原文标题:Trump's WLFI crypto investments aren't paying off

原文作者:Aaron Wood,CoinTelegraph

原文编译:邓通,金色财经

与美国总统唐纳德·特朗普家族有关的加密货币公司 World Liberty Financial (WLFI) 于去年年底首次亮相并引起轰动。WLFI 在总统就职典礼前夕推出,引起了轰动。观察人士指责该项目抢先报道了白宫加密货币峰会等重要的加密货币相关事件,并引发了利益冲突。

特朗普处于一个独特的位置,可以影响其投资组合的结果,但 WLFI 也未能免受更广泛市场趋势的影响,在重大的宏观经济担忧下,代币价格出现下跌。特朗普政府即将迎来执政百日。以下是 WLFI 的动态,以及总统的加密货币投资如何受到影响。

WLFI 的「金纸」上印有特朗普的赞美形象。资料来源:WLFI

特朗普加密投资 WLFI 项目的创始人和所有权

WLFI 于去年 9 月 16 日成立,当时的当选总统唐纳德·特朗普宣布进军 X。该公司由房地产巨头史蒂夫·维特科夫 (Steve Witkoff) 及其儿子扎克 (Zach) 指导创立,联合创始人还包括加密货币投资者、自称「互联网混蛋」的蔡斯·赫罗 (Chase Herro),以及社交媒体影响者、前搭讪艺术家扎克·福克曼 (Zak Folkman)。

特朗普家族也占据显著位置。特朗普总统被列为「首席加密货币倡导者」,而他的儿子埃里克、小唐纳德和巴伦则是「Web3 大使」。

WLFI 的领导团队。资料来源:WLFI

WLFI 代币销售

World Liberty Financial 的首批举措之一就是出售自己的代币。首次代币销售于 2024 年 10 月 15 日开始,以 0.015 美元的价格出售 200 亿个 WLFI $WLFI,为该公司赚取了约 3 亿美元。

2025 年 1 月 20 日,即特朗普就职典礼当天,WLFI 宣布进行第二次代币销售,理由是「需求巨大,兴趣浓厚」。该公司以 0.05 美元的价格发行了 50 亿个代币,价格较首次发售时上涨了 230%。第二次出售于近两个月后的 3 月 14 日完成,达到了 2.5 亿美元的全部目标。

根据该项目的「金皮书」,WLFI 代币将赋予持有者对影响协议的重要事项(例如升级)的投票权。预期的代币分配是:

· 35% 通过代币销售,

· 32.5% 用于激励和社区发展,

· 30% 用于「初始支持者」分配,

·「核心团队和顾问」占 2.5%。

总而言之,WLFI 获得了 5.5 亿美元的代币销售额。$WLFI 仅供合格投资者使用,根据条款和条件,不得转让或在交易平台交易。该代币的上市日期尚未公布。

WLFI 的投资组合

除了代币销售之外,WLFI 还充当一种加密基金,在过去几个月中积累了许多不同的代币。具体如下:

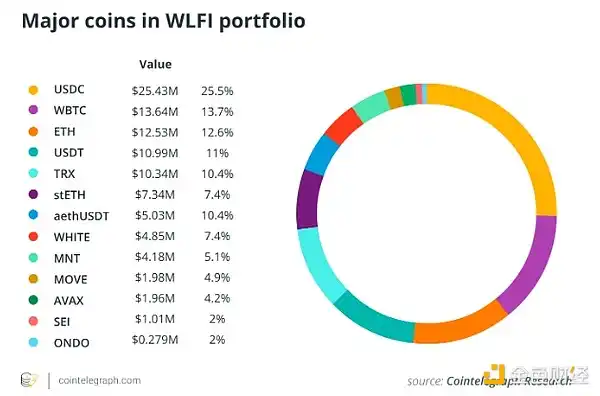

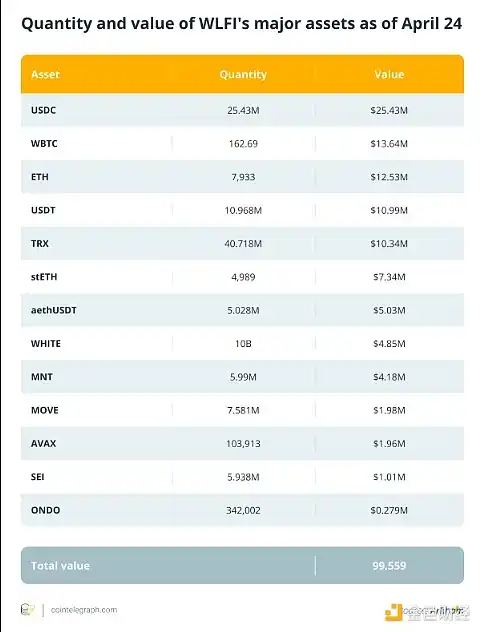

WLFI 投资组合包含多种不同的资产,截至撰写本文时,其中 13 种资产占据了最大份额。其持有的大部分是美元支持的稳定币 USDC,其次是 Wrapped Bitcoin (BTC) 和 Ether (ETH)。

据 Arkham 称,前 13 项资产占该公司 1.03 亿美元投资组合的近 1 亿美元。其余价值由数十种其他代币组成,其中一些小代币的总价值不到 100,000 美元。

WLFI 拥有价值 500 万美元的 Aave Ethereum USDC(aethUSDC),这意味着他们向 Aave 上的资金池提供 USDC。WLFI 的投资组合包含八种加密货币,这些加密货币是其购买的(而不是通过空投收到的)非稳定币资产。

· Wrapped BTC (WBTC)

· Mantle (MNT)

· Movement (MOVE)

· Sei (SEI)

· Avalanche (AVAX)

· Tron (TRX)

· Ondo (ONDO)

· Ether (ETH)

总体而言,WLFI 持有的 WBTC、SEI 和 AVAX 的表现最为成功。第一次 WBTC 购买发生在 12 月 18 日,当时 WLFI 将 103 WBTC 兑换为 103 cbBTC。近一个月后,WLFI 将所有资产都换成了 ETH。该基金再次开始积累 WBTC,主要使用 USDT,并于 2 月初将其发送给 Coinbase Prime。

WLFI 于 3 月 15 日一次性买入 AVAX,并在 2 月、3 月和 4 月分三次买入价值近 600 万美元的 SEI。

其他的表现就没那么好了。截至 4 月 24 日,MNT、MOVE、ONDO 和 ETH 的主要投资均出现两位数的损失。MOVE 遭受重创,WLFI 的总投资价值下跌超过 50%,投资损失约 2,100,000 美元。

考虑到 WLFI 代币购买的平均价格以及其资产的当前价格,其投资平均亏损 4,280,000 美元。值得注意的是,WLFI 还在 12 月和 1 月将几笔早期购买的代币存入 Coinbase Prime。

早在主要行动开始之前,WLFI 钱包就慢慢积累了 ETH。WLFI 从 11 月下旬开始收购价值超过 100 万美元的大笔资金,并每隔几天就持续这样做,直到 12 月 21 日。然后,它于 1 月 14 日将所有收购的 ETH(包括 10 月份存入的 3,700 ETH)转移到 Coinbase Prime。

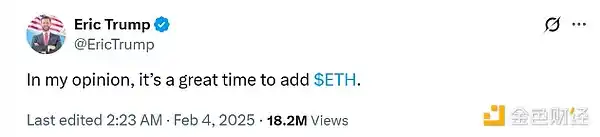

1 月 19 日至 1 月 21 日期间,它购买了近 57,000 个 ETH,并持续收购,直到 2 月 3 日,它将大部分 ETH 转移到 Coinbase Prime。巧合的是,埃里克·特朗普 (Eric Trump) 当时也在 X 上推销以太坊。

利益冲突与稳定币

WLFI 将代币转移到加密货币交易平台以及 Eric Trump 的帖子的奇怪时机引发了人们对特朗普家族影响其持有的代币的能力的质疑。3 月底,该机构银行委员会的一群参议员写了一封公开信,敦促监管机构考虑 WLFI 的潜在利益冲突,特别是该项目的稳定币 USD1。

据 CoinMarketCap 称,USD1 于 3 月初推出,截至发稿时,已在中心化交易平台 Kinesis Money 和 ChangeNOW 上进行交易。参议员们担心,特朗普处于一个独特的位置,可以影响并为自己的稳定币项目带来好处,特别是在国会即将审议的稳定币框架法案的情况下。

特朗普在「解放日」宣布加征关税后,市场暴跌,总统在右翼社交媒体平台 Truth Social 上发帖称,「现在是买入的好时机!!」进一步引发人们对内幕交易和市场操纵的担忧。

尽管存在这些担忧,特朗普政府与加密货币的联系却在加强。他的政府已经撤销了几起针对加密货币公司的高层执法案件,他在国会的盟友正在起草有利于该行业的立法。加密货币公司似乎对该项目充满信心。4 月 16 日,加密货币做市商 DWF Labs 宣布向 WLFI 投资 2500 万美元,并同意为其提供 1.5 亿美元的流动性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。