今天的作业我要水一下,每周四晚上都是最忙的时候,主要是要写周报的框架,没想到本周格外的难写,主要是觉得现在除了受到事件的影响以外,Bitcoin 的稍微独立性也需要讲讲,所以加大了很多 $BTC 的数据,以往数据只占周报内容的 1/4 左右,这次超过一半了,光是找这些数据的相关性就麻烦的要死。

昨天鲍威尔的讲话还是惹怒了川普,其实要怒早就该怒了,三月份的议息会议以后鲍威尔每次公开亮相的时候都是表示不会提前降息,每次也都表示川普没有权限去开除他,不知道为什么这次川普会这么生气,但美联储的独立性还是让川普没有办法。

相对于货币政策来说,关税的影响已经在逐渐下滑了,今天即便闹出了欧盟和美国的第二次不愉快,也终于要看到中国和美国“非常好”的协议,但对于风险市场的影响都在减弱,美股和加密货币对于关税已经逐渐的免疫了,反正怎们闹最后都不会太夸张。

明天开始就是假期,现在加密货币市场的情绪还是不错的,BTC也徘徊在 85,000 美元左右,VIX 也降低到了 30 以内,希望接下来的三天休息日能轻松一些,别整出什么幺蛾子就好,从数据面来看,每周最后一个工作日都是资金量较少的一天,今天也不例外,换手率已经有了明显的降低。

近期参与换手的主力仍然是短线投资者,不过最近 BTC 价格波动不大,所以换手率也在降低,多数的投资者还是维持着观望的态度。

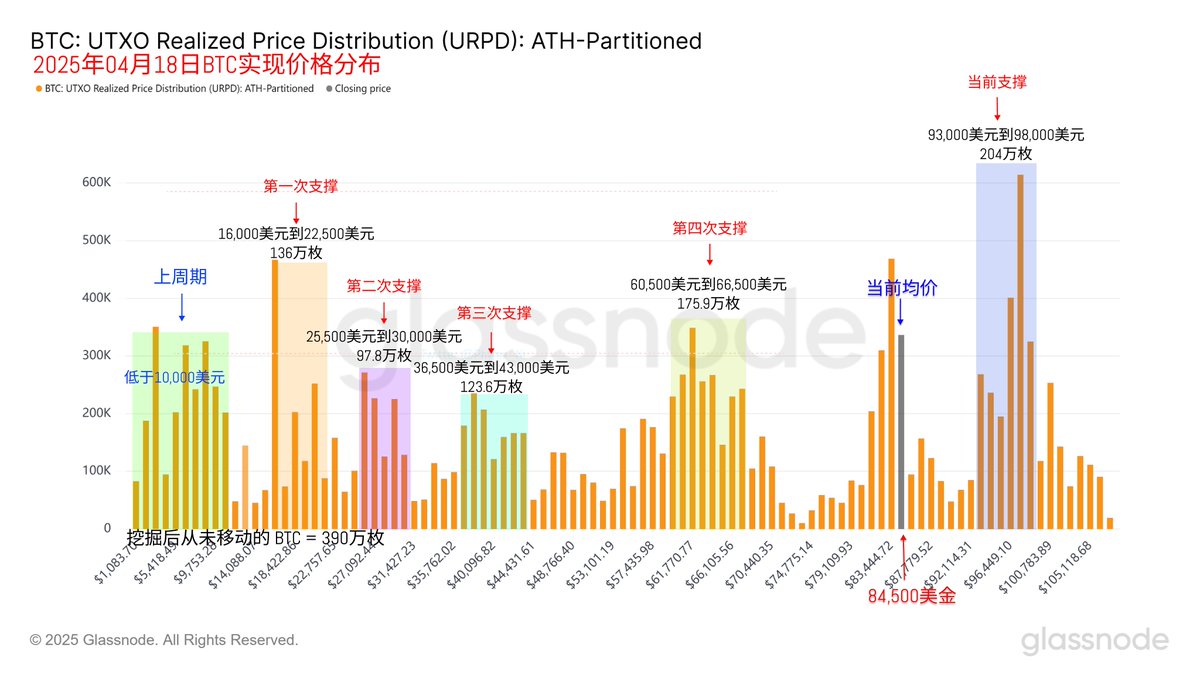

不过也能明显看到 83,000 美元附近的筑底已经越来越强势了,而对应的 93,000 美元到 98,000 美元之间的投资者也非常的稳定,这在历史中是很少出现的,新的筑底竟然没有从亏损投资者身上吸血,而亏损投资者竟然这么稳定,这也只能说明 BTC 的投资者对于未来有很强的预期。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。