作者:OneShotBug

自上个周期以来,平台币都不再只是“手续费折扣券”。从销毁机制、收益参与、链上质押到治理属性,各大中心化交易所(CEX)正不断重构其平台币的价值支撑逻辑。

而随着行业走入新一轮调整周期,用户对平台币的预期也发生了明显变化——从“涨多少”变成了“靠什么涨”。简单的营销驱动已经难以持续,取而代之的是对通缩机制是否真实有效、使用场景是否持续活跃、平台自身增长是否健康等更底层因素的关注。

近期,币安与 Bitget 分别公告完成了销毁计划。BNB 第 31 次销毁约 157.9 万枚,占总供应量约 1.1%;而 BGB 首次季度销毁3000 万枚,占总供应量约 2.5%。平台币赛道正从“有机制”走向“兑现机制”,新老平台在通缩路径上的策略差异也愈发明显。

本文将围绕以下几个核心维度,对比当前主流平台币的结构设计与落地表现:

●通缩机制的实际强度

●总量结构与释放风险

●实际使用场景与生态绑定程度

●所属交易平台的增长能力

●市场表现与价值锚逻辑

通过一系列横向数据、结构图表与定性观察,帮助用户厘清主流平台币在机制设计与落地成效上的差异与优势所在

一、通缩强度对比:谁在真销毁?谁还在讲故事?

平台币的通缩设计,是用户判断其长期价值的首要维度。但“有销毁机制”不等于“真正执行通缩”。关键在于两个问题:

●销毁频率是否稳定?

●销毁比例是否足够有压强?

当前几个主流平台币在通缩机制上的表现存在明显差异。以下是目前可核实的机制与执行节奏概览:

BGB 2025年Q1首次季度销毁达 2.5%,高于BNB历史记录。

BNB 在完成本次销毁后累计销毁 1,579,207 枚 BNB,折合约 9.16 亿美元,占其总供应量的约 1.13%。这一销毁行动延续了其成熟的通缩机制,也再次体现出币安对平台币价值管理的长期投入。

不过,如果从“本轮销毁金额 vs 当前市值”这一维度观察,BGB 所展现出的市场弹性甚至更为突出:

可以看到,尽管 BNB 本轮销毁的资金量高达 9 亿美元,约为 BGB 的 6.9 倍,但 BNB 的市值却是 BGB 的 16.5 倍。

这意味着,在平台币销毁资金与其市值的“相对压强”上,BGB 远高于 BNB。

这种结构上的不对称,释放出一个关键信号:BGB 当前的估值仍处于“被低估”阶段,其市值基础尚未完全反映出 Bitget 的平台增长、通缩执行力和生态绑定成果。

换句话说,相同体量的通缩行为,在 BGB 这样的中早期资产上,价格影响力更直接,价值重估弹性更强。这也是为什么本轮 BGB 销毁,不仅是机制兑现的节点,更可能是“结构性价值上移”的起点。

对比点评:

●BNB 拥有较成熟的通缩机制,采用 BEP-95 自动销毁 + 季度手动销毁的双轨模式,节奏明确、机制稳定。最新一次季度销毁金额达 9.16 亿美元,通缩执行力仍属主流平台币中最强之一。然而,其单轮销毁比例长期维持在 1% 左右,边际价格压强因市值体量庞大而显著降低,更多体现为“稳健压缩”而非价格驱动。

●BGB 则展现出“轻市值、高通缩压强”的结构特征。首次季度销毁即达 2.5% 占比,销毁金额虽远小于 BNB,但占其市值比重却接近后者的 3 倍,形成更强的供给削减效果。结合其以链上使用挂钩的执行机制和尚处价值低估阶段的市值体量,BGB 的通缩行为对价格的边际影响更加显著,具备高成长平台币的典型特征。

●OKB 目前仍处于“有销毁承诺但缺乏执行披露”的状态。虽然白皮书中明确存在通缩机制,但实际销毁节奏不透明、金额不公开、路径不可验证,用户难以建立稳定预期,对币价支撑和市场反馈也较为温和。

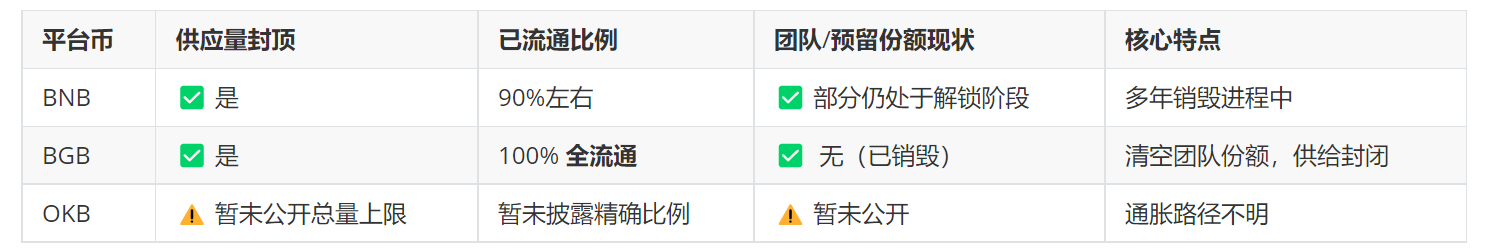

二、总量结构与释放压力:谁的供给更清晰?

判断一个平台币的通缩潜力,不仅要看销毁比例,更要看它的供给结构是否清晰:

●供应总量是否封顶?

●是否仍有大比例的团队或基金会份额待释放?

●流通量占比有多高?有没有“未来可能砸盘”的隐患?

以下是当前主流平台币的供给结构对比(数据来自官方白皮书、链上信息及市场平台披露):

对比点评:

●BNB尽管目标总量为2亿,并持续通过自动销毁机制减少供给,但仍存在少部分历史保留份额未解锁完毕。其供给结构相对稳定,但完全封闭尚需时间。

●BGB是目前为数不多已经“完全释放”的平台币。2024年底,Bitget官方一次性销毁了原本属于团队的8亿枚BGB,将总供应量从20亿直接压缩至12亿,并宣布当前为100%全流通状态,不存在后续解锁冲击或分配风险。

●OKB 的供给结构存在一定不确定性,可能有团队持仓和未披露的解锁计划。这类平台币的“未来供给弹性”较大,用户可能无法准确评估通缩效果能否长期维持。

在平台币的价值评估中,封顶供给 + 全流通状态是构建“稀缺性预期”的基本盘。BGB的做法是彻底消除供给端不确定性,通过提前锁死总量与释放节奏,把市场注意力引导至“实际使用驱动价值”这一主逻辑上。

三、实际使用场景:不是谁用途多,而是谁被频繁用

平台币的使用场景越多,理论上价值支撑越强。但现实中,“可用”≠“常用”,“挂名支持”≠“用户真在用”。

真正值得关注的,是哪些平台币高频出现在产品参与入口中,并且通过使用持续形成“锁仓-通缩-价值反馈”的正循环。

以下是目前主流平台币在平台内(CeFi)与链上(DeFi)两个维度的使用覆盖情况对比:

对比点评:

●BNB作为行业老牌平台币,在产品使用广度和生态成熟度上依然领先。其作为 BSC(现BNB Chain)的核心Gas资产,天然嵌入大量链上DeFi场景。不过,由于用户基数庞大,单用户平均参与收益降低,一定程度上弱化了BNB的参与动机。

●BGB的使用场景近年拓展迅速,不仅在Bitget交易所的核心产品(如 Launchpool、Launchpad、PoolX)中频繁使用,还绑定了理财专区、Earn策略组合、手续费抵扣等路径。而且这些产品大多要求质押或锁仓BGB参与,在实际操作中形成了稳定的“持币-锁仓-获益”链条。

●OKB在功能上支持参与项目发行、手续费优惠等,但链上使用能力弱,新产品上新节奏较慢,导致用户使用频率低、绑定粘性不足。

以Bitget的Launch系列产品为例,BGB几乎是所有新项目参与的门票币种,且多次活动动辄吸引几十万用户参与。与此同时,BGB在Bitget Wallet生态里提供Gas代付、链上质押等功能,并计划拓展至NFT铸造、DAO治理等Web3场景。这些布局说明,BGB不仅在CeFi层面高频使用,还在逐步构建链上应用闭环,强化其作为生态“中枢资产”的潜力。

对比而言,BNB 的使用已经进入稳定期,功能覆盖虽广但用户边际收益趋弱;而 BGB 仍处于“功能解锁 + 用户扩张”的早期阶段,后续随着链上DAO治理、NFT购权等功能上线,可能进一步扩大其使用闭环。

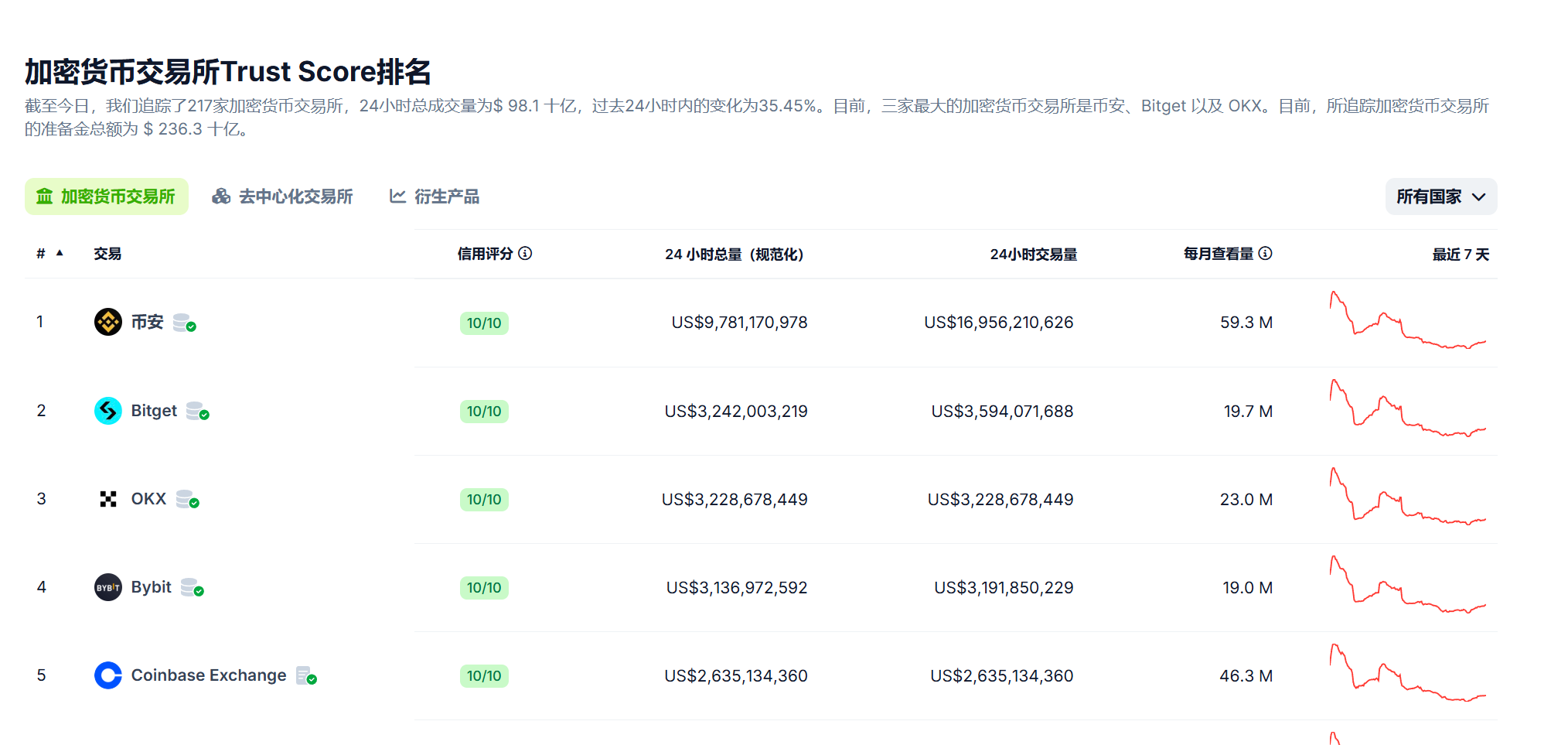

四、 平台支撑力:平台越强,币才更有价值锚

图片数据来源:CoinGecko,2025年4月14日

平台币的价值,归根到底还是“平台信用”。通缩机制决定稀缺性,使用场景决定需求强度,但最终的估值锚,还是要看背后交易所的实际体量、生态布局和发展趋势。

换句话说:平台币的中长期价值,靠的是平台的真实增长能力,而非概念刺激。

以下是主流平台的部分关键数据对比(数据来源:CoinGecko,2025年4月14日):

接下来基于TokenInsight《Crypto交易所2024年度报告》,对该三大交易所24年的发展情况进行对比分析:

●币安:市占领跑者,但增速放缓。作为全球最具影响力的加密交易所,币安无论在现货、衍生品还是用户体量上,仍稳居第一。截止2024年,其现货占比高达 48.2%,意味着其平台币 BNB 拥有极强的用户覆盖面和生态基础。不过,币安年度总市占从 42.2% 下滑至 32.7%,在用户增速、份额稳定性方面,开始显现边际放缓。

●Bitget:典型的高成长平台,跃升速度亮眼。Bitget 是过去一年中表现最突出的“第二梯队领跑者”。截止2024年,其现货份额增长 8.06%,全年总市占提升 5.2 个百分点,衍生品份额也逼近 12%。BTC、ETH 等主流币种成交活跃,24h总交易量 $3.6B 以上。尤其值得注意的是,Bitget 的增长并非靠单一爆点,而是围绕合约、跟单、理财、钱包生态多点推进,逐渐形成了交易所 + 钱包 + 产品平台三位一体的结构,这也构成了 BGB 的价值基础。

●OKX:份额稳定,产品线深但突破有限。OKX 是传统强势平台,尤其在衍生品方面保持了一定的市场存在感(15% 占比)。不过,现货份额在新兴平台冲击下略显被动,2024全年市占由 16.6% 降至 11.8%,BTC/ETH 流动性指标亦低于 Bitget。OKB 在平台内的使用逻辑相对保守,生态绑定度不如 BNB 与 BGB,这也在一定程度上影响了其估值天花板。

平台的强弱,是平台币价值的底层锚点。从当前格局来看:

●币安是“资产安全”与“流通广度”的代表;

●Bitget则代表“成长潜力”与“机制进化”的代表;

●OKX相对保守,平台币支持力度需进一步释放。

从这个角度看,BGB 当前的价格结构仍处于“高成长平台币”的估值折价阶段,具备重新定价的现实土壤。

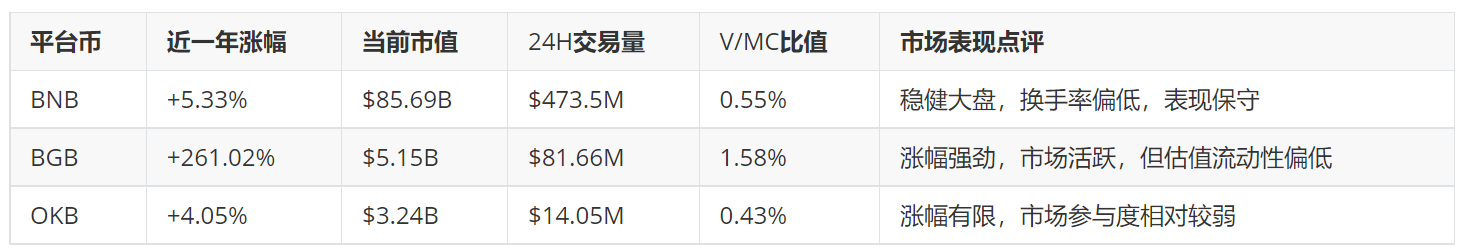

五、市场表现回顾:近一年走势、流动性、估值弹性

平台币的结构和机制固然重要,但最终市场怎么看,还得落回到三个指标:

●价格走势(能否体现结构价值)

●交易活跃度(日均流动性与参与强度)

●估值合理性(当前定价 vs 潜在空间)

以下是三大平台币从 2024年4月14日到 2025年4月13日的近一年市场表现对比(数据来源:CoinMarketCap):

注:V/MC = 日均交易量 ÷ 市值,用于衡量活跃度与流通性。

对比点评:

●BNB表现稳健,小幅上涨,继续维持加密市场龙头资产的特性。相对的低换手反映出其“价值存储”定位。

●BGB近一年涨幅超过 260%,是目前表现最强的平台币之一。V/MC 相对较高,表明可能仍处于被市场低估的状态,有较大的上涨潜力。

●OKB市值和成交量都相对表现中性,缺乏明显驱动力。

六、谁具备长期价值逻辑?

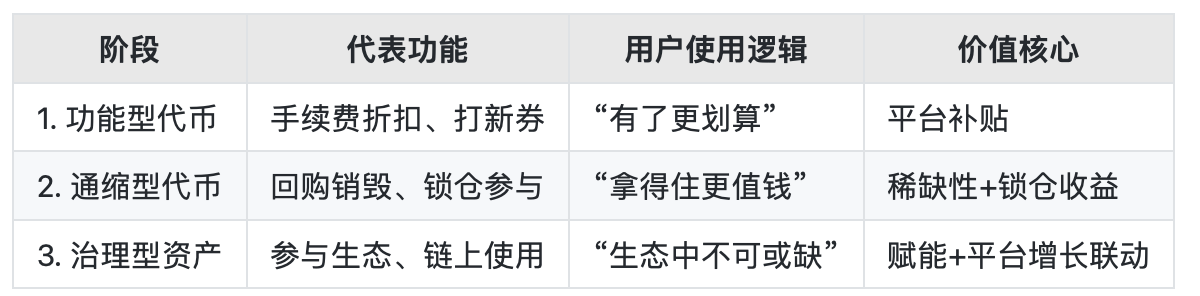

平台币的定位,正在经历一场从“工具型”向“资产型”的演进。

在早期阶段,大多数平台币的作用非常简单——抵扣手续费、参与打新、赚点小利差。本质上是平台的“用户激励代币”,并不具备稀缺性,也不具备独立的价值逻辑,市场对它的定价更多依赖情绪和波段行情。

但从 2021 年起,尤其是在头部平台构建自有生态、推动链上扩展之后,平台币逐步承担起三类更深的角色:

1. 通缩锚定器:绑定平台业务增长

●BNB:通过 BEP-95 将销毁与链上交易手续费挂钩;

●BGB:基于链上使用费 + 固定销毁量,实现双向销毁路径;

这意味着:使用场景越丰富 → 销毁越多 → 平台币价值越高,形成闭环。

2. 生态参与凭证:成为“产品门票”

●质押 BGB / BNB 可参与 Launchpad、Launchpool 等产品;

●锁仓平台币可享受更高理财利率、优先资格、白名单通道;

用户不是“为了炒币而持有”,而是“必须持有才能参与生态”,平台币变成了生态准入机制的一部分。

3. 链上治理资产:从平台走向链

●BNB 已参与链上治理提案、Gas支付、质押挖矿;

●BGB 在Bitget Wallet中支持链上质押,规划扩展DAO、NFT投票等功能;

●OKB 也提出链上治理计划,但目前尚未完全落地。

平台币正试图完成从CeFi内部激励 → DeFi外部赋能的“价值出圈”,成为生态治理的基准资产。

目前来看,BNB 处于阶段 2.5 到 3 之间,BGB 正在从阶段 2 向阶段 3 过渡,OKB 停留在 1.5-2 之间。

通过前面对通缩机制、供给结构、使用场景、平台支撑力与市场表现的对比可以看出,平台币虽然同属一个品类,但其背后的逻辑已逐渐分化成两类:

●一类是机制清晰、结构收紧、平台增长正向的平台币,如 BGB、BNB;

●另一类则是机制模糊、流通不明、使用参与感弱的平台币,长期价值支撑力不足。

基于当前数据,我们可以从以下几个核心维度重新归纳主流平台币的长期价值潜力:

通过对比可以看到:

●如果用户看重平台币的长期通缩压强 + 明确使用闭环 + 成长平台支持,BGB 是当前阶段结构最完整、潜力空间最大的“新型实用平台币”。

●如果更看重稳定性与安全边际,BNB 仍是加密行业中最具基本盘支撑的资产。

●OKB 或有波段机会,但缺乏结构明确性和可持续生态绑定,持有需要更高的投机容忍度与择时能力。

那么,哪些用户适合关注平台币?什么场景下可以考虑配置?

●对高频参与交易所产品、有Launchpad习惯的用户,BGB/BNB参与频率高、能实际获益;

●对于希望“低估值+长期潜力”的中期持有者,BGB 结构偏早期,弹性更强;

●偏好波段操作、接受短线博弈的,可以关注 OKB等平台币。

平台币的下一轮价值重估,不再依赖故事,而是依赖兑现。真正具备长期价值的平台币,一定是在机制明确、供给干净、场景真实、平台持续扩张这四条线上同时跑赢的资产。

未来的竞争,不只是“谁能涨”,而是“谁还能持续涨下去”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。