来源: Cointelegraph

原文: 《 比特币(BTC)突破9.5万美元后回调 机构活动增强或引发市场波动 》

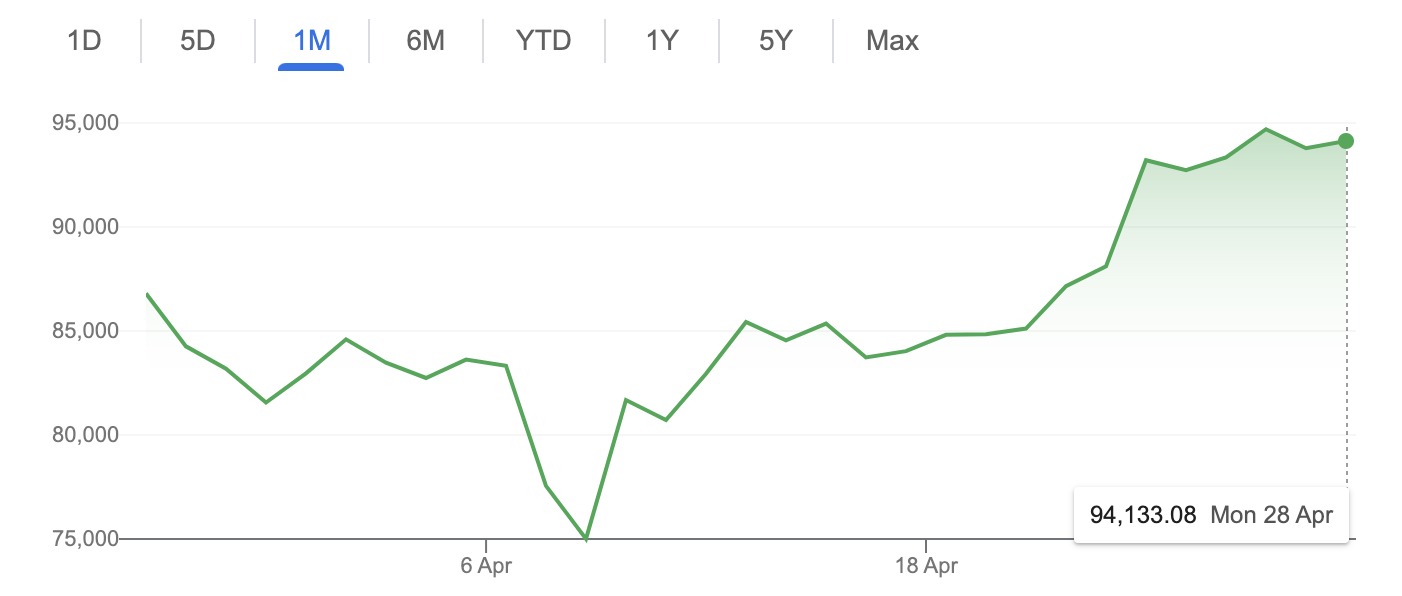

上周,比特币(BTC)价格突破9.5万美元,创下七周新高。但在周末却突然走低。截至星期一(4月28日)发稿时,比特币仍未能重拾上周的上涨势头。截至星期一下午1时,比特币24小时跌幅为0.26%,报9.4014万美元。

瑞士加密投资公司研究策略师Matt Mena此前指出,比特币在突破9.5万美元的阻力位后,会有短暂的盘整。此后,10万美元将成为关键的心理价位。

他说:“随着宏观和全球局势不断凸显对数字化、下一代价值储存手段的需求,比特币正越来越多地扮演这一角色。此次上涨的不同之处在于,投资者对比特币作为宏观对冲工具的信心显著增强。越来越多的投资者不再将其单纯视为投机资产,而是在传统市场不确定性上升的背景下,将其视为避险资产。”

上周二,追踪比特币价格的交易所交易基金(ETF)出现了资金流入激增的现象,在股市持续动荡和美元下跌的背景下,投资者对比特币作为对冲工具潜力的兴趣不断升温。根据SoSoValue的数据,比特币ETF当日录得9.3643亿美元的资金流入,是自1月17日以来的最大单日流入额。

在现货市场中,每个月实际购买比特币的资金量或交易量在减少。但链上数据分析平台CryptoQuant的研究主管Julio Moreno却指出,近期这种收缩趋势已有所放缓,减轻了比特币价格的下行压力。不过,他也警告称,需求增长指标距离2024年末的水平仍有一段距离,比特币若要维持上涨势头并创下新高,就还需要更强劲的需求支持。

全球多资产交易所和金融科技公司LMAX的市场策略师Joel Kruger表示:“这轮近期上涨主要反映出市场抓住机会,利用资产下跌获利。该资产不断证明其作为投资组合多元化、对冲宏观经济不确定性和美元波动的诱人选择的价值。”

大量加密货币从交易所流出,特别是流向非托管钱包时,往往表明投资者情绪和策略正在发生转变。根据CryptoQuant的数据,在上周五,有2.7750万枚比特币从币安(Binance)流出,这是币安史上第三大流出记录。

加密分析师Joao Wedson表示,虽然近期的资金流出并不意味着比特币价格暴涨,但它表明机构活动强烈,这通常是市场重大波动的前兆。

相关推荐:比特币(BTC)价格可能在五月创下历史新高——原因如下

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。