作者:jk,Odaily 星球日报

随着全球加密货币基础设施的逐步成熟,用户对于链上资产“现实可用性”的需求也日益增长。然而,如何将链上的资产真正用在现实生活中,一直是加密用户关心的问题。

加密支付卡(也称为“U卡”),正是在这个背景下悄然崛起——它们不仅打通了资产使用的“最后一公里”,也在悄然重塑人们对钱包、PayFi与支付网络的理解。

无论是直接绑定移动支付软件进行消费,还是通过抵押比特币借出稳定币灵活应对市场行情,加密支付卡的玩法越来越丰富。它们当中,有以交易所为依托、主打稳定性和返现奖励的,也有以钱包或协议为基础、强调链上原生资产和可组合性的。今天的加密支付卡,已经成为一个实用且日益成熟的加密金融入口。

为了厘清这类产品的真实使用体验和差异点,Odaily星球日报基于大量的信息搜集和社交平台的用户反馈,深度拆解了当前市场最具代表性的十大加密支付卡,包括 Bybit、Bitget、SafePal、Morph、Infini、Coinbase、Nexo、MetaMask、1inch 和 RedotPay,结合其申请门槛、支持资产、费率结构、返现机制及链上互动能力,进行系统性梳理和横向对比,帮助读者在这片迅速演化的领域中,找到最适合自己的那一张“通行证”。

适合中文区用户的新手U卡

Bybit卡:使用最广泛的交易所U卡

Bybit近期推出的虚拟借记卡因其无年费、低门槛的特性,在最近的社交平台较为火热。这张卡片支持大陆KYC认证,办理过程免费。

申请流程相当简便:用户首先需要注册Bybit账户,完成注册后,在平台进行实名认证,据悉使用中国大陆身份可以通过KYC审核。认证通过后,在首页找到"Card"选项进入申请页面,然后用户可以选择不同的地区进行开卡:

选择澳大利亚作为开卡地区,选择这个选项的情况下,申请虚拟卡不需要提供地址证明。提交申请后,审核时间大约需要5至7个工作日。这个版本下,卡片的默认货币为美元。

用户也可以选择欧洲经济区(EEA),但需要注意EEA版本需要提供欧洲经济区地址证明,如欧洲地址的水电账单、信用卡账单等。此版本下卡片的默认货币为欧元。

在使用方面,该卡可以在Bybit App里进行管理,虚拟卡可以直接绑定Apple Pay、Google Pay等消费,在全球支持Mastercard的商家均可刷卡使用。

推特近期消息称,澳大利亚版本的虚拟卡近期已经无法绑定支付宝和微信支付进行消费,这主要是由于返现活动被撸毛工作室等过度利用所致。但也有用户消息称,支付宝的碰一碰可以进行交易,这点可能根据每个用户的账户风控不同也有所不同。如果需要绑定这些支付工具,可以考虑申请欧卡版本,据推特信息,欧卡版本目前仍可正常绑定支付宝等进行使用。

在费率方面,Bybit卡具有相当的竞争力:交易手续费介于0.9%至3%之间,具体取决于开卡地区、交易币种以及消费地点等因素。部分交易可能会产生额外的中间商手续费(如支付宝等平台)。目前平台正在开展新卡促销活动,用户消费可享受10%的返现优惠。

需要特别提醒的是,不同地区的消费可能会产生额外的货币转换费等成本。例如,如果用户在使用日元的商户刷卡消费,那么最终的手续费中可能会包含从美元/欧元转换为日元的汇率,而这部分也需要用户承担。总体而言,这张卡与交易所挂钩从而使用方面具有明显优势,是当前市场上较为便利的选择之一。

Bitget卡:为VIP提供的专属支付卡

相较于传统银行卡,Bitget推出的虚拟借记卡同样以“无年费”与“直接消费USDT”作为主要卖点,吸引了不少加密用户的关注。该卡目前支持两种卡组织选项:银联(UnionPay)和 Mastercard,覆盖不同地区和消费场景下的实际需求。

Bitget卡的发卡方为 DCS(DeCard)品牌,该机构为新加坡本地受监管的发卡银行,据市场消息已经被Bitget收购了大部分股权。尽管 DeCard 也提供面向个人用户的卡申请服务,但该路径通常要求申请人具备新加坡本地身份认证和手机号,门槛较高。因此,通过 Bitget 平台申请是更为可行的方式。

需要注意的是,Bitget卡当前并非对所有用户开放申请。根据平台现行规则,只有达到 VIP 等级的用户才具备申请资格,其中一个常见的门槛是账户余额需达到 3 万 USDT 或等值资产。因此,该卡的目标用户群体更多面向高净值或活跃交易用户。

目前Bitget卡同样支持Apple Pay、Google Pay、支付宝、微信等绑定操作,其功能聚焦于链上资产的流动性释放与日常消费结合。需要注意的是,Bitget卡种类不同,官方网站上的Bitget卡是以美元为底层结算货币的Visa卡,而推特上较为火热的Bitget优享支付卡是以新加坡元作为底层结算货币的Mastercard/银联卡,略有不同。根据Twitter上的用户体验来看,此卡在所有支持Mastercard地方都可以流畅使用。

同时,Bitget在主页上写明,未来会有BGB返现的机会。

同时,Bitget在主页上写明,未来会有BGB返现的机会。

从费率来看,Bitget卡的交易手续费同样为 0.9% 至 3%,主要受到交易币种、消费地点以及是否涉及货币兑换等因素影响。例如,若在非美元/新加坡元的地区进行以 USDT 结算的交易,可能会触发一定的货币兑换费用。此外,不同支付通道(如银联与 Mastercard)也可能影响到账时间与中间手续费。同时,支付宝和微信支付也会在300元以上的额度的交易中收取手续费。

总体来看,Bitget卡作为交易所衍生的虚拟金融产品,为用户提供了又一个将加密资产用于现实消费场景的通道,尤其适合资产规模较大、频繁跨境消费的用户群体。

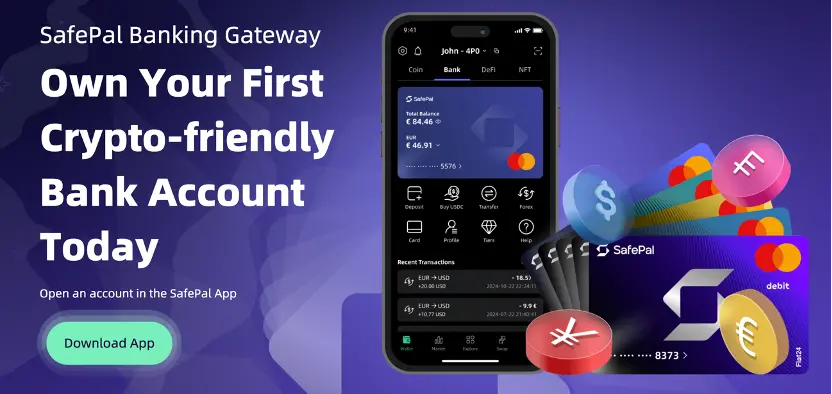

SafePal x Fiat24:不只是一张U卡,更是一个合规银行账户

与传统意义上的“虚拟卡”不同,SafePal 提供的是一种更为融合式的加密金融服务,其背后由瑞士注册银行 Fiat24 提供基础账户支持。用户在完成身份认证与地址验证后,将获得一个真实的欧洲银行账户(含 IBAN),可用于国际收款、出金、甚至与该账户关联的借记卡消费。

申请流程相较其他卡片略为复杂。用户需先在 SafePal 钱包界面内进入相关模块,前提是账户所在区域支持该服务(目前包括中国大陆)。接下来,用户需要在 Arbitrum 网络上转入少量 ETH 用于铸造身份 NFT,作为获取 Fiat24 银行服务的必要凭证。完成 KYC 与地址认证后,系统将分配一个 Fiat24 银行账户,并可同步申请与账户绑定的 Mastercard 借记卡。2023 年部分用户曾收到 Visa 卡,目前主流版本为 Mastercard。

该卡片同样支持绑定Apple Pay、Google Pay、支付宝和微信支付的绑定等等,底层结算货币支持欧元、美元、瑞士法郎和人民币。

在费率方面,SafePal 借记卡的综合费率区间为 1% 至 3%,视具体交易结构而定。账户出金环节约为 1% 手续费,而同币种消费则不再额外收费,对于以上四种货币有消费需求的用户来说是好消息。一旦银行卡中的法币余额耗尽,系统将自动从绑定的加密货币余额中进行扣费,实现加密资产的消费。

同时,因为用户获得的是一个完整的银行账户,该账户支持国际转账至各大银行,以及ifast、Wise、Revolut等国际数字银行,在社交平台上有不少的实验和费率评估。

相较其他交易所主导的卡类产品,SafePal 与 Fiat24 的合作更接近于传统金融服务向加密世界的延伸。它为用户提供的不仅仅是一张卡片,更是一个可自由收发欧元、关联加密资产、并具备合规身份标签的完整金融账户,特别适合有跨境收支需求或资产出口需求的用户群体。

Morph Black Card:高端信用卡方面的“扛把子”

Morph Black Card 是由定位消费L2的 Morph 推出的旗舰级会员权益载体,定位于高净值加密用户的“链上身份+现实特权”组合产品。不同于传统虚拟借记卡,Morph Black 的申请门槛为持有特定的 NFT —— Morph Black NFT,其在二级市场上的当前地板价约为 0.87 ETH。这一 NFT 不仅象征着用户的会员身份,更内嵌了链上金融权益的定价与流转功能。

在功能设计上,Morph Black NFT 被官方定义为 MorphPay 生态的旗舰资产,其持有者将可能获得平台未来 Morph Token 空投,享有最低完全稀释估值(FDV)阶段的分配权。同时,NFT还将链接到包括 BAI Fund 在内的多个生态项目为用户带来空投激励,持卡人还可参与平台链上存款,获得年化收益率最高可达30%的回报。

在卡片权益层面,Morph Black 卡为22g的实体黑金质地卡片。持卡人完成 KYC 后可申请该卡,宣传的权益包括免除传统黑卡常见的约300美元年费,并在出入金过程中享受低至0.3%的手续费(视换汇需求而定)。该卡设有高达100万美元的单日出入金额度,还将附带新加坡的美元银行账户。同时,据平台公开资料与社区讨论,该卡还将联动全球范围内的酒店、机票预订和私人礼宾服务,可能通过Aspire VIP体系提供支持,为加密资产持有者打造类似传统高端信用卡的出行与生活配套服务。

此外,据社区与社交平台消息,Morph Black 实体卡可能基于 DCS(DeCard)发行体系构建,其资方Bitget 被传已收购 DCS大部分股权,因此该卡极有可能是以 DCS 的 Mastercard卡为蓝本开发,部分权益可能将会来自DCS黑卡Imperium World Elite Card,且具备信用卡机制。

据Morph团队表示,未来将推出面向更广泛用户的普通卡版本,以扩展其支付网络与生态渗透力。整体而言,Morph Black Card 是目前市场上最具“高端金融”象征意义的卡类产品之一,适合寻求资产尊享化、权益可组合化的加密资深用户群体。

值得一提的是,Morph在几天前刚刚开始了Morph Platinum SBT的销售。通过铸造Morph Platinum SBT,用户可以在500亿美元的FDV下确保其在生态系统中的额度权益,并在TGE时解锁50%的代币。同时,SBT持有人将会获得Morph白金卡(Platinum Card),关于卡的细节尚未披露,但同样是一张支持加密货币直接消费的U卡,赠送价值300美元的一年黑卡卡片权益试用。目前,铸造Morph Platinum SBT的费用为0.3 ETH。

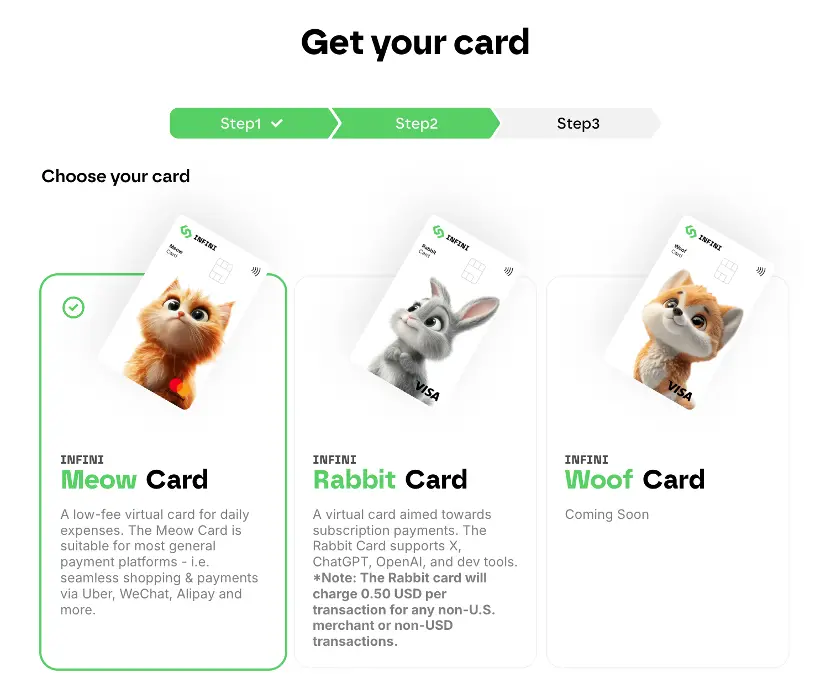

Infini Card:支持OnlyFans 的虚拟卡

Infini 旗下拥有三种不同的卡片:Meow Card 与 Rabbit Card 是核心虚拟卡产品,面向不同用户需求提供灵活的链上支付与日常消费解决方案。目前,两种卡片均以 9.9 美元的定价出售,不收取年费或月费,支持绑定支付宝与微信支付,是少数兼容中国用户主流支付工具的境外虚拟卡产品之一。

Meow Card 属于 Mastercard 网络,更适用于以人民币计价的日常消费场景,其交易服务费为每笔消费金额的 0.8%。在进行非美元币种支付时,系统将自动进行货币兑换,并收取 1% 至 1.5% 的跨境手续费,最低为 0.01 美元。

Rabbit Card 则采用 Visa 网络,定位更侧重于美元商户,尤其适用于一系列订阅制平台,包括 ChatGPT Plus、OpenAI API、Midjourney、Cursor、AWS、Google Cloud、Notion、Godaddy、GitHub 等开发类服务,同时覆盖 Netflix、YouTube、eBay、Amazon 等主流消费平台,基本覆盖日常需要使用的全部美元订阅服务。Rabbit Card 的基础服务费亦为每笔交易 0.8%,但其非美国商户或非美元交易的费用为固定 1% 加 0.50 美元,同样设有 0.01 美元的最低费率门槛。

当然,Infini官网还贴心的为用户标明,无论是Meow Card还是Rabbit Card,都支持OnlyFans的订阅,确实把用户需求落到了实处。

两款卡片虽为虚拟形式,但在实际使用中均可快速绑定至支付宝和微信支付,实现无缝支付体验。官网上可以看到,Infini实体卡产品 Woof Card 正在筹备中,未来将支持 Apple Pay 与 Google Pay,并具备更广泛的线下支付能力,预计将进一步拓展用户群体。

海外居民的福利卡种:无手续费卡、返现卡、“借贷”卡

注:以下所有的KYC要求均为“居民”,而不限国籍。即,能够提供当地居住地址证明,如水电账单和信用卡账单的居民,按照不同发卡方的要求,KYC难度也有所不同。

Coinbase卡:唯一一张“无手续费、无损耗”的支付U卡

作为全球规模最大、最具合规背书的加密货币交易平台之一,Coinbase 推出的借记卡在用户信任度与资金安全性方面拥有显著优势。该卡面向拥有 Coinbase 账户的用户发行,特别适用于常驻美国或欧洲经济区(EEA)的居民。申请人必须具备所在地的合法居留身份及真实居住地址,不支持中国大陆地区的 KYC 审核。

但是,严格KYC换来的是高端福利:Coinbase 借记卡最大的特点之一是免除所有费用;其“原生资产支付”机制让用户可直接使用 USDC 等稳定币进行日常消费。平台还支持免手续费将法币兑换为 USDC,这在很大程度上降低了持卡人的资产转换成本。日常交易以及 ATM 提现也通常免收手续费,为用户提供了几乎无损耗的支付体验。此外,卡片为 VISA 借记卡,可在全球范围内支持该网络的商户和服务中正常使用,覆盖场景广泛。

用户在将资金从 Coinbase 提现至本地银行账户时,如账户位于 Coinbase 支持的国家或地区,通常可以实现快速到账,整个流程被广泛评价为“丝滑且稳定”。此外,Coinbase 偶尔会针对借记卡用户推出返现活动,尽管频率不高,但对长期持卡者而言是一种额外激励。

总体而言,Coinbase 借记卡因其合规背景、低费率体系与良好的法币出入金体验,成为欧美用户中最受欢迎的加密借记卡之一。对于已经在 Coinbase 平台进行资产管理的用户而言,该卡无疑是其链上资产日常使用场景中的理想延伸。

Nexo Card:居住在欧洲人士的返现信用卡

Nexo Card 由总部设于法国、在欧盟及英国具备合规牌照的加密交易平台 Nexo 推出,仅面向欧洲经济区(EEA)及英国居民开放服务,中国护照持有人需要欧洲的地址证明和居留卡才可以开设。这张卡不仅支持加密资产消费,更是少有的真正的“信用卡模式”的U卡,允许用户先行支付、后续归还,还支持相当费率的返现,是少有的能和北美信用卡一争高下的甜点卡。

Nexo Card 属于 Mastercard 网络,在网络内商家基本均可以使用。

Nexo Card 的返现机制采用基于用户资产配置的动态奖励模型。所有日常消费都可获得加密货币返现,基础返现为消费金额的 0.5%,支付币种可在平台内灵活选择 NEXO Token 或比特币(BTC)。当用户账户中持有的加密资产总额超过 5,000 美元时,将自动被纳入 Loyalty Program,并根据 NEXO 代币在资产组合中的占比被划分至不同的忠诚等级,从而获得更高比例的返现激励。

具体而言,最高的白金级用户可获得高达 2% 的 NEXO 代币返现,或选择以 0.5% 的比例返还 BTC;黄金级用户分别为 1% 和 0.3%;银级为 0.7% 和 0.2%;而基础级别则维持在 0.5% NEXO 或 0.1% BTC 的返现水平。该阶梯式奖励机制鼓励用户在平台持有更多 NEXO Token,从而增强用户粘性与平台代币的内在价值支撑。

在费用方面,Nexo Card 无年费和月费,外汇转换手续费结构也较为透明,但与传统的转换费率设计并不一样。如果是交易币种与卡片默认币种(欧元或英镑)相同的话,是不收费的;对于卡片币种(欧元或英镑)与商户当地货币不同的交易,即外币交易,系统将对交易金额进行币种转换。若交易以欧元、瑞士法郎或者英镑结算,货币转换费用仅为 0.2%;而其他国家或地区的币种则是2% 费率。此外,所有周末进行的外币交易还将额外加收 0.5% 的手续费,这一规则不免有些奇怪。

结合其信用支付能力、动态返现制度以及加密资产导向的会员模型,Nexo Card 为传统金融体系与加密资产使用场景之间建立了较为成熟的桥梁,适合居住地点在欧洲而且需要返现需求的用户。

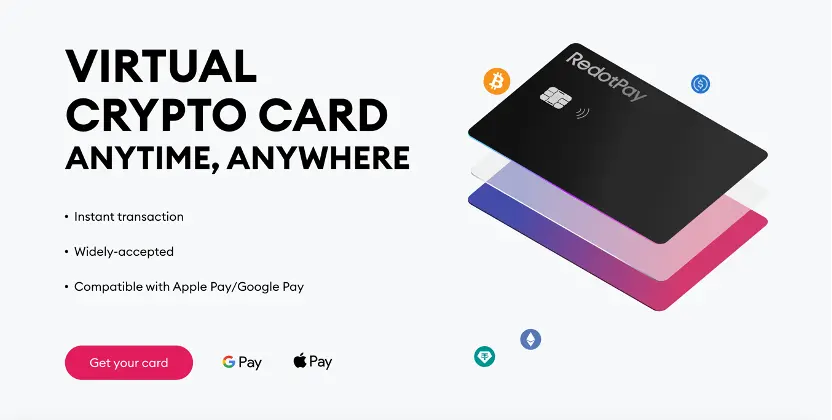

RedotPay(小红卡):港澳台地区的支付友好方案

RedotPay 是一家总部位于香港的加密支付公司,于 2023 年底正式推出其加密货币支付卡,旨在满足用户在现实场景中使用加密资产的便捷需求。该卡的核心定位类似于传统的签账金融卡(debit card),用户在消费时,系统会直接从其绑定账户中扣除加密货币等值金额,用以支付消费金额,整个过程无需提前充值至法币账户,也不涉及信用贷款功能。与此前介绍的交易所背景的卡类产品不同,RedotPay 并非虚拟货币交易所,而是专注于提供基于区块链的支付解决方案,因此其卡产品也更聚焦于链上资产的使用路径本身。

该卡目前不支持中国大陆居民注册与使用,但可在多个海外区域进行申请和消费。整体费用结构处于中等水平,综合手续费约为 1% 至 3% 之间,具体费率取决于币种转换及消费场景。RedotPay 卡的一大亮点在于其对 Binance Pay 的直接支持,用户可通过 Binance 钱包体系完成充值和结算,使其在链上生态的互通性方面具备一定优势。

在卡片类型方面,RedotPay 提供的是 VISA 卡,这在加密卡市场中相对少见。此外,该卡免除年费,为用户降低了长期持卡成本,但实体卡申请则需支付一次性 100 美元费用。

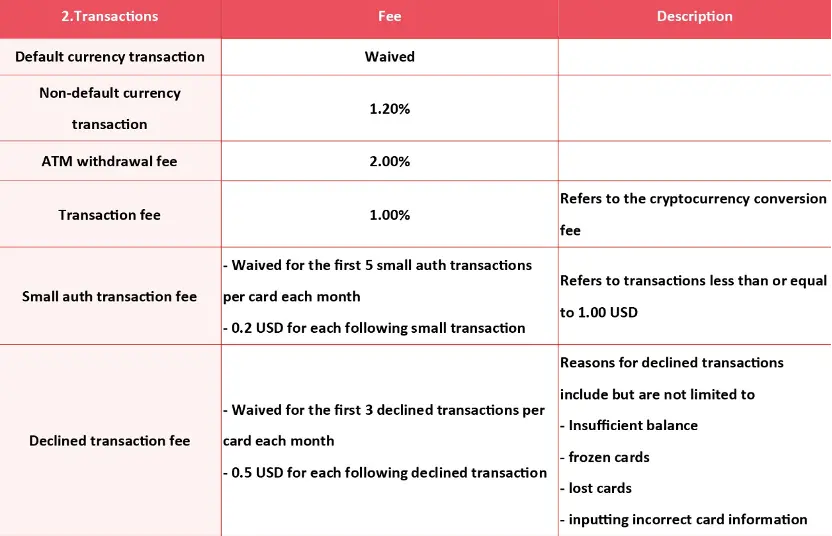

在费率方面,Redotpay给出了一个完整的费率表:

其中可以看到,非默认底层货币的交易费率是1.2%,ATM取现费用是2%,交易费用是1%。这些费用不包括交易平台(如支付宝)收取的费用。

总体来看,RedotPay 加密卡面向的是有跨境生活或在线消费需求的海外用户,适合希望将链上资产直接用于日常支付、同时不依赖中心化交易所进行资产托管的使用者,是目前加密卡市场中少数走“轻平台化”路线的代表产品之一。

去中心化项目方U卡系列,主打自托管资金

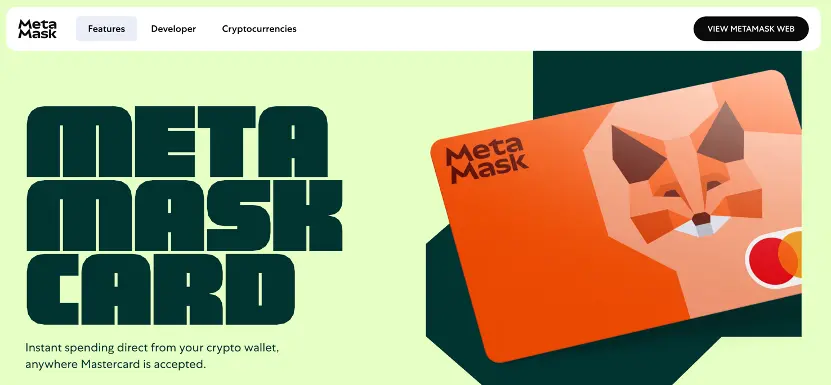

MetaMask Card:Metamask官方推出的低手续费支付卡

MetaMask Card 是由加密钱包巨头 MetaMask 推出的一款轻量级加密支付工具,主要面向已有钱包用户,旨在将链上资金直接延伸至日常消费场景中。该卡目前正处于早期开放阶段,仅对部分国家和地区的居民开放注册,包括美国(不含纽约和佛蒙特州)、英国、欧盟成员国、瑞士、墨西哥、哥伦比亚和巴西等市场。其全球版本尚未全面开放。

Metamask卡同样属于Mastercard商户网络。据悉,未来会有实体金属卡作为空投权益开放。

在资产支持方面,MetaMask Card 目前支持USDC、USDT 与 wETH 三种代币,所有资金必须存储在Linea 网络中,用户需将相关资产跨链至该链上进行充值。充值后,卡片可直接连接至 Apple Pay 或 Google Pay实现移动支付,无需实体卡即可使用。使用过程中,每笔消费时系统将实时将所选加密资产兑换为法币,并结算为当地货币,转化过程在交易发起时即时完成。

手续费方面,使用 USDC 或 USDT 等稳定币进行支付时,仅需承担一次 Linea 网络的 gas 费用,通常在 $0.02 左右;而若使用 wETH 等非稳定币,还需额外支付 0.875% 的链上 swap 手续费。所有费用将在交易完成后在卡片后台“Manage”模块中展示,用户可查看详细账单,包括兑换汇率、扣款金额及手续费等信息。

此外,MetaMask Card 对所有消费提供 1% 的 USDC 消费返现,进一步提升用户在链上资产直接消费场景下的性价比。这种返现模型及可视化的费用结构,使得该卡非常适合熟悉 DeFi 与链上操作的用户群体,尤其是已经将 MetaMask 钱包作为主要资产管理工具的用户。

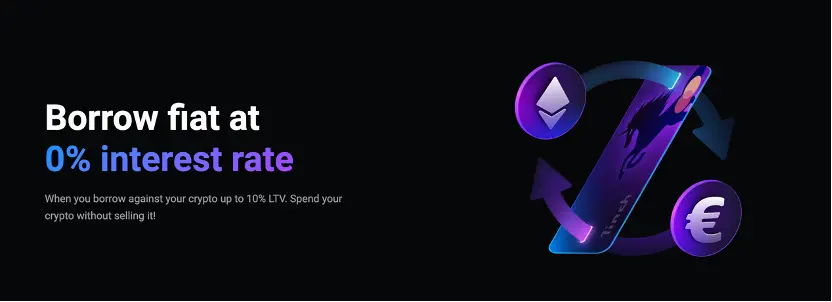

1inch Card:允许抵押借出稳定币消费的神奇“借贷”卡

由加密聚合交易平台 1inch 推出的 1inch Card,是由 Crypto Life 提供支持,并以 Baanx 作为合规出入金服务商的一款加密资产消费卡。该卡不仅具备常规的链上支付能力,更通过“抵押+借贷”的模式,为用户提供更具策略性的资产消费选择。在身份验证方面,1inch Card 所需的 KYC 程序与 Baanx 生态下其他产品相似,主要面向欧洲经济区和英国的合规居民开放,需要当地的地址证明。

与多数加密卡直接消费链上资产不同,1inch Card 允许用户以 BTC 或 ETH 作为抵押物,借出稳定币用于日常消费。用户可选择 USDC、USDT 或 EURT 作为借出币种,并可在 6、12、18 或 24 个月之间设定借款周期。该借贷模型对于长期看涨加密资产的用户尤其友好。举例来说,在比特币价格较低时,用户可通过抵押 BTC 借出稳定币用于消费,而无需直接消费自己的比特币。当 BTC 价格上涨后,用户可选择归还稳定币,从而赎回更高价值的原始资产。这种机制不仅保留了资产的未来增长潜力,也满足了现实流动性需求。

当然,稳定币借贷必然有利息,但只要抵押资产的上涨能够覆盖这部分利息,借贷卡的优势就非常明显。根据官网,借贷期间,每月需自动偿还利息部分,扣款操作通过系统内稳定币钱包自动完成。一旦借款与利息全部偿还,用户将原样收回所有抵押资产。

同时,平台支持用户获得最高以其抵押资产价值的60%的信用额度。

在支付币种方面,1inch Card 支持 BTC、ETH、LTC、XRP 等主流 Layer 1 资产,但暂不支持 Layer 2 网络资产。用户消费时,系统将自动转换为法币并完成结算。平台收费结构较为复杂但清晰:卡片消费手续费为 2%,加密货币之间的兑换及加密转法币均为 1.75%;若为加密资产提现,手续费为 0.4% 至 0.5%;通过银行转账提取法币则需支付 3.49%。在卡片服务方面,无年费及维护费,但英镑取现需支付 €2.50,外币取现则为 €3.00 外加 1.5% 的手续费。

以上手续费看似高,但实际上并不叠加。也就是说,直接刷卡消费就是2%加上潜在的外汇转换费用,而以1.75%的费率转换成法币后,就可以直接以法币消费,总体来说和其他加密资产区别不大。

此外,1inch Card 提供每笔消费 2% 的加密返现,进一步提高了日常使用的性价比。结合其基于抵押的稳定币借贷能力、灵活的期限设定与广泛支持的资产类型,1inch Card 不仅是一张消费卡,更是一个面向加密资产持有者的微型金融工具包,在日益融合的 DeFi 与现实金融场景中占据了独特位置。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。