DeFi deregulation, the repeal of the broker bill, CAKE governance attack, sUSD continues to depeg, reflecting on recent thoughts about DeFi:

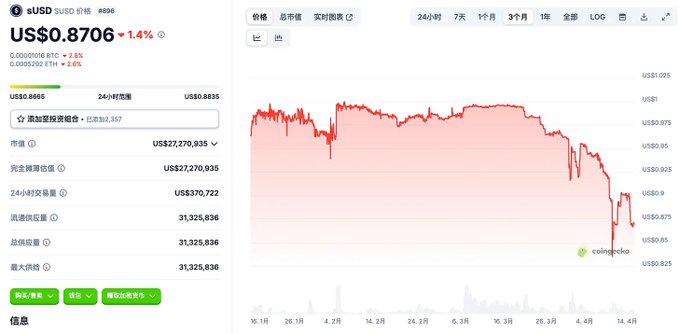

1/ sUSD continues to depeg, why hasn't it been fixed yet?

Since the approval of the SIP-420 proposal at the beginning of the year, sUSD has experienced depegging, recently entering a serious depegging range below $0.9. The key change in this proposal is the introduction of the "delegated pool," which is designed to encourage users to mint sUSD through this mechanism. The benefits are:

- 200% collateralization rate (originally designed to be 500%+)

- Debt can be linearly transferred to the protocol

- After all transfers, users do not need to repay

- The protocol resolves debt through profit-making methods and $SNX appreciation

The advantages are clear, improving the minting efficiency of SNX while eliminating the liquidation risk for borrowers. If the market has strong confidence in SNX, it will enter a positive cycle.

However, problems quickly emerged:

- The market still has serious PTSD regarding SNX - sUSD as an endogenous collateral

- Insufficient confidence, combined with the increased minting efficiency of SNX, has led to additional sUSD flowing into the market, causing the Curve Pool to deviate significantly

- Due to the design of the "delegated pool," users no longer actively manage their debts and cannot arbitrage by purchasing low-priced sUSD in the market to repay debts

The most concerning question is whether it can return to peg. This question heavily relies on the project team, as it is necessary to increase the demand or incentives for sUSD. @synthetix_io is also very aware of this, but whether the market will accept such endogenous collateral algorithmic stablecoins is uncertain; the aftereffects of LUNA are still too significant. However, purely from a design perspective, the synthetix model is still advanced and might have been favored if it had emerged during the early days of algorithmic stablecoins.

(This does not constitute trading advice, but merely states the reasons for events for learning and research purposes)

2/ veCAKE governance attack, cakepie protocol faces liquidation

Dramatically, the ve model was designed to prevent governance attacks, but veCAKE was killed by centralized sanctions.

The process of this event will not be elaborated on; the main controversy lies in Pancake's belief that @Cakepiexyz_io is guiding CAKE emissions to liquidity-inefficient pools through governance power, which is a "parasitic" behavior harmful to Pancake's interests.

However, this result does not violate the operational principles of the ve mechanism. CAKE emissions are determined by the governance token locked vlCKP of cakepie, and vlCKP represents governance power, which can form a bribery market. This is the significance of protocols like cakepie and convex.

The relationship between Pancake - cakepie and Curve - Convex is essentially the same. Frax and Convex benefit from accumulating a large amount of veCRV voting power, and the design of the ve model does not directly link fees and emissions. The issue pointed out regarding cakepie's guidance on emissions is, from a market perspective, a result of insufficient competition for governance power. The conventional approach is to wait for or promote market competition. If artificial intervention is necessary, there are actually better regulatory solutions, such as setting incentive caps for pools or encouraging more people to compete for veCAKE voting power.

3/ Following the veCAKE governance attack, Curve founder @newmichwill provided a quantitative calculation method:

- Measure the amount of CAKE locked as veCAKE through Cakepie (these CAKE are permanently locked).

- Compare a hypothetical scenario: if the same veCAKE were used to vote in support of "high-quality pools," and all profits were used to buy back and burn CAKE, how much CAKE would be destroyed?

- Through this comparison, it can be determined whether Cakepie's behavior is more efficient than directly destroying CAKE.

According to Michael's experience, on Curve, the veToken model is about three times more efficient in reducing CRV token circulation than directly destroying tokens.

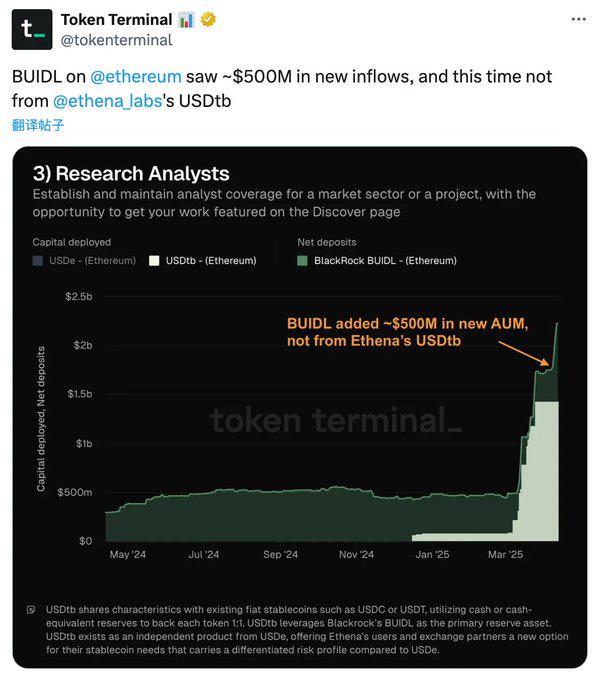

4/ BUIDL continues to grow, increasing by 24% in 7 days

(1) Last time it was noted to break $2 billion, now nearing $2.5 billion

(2) The recent increase of $500 million did not come from Ethena

(3) It may have attracted a new group of investors

(4) On-chain traces suggest it may come from Spark, a lending protocol under Sky (MakerDAO)

RWA business continues to grow but has not integrated well into the DeFi ecosystem, currently presenting a state of "disconnection from the market, unrelated to retail investors."

5/ IRS DeFi broker bill officially repealed

On April 11, President Trump signed the bill, officially repealing the IRS DeFi crypto broker rules.

The DeFi sector has seen some increase, but not much. Personally, I believe this is a significant positive for DeFi, as the regulatory stance is loosening for DeFi, potentially releasing more possibilities for application innovation.

6/ Unichain launches liquidity mining, $5 million in $UNI token rewards for 12 pools

Tokens involved: USDC, ETH, COMP, USDT0, WBTC, UNI, wstETH, weETH, rsETH, ezETH

It has been 5 years since Uniswap's last liquidity mining, which was in 2020 with the launch of the UNI token. This time, the goal is to guide liquidity for Unichain. Many people are expected to participate, seizing the opportunity to acquire UNI tokens at a low cost.

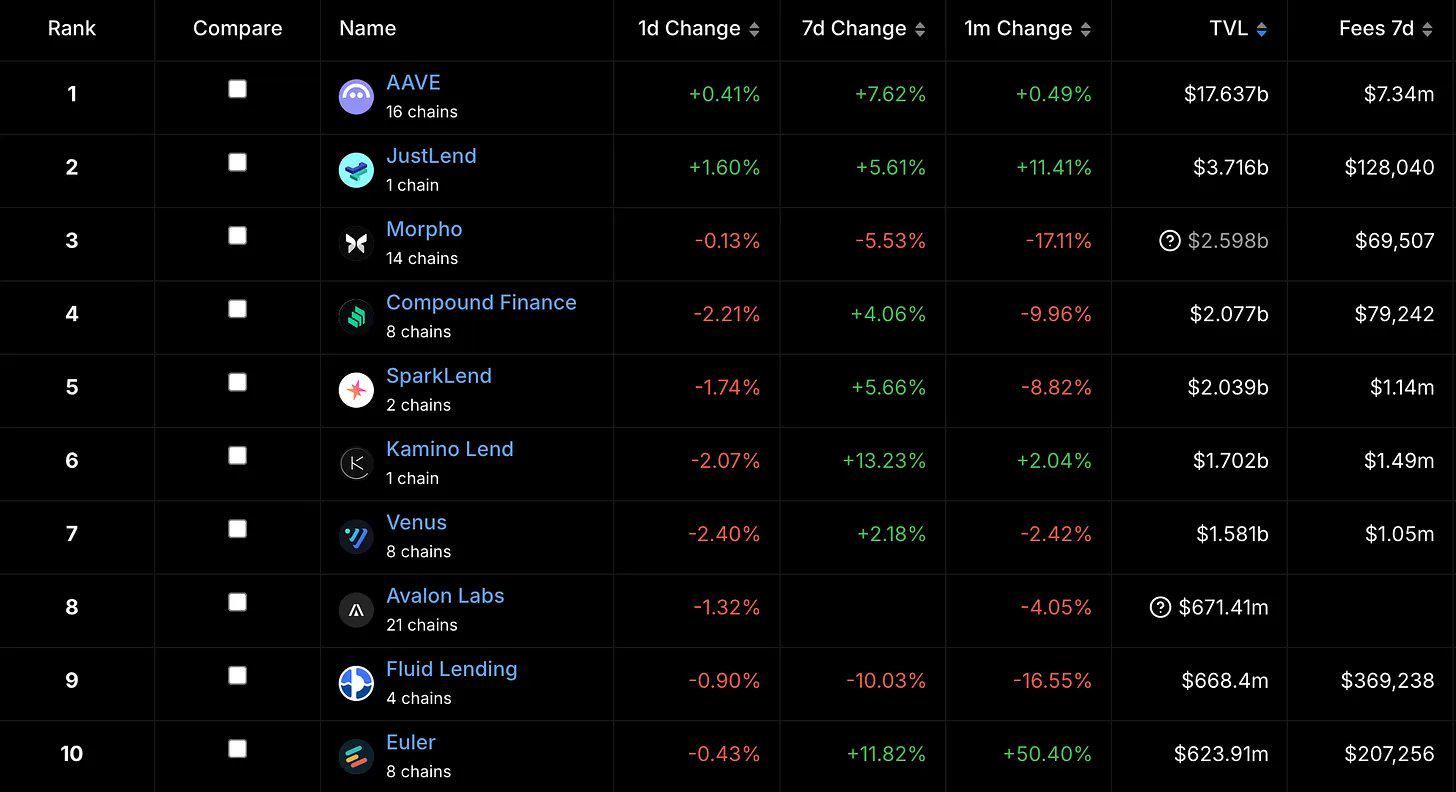

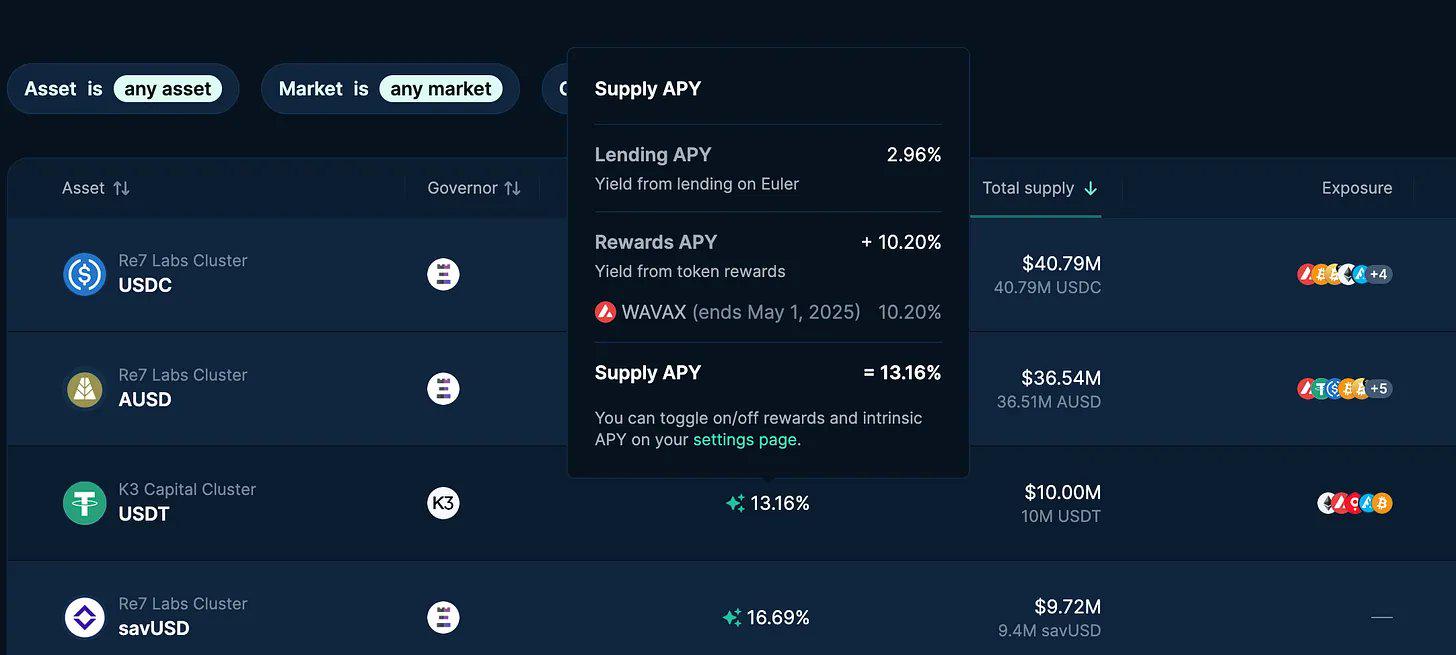

7/ Euler expands to Avalanche, TVL has entered the top 10 of lending protocols

(1) TVL increased by 50% in a month

(2) Most of the growth comes from incentive measures, mainly from Sonic, Avalanche, EUL, etc.

8/ Cosmos IBC Eureka officially launched

(1) Based on IBC v2

(2) Each transaction consumes gas $ATOM, which is destroyed

(3) Supports cross-chain transactions between Cosmos and EVM

(4) Currently supports mainstream assets on Ethereum mainnet and Cosmos, not yet expanded to L2

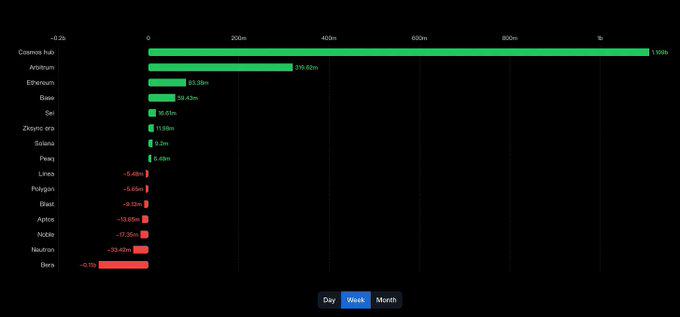

(5) In the past week, $1.1 billion flowed into the Cosmos hub cross-chain

This brings strong empowerment to ATOM. Any chain in Cosmos that can attract a large amount of funds will likely drive the value growth of ATOM, improving the situation where the ecological explosion during the LUNA period could not generate a connection with ATOM.

Although there has been a large inflow of funds in the past week, to change the fundamentals of ATOM, sustainability needs to be examined.

9/ Buyback

(1) AaveDAO officially starts to buy back tokens

(2) Pendle proposal to list PT token on Aave

10/ Berachain farming

(1) Update POL reward distribution rules, setting a cap of 30% for the allocation ratio of a single Reward Vault

(2) Berachain governance update introduces a new guardian committee responsible for reviewing and approving RFRV

(3) OlympusDAO prepares to move part of the POL liquidity in response to the new rules to maintain high incentives for the $OHM pool

(4) Yearn's $yBGT lands on Berachain

After experiencing a golden March, Berachain's token price and TVL have entered an adjustment phase. The official has made modifications and restrictions regarding the exposed issues of unreasonable incentive distribution. Although there has been significant outflow of TVL in recent weeks, it remains one of the most DeFi-centric chains. Continuous observation of more protocol integrations and TVL inflow is needed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。