比特币主导地位攀升至59.1%

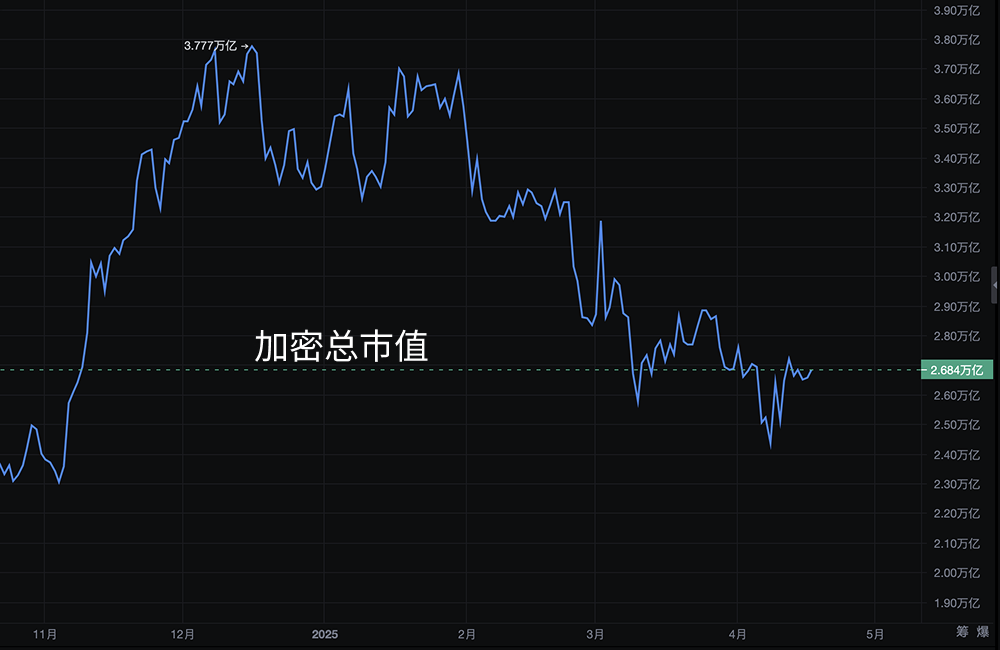

在市场低迷中,比特币(BTC)展现出相对韧性,其市场主导地位从2024年底的54.5%上升至59.1%(截止第一季度末),创下2021年以来新高。报告指出,比特币价格在1月22日触及106,182美元的历史高点,但随后回落,季度末报82,514美元,跌幅11.8%。尽管如此,比特币的表现仍优于大多数其他加密资产。相比之下,黄金在本季度表现强劲,上涨18%,成为最佳资产类别,而纳斯达克和标普500指数分别下跌10.3%和4.4%。

以太坊重挫,抹去2024年全部涨幅

以太坊(ETH)在本季度遭遇重创,价格从3,336美元暴跌至1,805美元,跌幅高达45.3%,抹去了2024年的全部涨幅,其市场主导地位也降至7.9%,为2019年以来最低水平。交易量同样萎缩,日均交易量从上一季度的300亿美元降至244亿美元。报告分析,市场对以太坊的信心受到价格波动和去中心化金融(DeFi)生态系统低迷的拖累。

迷因币热潮熄火,Pump.fun活动骤降

迷因币市场在本季度经历了过山车式行情。特朗普上任前推出的TRUMP和MELANIA迷因币掀起热潮,带动Pump.fun平台每日代币部署量创下7.2万个的历史新高。然而,阿根廷总统米莱推广的LIBRA代币因开发商“rugpull”(卷款跑路)事件崩盘,市值从46亿美元跌至2.21亿美元,重创市场信心。Pump.fun的每日代币部署量随后暴跌56.3%,至3.1万个,反映出迷因币热潮的迅速退却。

中心化交易所交易量下滑,币安稳居龙头

中心化交易所(CEX)的现货交易量在本季度达到5.4万亿美元,较前一季度下降16.3%。币安以40.7%的市场份额继续领跑,但其3月交易量从去年12月的1万亿美元跌至5887亿美元。HTX是前十大交易所中唯一实现增长的平台,交易量增长11.4%。相比之下,Upbit交易量暴跌34%,Bybit则因2月黑客攻击事件导致交易量环比锐减52.4%。

Solana领跑去中心化交易所,DeFi总锁仓量大跌

去中心化交易所(DEX)方面,Solana延续2024年底的强势,占据39.6%的市场份额,1月交易量更是占到52%,创历史新高。然而,随着迷因币热潮消退,以太坊在3月重夺DEX交易量榜首,市场份额达30.1%。与此同时,DeFi总锁仓量(TVL)在本季度减少27.5%,从1774亿美元降至1286亿美元。以太坊TVL占比从63.5%降至56.6%,Solana和Base的TVL也因代币价格下跌而分别下滑23.5%和15.3%。值得注意的是,新上线的Berachain在2月6日推出后迅速吸引52亿美元TVL,跻身第六大DeFi网络。

市场展望:谨慎情绪主导

CoinGecko的报告显示,2025年第一季度加密市场在经历年初短暂狂热后迅速降温,比特币的稳固地位和迷因币热潮的昙花一现成为本季度亮点。尽管市场整体低迷,Solana在DEX领域的持续强势和Berachain的快速崛起为行业注入了一些新活力。报告建议投资者关注后续市场动态,特别是DeFi和迷因币领域可能出现的反弹机会。

更详细解析:2025 Q1 Crypto Industry Report

本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区讨论该事件

官方电报(Telegram)社群:t.me/aicoincn

聊天室:致富群

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。