作者:Route 2 FI

编译:白话区块链

随着加密货币行业的成熟,其发展轨迹逐渐明朗,受到创新、挑战和优先级变化的共同塑造。以下是对这一动态市场演变的关键洞察,探讨其最大机会与障碍所在。

投机:加密货币核心的命脉

加密货币本质上是一种革命性的金融系统基础设施,类似于互联网对信息获取的变革。然而,尽管其具有变革潜力,投机仍是推动行业活动的主导力量。

无论是通过交易、借代还是衍生品市场,投机创造了最大的成果和收入来源。虽然投机活动的节奏和强度可能随时间波动,但它始终是加密货币行业的核心驱动力。这一现实表明,尽管加密货币的实用性未来可能扩大,其投机本质将在未来多年继续占据中心地位。

稳定币:接近转折点

随着Circle即将IPO,稳定币市场正接近一个转折点。尽管稳定币长期被认为是加密货币普及的基石,但由于监管挑战和竞争优势的减弱,其增长可能很快会趋于平稳。较低的利率可能进一步削弱其吸引力。

稳定币的下一波机会可能不在于全球美元支持的解决方案,而在于利用加密支付轨道的地方化金融科技应用。硅谷以外的创业者——尤其是那些无法获得大规模早期资金的创业者——可能通过专注于区域性用例而获得更多成功,而不是试图复制以美国为中心的市场模式。

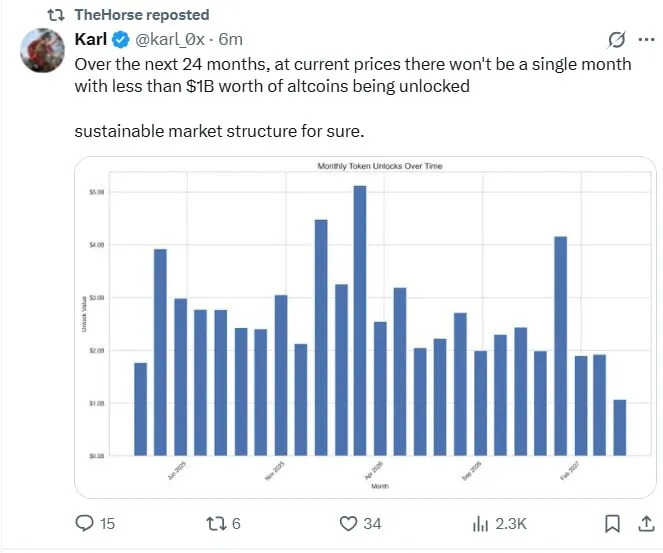

Token溢价的衰退

近年来,Token市场动态发生了巨大变化。曾经被视为高潜力资产并享有显著溢价的Token,如今面临投资者更严格的审查,他们更看重切实的收入来源而非投机炒作。

两个主要趋势推动了这一转变:

在后牛市环境中,Token溢价的崩塌,Token在归属计划生效后实现高估值变得越来越困难。只有少数与切实收入挂钩的Token可能在这个新环境中蓬勃发展。

风险投资面临清算

随着Token上市的流动性枯竭,专注于加密货币的风险投资正在经历范式转变。历史上依赖零售驱动的交易平台上市获取回报的许多风险投资公司,现在面临一个新市场:越来越少的创业者选择发行Token。相反,创业者倾向于组建专注于可持续收入来源的小型团队,这一趋势挑战了传统的风险投资模型。

自FTX和其他高调失败事件以来,市场发生了更广泛的变化。随着行业适应这些新现实,只有最具适应能力的风险投资公司才能保持相关性。

以长期愿景构建消费者应用

加密生态系统的一个明显差距是缺乏类似Uber或Instagram的大型消费者应用。虽然许多人将其归因于糟糕的用户体验或营销失败,但更深层次的问题在于加密货币内部的资本流动优先考虑短期回报而非长期产品开发。

要释放大众市场消费者应用的潜力,创业者必须拥抱更长的时间视野,并抵制即时Token流动性的诱惑——这是一个具有挑战性但对可持续增长必要的转变。

加密货币与AI:前景光明但发展不均

加密货币与人工智能(AI)的融合具有巨大潜力,但尚未在大规模实现。诸如出处和分布式计算等概念在理论上听起来很吸引人,但在应用于现实世界的AI用例时面临显著的可扩展性挑战。

一个有趣的探索领域是众包IP地址——这种模式类似于“玩赚”游戏,可能为去中心化网络开启新的可能性。

为加密原生用户提供银行解决方案

为月收入在5000美元至2万美元的加密原生用户提供定制银行解决方案是一个小众但有价值的机会。这些用户需要集成的金融服务,包括工资管理、投资组合构建(包括股票等传统资产)和借代选项——所有这些都在一个对加密友好的框架内。

尽管这一市场最初可能较小(估计有5000至1万用户),但它代表了创新金融产品的未开发潜力。

通过社区协调复兴DAO

去中心化自治组织(DAO)因许多用户对管理借代协议或衍生品交易平台等平台失去兴趣而难以保持相关性。然而,像Farcaster这样的平台可能通过围绕共享资源和资产进行大规模社区协调,为DAO注入新的活力。

如果成功,这种方法可能为更可持续的迷因币铺平道路,这些迷因币与社区驱动的价值而非投机炒作相关联。

加密游戏:准备复兴的领域

尽管自2022年Axie Infinity热潮消退后看似沉寂,加密游戏仍是消费者应用中潜力最高的领域之一。随着稳定和产品开发的足够时间,2025-2026年可能成为结合引人入胜的游戏玩法与可持续经济模型的游戏的突破期。

愿意在这一挑战阶段坚持的创业者可能最终拥有数百万用户和繁荣的市场。

人才流失:超越流动性的挑战

随着加密货币行业的进展相对于AI的快速发展放缓,许多优秀人才正在彻底离开这一行业——这一趋势可能比价格下跌更深地影响士气。

在这种环境中,拥有强大文化的公司将成为希望的灯塔,即使在动荡时期也能吸引顶尖人才。

媒体与研究的整合

随着传统资金来源的枯竭,专注于加密货币的媒体和研究正进入整合期。未来属于那些将高质量创意输出与金融专业知识和强大分发策略结合起来的公司——这种组合虽然罕见但极具价值。

筹得股权的日益影响力

随着越来越少的创业者发行Token,更多企业实现显著的收入里程碑,筹得股权公司将在加密货币的演变中发挥越来越重要的作用。在未来18个月内,筹得股权可能成为资助具有可扩展性和已验证收入来源项目的主导力量。

创意与加密货币的结合:开启新前沿

将音乐、艺术和写作等创意产业与加密原生技术相结合,以更大规模触及受众,具有未开发的潜力。在这一领域的成功需要既了解消费者分发又理解创作者独特需求的合作伙伴。

结论

加密货币继续以惊人的速度演变——既充满理想主义又在道德上复杂,因为它在重塑全球系统的同时应对新挑战。通过专注于数据驱动的洞察和长期战略,而非短期噪音,创新者可以在导航其双重性质的同时,帮助塑造其下一章。

本文链接:https://www.hellobtc.com/kp/du/04/5746.html

来源:https://theblackswans.substack.com/p/the-evolution-of-crypto-a-look-at

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。