作者:fejau

编译:深潮TechFlow

我想写下我思考已久的一个问题:在资本流动发生重大转变的情况下,比特币可能会如何表现,这种情况是比特币自诞生以来从未经历过的。

我认为,一旦去杠杆化结束,比特币将迎来一个令人难以置信的交易机会。在这篇文章中,我将详细阐述我的思考。

比特币价格的历史关键驱动因素是什么?

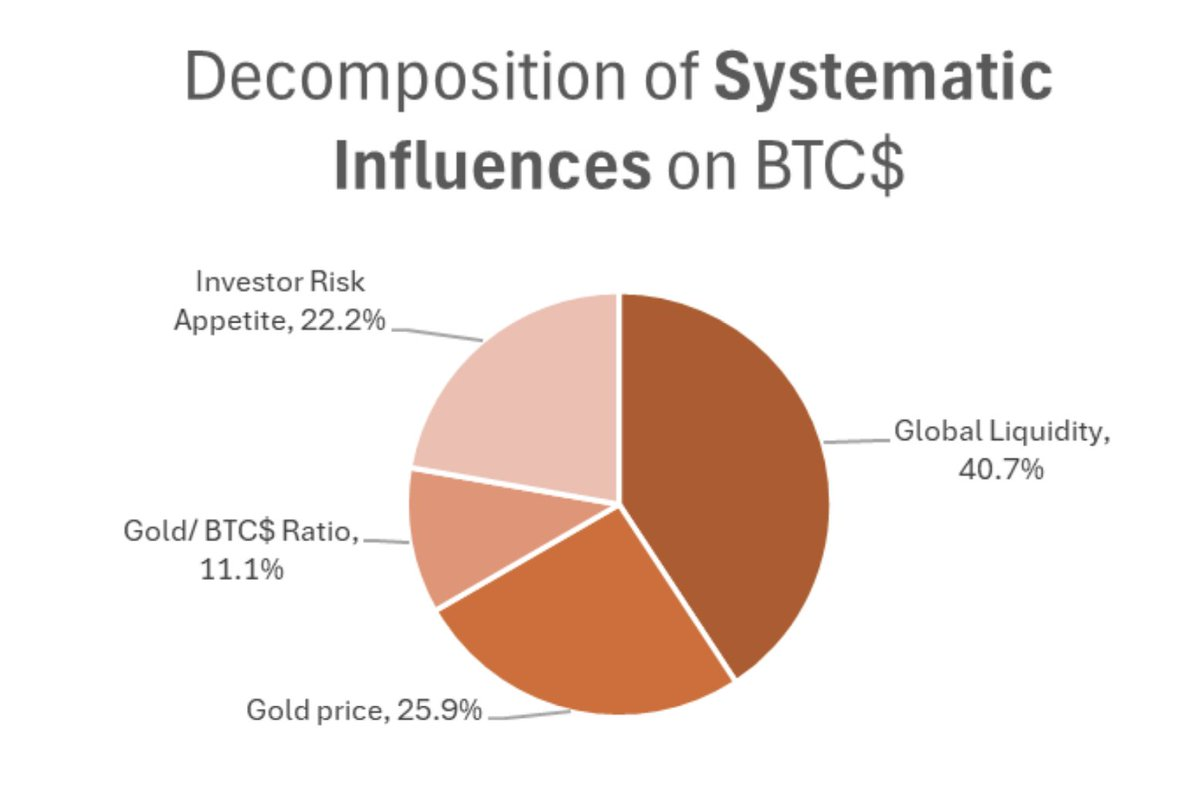

我将采用Michael Howell关于比特币价格历史驱动因素的研究成果,并利用这些成果进一步理解这些交叉因素在不久的将来可能如何演变。

如上图所示,比特币的驱动因素包括:

-

投资者对高风险高β资产的总体需求

-

与黄金的相关性

-

全球流动性

自2021年以来,我用一个简单的框架来理解风险偏好、黄金表现和全球流动性,即关注财政赤字占GDP的百分比,以此作为了解自2021年以来主导全球市场的财政刺激的简便途径。

较高的财政赤字占GDP的百分比机械地导致更高的通货膨胀、更高的名义GDP,因此企业的总收入也更高,因为收入是一个名义指标。对于能够享受规模经济的企业来说,这对其盈利增长是一个福音。

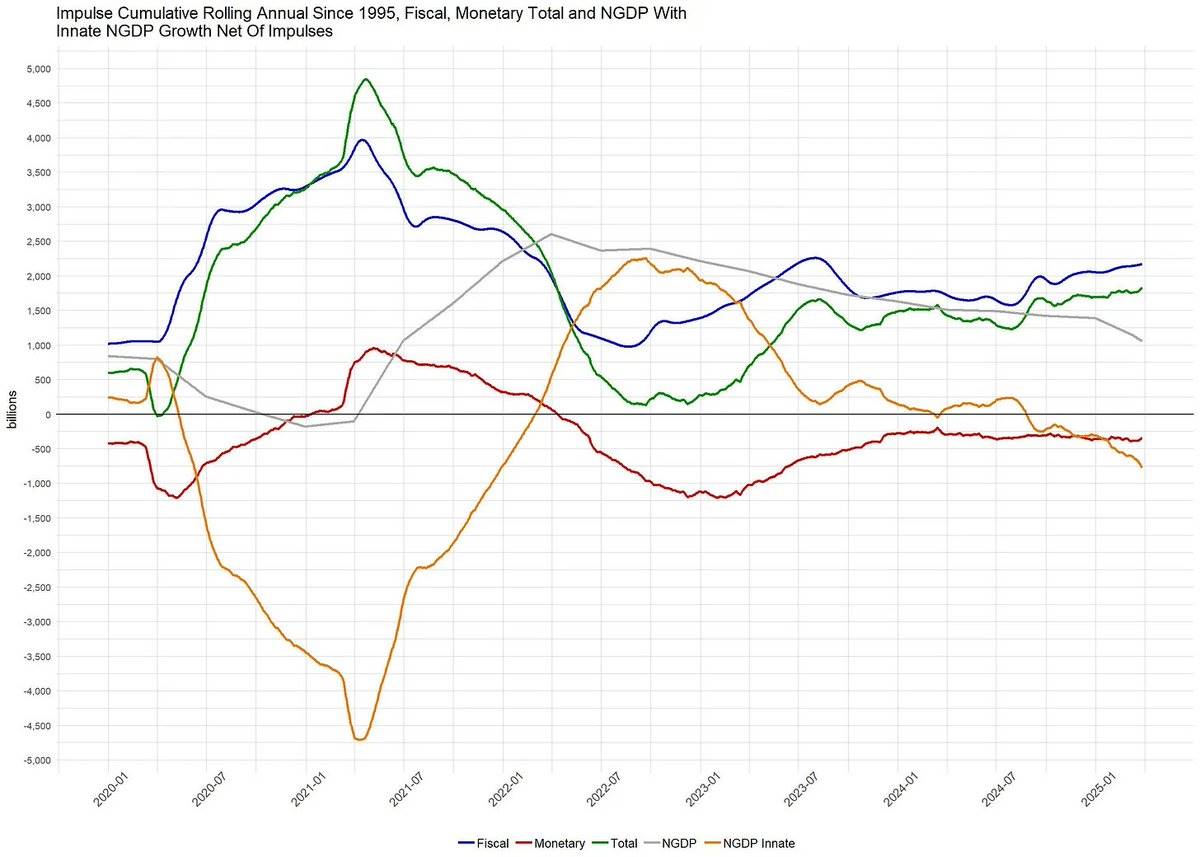

在大多数情况下,货币政策在风险资产活动中扮演次要角色,而财政刺激一直是主要驱动力。如@BickerinBrattle定期更新的这张图表所示,美国的货币刺激相较于财政刺激是如此微弱,以至于我在这次讨论中将其搁置一旁。

如下面的图表所示,在主要发达的西方国家经济体中,美国的财政赤字占GDP的比例远高于任何其他国家。

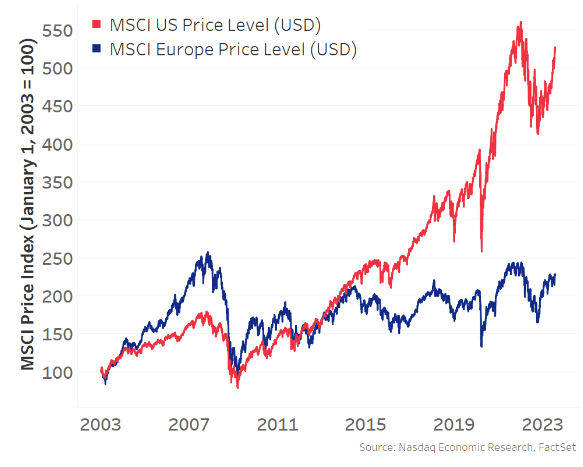

由于美国运行如此大的赤字,收入增长一直是主导,并导致美国股市相较于其他现代经济体表现突出:

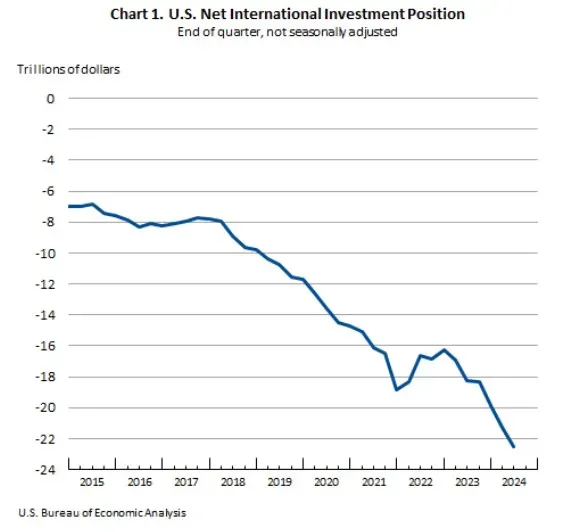

由于这种动态,美国股市成为了风险资产增长、财富效应、全球流动性的主要边际驱动力,因此成为全球资本的吸引地:美国。由于资本流入美国这一动态,再加上巨大的贸易逆差,导致美国以商品换取外国获得的美元,而这些美元随后被再投资于以美元计价的资产(如国债和MAG7),美国成为全球风险偏好的主要驱动力。

现在,回到上述Michael Howell的研究。风险偏好和全球流动性在过去十年主要由美国驱动,自新冠疫情以来,这一趋势因美国相较于其他国家运行如此巨大的财政赤字而加速。

因此,比特币,尽管是全球流动性资产(不仅仅是美国),自2021年以来与美国股市的正相关性越来越强。

现在,我认为与美国股市的相关性是虚假的。当我在这里使用“虚假相关性”这个词时,我是从统计学的角度出发,认为在相关性分析中没有显示的第三个因变量才是实际的驱动因素。我相信这个因素是全球流动性,正如我们上面所述,近十年来一直由美国主导。

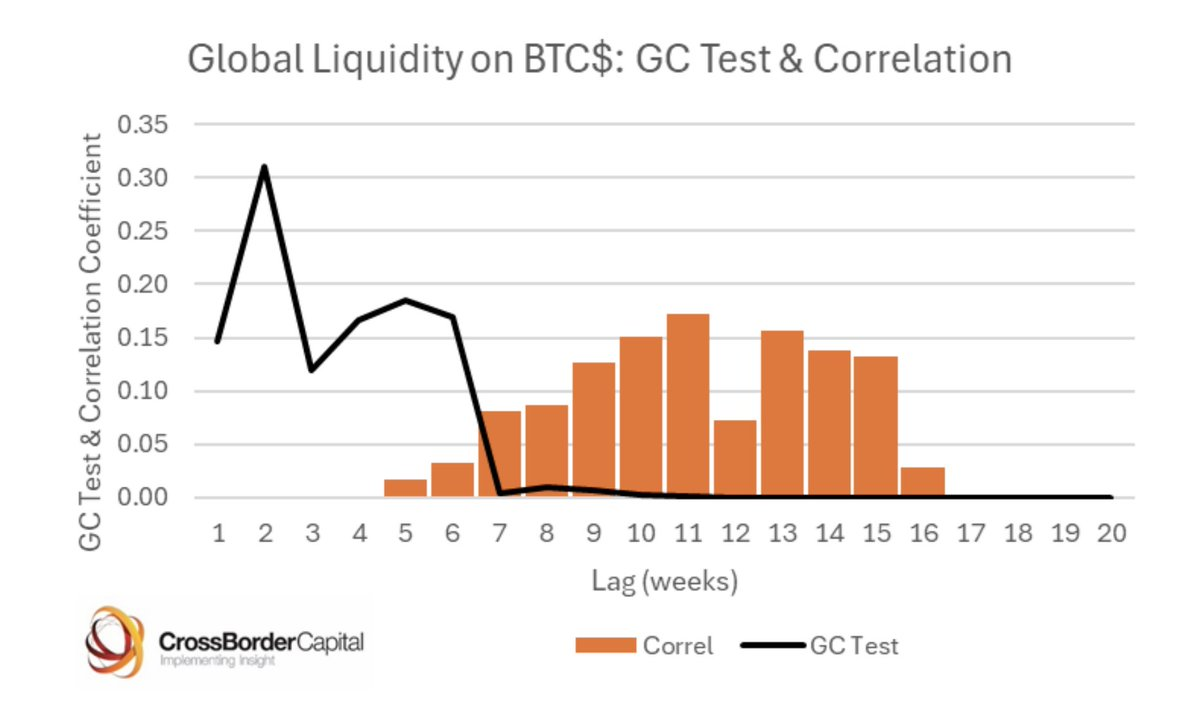

随着我们深入统计显著性的探讨,我们也必须建立因果关系,而不仅仅是正相关。幸运的是,Michael Howell在这方面也做了一些出色的工作,通过Granger因果关系检验建立了全球流动性与比特币之间的因果关系。

那么,这为我们提供了一个怎样的基准起点呢?

比特币主要由全球流动性驱动,而由于美国是全球流动性增加的主要驱动因素,因此出现了虚假的相关性。

在过去的一个月里,随着我们对特朗普贸易政策目标和全球资本及商品流动重组的猜测,一些主要的叙述浮出水面。我将其视为:

-

特朗普政府希望降低与其他国家的贸易逆差,这在机械上意味着减少流向外国的美元,这些美元将不会被再投资于美国资产。贸易逆差的减少无法在不出现这种情况的情况下发生。

-

特朗普政府认为外国货币被人为压低,因此美元被人为地强势,并希望重新平衡这一点。简而言之,较弱的美元和较强的外国货币将导致其他国家的利率上升,从而促使资本回流,以捕获这些在外汇调整后的条件下表现更好的利率,以及国内股票。

-

特朗普在贸易谈判中采取“先开枪,后提问”的做法,导致世界其他国家摆脱与美国相比(如上所述)微薄的财政赤字,转而投资于国防、基础设施和普遍的保护主义政府投资,以使其更加自给自足。无论关税谈判是否降级(例如中国),我相信此事已成定局,各国将继续追求这一目标。

-

特朗普希望其他国家增加其国防支出占GDP的比例,并为北约支出贡献更多,因为美国在这方面承担了大量费用。这也会增加财政赤字。

我将暂且搁置我对这些观点的个人看法,专注于如果我们按照这些叙述的逻辑终点推进,它们可能带来的影响:

-

资本将离开以美元计价的资产并回流本国。这意味着美国股市相对于世界其他地区表现不佳,债券收益率上升,美元走弱。

-

这些资本将回流到财政赤字不再受限的地方,其他现代经济体将开始大肆支出和印钞,以资助这些增加的赤字。

-

随着美国从全球资本合作伙伴转向更具保护主义的角色,持有美元资产的人将不得不增加这些曾经完美资产的风险溢价,并为其标注更广泛的安全边际。随着这一过程的进行,将导致债券收益率上升,外国央行将寻求将其资产负债表多样化,摆脱仅仅是美国国债,转向其他中立商品如黄金。同样,外国主权财富基金和养老金也可能会追求这种多样化。

-

这些观点的反面是,美国是创新和技术驱动增长的中心,没有哪个国家会推翻这一想法。欧洲过于官僚和社会主义化,无法像美国那样追求资本主义。我对此观点表示同情,这可能意味着这不是一个多年的趋势,而是一个中期趋势,因为这些科技公司的估值将在一段时间内限制其上行空间。

回到这篇文章的标题,第一个交易是卖出全世界都持有过多的美元资产,避免正在进行的去杠杆化。因为世界对这些资产的持有量过多,当风险限额被大资金管理者和具有严格止损的多策略对冲基金等更具投机性的玩家触及时,这种去杠杆化可能变得混乱。当这种情况发生时,我们会看到类似追加保证金的日子,所有资产都需要被卖掉以筹集现金。现在,交易的策略是生存下来,并保持资金充裕。

然而,随着去杠杆化的平息,下一步交易开始——转向更为多元化的投资组合:外国股票、外国债券、黄金、大宗商品,甚至是比特币。

在市场轮动日和非追加保证金日,我们已经开始看到这种动态的形成。美元指数(DXY)下跌,美国股市表现不如其他地区股市,黄金飙升,而比特币相较于传统的美国科技股表现出乎意料地坚挺。

我相信,随着这种情况的发生,全球流动性的边际增加将转向我们习惯的完全相反的动态。其他地区将承担起增加全球流动性和风险偏好的重任。

在我思考全球贸易战背景下这种多元化的风险时,我担心过于深入其他国家风险资产的尾部风险,因为在潜在的糟糕的关税新闻方面存在一些大地雷。因此,这使得黄金和比特币成为在这种转变中全球分散投资的选择。

黄金一直在绝对上涨,现在每天都在创下新的历史高点,反映了这种制度转变。然而,尽管比特币在整个制度转变过程中表现出乎意料地坚挺,但其与风险偏好的贝塔相关性迄今为止限制了其表现,未能跟上黄金的表现。

因此,随着我们走向全球资本的再平衡,我相信在这之后的交易是比特币。

当我将这个框架与Howell的相关性研究进行对比时,我可以看到它们结合在一起:

-

美国股市不能受全球流动性的影响,只能受到财政刺激所衡量的流动性加上一些资本流入的影响(但我们刚刚确定这一流动的方面可能会停止甚至逆转)。然而,比特币是全球资产,反映了这种全球流动性的广泛视角。

-

随着这一叙述的确立和风险分配者继续再平衡,我相信风险偏好将由其他地区而非美国驱动。

-

黄金表现得非常好,因此对于与黄金相关的比特币部分,我们在这里也可以打勾。

鉴于这一切,我首次在金融市场中看到比特币有可能脱离美国科技股。我知道,这个想法常常标志着比特币的局部顶点。不同的是,这次我们看到资本流动发生重大变化的潜力,这将使其持久。

因此,对于我这样一个风险偏好的宏观交易者来说,比特币在这里感觉是最纯粹的交易。你不能对比特币征收关税,它不在乎它位于哪个边界,它为投资组合提供高beta值,而没有与美国科技相关的当前尾部风险,我不必对欧盟能否整顿好自己的事务发表看法,并提供对全球流动性的纯粹敞口,而不仅仅是美国流动性。

这个市场体制正是比特币诞生的原因。一旦去杠杆化的尘埃落定,它将是最快的马匹,加速前进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。