撰文:深潮 TechFlow

美国东部时间4月2日下午4时,特朗普签署行政令执行全面新对等关税政策,从4月5日起对所有进口美国商品征收至少10%的关税,并从4月9日起对包括欧盟和中国在内约60个贸易伙伴征收更高关税。

这一举措引发全球市场动荡,在与多个国家进行谈判博弈后,特朗普于 4 月 9 日表示将暂停这些关税90天,但将中国出口产品关税再次提高至惊人的125%。

反复无常的关税政策,牵动着全球股市的起伏,加密市场跌跌不休。除此之外,关税背后也埋藏着一场美国比特币矿业的成本风暴。

4 月 13 日,美国CBP官网最新发布《特定产品对等关税豁免指南》,20项商品编码得到关税豁免,但目前主流矿机所需的芯片型号并不在特定的CBP类别之中。

关税风起暂止,美国比特币挖矿产业能否暂时喘息,又将飘向何方?

“关关相报”,美国矿企陷入泥潭

2021 年中国禁止加密货币挖矿之后,得益于较为宽松的监管环境、丰富的能源资源和先进的技术基础,美国已成为最大的加密货币挖矿中心之一。

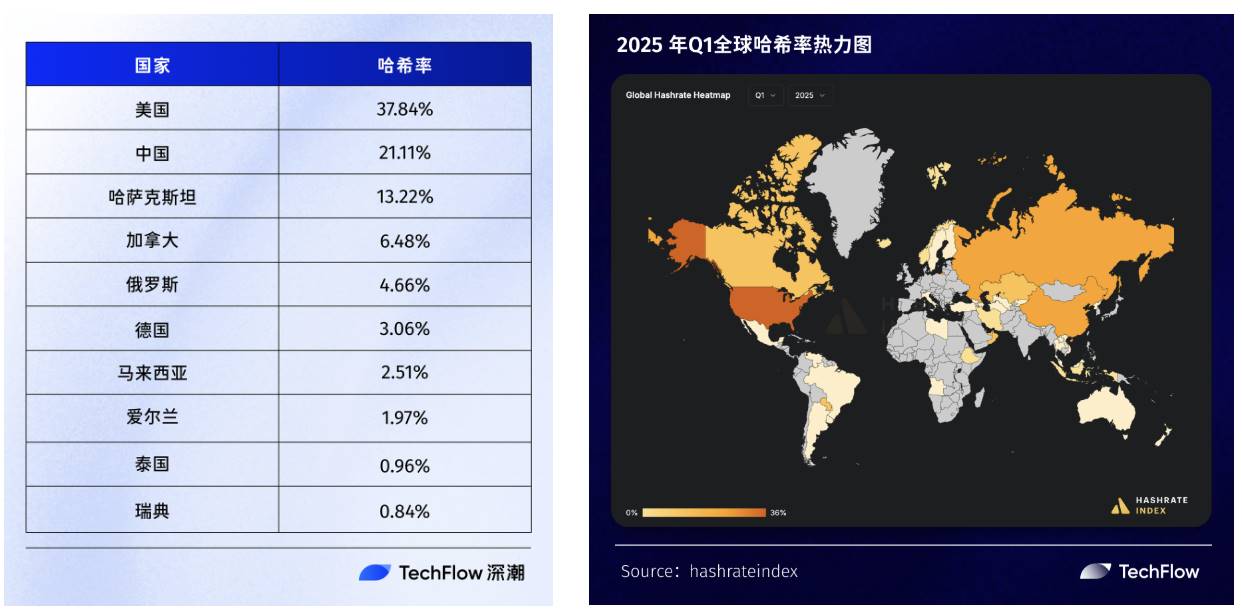

在全球比特币矿业版图中,美国以每月哈希份额37.84%遥遥领先。然而特朗普宣布加征关税后,美国比特币挖矿行业可能深陷贸易战的泥潭。

对比特币挖矿产业而言,硬件成本能够占据总支出的 30% 至 40%。美国作为全球加密货币挖矿中心,集中了许多大型矿商,但挖矿产业的供应链却扎根于亚洲。

中国公司控制着全球 ASIC 硬件市场 70% 至 80% 的份额,WOO X 研究主管 Pat Zhang表示,这意味着特朗普针对中国所加征的高额关税将直接带来美国矿企设备成本大幅提升。

Mitchell Askew(Blockware Solutions 首席分析师)曾指出,关税将会压缩矿机离岸供应,进而加剧美国矿工的需求,如果这再与比特币的上涨相结合,ASIC 矿机可能会像 2021 年那样暴涨 5 至 10 倍。

在此背景下,美国上市矿企股价应声下跌。比特币矿业股票指数在 4 月 4 日和 4 月 9 日迎来两个波谷,这一指数是根据当今市场上公共采矿设备制造商、铸造厂和矿工的比特币采矿相关股票综合加权计算得到的。

与之能够相互印证的是 4 月 9 日关税政策生效后,包括 MARA Holdings 和 CleanSpark Inc 在内的美国上市比特币矿机公司的股价均暴跌约 10%。

Blockspace 估计,美国比特币矿工去年进口了价值超过 23 亿美元的 ASIC 矿机,第一季度进口额超过 8.6 亿美元,其中马来西亚、泰国和印度尼西亚是此类机器的主要制造商。

在过去几年中,美国上市的矿业公司已经为在德克萨斯州等能源丰富的地区建设数据中心筹集了数十亿美元,它们的挖矿设备大多来自中国最大的比特币挖矿设备制造商——北京比特大陆科技有限公司。

该公司在印度尼西亚、马来西亚和泰国均设有工厂,在特朗普宣布对大多数国家暂停实施所谓“对等关税”90天,只收取10%的“最低基准关税”之前,这些国家均在被征收“更严厉关税”的国家之列。但不止比特大陆,东南亚也是其他主要矿机生产商如微比特(MicroBT)和嘉楠(Canaan)等的布局之处。

机器成本在加密货币矿工资本支出中占比很高,对于加征关税政策带来的后果,Luxor Technology(比特币挖矿软件和服务公司)的硬件主管Lin表示“这意味着他们的投资回报率将受到严重影响。”同时,最新的关税将“抑制该行业的持续增长”,Synteq Digital的首席执行官Taras Kulyk说。

4 月 12 日,美国CBP官网发布了《特定产品对等关税豁免指南》,20项商品编码得到关税豁免。

美国将比特币挖矿机归类为 8543 品目下的具有独立功能的、未在其他地方列明或包含的电气机械及器具,因而为比特币挖矿设计的专用集成电路(ASIC)矿机并不符合《特定产品对等关税豁免指南》中的商品类别,而美国成分规则对美国加密矿机厂商也应用困难。90 天的暂停期只是一个喘息的间歇,高额关税仍然存在重现的可能,因而本篇对矿机成本的预估仍然参考原定4 月 9 日落地政策税率。

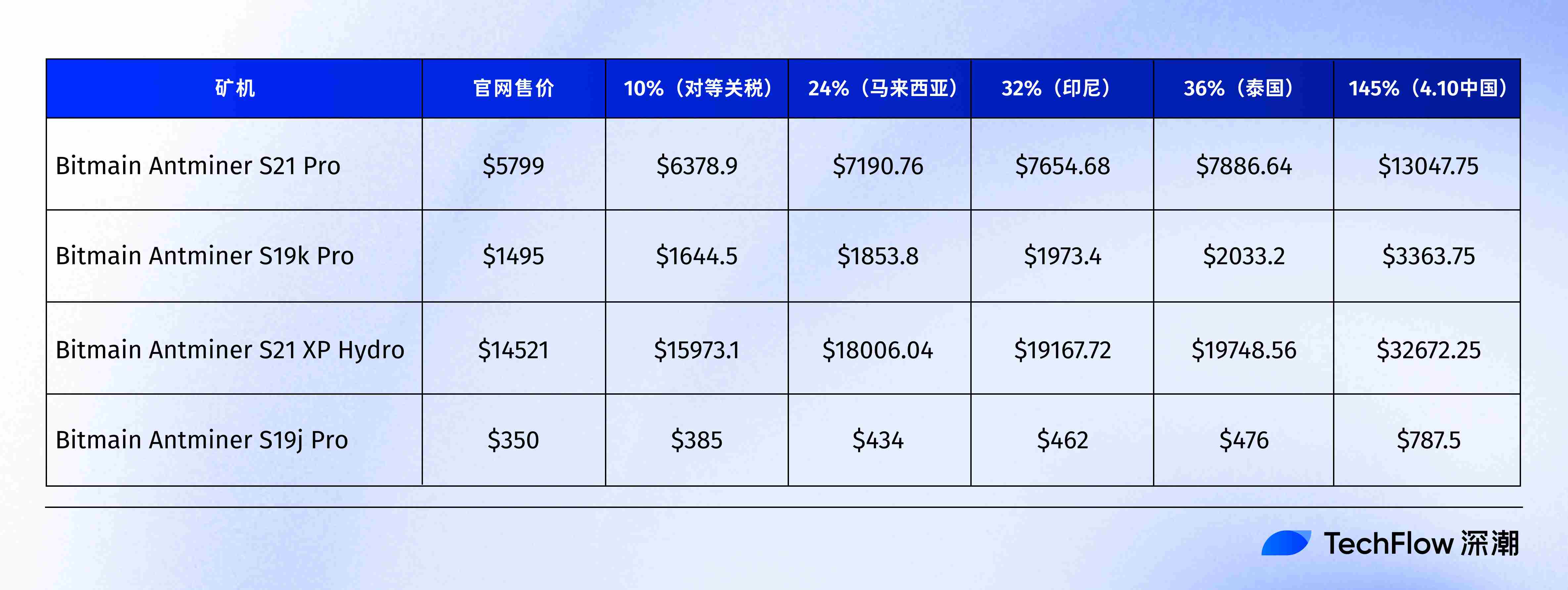

下为Top 10 Bitcoin Mining ASIC Machines for 2025中部分比特大陆矿机在4月 2日公布关税清单下的价格对比(中国更新)

加征关税给矿机成本带来惊人的提升,为了尽量躲过美国对矿机产地中国及东南亚国家加征关税带来的价格影响,Blockspace 的报告称, 美国大型矿企不惜以通常价格的 2-4 倍租用飞机,而不是用更常见且更便宜的海运从中国、马来西亚和泰国等国家进口采矿设备,每次花费 200 万至 350 万美元,以逃避关税可能带来的价格上涨。

这几乎是 2021 年5 月中国释放出“打击比特币挖矿和交易行为”的信号后,中国矿机生产商用空运加急矿机出口的重演。

比特币挖矿公司 Luxor 的首席执行官Nick Hansen在采访中表示: “天哪,每天都一片混乱。”

为了赶在特朗普总统的关税政策落地之前,Kulyk和Lin均表示他们正在“手忙脚乱地”加速将国外生产的矿机运往美国。

“理想情况下,我们可以包机把机器运过来——只是尽可能发挥创意,把机器运出来。”4 月 9 日特朗普政府宣布 90 天的暂停期之后,美国比特挖矿企业成本压力有所下降,股价也逐渐回升。

关税大棒高高举起,吹落一地狼狈后仿佛轻轻放下。但这阵风真的过去了吗,还是在酝酿一场新的风暴?

恐慌,转移?

受到上述关税政策给美国矿企带来的巨大成本打击,2025 年 4 月 7 日,比特币的哈希价格 (衡量挖矿盈利能力的指标)跌破 40 美元/小时/秒 ,创下 2024 年 9 月以来的新低。虽然在 4 月 9 日特朗普宣布 90 天暂停期之后,市场有所回暖,但比特币的哈希价格也只是在低于45美元/小时/秒 的水平徘徊,近 4 日都维持在 44美元/小时/秒左右,仍然处于2025 年以来的低值。

Hansen表示“大多数矿工都认为 40 美元是他们的熊市”,他已经与许多矿业公司进行了沟通,大家都“不确定该怎么办”。

据 TheMinerMag 报道,40 美元的数字意味着许多矿工的运营成本处于或低于盈亏平衡点。

从中国进口的新机器的总关税成本上升至三位数令美国矿工感到痛苦,但不仅仅是关税,比特币的价格波动、不断减少的费用和一直上升的网络难度都将带来“盈利能力下降、矿企增长放缓、甚至潜在的整合、关闭或哈希率从美国转移,”Braiins 首席执行官 Eli Nagar 在采访中表示。

哈希成本衡量每 TH/s 或 PH/s 算力在 24 小时内产生相应收益所需的原始电力成本(以美元计),计算公式为:每日哈希成本($/PH/s)= 电力效率(J/TH)* 电力成本($/kWh)* 24(小时)。由此可见,在政策允许的前提下,挖矿成本受两个因素影响:所用 ASIC 矿机的能效和用户支付的电费。

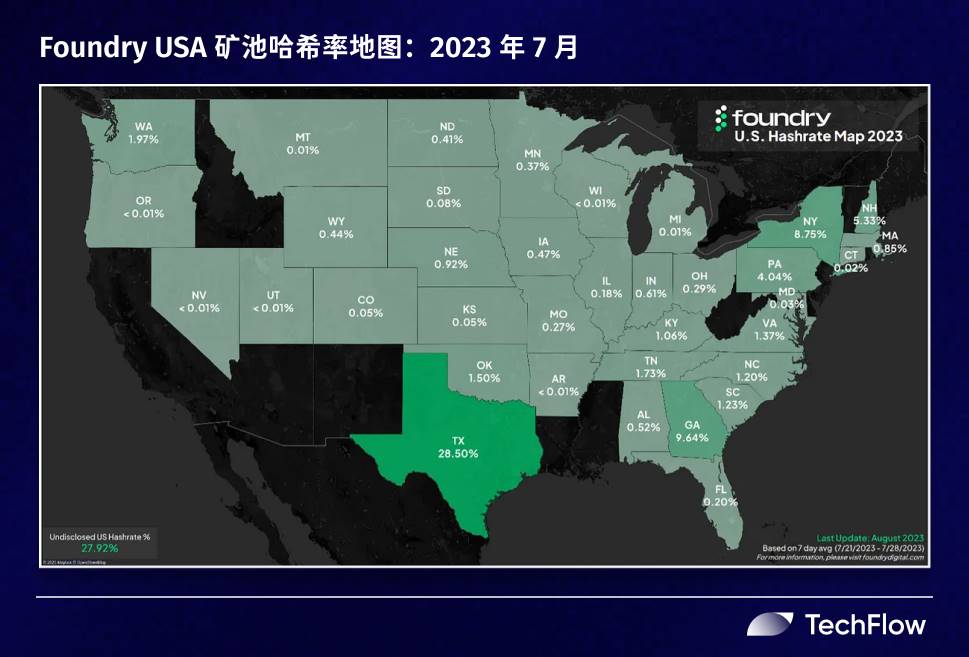

由于挖矿需要大量电力来运行和冷却计算机,能源成本一直是挖矿利润的关键。受到电力能源价格影响,美国矿场大多分布在德克萨斯州、纽约州、肯塔基州和佐治亚州,其中德克萨斯州尤为突出。

据2024 年 7 月 18 日美国能源信息署报告,德克萨斯州是全美能源生产大州,提供全美约四分之一的国内一次能源。除了丰富的原油、天然气田和煤炭资源,德克萨斯州还拥有丰富的可再生能源资源,风力发电量位居全美第一。与剑桥公布的2021年12月美国各州哈希率分布中的11.2%相比,德克萨斯州在Foundry USA2023 年 7 月更新数据中占全美哈希率已近 30%。

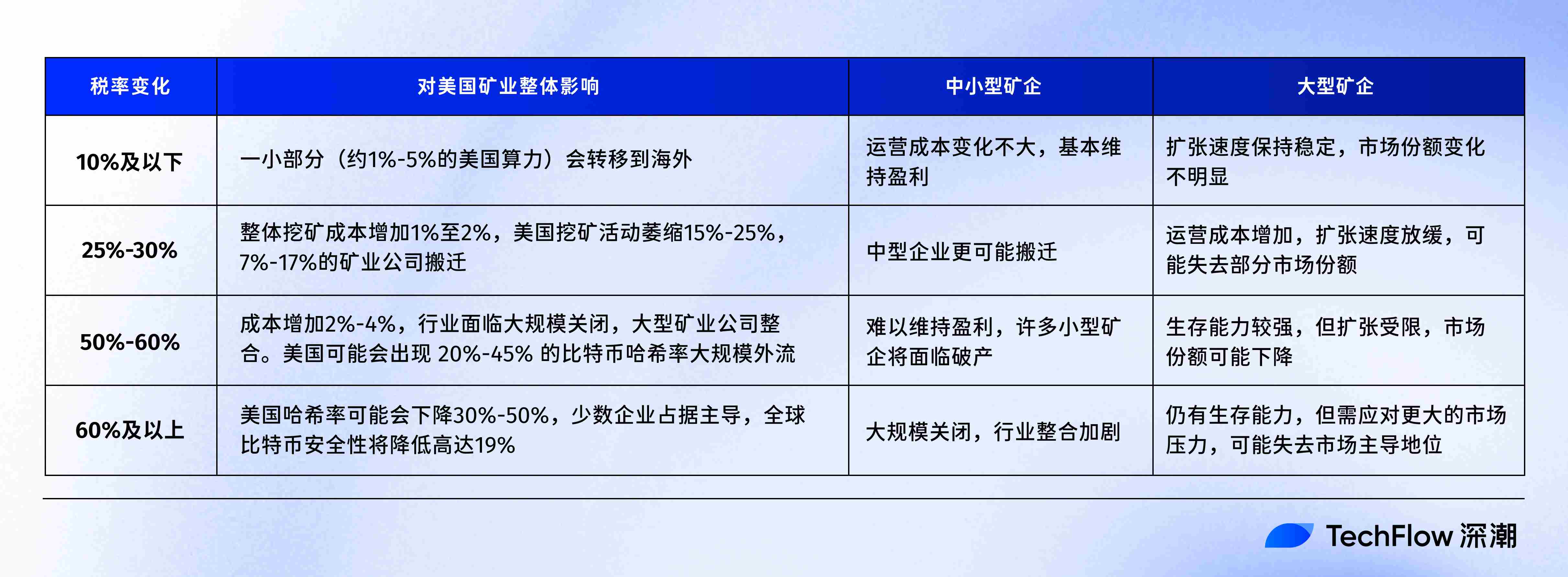

关税带来矿机成本提高可能的当下,中小型挖矿公司将受到最严重的打击。Investing的研究显示,关税税率升高会逐渐导致美国在全球比特币哈希率中的份额下降。当关税超过 25%,美国在全球比特币哈希率中的份额就有可能降至 30% 以下。并且随税率增加,中小型矿企将会经历勉强维持、盈利困难、甚至退出市场的过程,带来哈希率在美国大型矿业进一步整合。

来源:Investing

Hashlabs Mining首席执行官Jaran Mellerud认为,未来特朗普政府关税的逆转不会恢复美国加密货币矿业运营商的信心。“即使这些关税在几个月内被取消,损害已成——长期规划的信心已被动摇,”Mellerud说。“当关键变量可以在一夜之间改变时,很少有人会愿意进行重大投资。”这或许会进一步引导美国国内矿企向能源丰富的州(如德州)甚至其他国家转移。

此外,由于关税提高了进口 ASIC 矿机和其他挖矿设备的成本,在其他条件相同的情况下,美国现有设施变得更有价值,寻求扩张的美国矿工可能会将目光转移到收购上。

Kulyk 预计“突然之间,这些拥有老旧设备、看似僵尸企业的矿机,实际上却带来了有吸引力的收购机会。”

长远而言,美国比特币挖矿行业重新整合暗流涌动,未来少数大规模公司将主导市场,放眼国际,比特挖矿的全球格局或许也将悄然改变。

塞翁失马,焉知非福

单论美国矿业,这场风暴不止是打击,Hansen表示特朗普引发的动荡中也存在一线希望——“已经部署的美国矿工的韧性正在增强。”

美国矿企正在通过在国内部署ASIC 制造来降低未来可能重现的高额关税限制,这是他们减少对中国硬件依赖的一种尝试。

而对比特币发展本身,美国矿业控制哈希率的下降以及比特币挖矿产业的转移或许是有利的。

里德学院哲学与人文学科教授Troy Cross 曾表示,如果一个国家控制了过多的比特币算力,比特币核心价值主张之一的抗审查性就处于危险之中。

对于未来,Cross认为比特币与其他新兴技术的不同之处在于,它不会因一个国家控制了大部分行业而受益。并且对于比特币网络,各国最好控制不要超过 50%的部分网络。哈希率高度集中在某一国家或地区,将会给比特币带来更大受到政府控制的风险,而高关税的可能将促使美国矿企让出部分国际市场,重塑全球挖矿格局。

Jaran Mellerud在4月8日的一份报告中表示,“制造商最初为美国市场准备的过剩库存将会积压,因而他们可能需要降低价格以吸引其他地区的买家。”

Luxor 首席运营官 Ethan Vera 也表示,“如果你为一台机器支付的费用比加拿大或俄罗斯的竞争对手更高,那么你将很难与国际矿工竞争。”

“从经济角度来看,加拿大实际上将成为一个更具吸引力的经商之地。企业税预计将降低。资本利得税也将降低。加拿大经济增长的宣传力度很大,尤其是在数据中心领域”,同时Kulyk 也认为北欧可能成为扩大哈希率的目标。未来,矿工们也许会在南美和非洲部分地区找到几千兆瓦的机会,Vera 说。

90天的暂停期,是缓冲也是倒计时。加税飓风掠过,美国矿商站在选择的十字路口。多少矿商会咬牙坚守国内阵地,又有哪些矿企正在筹划全球迁徙?

关税幽灵并未消散,犹如一把达利摩斯之剑悬吊在美国矿商头顶。豁免期的倒计时滴答作响,秩序在沉默中变化,而算力的洪流,永不回头。

参考文章:

https://www.coindesk.com/tech/2025/04/10/how-bitcoin-miners-are-adjusting-to-trump-s-tariffs-blockspace

https://store.bitbo.io/blogs/mining/country

https://cn.cointelegraph.com/news/trumps-tariffs-lower-bitcoin-miner-price-outside-us

https://www.dlnews.com/articles/markets/trump-sons-launch-american-bitcoin-mining-with-hut-8/

https://www.newsbtc.com/news/bitcoin-mining-in-the-u-s-4-states-attract-the-most-miners/

https://www.theminermag.com/learn/2022-09-08/bitcoin-mining-wikipedia-glossary

https://www.bloomberg.com/news/articles/2025-04-03/tariffs-threaten-to-upend-bitcoin-mining-supply-chain-mara-riot

https://share.foresightnews.pro/article/detail/82090

https://www.editverse.com/zh-CN/%E6%AF%94%E7%89%B9%E5%B8%81%E5%93%88%E5%B8%8C%E7%8E%87/

https://news.marsbit.co/flash/20230928021623518179.html

https://cointelegraph.com/news/texas-home-nearly-30-percent-bitcoin-hash-rate-foundry

https://medium.com/foundry-digital/foundry-usa-pool-hashrate-by-state-f9dc92e7bc3b

https://hashrateindex.com/blog/top-10-bitcoin-mining-asic-machines-of-2025-2/

https://www.findhs.codes/hs-code-for-bitcoin-mining-machine?locale=zh_CN

https://content.govdelivery.com/bulletins/gd/USDHSCBP-3db9e55?wgt_ref=USDHSCBP_WIDGET_2

https://bitcoinmagazine.com/print/the-future-of-bitcoin-mining-is-distributed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。