来源: Cointelegraph

原文: 《 比特币(BTC)“幂律模型”预测2025年比特币价格将达20万美元 》

关键要点:

比特币(BTC)价格本周上涨了11%,是2025年以来的最佳单周涨幅,也是自2024年11月初以来的最高7天涨幅。 4 月 25 日,比特币价格也达到了 95,000 美元,这是自 2 月 24 日以来的首次。

比特币1周图表 来源:Cointelegraph/TradingView

第21位Capital联合创始人Sina提到,比特币重新获得了幂律价格。 幂律的预测准确性源于比特币网络遵循梅特卡夫定律的增长,其中价值与用户的平方成正比。

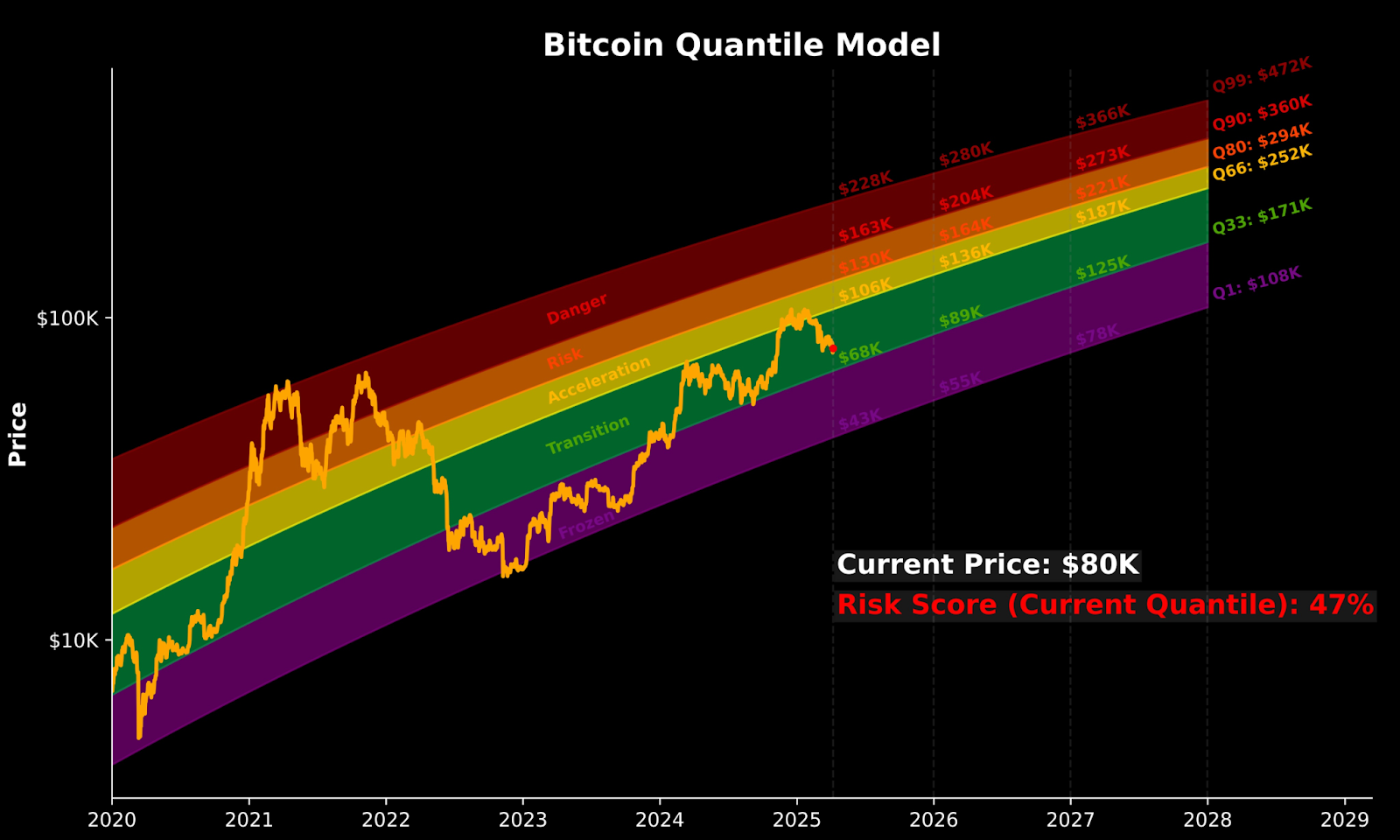

根据新浪的比特币分位数模型,恢复幂律价格使比特币有望在2025年底前达到13万美元和16.3万美元的价格目标。

新浪比特币分位数模型 来源:X.com

如图所示,比特币目前处于“过渡”区间,即BTC积累发生。 一旦进入“加速”区,加密资产将进入33%至66%的上涨区间,并在接下来的几个月内逐步达到106,000美元、130,000美元和163,000美元。

然而,匿名比特币分析师apsk32预测,到2025年,比特币的价格目标可能高达20万美元。 该预测基于“比特币功率曲线时间轮廓”,该轮廓叠加了比特币在四年周期(2013年、2017年、2021年和2025年)内的价格走势。 该图表显示,2025年第三季度和第四季度表现强劲,分析师指出,比特币的历史四年周期保持不变。 这位分析师说:

“看看今天、4年、8年和12年前的两年期。使用功率曲线趋势线进行价格缩放。预计第四季度比特币价格将超过20万美元。 黄金表明,我们可以走得更高。"

比特币功率曲线时间轮廓图 来源:X.com

黄金-比特币滞后可能会重演第四季度的涨势

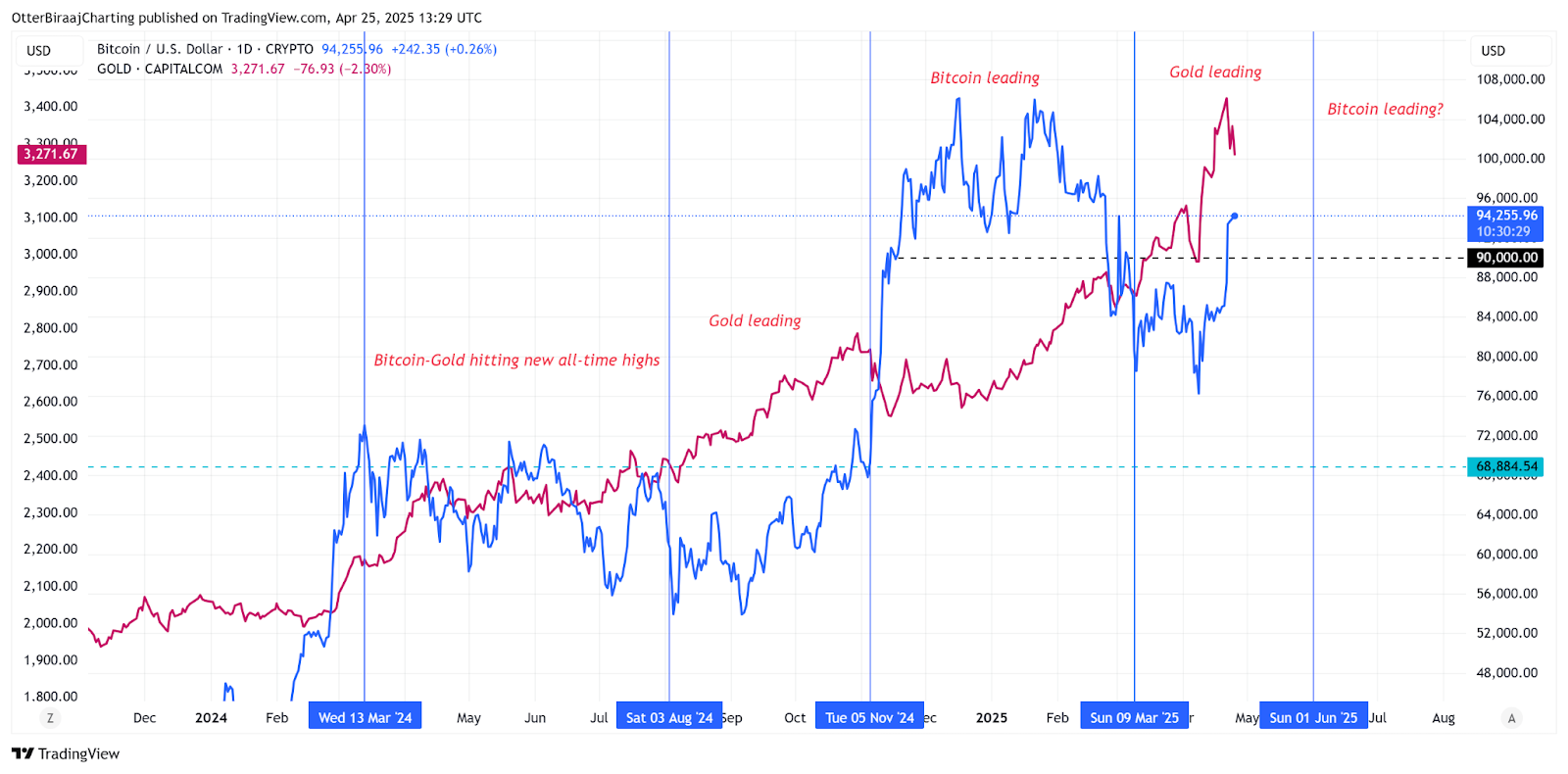

自2024年初以来,比特币和黄金在市场上创下新高,每种资产在特定时期的表现都优于另一种资产。

如图所示,比特币和黄金在2024年3月至8月期间创下新高。 然而,在2024年第三季度,黄金率先反弹,超过了比特币的表现。 到第四季度,比特币重新获得了动力,超过了贵金属,并保持领先地位,直到2025年3月黄金再次领先。

比特币黄金价格表现图 来源:Cointelegraph/TradingView

黄金仍然领先于比特币,但自创下新高以来已下跌6%,而比特币则上涨了11%。 Cointelegraph 报道称,BTC 往往会在 100-150 天后跟随黄金的方向性偏差。 基于这种说法,比特币在未来几周内可能会领先黄金。

同样,美元指数(DXY)在4月21日跌至三年新低,这进一步加剧了风险资产反弹的可能性。Cointelegraph报道称,多年来的DXY低点对比特币来说是历史性的看涨。 加密货币分析师“Venture Founder”也指出,

“传统上,DXY下跌对BTC非常有利,我们现在对DXY有巨大的看跌分歧,这可能表明它跌至90美元。 最近两次发生这种情况,引发了比特币在牛市最后阶段(持续12个月)的抛物线牛市。”

本文不包含投资建议或推荐。 每一次投资和交易都涉及风险,读者在做出决定时应该进行自己的研究。

相关文章:比特币(BTC)飙升至七周高位,但分析师对其反弹至10万美元存疑

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。