LTH-MVRV represents the profit status of long-term holders.

Author: Mr. Beig

🔸TL;DR

- This article will continue the concept of MVRV and introduce LTH-MVRV

- LTH = Long Term Holders, defined as BTC held for more than 155 days

- LTH-MVRV represents the profit status of long-term holders

- LTH-RP represents the average cost of long-term holders

🟡 What is LTH?

LTH = Long Term Holders, defined by Glassnode as "BTC held for more than 155 days."

As for why it is 155 days, Glassnode provides a detailed explanation on their official website.

Due to the complexity of the content, I will refrain from elaborating here; interested readers can read it themselves.

🟡 Introduction to LTH-RP

LTH-RP is the Realized Price of long-term holders, which is their average holding cost.

The algorithm divides LTH-Realized Cap by the circulating supply.

As shown in the figure below, the light green curve represents the Realized Price of the entire market, while the dark green curve represents the Realized Price of LTH.

It is evident that the holding cost of long-term holders is usually lower than the average cost of the entire market.

(Comparison of Realized Price and LTH-RP)

🟡 Introduction to LTH-MVRV

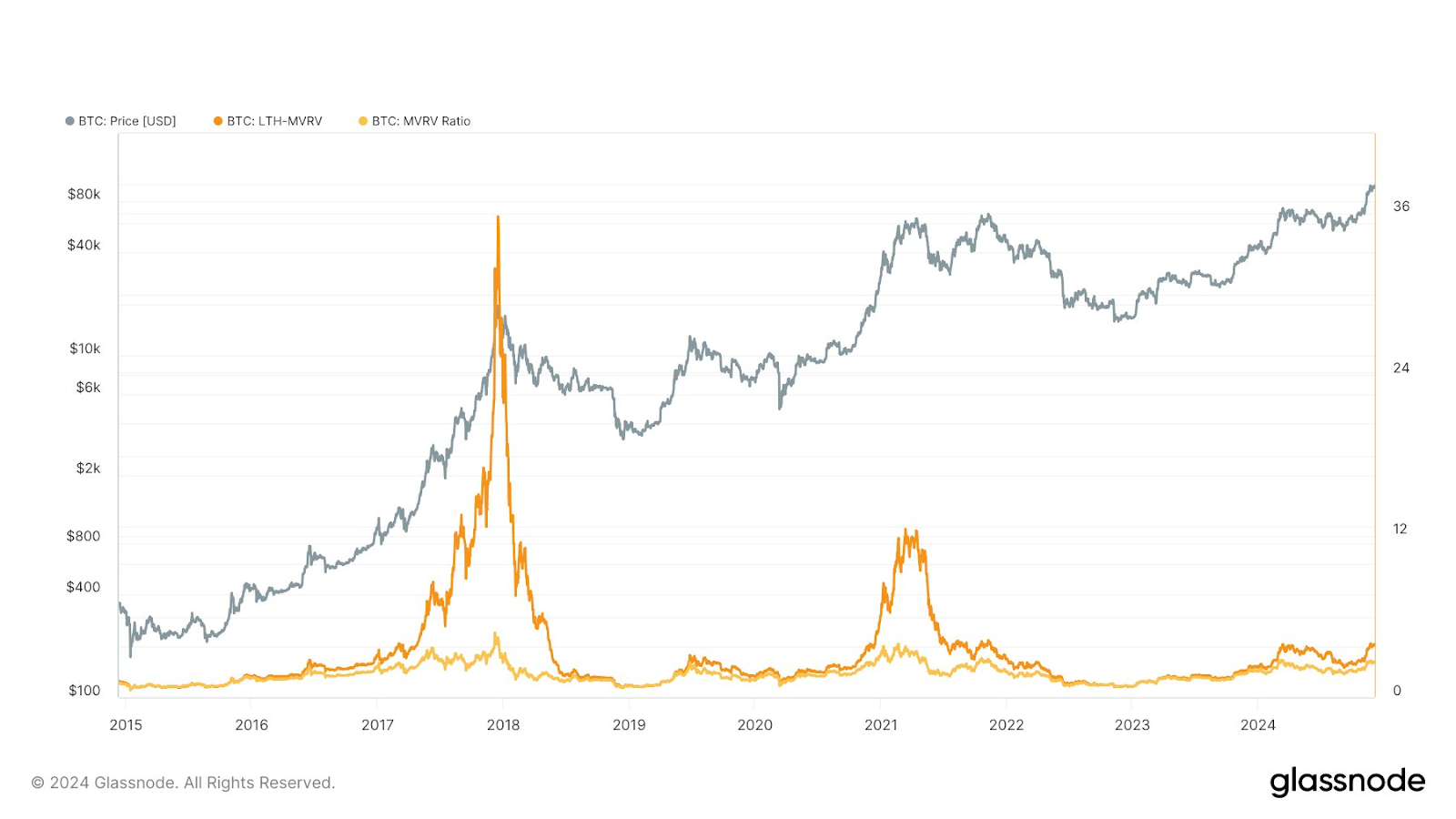

LTH-MVRV represents the profit status of long-term holders, and its calculation method is quite similar to that of MVRV.

The algorithm is "current market value / LTH-Realized Cap," which can also be written as "current market price / LTH-RP."

As shown in the figure below: the changes in LTH-MVRV are usually more pronounced than those in MVRV.

This is because the profits of LTH are usually quite substantial (meaning they tend to make more money!).

(Comparison of MVRV and LTH-MVRV, with the orange line representing LTH-MVRV and the yellow line representing MVRV)

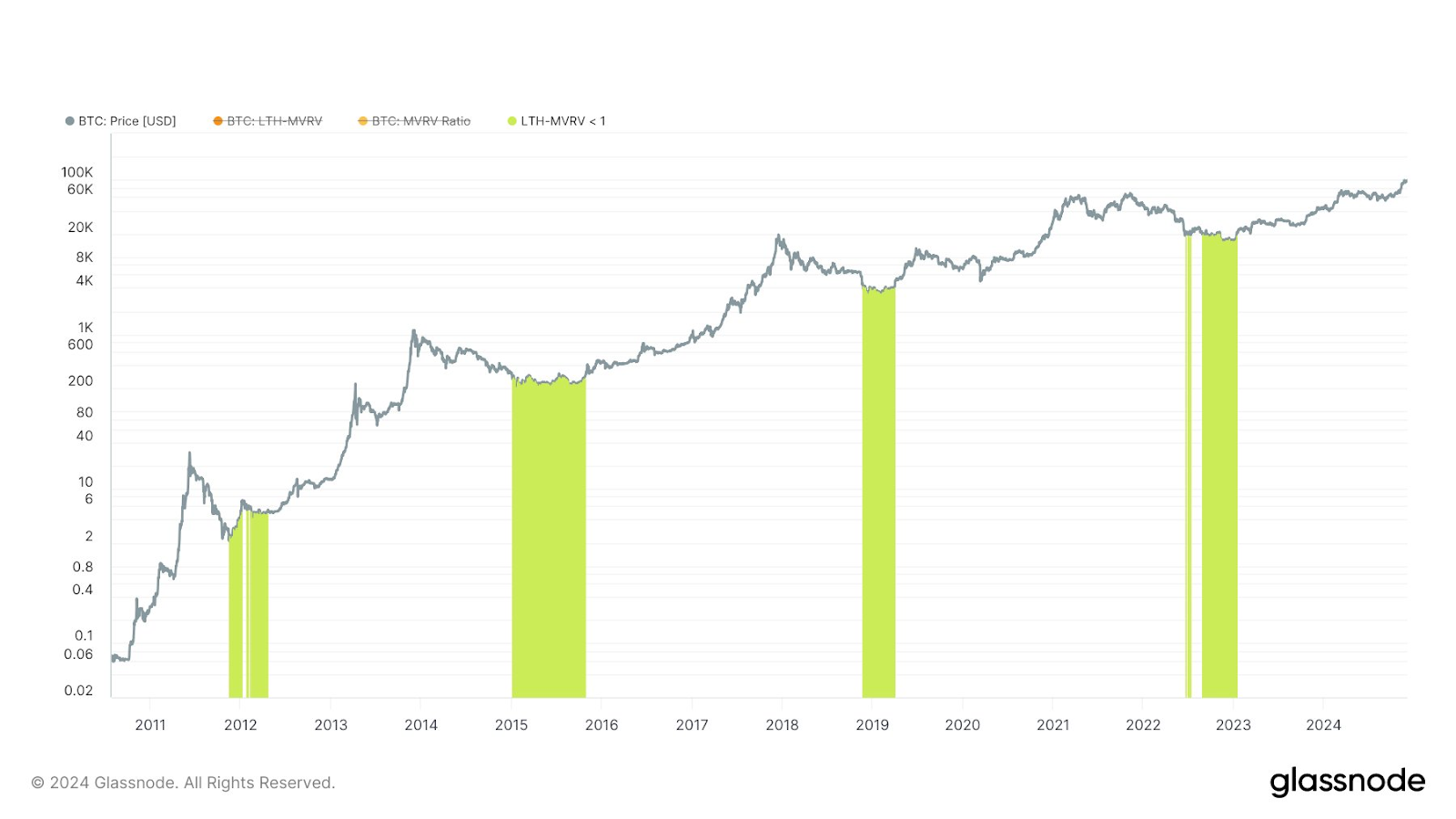

🟡 Application of LTH-MVRV for Bottom Fishing

When LTH-MVRV is 1 (or when the market price is below LTH-RP), it indicates that even long-term holders are generally at a loss.

Typically, this is a good time for bottom fishing 📈

As shown in the figure below, I have marked the points when LTH-MVRV is 1, which correspond almost entirely to cyclical major bottoms.

Therefore, when designing bottom-fishing strategies, consider incorporating this indicator!

(Prices corresponding to when LTH-MVRV is 1)

🟡 Conclusion

That concludes the content of the On-Chain Data Academy (Part Two).

For readers interested in learning more about on-chain data analysis, be sure to follow this series of articles!

I hope this article has been helpful to you, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。