Kaito 数据驱动的“未发币”项目洞察:基于用户心智份额的分析

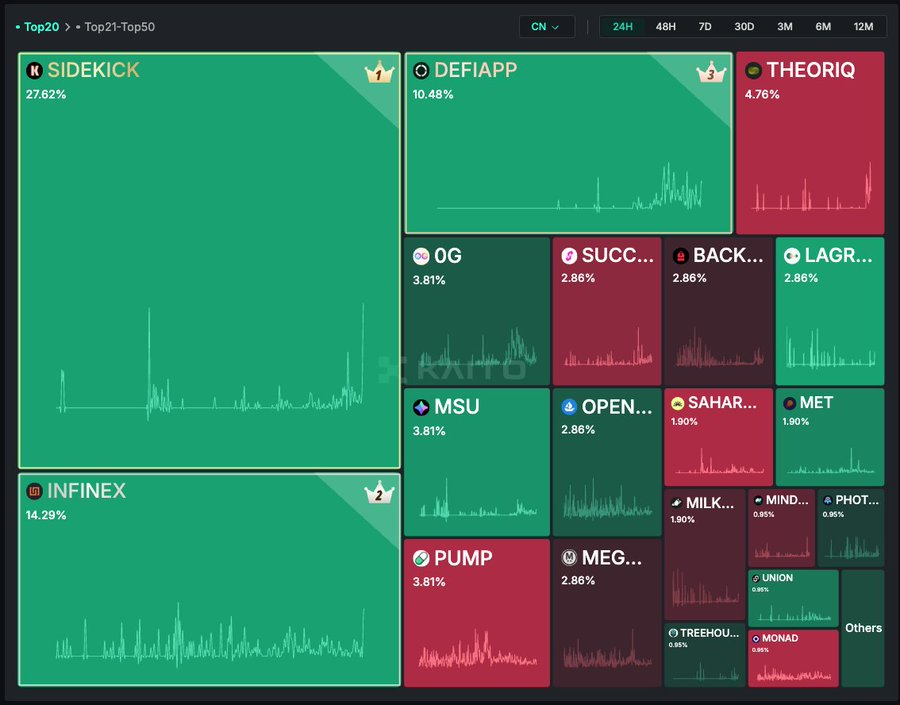

1/ 中文语言区 Pre-TGE Mindshare Arena

根据 Kaito 最新数据,@Sidekick_Labs 在中文语言区以 32.8% 的用户心智份额遥遥领先,展现出强大的市场影响力。

Sidekick 做对了什么?我想可能是:

产品定位精准:Sidekick 定位自身为“Web3 抖音”。

资本背书:YZi Labs 的战略投资。

生态初步成型:通过吸引优质 KOL 和用户入驻直播平台,Sidekick 已形成自循环的内容生态,网络效应初显。

@defidotapp 在中文区排名第三,用户心智份额约为 8.5%。作为典型西方背景的 DeFi 项目,其在华语区的 Go-To-Market 策略表现出色,尤其在中英双语区均进入榜单前列,显示出优秀的本地化能力。

关于这点,@yueya_eth 小姐姐比我更有发言权。

2/ 英文语言区 Pre-TGE Mindshare Arena

英文区榜单分布较为均衡,头部项目心智份额差距较小:

@AbstractChain:以 9.8% 的用户心智份额位居第一。

@Somnia_Network:以 7.48% 的份额紧随其后。

Abstract 在英文区表现突出,但在中文区未能进入前 20,原因可能包括:

品牌影响力差异:胖企鹅在海外市场具有较高辨识度,但在中文区文化共鸣有限。

市场运营缺失:Abstract 未针对中文市场进行系统性运营,缺乏本地化内容与社区建设。

最后,@pumpdotfun 和 @Polymarket 作为本轮周期的代表性应用,持续位列榜单前列。然而,从理论视角看,二者发币的必要性较低:

商业模式成熟:均已建立稳定的收入模型,无需通过代币激励来驱动增长。

代币经济风险:引入代币可能导致激励机制复杂化,增加监管与波动风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。