Author: CoinGecko

Translated by: Shan Ouba, Jinse Finance

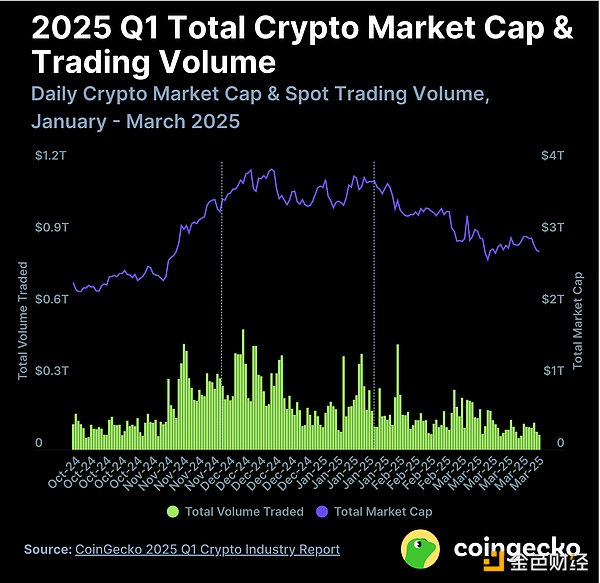

At the beginning of 2025, the cryptocurrency market faced setbacks, contrasting sharply with the frenzied peak at the end of 2024. The total market capitalization of cryptocurrencies fell by -18.6% in the first quarter, closing at $2.8 trillion, after briefly reaching $3.8 trillion on January 18—just two days before Donald Trump's inauguration. Accompanying the decline was a reduction in investor activity, with the average daily trading volume dropping -27.3% quarter-on-quarter to $146 billion.

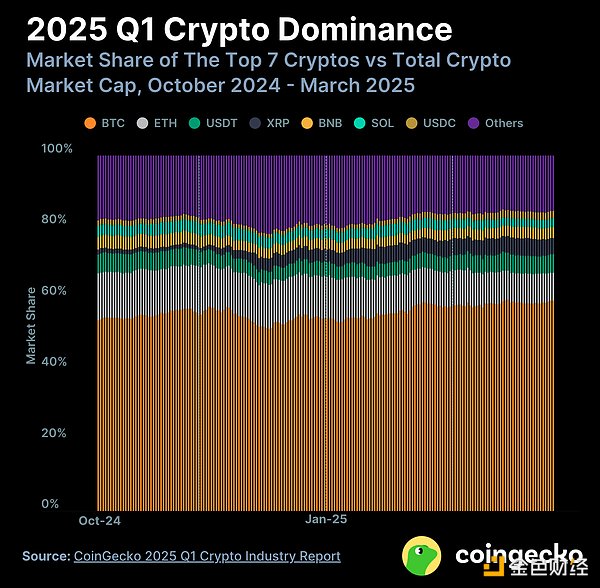

During the market downturn, Bitcoin strengthened its dominance, reaching 59.1% at the end of the first quarter—its highest level since early 2021—as altcoins bore the brunt of the decline. Although Bitcoin set a historic high of $106,182 in January, it had retreated to $82,514 by the end of the quarter, a drop of -11.8%.

Our comprehensive "2025 Q1 Cryptocurrency Industry Report" covers everything from an overview of the cryptocurrency market to analyses of Bitcoin and Ethereum, in-depth discussions on decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, as well as a review of the performance of centralized exchanges (CEX) and decentralized exchanges (DEX).

Eight Highlights from CoinGecko's "2025 Q1 Cryptocurrency Industry Report"

- The total market capitalization of cryptocurrencies fell by -18.6% in Q1 2025, after reaching a high of $3.8 trillion year-to-date.

- Bitcoin's dominance increased, now accounting for 59.1% of the total cryptocurrency market capitalization.

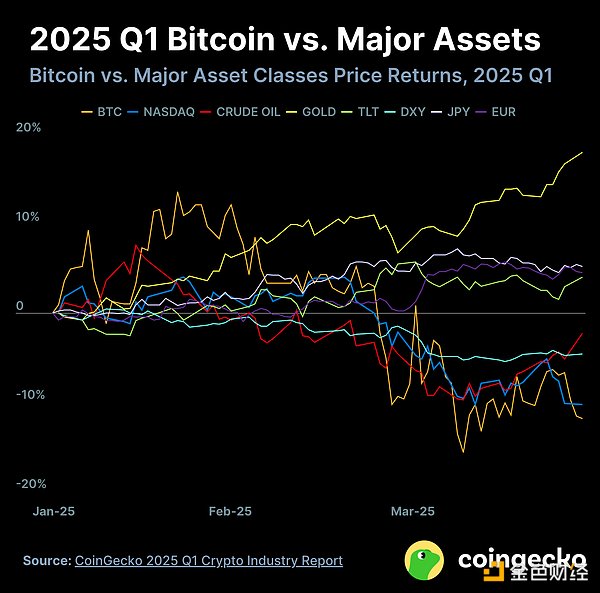

- Bitcoin fell by -11.8% in Q1 2025, underperforming compared to gold and U.S. Treasury bonds.

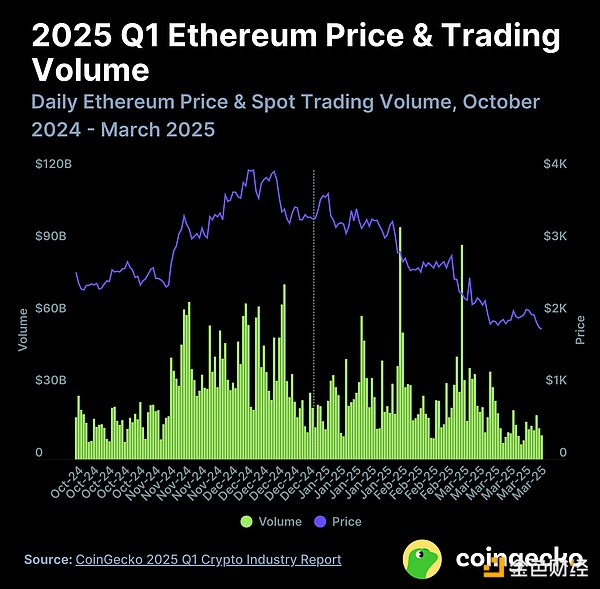

- Ethereum's price plummeted from $3,336 to $1,805 in Q1 2025, erasing all gains from 2024.

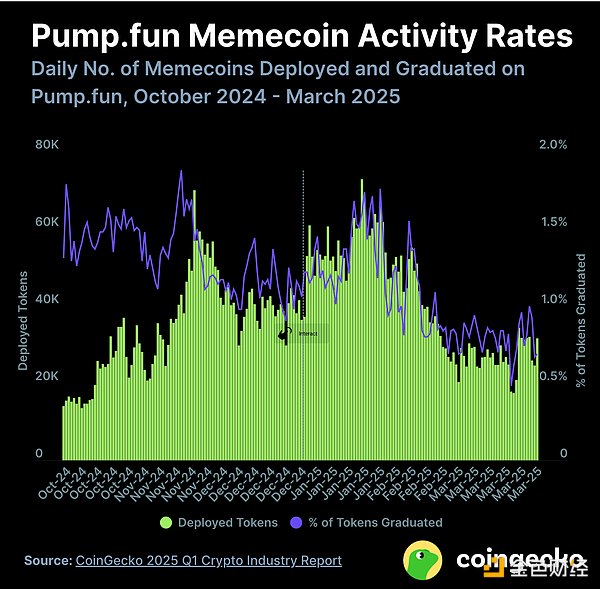

- Following the Libra incident, meme coins crashed, with the number of tokens deployed daily on Pump.fun dropping by -56.3%.

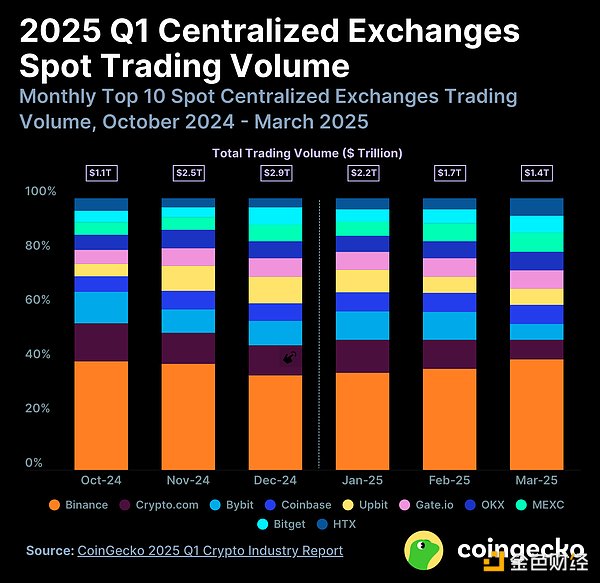

- In Q1 2025, the spot trading volume of centralized exchanges reached $5.4 trillion, a quarter-on-quarter decrease of -16.3%.

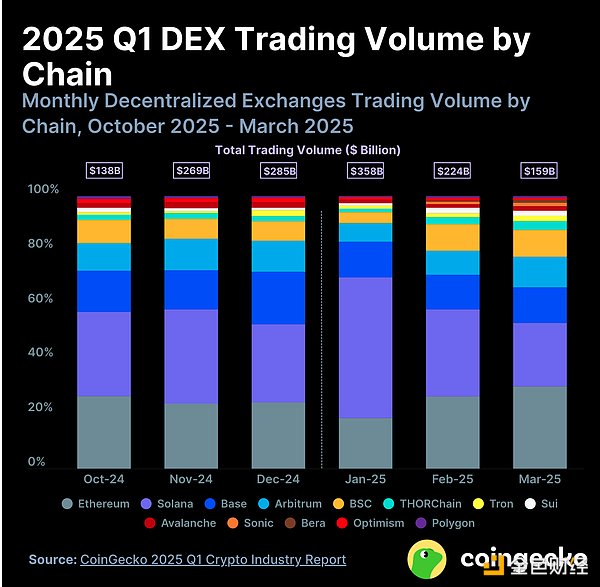

- Solana continued its dominance in on-chain spot trading on decentralized exchanges since the end of 2024, accounting for 39.6% of all trades in Q1 2025.

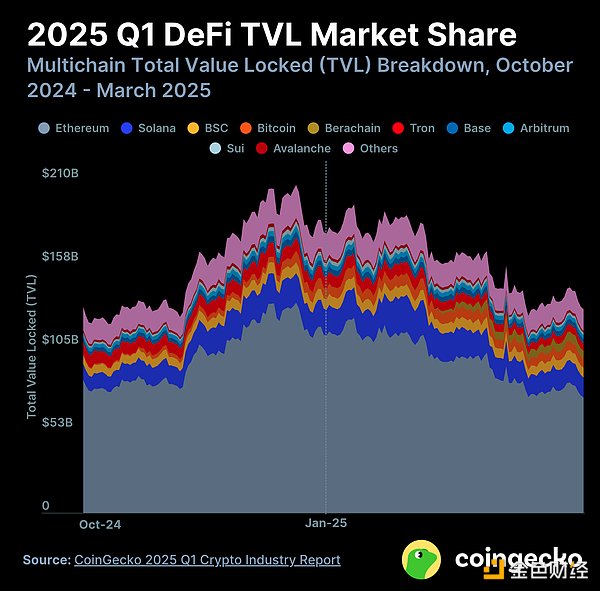

- In Q1 2025, the total TVL of Multichain DeFi evaporated by $48.9 billion, a decrease of -27.5%.

1. The total market capitalization of cryptocurrencies fell by -18.6% in Q1 2025, after reaching a high of $3.8 trillion year-to-date

The total market capitalization of cryptocurrencies fell by -18.6% ($633.5 billion), closing at $2.8 trillion at the end of Q1 2025. The market reached a local high of $3.8 trillion on January 18, just two days before Donald Trump's inauguration. However, the market trended downward for the remainder of the quarter.

Meanwhile, the average daily trading volume in Q1 also saw a significant decline, dropping -27.3% quarter-on-quarter to $146 billion. The trading volume in Q4 2024 was $200.7 billion.

2. Bitcoin's dominance increased, now accounting for 59.1% of the total cryptocurrency market capitalization

Bitcoin (BTC) continued to rise in dominance, increasing by 4.6 percentage points in Q1 2025. In the downturn affecting altcoins, Bitcoin's dominance reached 59.1% at the end of the quarter, the highest level since Q1 2021.

Stablecoins also benefited from the market downturn as investors flocked to safety. Tether (USDT) saw a slight increase in market share to 5.2%, while USDC reclaimed the seventh position, replacing Dogecoin (DOGE).

Ethereum (ETH) saw a significant drop of -3.9 percentage points in its dominance, now at 7.9%, the lowest level since the end of 2019. The decline in "other" coins was smaller, down -3.5 percentage points, accounting for 15.7% of the market share. Among major coins, only XRP and BNB managed to maintain their market share.

3. Bitcoin fell by -11.8% in Q1 2025, underperforming compared to gold and U.S. Treasury bonds

Bitcoin (BTC) rebounded at the beginning of the year, reaching a slightly new all-time high of $106,182 on January 22, 2025. This marked the highest point for Bitcoin year-to-date, just two days after Trump's inauguration, followed by a downward trend, ending the quarter down -11.8% at $82,514.

In this turbulent and uncertain quarter, gold (+18.0%) emerged as the strongest asset class in Q1 2025. Alongside Bitcoin, risk assets such as the Nasdaq and S&P 500 also fell, down -10.3% and -4.4%, respectively.

The U.S. Dollar Index (DXY), typically negatively correlated with risk assets, fell by -4.6%, possibly due to uncertainties surrounding U.S. tariffs. The Japanese Yen (+5.2%) and Euro (+4.5%) strengthened against the dollar, partly due to the Bank of Japan's interest rate hike in January, leading to further unwinding of yen carry trades.

4. Ethereum's price plummeted from $3,336 to $1,805 in Q1 2025, erasing all gains from 2024

Ethereum (ETH) closed at $1,805 at the end of Q1 2025, down -45.3% during the quarter from a high of $3,336. It has erased all gains from 2024, returning to levels seen in 2023. Its performance significantly lagged behind major coins like Bitcoin, Solana, XRP, and BNB, which experienced much smaller declines.

Trading volume in Q1 also decreased, dropping from an average of $30 billion per day in Q4 2024 to $24.4 billion in this quarter. Days of soaring trading volume often coincided with sharp declines in Ethereum's price.

5. Following the Libra incident, meme coins crashed, with the number of tokens deployed daily on Pump.fun dropping by -56.3%

Before Trump's inauguration, the sudden issuance of his official TRUMP meme coin and the subsequent launch of MELANIA triggered a wave of meme coins, pushing the number of tokens deployed daily on Pump.fun to a historic high of 72,000.

This gave rise to the trend of "political meme coins," with dozens of tokens related to politicians and countries being launched in succession. However, this trend abruptly halted with the launch of LIBRA, promoted by Argentine President Javier Milei. Shortly after he tweeted about it, the token's price plummeted as developers executed a rug pull, causing its market cap to drop from a peak of $4.6 billion to $221 million in just a few hours.

Subsequently, activity on Pump.fun significantly declined, with the number of tokens deployed daily dropping over -56.3% from January's peak to 31,000 by the end of Q1 2025. The ratio of "graduated" tokens also fell from 1.4% in January to 0.7% by the end of the quarter.

6. In Q1 2025, the spot trading volume of centralized exchanges reached $5.4 trillion, a quarter-on-quarter decrease of -16.3%

In Q1 2025, the top 10 centralized exchanges (CEX) recorded a spot trading volume of $5.4 trillion, a quarter-on-quarter decrease of -16.3%.

Binance remained the dominant spot CEX, with a market share of 40.7% in March. Its market share continued to rise throughout the quarter. However, its trading volume in March plummeted to $588.7 billion, down from over $1 trillion in December.

HTX was the only exchange among the top 10 to achieve growth in Q1, with a trading volume increase of +11.4%. The trading volumes of other top 10 CEXs fell between -1.8% and -34.0%. Upbit experienced the largest decline, with its trading volume crashing -34.0% from $561.9 billion in Q4 2024 to $371 billion in Q1 2025.

Bybit saw the largest month-on-month decline after suffering a major hack in February, with its trading volume dropping from $178.2 billion to $84.7 billion, a decrease of -52.4%.

7. Solana continued its dominance in on-chain spot trading on decentralized exchanges since the end of 2024, accounting for 39.6% of all trades in Q1 2025.

Continuing the trend from the end of 2024, Solana maintained its dominance in DEX trading, reaching a market share of 52% in January 2025; newcomers Sonic and Bera emerged prominently.

Solana was the leading chain for DEX trading in Q1 2025, with a quarterly market share of 39.6%. It grew by +35.3%, increasing from $217 billion in Q4 to $293.7 billion in Q1.

In January, driven by the $TRUMP-led "political meme coin" frenzy, Solana accounted for 52% of on-chain transactions among the top 12 blockchains. Its trading volume exceeded $184.8 billion, setting a historical high for the chain. This led to Ethereum's market share falling below 20% for the first time.

However, as the meme coin trend faded, Ethereum successfully reclaimed the top spot in March, with a market share of 30.1%, while Solana held 23.4%.

Optimism and Polygon were pushed out of the top 10 in March by newcomers Sonic and Berachain. However, for the entire quarter, these two chains still led.

8. In Q1 2025, the total TVL of Multichain DeFi evaporated by $48.9 billion, a decrease of -27.5%

The total locked value (TVL) of Multichain DeFi showed a downward trend in Q1 2025, decreasing by -27.5%, from $177.4 billion at the end of 2024 to $128.6 billion by the end of March 2025. This was primarily due to the significant depreciation of altcoin values.

Ethereum, in particular, lost a substantial portion of its TVL, with its dominance dropping from 63.5% at the beginning of 2025 to 56.6% by the end of the first quarter. Its TVL fell by 35.4%, from $112.6 billion to $72.7 billion.

The TVL of Solana and Base also saw significant declines, down -23.5% and -15.3%, respectively, but this was mainly due to the sharp drop in the prices of SOL and ETH. Nevertheless, both networks experienced a slight increase in their TVL dominance.

Launched on February 6, Berachain rapidly grew to a DeFi TVL of $5.2 billion by the end of Q1 2025, currently holding the sixth-largest TVL share. Its Boyco pre-deposit treasury alone attracted approximately $2.3 billion in funds, enhancing its liquidity on the first day.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。