比特币并不是唯一在美国总统唐纳德·特朗普本月对几乎所有国家实施“互惠”关税后闪耀的加密货币。

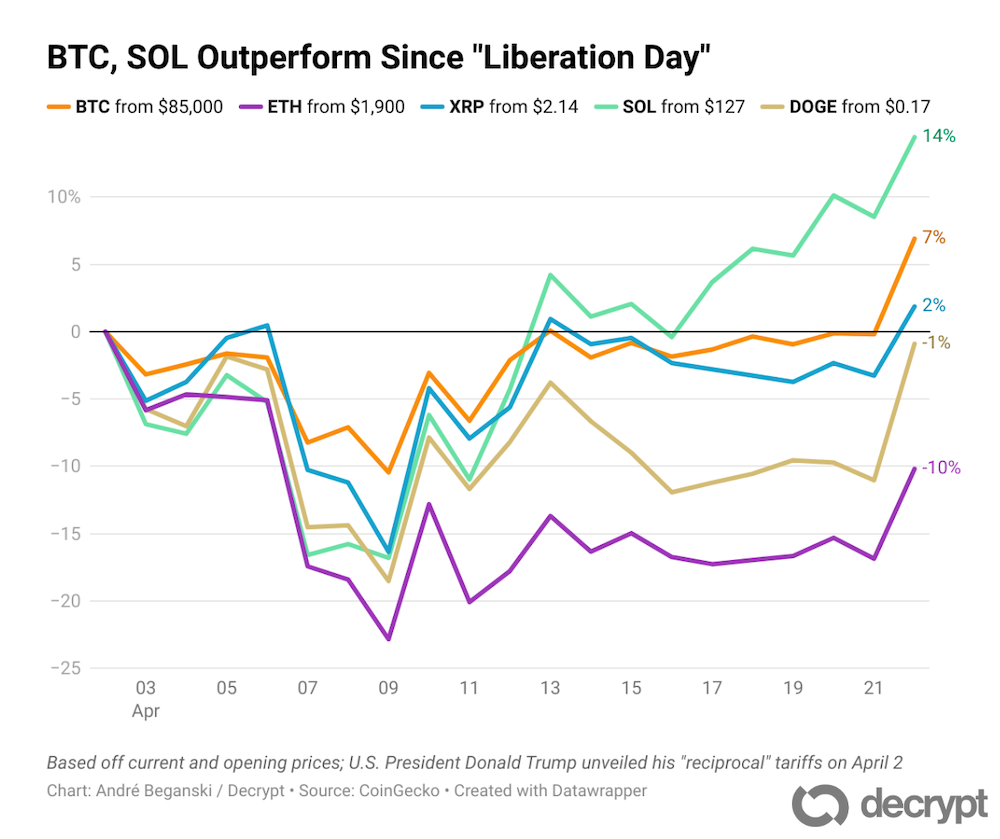

自特朗普的解放日(4月2日)以来,索拉纳和比特币的表现优于其他主要加密货币,分别上涨了14.5%至145美元和7%至约91,100美元,数据来源于加密数据提供商CoinGecko。以太坊(-10%)、XRP(-12%)和狗狗币(-1%)则出现下跌。

索拉纳和比特币推动了更广泛的加密行业,自4月2日以来,全球加密市场总市值增加了6%,达到了295万亿美元。索拉纳占加密市场整体价值的2%。比特币的市场主导地位保持在约60%的市值不变。

索拉纳最近的优异表现与其作为价值储存的优点关系不大,Messari研究分析师马修·奈告诉Decrypt。相反,这种加密货币被“超卖”,因为交易者对迷因币的兴趣减退,代币解锁影响了投资者情绪。

“你开始看到Fartcoin的复苏,”奈说,他将基于索拉纳的资产描述为对迷因币热情的象征,以及该网络在加密所谓赌场中的影响力。“它永远不会回到以前的样子,但它没有转向其他链。”

上个月,破产的加密交易所FTX的破产财产获得了价值16亿美元的1100万索拉纳的访问权限。这代表了自2021年1月以来最大的解锁,瞬间增加了索拉纳的流通供应,数据来源于Messari。

虽然代币解锁通常是看跌的,奈表示社区现在正在期待会议和网络升级,例如验证者客户端Firedancer。

“人们仍然喜欢这个资产,”他说。“它只是被超卖了,这就是为什么这次复苏如此强劲。”

比特币作为价值储存

比特币可能因为其“价值储存”的叙述而领先,Coinbase Institutional的研究主管大卫·杜昂告诉Decrypt。随着投资者涌向非主权资产如黄金(不受政府支持),他认为比特币可能正在获得类似的需求。

在加密领域,杜昂补充道,比特币也有独特的优势。他强调了华尔街日益增长的接受度以及去年在美国获得批准的交易所交易基金。

“比特币获得机构采用并通过现货ETF被纳入更多投资组合的事实,使其与其他代币区分开来,”他说。“比特币从峰值的价格下跌相较于我们在之前周期中看到的情况相对温和,这表明对长期持有比特币的信心更强。”

编辑:詹姆斯·鲁宾

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。