在快节奏的加密货币市场中,1秒的延迟可能意味着百万收益的流失。当竞品还在用“5账户上限”“复杂操作流程”限制交易者时,AiCoin以“无限API管理、零门槛批量跟单、智能分仓风控”三大杀器,重新定义了专业级交易工具的标准。本文将为你揭秘:如何用AiCoin多账户下单(Multi-APl trading)功能实现“一人操控百账户,10秒完成全天操作”的极致效率。

一、为什么选择AiCoin?

AiCoin多账户下单功能专为需要同时操作多个交易所账户的用户设计,无论是机构用户、资管团队,还是希望复制策略的KOL,都能从中受益。以下是其核心优势:

1、无限API账户授权

-

痛点解决:传统交易工具账户数量受限,频繁切换登录耗时费力,管理成本高。

-

AiCoin优势:支持无上限API授权,一个平台管理所有账户,轻松应对多交易所、多策略需求。

2、智能跟单与分仓功能

-

痛点解决:批量下单繁琐,分散风险或复制策略效率低下。

-

AiCoin优势:提供“跟单模式”和“分仓模式”,一键同步多账户交易,灵活分配资金,降低操作复杂性。

3、全景账户资金管理

-

痛点解决:多账户资金监控困难,调仓决策耗时。

-

AiCoin优势:实时监控所有账户仓位、资金流向,快速调整投资组合,决策效率翻倍。

4、极简界面,流畅交互

-

痛点解决:复杂工具学习曲线陡峭,操作体验差。

-

AiCoin优势:简洁直观的UI设计,高级功能一目了然,操作丝滑,专为专业交易者打造极致体验。

5、差异化定位

相较于市场上其他交易工具(账户数量限制、操作复杂、收费高),AiCoin以“无上限账户管理+极简高效操作”重新定义效率,堪称“专业交易者的效率革命”。

二、谁需要多账户下单?

1、多账户管理者:同时管理多个交易所账户(如币安、OKX、Bybit等)的个人或机构用户

痛点:频繁切换账号,登录麻烦,下单易出错。

解决方案:统一管理所有账户,批量下单与查看,减少操作成本。

2、资管团队:需要跨账户进行跟单、分仓、风控的专业团队

痛点:跨账户调仓慢,人工操作容易出错,监控不到位。

解决方案:设置账户组,自定义比例快速调仓、查看盈亏,全盘掌控。

故事化场景:小C是某加密基金的资管经理,管理50个交易账户。过去,他需要在不同平台手动下单、调整仓位,单次操作耗时30分钟,且容易出错。使用AiCoin多账户下单后,他通过“分仓模式”一键分配资金到100个账户,设置比例后,5秒内即可自动完成批量下单,效率提升300倍!更重要的是,分仓功能帮助他分散风险,单平台敞口降低50%。

3、KOL/带单老师:希望快速复制交易策略到多个客户账户的交易达人

痛点:复制策略麻烦,容易错过关键交易点,无法实时同步。

解决方案:设定主账号为信号源,其余账户同步跟随操作。

故事化场景:小A是一位加密KOL,拥有200个客户账户需要同步交易策略。以前,他需要逐一登录客户账户下单,耗时数小时。AiCoin的“一带多”跟单功能让他只需操作主账户,200个跟随账户按比例自动完成下单、止盈止损等操作,10秒内搞定所有账户,学员满意度提升30%+。

4、专业交易者:追求极致效率、需要批量操作的高频交易者

故事化场景:小E是一位高频交易者,管理5个账户,每次交易时,需要频繁切换账户容易错过最佳下单时机。AiCoin的集中管理功能让他通过一个界面实时监控所有账户,批量下单、撤单、平仓一气呵成,交易效率提高100%+,抓住更多市场机会。

三、多账户下单功能的四大特色用法

AiCoin多账户下单功能围绕“集中管理、灵活下单、批量操作、策略复制”四大场景,满足用户多样化需求。以下是详细解析:

1. 集中账户管理

-

功能概述:通过API授权,用户可在一个平台管理多个交易所账户,无需频繁切换登录。

-

使用场景:快速查看账户余额、仓位、订单状态,简化多账户操作流程。

-

操作亮点:支持API标签Tab切换,N个账户一目了然。

2、灵活下单模式

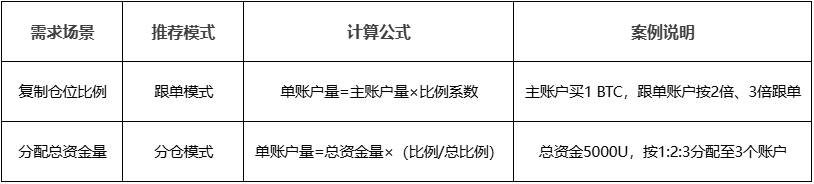

AiCoin提供两种下单模式,满足不同交易需求:

a.跟单模式

-

定义:按比例倍数下单,主账户下单后,跟随账户按设定倍数同步操作。

-

适用场景:KOL带单、需要放大交易规模的场景。

-

示例:主账户A下单100 USDT,设置B、C、D账户比例为1:2:3:4,则B下单100、C下单200、D下单300、E下单400,10秒完成。

b.分仓模式

-

定义:按总资金比例分配下单,跟随账户按比例分割总下单量。

-

适用场景:资管团队分散风险、优化资金分配。

-

示例:总下单1000 USDT,设置B、C、D账户比例为1:2:3:4,则B下单100、C下单200、D下单300、E下单400,自动分配高效精准。

3、批量交易操作

-

功能概述:支持“一带多”批量操作,主账户操作自动同步到跟随账户。

-

支持操作:买卖开平仓、市价全平、止盈止损、批量撤单等。

-

使用场景:高频交易、紧急调仓、批量清仓。

-

示例:某用户管理5个账户,需快速清仓BTC持仓。仅需主账户点击“市价全平”,5个账户同步完成,效率提升100%+。

4、复制交易策略

-

功能概述:主账户交易策略一键复制到多个跟随账户,支持比例调整。

-

适用场景:KOL带单、资管团队统一策略执行。

-

操作亮点:带单老师设置主账户后,跟随账户按比例同步执行,无需逐一操作。

-

示例:某KOL将BTC买入策略复制到100个客户账户,设置1:1比例,10秒内完成所有账户下单,客户及时抓住上涨行情。

四、多账户下单使用教程:6步快速上手

以下是AiCoin多账户下单的详细操作步骤,新手也能轻松上手:

1、开启功能

在AiCoin下单面板,找到“多账户下单”开关,点击开启。

2、添加API账户

进入账户管理页面,绑定需要操作的交易所API(如币安、OKX等),确保API权限包含交易功能。

3、选择下单模式

根据需求选择“跟单模式”或“分仓模式”,并自定义比例(如1:2:3:4)。

4、一键下单

在主账户输入下单量(如100 USDT),跟随账户将按比例自动下单,支持止盈止损等高级设置。

5、多账户仓位管理

需要批量撤单或调整仓位时,主账户操作一键同步,支持全景仓位监控,随时掌握资金动态。

小贴士:首次使用建议从小额测试开始,熟悉比例设置后再放大操作规模。

五、高频问题解答

1、AiCoin多账户下单收费吗?

答:功能完全免费,无任何隐藏费用

2、API账户有数量限制吗?

答:API无数量限制,想连几个就连几个

3、支持哪些交易平台?

答:支持欧易OKX、Binance、Bitget、HTX、Bybit、Gate芝麻开门、派网七大交易平台

4、支持不同平台的同时下单吗?

答:多账户下单功能只支持同一平台内的多个账户进行操作。例如,可以同时使用两个OKX账户进行下单,但暂时无法同时使用两个OKX账户和一个币安账户进行下单。

5、APP支持多账户下单吗?

答:当前多账户下单支持下载AiCoin电脑端使用,手机端仍在开发中,敬请期待。

6、AiCoin所有的交易工具都支持多账户管理?

答:AiCoin普通下单支持多账户下单,网格、DCA、组合下单等策略工具待支持,可以期待。

7、如何确保多账户交易安全?

答:所有接入交易功能的API都经过AiCoin的安全认证,所有密钥经过重重加密并且仅存储在当前设备中,而且密钥不会在网络上传输,所以安全性是极高的,可放心使用。

六、总结:开启您的交易效率革命

AiCoin多账户下单功能以“无限授权、智能跟单、分仓风控、全景管理”为核心,重塑多账户交易体验。无论你是机构、资管团队、KOL,还是个人交易者,这一功能都能帮你节省时间、降低风险、提升收益。从集中管理到一键下单,从策略复制到全景监控,AiCoin让交易从未如此高效!

立即访问AiCoin官网体验多账户下单功能,免费开启您的效率革命:https://www.aicoin.com/zh-Hans/tg/multi-account?lang=cn

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。