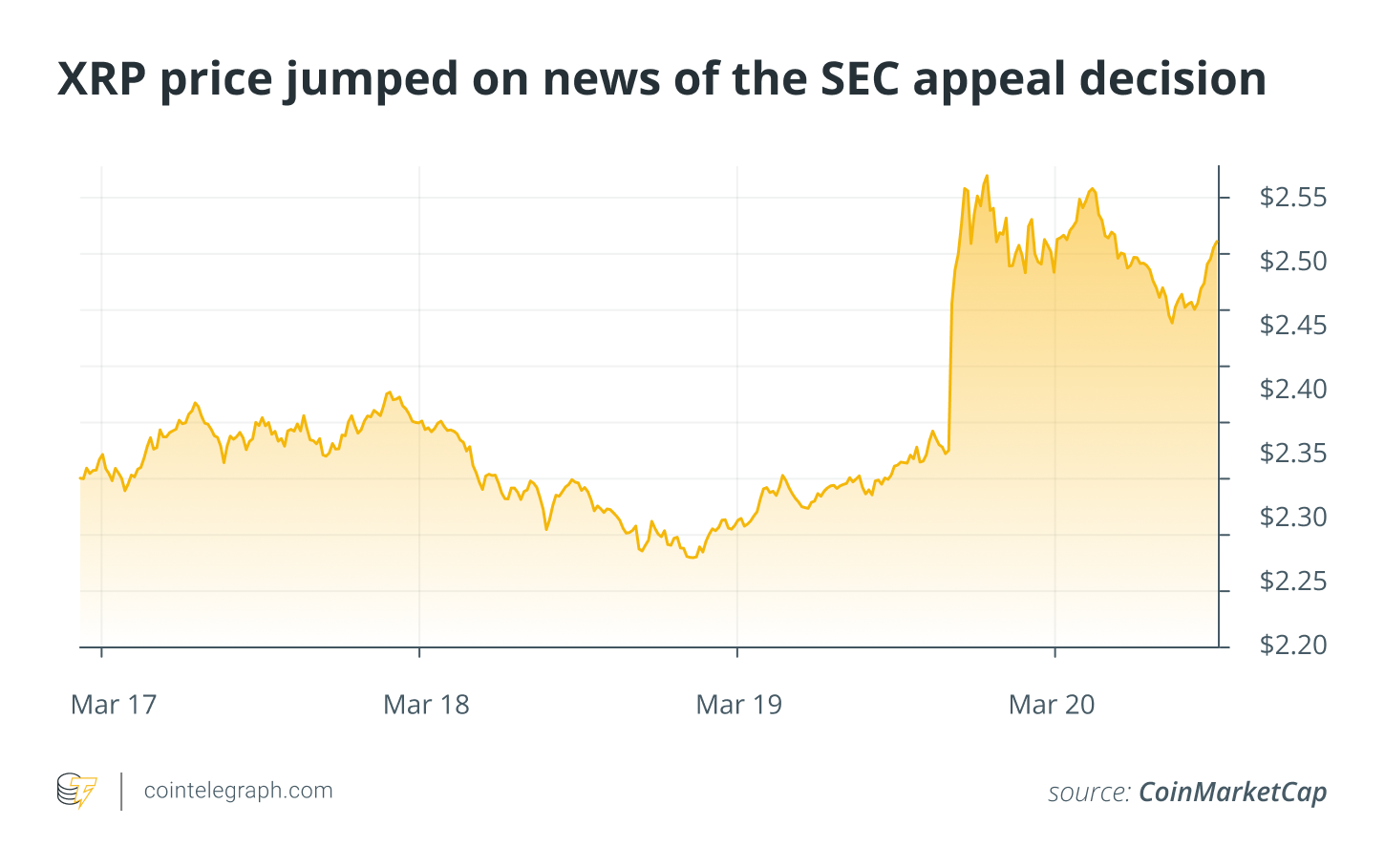

Cryptocurrency lobbying groups quickly welcomed the SEC's decision, which was announced by Garlinghouse at the New York Digital Assets Summit on March 19. The market reacted accordingly—XRP's price rose by 9% within the first hour after the announcement.

Supporters and observers actively discussed on the X platform how this case would set a precedent for the cryptocurrency industry. However, legal observers are cautious about the overall impact of the SEC's appeal decision on the entire cryptocurrency sector.

Attorney Aaron Brogan told Cointelegraph that the Ripple case "did not create any precedent that other companies can rely on." He added that while "there is no doubt that the current regulatory environment is more favorable for cryptocurrency companies," the SEC's specific policies will not become clear until Paul Atkins is nominated as chair.

Metaplex's General Counsel Brian Grace further pointed out that the 2023 ruling the SEC is appealing does not constitute a legal precedent.

He wrote on March 19: "The Ripple ruling does not have binding legal precedent. It is merely a ruling made by a district court judge based on the facts of the case."

The SEC's withdrawal of the appeal has limited impact on the ongoing legislative efforts to create a framework for the cryptocurrency industry in the U.S. Grace stated that the responsibility for establishing lasting legal changes for the cryptocurrency industry lies with Congress, not the SEC.

"The U.S. cryptocurrency industry needs new legislation to provide clarity and protection. Without this, plaintiff lawyers can continue to invoke the Howey test in district courts across the country. Even a friendly SEC cannot change that. We need a cryptocurrency market structure law," he said.

Brogan expressed that he believes this decision will not have any direct impact on the legislative process, but the SEC can still address issues related to rulemaking.

"I think many in Congress would welcome this, as the market structure legislation currently in the works seems to be at a standstill," he said.

Garlinghouse Hopes to Address Outstanding Issues with the SEC

The SEC's decision to appeal may put a "final exclamation point" on whether XRP is a security, but the legal battle between Ripple and the SEC may continue.

In an interview with Bloomberg on March 19, Garlinghouse raised the possibility of filing a cross-appeal, which is an appeal by the appellee requesting a higher court to review the lower court's ruling.

Specifically, Garlinghouse hopes to revisit the 2023 ruling. In that ruling, Judge Analisa Torres determined that the tokens sold by Ripple to the public do not constitute securities, but imposed a $125,000 fine on Ripple, stating that these tokens should have been sold to institutional investors.

The company is also subject to a five-year "bad actor" fundraising ban, which Brogan indicated could have a substantial impact on its operations.

"Right now, what we are fighting for is whether to contest that $125,000," Garlinghouse said.

He added that while the ruling on XRP as a security is a "clear legal victory," "there are some parts we believe can be improved. The question is, do we continue this fight, or can we reach an agreement with the SEC to drop everything?"

Outside the courtroom, Congress is still working to advance stablecoin legislation. Bo Hines, Executive Director of the President's Advisory Council on Digital Assets, expects the final version to be completed within a few months.

The cryptocurrency framework bill FIT 21 failed to pass the Senate during the 2024 legislative session, but some lawmakers are optimistic that the bill will pass this session after "moderate modifications."

The cryptocurrency lobbying organization Blockchain Association anticipates that these two pieces of legislation will pass before August, while Democratic Congressman Ro Khanna from California stated that these bills could be finalized by the end of the year.

Related Articles: Bitcoin (BTC) Pulls Back After Surpassing $95,000; Institutional Activity May Trigger Market Volatility

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。