作者:Frank,PANews

MEME市场似乎又一次热了起来,3月中旬开始,Fartcoin开始触底反弹,约1个月的时间上涨约349%,总体市值最高接近9.85亿美元。与此同时,链上MEME巨鲸的动作也受到关注,一些巨鲸花费上百万美元投入Fartcoin、RFC等MEME币引发相关代币市值快速拉升。

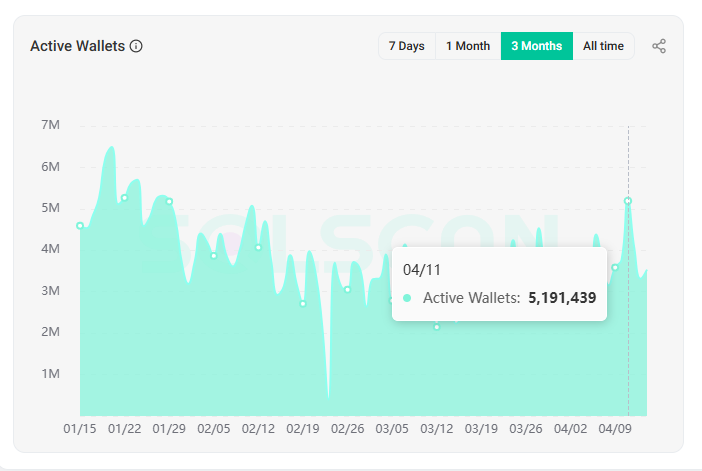

在这些异动的背后,4月11日,Solana链上活跃地址数再次突破510万个,接近1月份的峰值水平。

这一轮MEME行情的小爆发,到底是MEME牛市再次回归还是无聊市场之下的一次游资返场?PANews针对几个近期涨幅较大的MEME币大户地址进行了数据分析,希望找到蛛丝马迹。

Fartcoin剖析:巨鲸3月中旬入场,平均成本约0.62美元

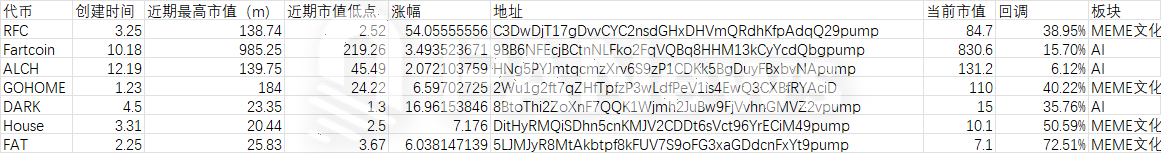

首先,在观测多个此前市值较高的代币之后PANews发现,本轮的MEME热潮并不具有普遍性,而是集中在几个特定的代币之中。多数此前市值过亿的MEME(如Trump、BONK、WIF、POPCAT)仍处于下滑或底部震荡阶段。在PANews统计的几个代币当中,除了Fartcoin之外,其他的代币要么是近1~2个月内诞生的新币,要么则是发行之后一直不温不火的代币。以下是PANews观测的几个代币:RFC、Fartcoin、ALCH、GOHOME、DARK、House、FAT。

代币筛选规则是市值在1000万到1亿美元以上,近1个月到3个月内行情上迎来较大涨幅或反弹的代币。其中,近段时间较为火热的RFC涨幅最大,近一个月涨幅最大达到54倍。

这一轮的引领代币是Fartcoin,自3月10日跌至谷底之后,Fartcoin开始了新一轮上涨趋势。市值一度达到9.48亿美元,再次成为MEME领头羊。

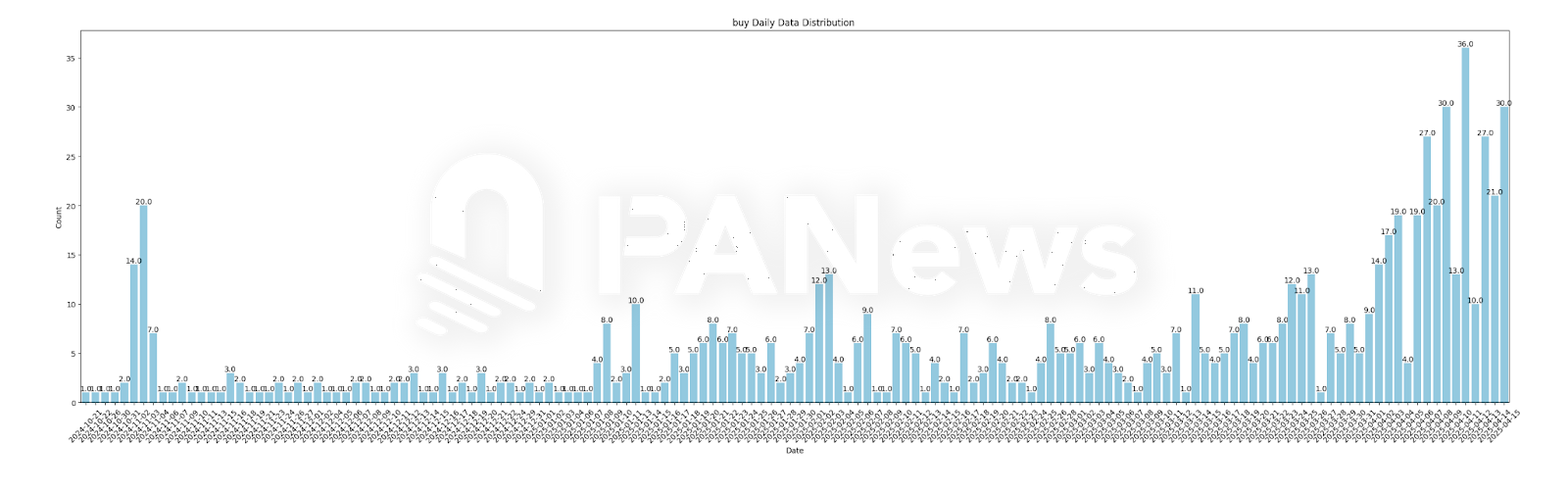

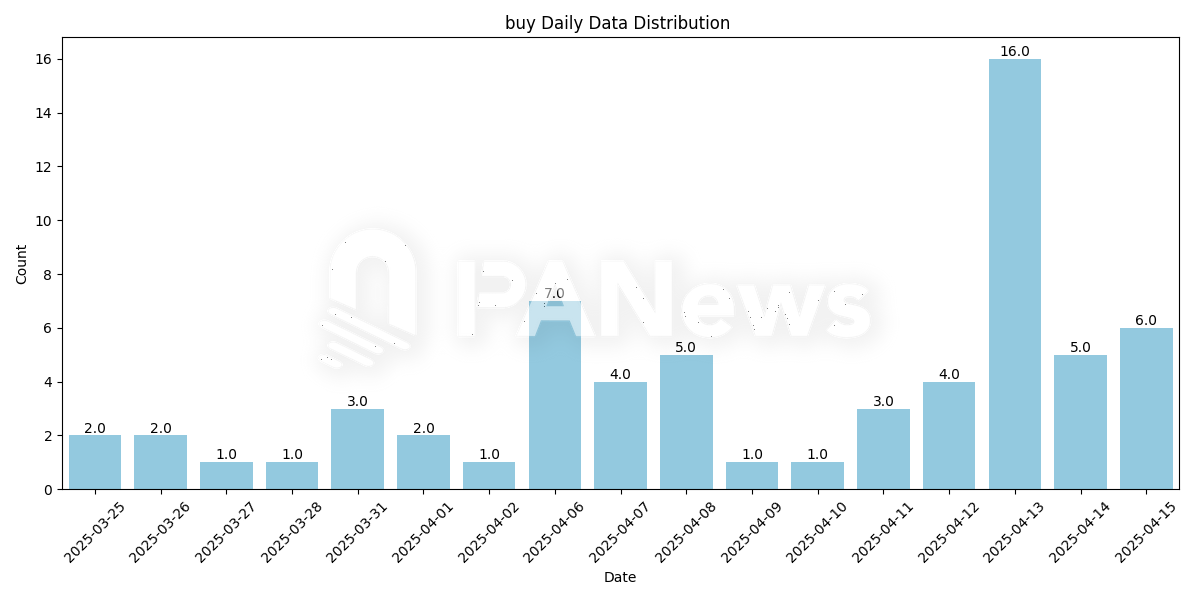

从大户的初次购入时间上进行分析可以发现,这一轮的大户集体入场时间是从3月中旬开始买进。一直持续到4月10日,大户的进场都保持上升态势。

Fartcoin大户进场时间分布

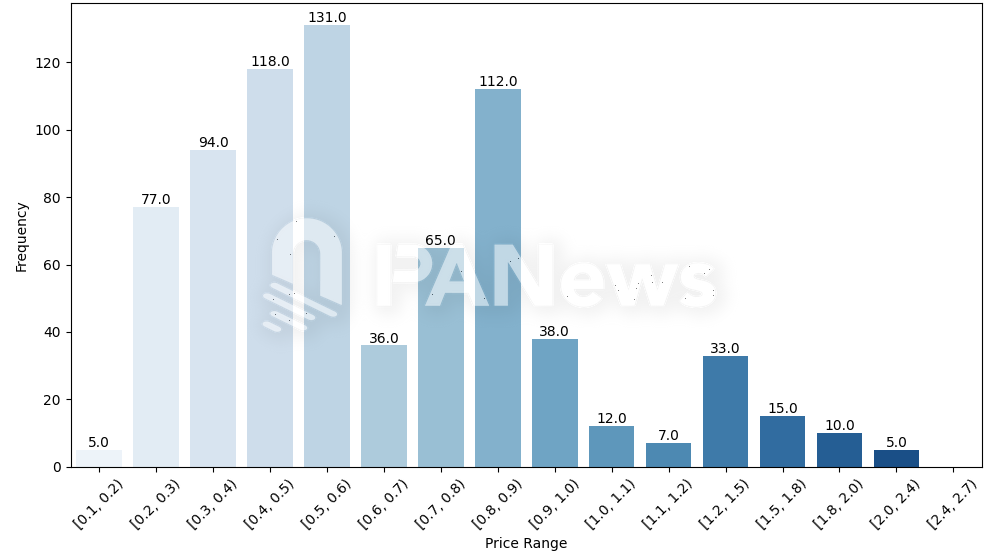

从成本上来看,前1000名大户初次购买的成本基本集中在0.2~0.6美元和0.6~0.9美元之间。结合Fartcoin的图表来看,目前仍被套牢在1美元以上的大户占比较小。且综合分析来看,目前的持仓大户基本都是在3月12日价格低点之后开始进场的。

Fartcoin大户持仓成本分布

总体计算,Fartcoin的大户初次购买持仓成本约为0.62美元。以当前0.844美元的价格计算,这些新晋大户们平均约有36%的盈利空间。

23%地址交叉持仓,DARK、RFC走出重复剧本

从整体来看,通过对这些代币持币前1000名的大户对比发现,有23%的大户地址至少持有2种以上的代币。其中,大户们持有最多的代币就是DARK,这个代币创建的时间最短,但有116个大户重复持有了这个代币。

其次,就是RFC的重复出现次数最多,达到了110次。Fartcoin近期的市场关注度较高,且市值也是这几个分析的代币最高的,但重复出现的次数只有76次。不过,据PANews分析,造成这个的原因可能是源于Fartcoin的市值已经在拉升至一个较高的水平,有不少持仓的大户已经撤离或者换车。由于无法追踪到具体某个时间的大户历史信息,我们目前也无法得出一个明确的答案。

不过,从RFC和DARK的分析来看这两个代币似乎有着较为相似的剧本。

首先是两者的K线图走势上,除了创建的时间有所不同,其他的走势包括回调形态都趋于相似。

此外,这两个代币大户重复持有的数据也比较接近,都在110个以上。而在更加详细的分析当中,PANews看到,有75个地址同时持有DARK、 RFC这两个代币,是大户持有组合当中数量最多的。其次是Fartcoin、House这个组合,有35个地址同时持有这两个代币。

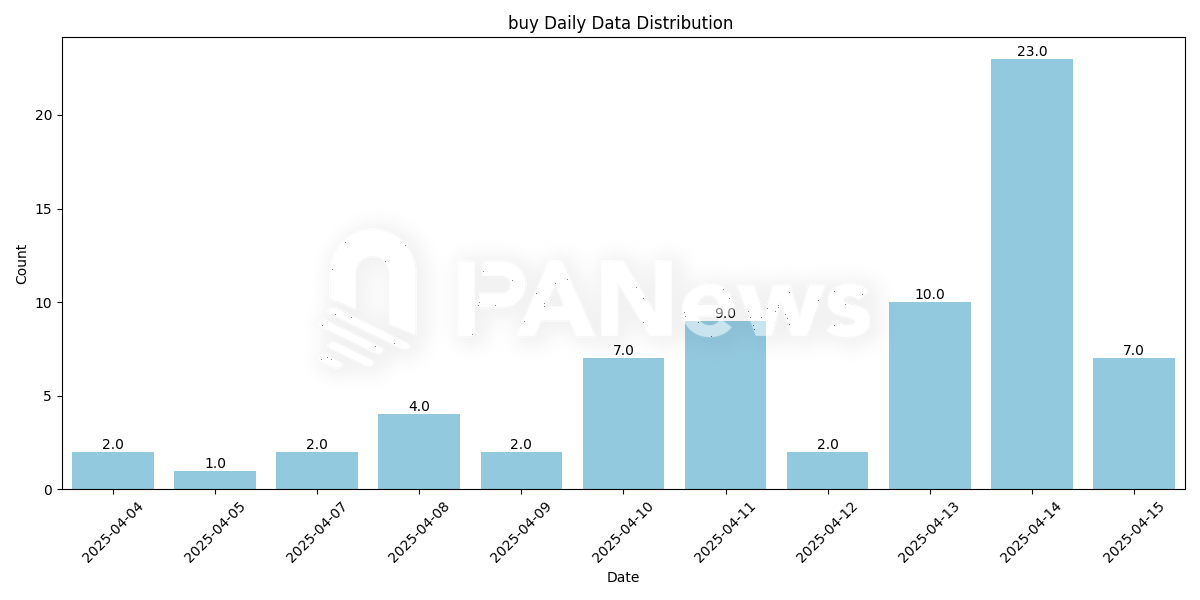

在进一步分析这些同时持有RFC、DARK的地址买入时机来看,大多数的大户地址初次买入这两个代币的时间分别为4月13日和4月14日。

从K线走势上来看,4月13日正是RFC极速拉升的日期,当天涨幅达到65%,振幅达到107%。而4月14日,DARK则迎来类似的行情,当日涨幅达到80%,振幅218%。这种前后脚的大幅拉升,看起来似乎像是主力的换车拉升动作。

RFC的主力初次买入分布日期

DARK的主力初次买入分布日期

当然,需要注意的是RFC的市值最高达到1.38亿美元,而DARK的最高市值仅为2300万美元。看起来这股背后大户并不是市场中的绝对主导力量,或者说主力对于这两个代币的预期并不相同。因此,不能认为DARK能够复刻RFC的市值规模。

另外,Fartcoin、House或DARK、House等代币组合在大户们的持仓中出现的次数也不少。

“人造牛”钟爱MEME文化和AI

在整体数据当中,这些重复持仓的大户们在这7个代币当中总计的持仓金额约为1亿美元(除去了Gate、Bitget、Raydium等几个主要交易所的持仓),占到这些代币市值的8.47%。

截至4月16日凌晨,这些代币普遍也迎来了一定的回调。其中,FAT自高点回调月72.51%,House回调达到50%,整体的平均回调幅度大豆37.12%。其中,只有ALCH的回调幅度较小,该项目从性质上来看,是唯一一个具有实际应用的AI相关代币。不过,从周期来看ALCH或许只是恰好处于市场轮动上涨的阶段,还没有进入抛售的周期而已。

在这场MEME轮动上涨的背后,似乎存在着一些人造MEME牛市的踪迹。KOL@MasonCanoe在推特上表示,RFC上涨的巨鲸地址与此前TRUMP、VIRTUAL、LIBRA等多个代币有做市行为的地址有关联,并同时关联到了几个很早埋伏在RFC上的地址。据此,@MasonCanoe认为,RFC的推高绝非偶然,有可能是背后大资金精心布局的信号。

从数据的表现来看,Solana链上的MEME似乎确实正在一些巨鲸的推动下再次开始吸引市场关注。只不过,由于这种拉动效果并不能惠及所有MEME代币,因此只能是通过追踪这些主力资金的实时动态来判断走向。另外,从几个代币的分类来看,猫、狗、青蛙题材的代币似乎没能在近期的上涨当中占领一席之地,而主要是AI和MEME文化类的代币表现突出。

总体而言,近期 Solana 链上的这轮 MEME 热潮并非全面开花,而是高度集中在少数特定代币上,其中Fartcoin作为领头羊吸引了大量3月中旬后入场的新晋大户。更值得注意的是,在RFC与DARK这两个走势高度相似的代币背后,存在大量重叠持有的大户地址,且其主要买入时间集中在两者前后脚发生剧烈拉升的4月13日与14日,这强烈暗示了可能存在的协同操作或主力轮动行为。这轮上涨似乎并非纯粹的市场自发行为,带有“人造牛市”的痕迹,而这场“人工降雨”是否能演变为自然的资金涌入,仍有待观察。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。