作者:Frank,PANews

过去一年,稳定币市值大幅增长,应用场景逐渐增多,除了在DeFi等加密原生场景中扮演“硬通货”,其角色也在不断扩展,更大的趋势是闯入Web2的支付、跨境结算、价值存储等方面。

稳定币巨大市场和潜力使其成为各大公链必争的关键资源。而要想支撑这些更大规模的现实应用场景的落地,对公链的基础性能和生态的偏好特点等方面提出了更高的要求。

在这场无声的金融管道革命中,BNB Chain以"性能轴-生态轴-场景轴"构建起三维基建体系,悄然铺就未来金融的高速路网。

数据是最直接的佐证,越来越多的用户、项目、机构选择在BNB Chain上进行稳定币相关活动。最近特朗普家族WLFI推出的美元稳定币USD1也将BNB Chain作为发行主战场,该链占当前总流通超近9成,BNB链的USD1市值目前已超过1.1亿美元。

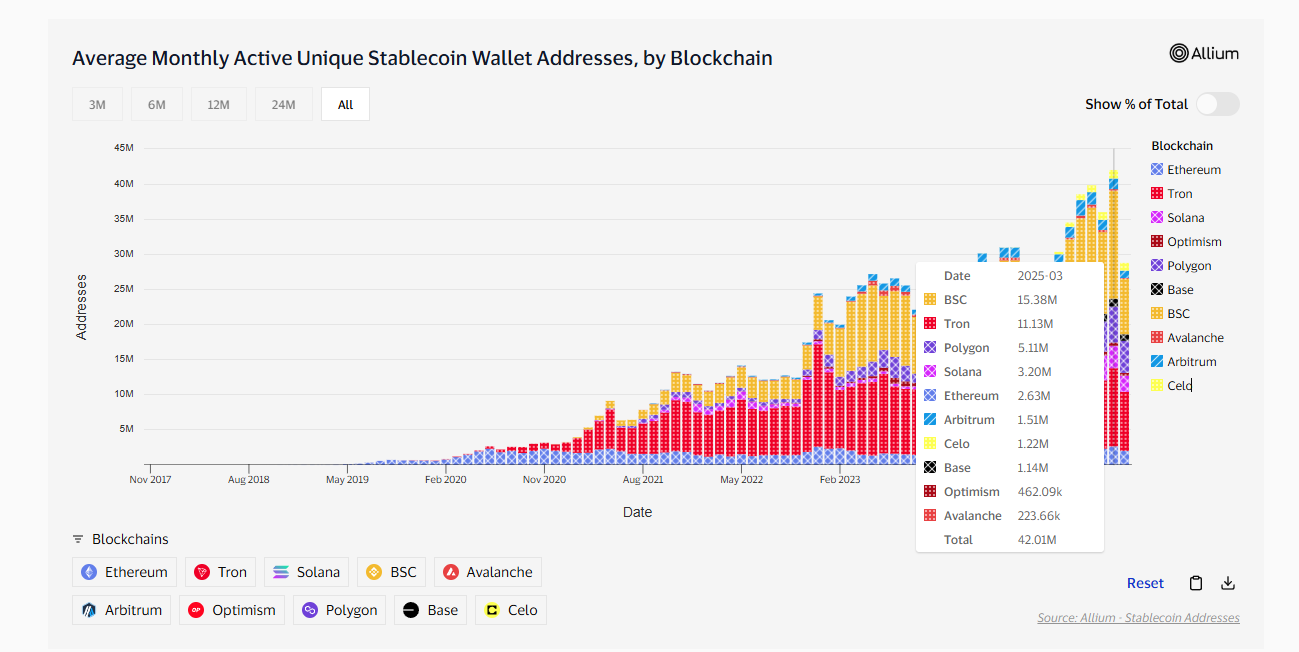

2025年3月,BNB Chain的活跃稳定币独立钱包地址数达到历史新高,超过1538万个,领先于其他公链。BNB Chain链上近1个月活跃USDT地址数量达1200万,位居第一。过去一年,BNB Chain上稳定币市值实现了约75%的增长,表现出强劲的资金吸引力。

锻造金融高速公路的"三极引擎"

在稳定币向实体经济渗透的过程中,BNB Chain通过三级动力系统构建价值传输基础设施,分别为性能方面的3秒区块确认+5000TPS处理能力的极速传动轴;低至0.03美及零Gas计划的零摩擦轴承;BSC主链+opBNB扩容层+Greenfield存储的模块化底盘。

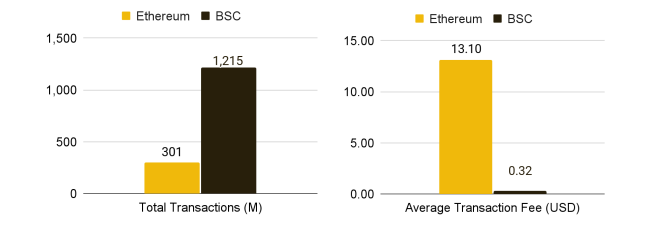

性能方面,BNB Chain主网BSC的出块时间约为3秒,本月Lorentz升级完成后将降至1.5秒,远快于以太坊主网的约12秒。在交易处理能力(TPS)方面,理论容量可达5000TPS。相比之下,以太坊在合并后(PoS)的TPS约为30 ,历史最高实测约为22.7。强大的性能可为稳定币的大规模、实时应用提供了基础保障。

架构方面,其多链架构(通用型BSC、扩容层opBNB、存储层Greenfield)正在满足不同应用场景的需求,为稳定币在各种应用中的集成提供了灵活的基础 。这种战略转变意味着BNB Chain不仅仅满足于成为稳定币的通道,更要成为稳定币创造价值的核心平台。

成本同样也是稳定币大规模应用的关键因素,特别是小额支付场景。BSC的平均交易费用极低,约为0.03美元至0.11美元之间,为以太坊费用的1/30。这意味着,即使用户每天在BSC上进行100次稳定币转账,其总成本也可能仅为3美元左右(按$0.03/笔计算)。

构建稳定币的“热带雨林”系统

生态构建,始终是稳定币大规模应用的前置条件,BNB Chain通过打造开发者沃土,外部资源储备池,安全防护林构建出一套独特的稳定币生态雨林。

吸引开发者构建稳定币应用是生态繁荣的关键之一,BNB Chain通过提供兼容的环境和丰富的工具链来降低开发门槛。BNB Chain完全兼容以太坊虚拟机(EVM),这意味着为以太坊开发的智能合约和去中心化应用(dApp)可以以最小的改动迁移到BSC上 。而BNB Chain还设立了多种开发者支持计划,包括提供资金支持的Builder Grants、成长激励计划、最有价值建设者(MVB)加速器计划等,全方位扶持生态项目发展 。

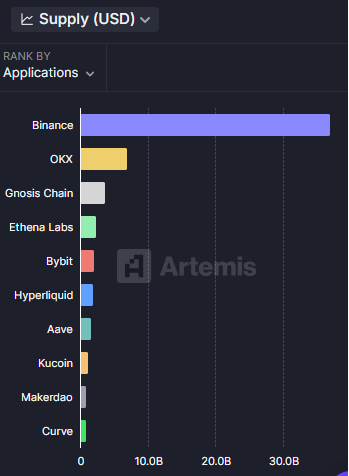

在生态环境方面,BNB Chain有着得天独厚的优势。这里有着最活跃且数量大的用户群之一。此外,流动性充裕——不仅源于其与全球领先交易所币安的紧密联系,也打通了市场上多数主流交易所和钱包以及跨平台通道,成为应用最广泛的公链。

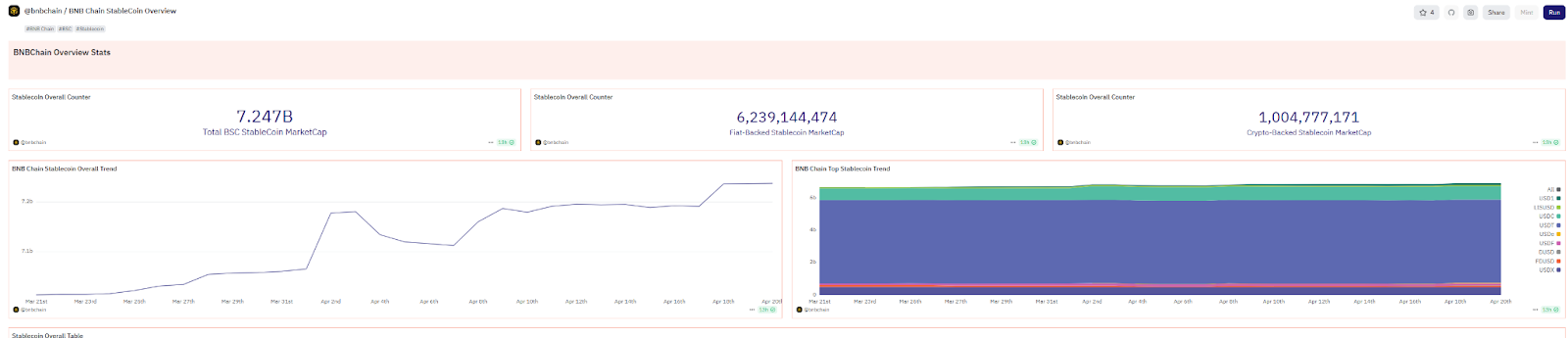

截至2025年4月,BNB Chain稳定币总市值达到72亿美元,排名全网第四,已成为稳定币发行、采用最主要的公链之一。

同时,Binance Labs(现更名Yzi labs)也持续对BNB Chain项目进行投资,仅2024年Binance Labs投资的46个项目中就有14个来自BNB Chain,包括长期合作的MVB项目。这种生态的扶持或将为稳定币提供更多的施展空间。这些资源共同构成了对BNB Chain稳定币生态发展的强大“协同”效应。

作为币安创始人,CZ一贯看好稳定币的应用前景。早在2023年,他便在社交媒体上指出,稳定币在跨境支付、通胀对冲等方面具备巨大潜力,并强调监管的逐步清晰将反而加速其普及。近期,面对“稳定币之战”的加剧,CZ表示市场的良性竞争才刚刚开始。

为了进一步推动稳定币应用,BNB Chain于2024年9月推出了零Gas费狂欢节计划,该计划已延长至2025年6月。该计划为BNB Chain推动稳定币支付应用的关键举措,目前已覆盖超过300万美元手续费。各大主流交易所、钱包等都已纳入活动伙伴,近期新上线的USD1也享受0 gas费,进一步降低用户的链上稳定币使用成本。

这些资源共同构成了对BNB Chain稳定币生态发展的强大“反哺”效应。同时,这种与顶级CEX的深度整合和正外部性,为BNB Chain带来了其他公链难以比拟的流动性入口和用户基础。

在技术狂飙的同时,安全防护网已铺开。作为AvengerDAO安全体系的一部分,Red Alarm工具持续监控并标记高风险项目和合约,为用户筑起防骗防火墙 。

从DeFi到线下支付,打造稳定币场景立体空间

在构建了生态和优秀的性能基础之上,走入更多应用场景才是稳定币的最终价值目的地。通过更积极地布局DeFi、GameFi、AI和现实支付等关键领域,打造和推动多元化链上金融环境层应用生态的繁荣,BNB Chain为稳定币提供了丰富的应用场景和价值放大的机会。

DeFi是稳定币最主要的应用领域之一,BNB Chain拥有繁荣的DeFi生态,稳定币在其中扮演着核心角色。比如,PancakeSwap作为BNB Chain上的旗舰DEX ,成为稳定币链上交易和流动性的主要场所,其周交易量常超百亿美元,意味着用户可以低滑点地进行兑换。

Venus Protocol是BNB Chain上历史悠久且规模领先的借贷平台 ,截至2025年4月其在BNB Chain上的TVL约为15.5亿美元。用户可以在Venus上存入稳定币赚取利息,或抵押其他加密资产(如BNB、ETH等)借出稳定币。

新兴的ListaDAO作为借贷领域的新趋势,它结合了流动性质押衍生品金融(LSDFi)。用户可以抵押BNB或其流动性质押代币slisBNB等资产,借出协议的原生稳定币lisUSD或最近推出的与美元挂钩的稳定币USD1。截至2025年4月,ListaDAO在BNB Chain上的TVL已达7.48亿美元,借款总额约1.55亿美元。

这些借贷协议极大地扩展了稳定币的用途,使其成为获取流动性、加杠杆或进行收益策略的重要工具。

除了DeFi,BNB Chain也正积极推动稳定币进入实体经济的支付场景,连接链上价值与线下消费。

在曼谷街头,用户曾通过TADA Telegram小程序享受首单免费以及BNB Chain稳定币支付;在新加坡商场,dtcpay的visa卡让稳定币秒变法币消费。——这些场景正将加密实验变为日常金融现实。

从DeFi到支付,从链上到链下,从处理交易到价值流转。BNB Chain不断拓展稳定币应用边界,更在推动其融入全球支付体系中扮演关键角色,为稳定币的普及与主流化奠定了坚实基础。

随着稳定币逐步从加密原生金融走向更广泛的现实世界场景,其背后的公链基础设施也正在经历一场深刻的洗牌。而在这场新秩序的重构中,BNB Chain正以其高性能、低成本、强生态、安全性和顶级资源整合能力,悄然成为这场变革的中坚力量。

在这里,稳定币成为构建未来金融高速之路,触达下一个10亿用户的起点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。