在过去的一段时间内,Alliance DAO因成功孵化Pump.fun、Moonshot等Web3消费者应用而获得了很大的影响力。本篇文章首先总结Alliance DAO对Web3消费者赛道的投资理念,并提出自己对该赛道的观察,以综述当前Web3消费者应用的主流范式、面临的挑战与潜在的机遇,最后总结我们对Web3消费者应用投资理论的思考。

Alliance DAO 对 Web3 消费者赛道的孵化

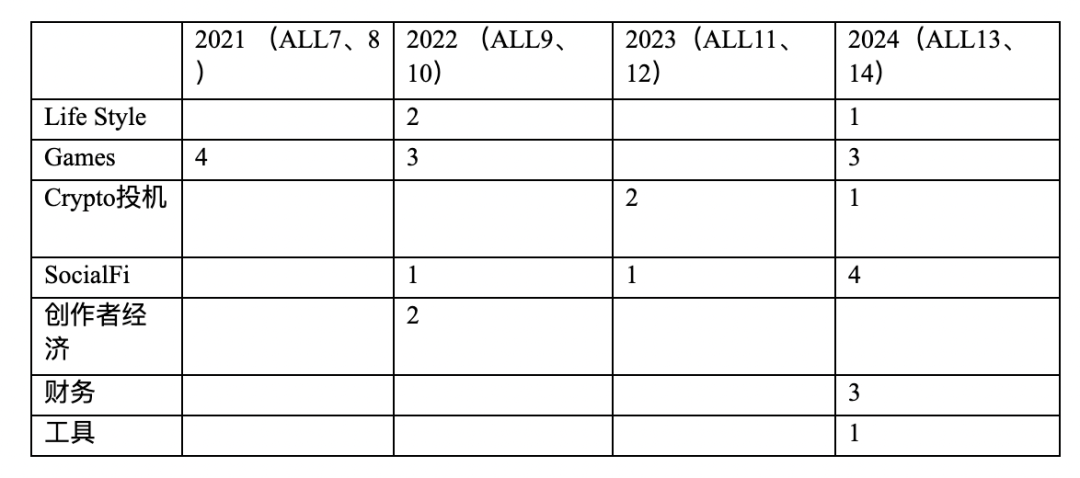

自推出以来,Alliance DAO Accelerator共孵化或对外投资了 28 个Web3消费者应用程序。它们大致可分为 7 大类:

1. Life Style 类

定义:旨在通过Web3的方式,培养用户新颖的、健康的生活方式的项目;

数量:3个;

具体项目:

StepN:Web3生活类应用,核心创新机制为Move to earn,用户可以购买跑鞋NFT,追踪用户运动数据,给予Token奖励。

Sleepagotchi:Web3 睡眠监测与 Sleep-to-Earn 助眠游戏移动应用,卡牌gacha养成游戏,睡眠获取token,使用token参与gacha抽卡。

GM:健康管理的Web3 AI Agent,利用AI增进健康并获得收益

2. Games 类:

定义:Web3游戏或GameFi;

数量:10个;

具体项目:

Axie Infinity:Axie Infinity是一款 Sky Mavis 开发的卡片游戏,允许玩家繁殖、饲养、战斗和交易Axie生物。

Genopets:Genopets 是 Solana 上的一款 Move-to-Earn NFT 手机游戏,让积极的生活方式变得有趣和有益。 Genopet是玩家的数字宠物,它的进化和成长与他自己的密不可分。随着玩家探索、战斗和进化,玩家每天所采取的步骤为他们在 Genoverse 中的旅程提供了动力——在游戏中赚取加密货币。

Nine Chronicles:Nine Chronicles 是一款去中心化的卡牌类格斗 RPG游戏。

Chibi Clash:Chibi Clash构建一个以其旗舰自动格斗游戏为中心的Web3游戏世界。 Chibi Clash Auto Battler 的灵感来自炉石战场的游戏玩法和冒险岛的艺术风格,是一款异步 PvP 游戏,玩家可以在其中招募、升级和派遣部队参战。

Primodium:Primodium 正在构建一个完全链上、开源、可组合的游戏,玩家的目标是获得地图控制权、研究技术并扩大其工厂。

Starbots:Starbots 是一款机器人对战 NFT 游戏,玩家可以在其中创建幻想机器人来对抗其他竞争对手,然后收集 NFT 物品和代币。

Legends of Venari:Legends of Venari 是一家区块链游戏初创公司,创建了一款探索性生物集合角色扮演游戏。在《Legends of Venari》中,玩家可以在玩家驱动的沙盒中,诱捕、驯服和收集 Venari 生物,争夺地盘和稀有资源。

Force Prime:Force Prime 是一个全链策略类Web3游戏平台,提供多人英雄战斗体验。玩家可以培养和定制自己的英雄,与全球玩家进行对战。

Amihan:游戏工作室FARM FRENS的第一个游戏,TG休闲农场小游戏。

Wildcard:Wildcard 是面向游戏玩家、粉丝和收藏家的基于Web3卡牌收集游戏。

3. Crypto 投机类:

定义:聚焦于满足用户的Crypto投机需求的相关产品;

数量:3个;

具体项目:

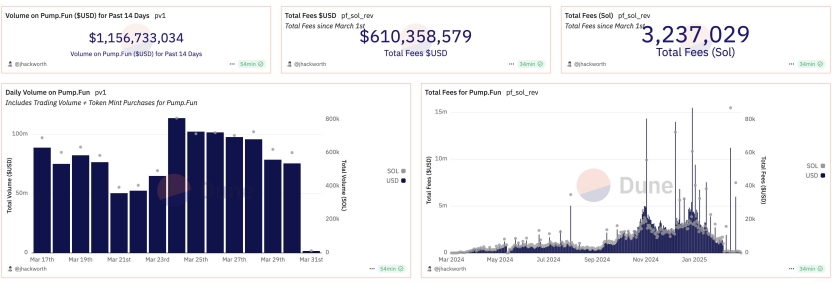

Pump Fun:Pump 是一个 meme 币启动平台,用户可以推出一种可以立即交易的代币,而无需提供流动性。

Moonshot:Moonshot 是一个发现、购买和销售 Meme 币的平台,支持用户使用信用卡和借记卡进行现金存款,以及通过银行转账随时兑现资产。

Candlestick:Candlestick 是一种由可操作交易信号和预测提供支持的加密机会雷达,提供了有关最大涨幅、最大跌幅和交易量最高代币的大量数据。

4. SocialFi 类:

定义:Tokenize用户的在社交媒体平台的影响力,形成新的投机标的项目;

数量:6个

具体项目:

fantasy.top:Fantasy是一款SocialFi交易卡游戏(TCG),玩家可以使用推特平台的加密领域影响者的交易卡在线游戏中竞技,利用他们的社交资本和研究专长来实现货币化。

0xPPL:面向加密货币原生用户的去中心化社交网络,聚合用户在Lens、Farcaster和Twitter上的内容,并封装一些Crypto功能。

time.fun:time.fun 是一个时间代币化平台,允许时间持有者与粉丝建立联系。随着时间持有者为粉丝提供更多价值,他们的时间价值自然会因市场需求而增加。每当有人交易他们的时间时,时间持有者都可以从交易费和赎回中赚取 ETH。

fam.:Fam 是一个web3原生社区中心,用于发现、组织和享受web3家庭的活动。fam.使用链上身份,让用户无论身在何处,都可以轻松地找到和收集同伴持有者。

Tribe.run:Tribe 是一个基于 Solana 的加密社交协议。SocialFi,私有群,进群进群需要token,可投机,可以开视频或语音直播等。

EarlyFans:EarlyFans 是 Blast L2 上的 SocialFi 产品,创作者可以通过EarlyFans做出公开承诺,并拍卖该承诺,同时粉丝也可主动发起行贿,并拍卖行贿权,若创作者拒绝或过期,则退回所有资金。

5. 创作者经济类:

定义:为内容创作者(文字、视频、艺术等)提供新的经济模型的Web3内容分发平台;

数量:2个;

具体项目:

Koop:Koop使任何创作者、收藏家或社区能够通过NFT艺术或收藏家通行证来组织和筹款。来自收集者通行证的资金形成每个社区的国库(或银行),以支持他们在链上的项目和任务。然后,社区可以直接管理他们的财务,利用其成员的独特技能,并以有趣和社交的方式管理他们的组织。

CreatorDAO:CreatorDAO 是一个去中心化的自治组织 (DAO),专注于加速创作者的职业生涯,并赋予他们对资本、技术和社区的共享访问权。 CreatorDAO 为创作者提供指导、发展品牌所需的专业工具以及为彼此的成功投资的社区。

6. 财务类:

定义:旨在降低用户对Crypto的使用与管理成本的产品,例如出入金;

数量:3个;

具体项目:

Hana Network:Hana Network 是一个具有社交网络效应的超休闲金融体系,并推出了法币出入金解决方案 Hana Gateway,Hana Network 旨在通过现有开放式社交网络实现用户驱动的分发。

P2P.me:去中心化的印度出入金平台,链下部分通过声誉系统提高安全性,通过ZK提高隐私性。

Offramp:Offramp 是一种去中心化的去中心化法币通道协议,使世界上任何人都可以快速启用/退出加密货币,完全自我托管资金、无需 KYC 和低费用。

7. 工具类:

定义:解决用户实际生活问题的产品,例如Web3地图;

数量:1个;

具体项目:

proto:印度版Google maps,Proto 是一个用户生成、代币激励的地图平台,旨在改变地理空间数据行业。通过去中心化的数据收集,Proto 能够以传统方法成本的一小部分提供高质量的实时地图数据。Proto 独特的方法使它能够轻松渗透密集、复杂的区域,为企业提供满足其需求的准确和最新的数据。

从投资偏好的发展趋势来看,Alliance DAO从2021年开始对Consumer类项目的投资与孵化,在2021~2023上半年,其主要投资与孵化方向侧重于Games和创作者经济类项目。自2023年下半年开始直到2024年,其偏好切换为Crypto投机类、SocialFi类以及财务类。

笔者追踪了Alliance DAO公开发表的一些文章、Podcast等内容,总结其关于Web3消费者赛道的投资理念,具体如下:

1. 首先其认为生态基础工具已经日趋完善,需要更多应用层为生态带来真正的价值获能力;

2. 创始团队应以PMF为主,通常情况下在市场验证过程中通常面临两方面风险,产品侧风险和市场侧风险,Consumer项目的市场侧风险更大,因此需要考虑避免过早引入Token,使得PMF验证结果失真。

3. Web3消费者应用的目标用户可以按照对Web3的接受度坐标来划分,左侧为非Web3普通用户、右侧为Web3 Native用户,针对左侧用户的应用设计中Web3元素主要是通过“广告代币“降低获客成本,抢占更多市场份额,右侧用户则需围绕资产化新的标的,带来额外的投资、投机需求,或解决Web3原生用户的独特需求。从结果上来看,目前其偏好更偏重后者。

4. 明确Solana生态与EVM生态的用户画像不同,前者更有利于Consumer应用成功,原因有四点:

- 更具活力的社区:Solana用户对于新项目的参与热情很高,特别是对具备投机潜力的项目,可能和财富效应有关;

- 更强且高效的生态资源支持:Solana生态核心成员更拥抱社区,具备极强的社区调动能力,且对新项目的支持响应更迅速。

- 更快和低成本的基础设施:旨在打造链上纳斯达克,交易成本低、确认速度很高,且由于基础组件不分散、且更追求易用性,因此新用户的学习成本相对低。

- 更高的产品竞争壁垒:由于采用了非EVM的技术选型,Solana DApp的Copy成本更高。

什么是Web3消费者应用

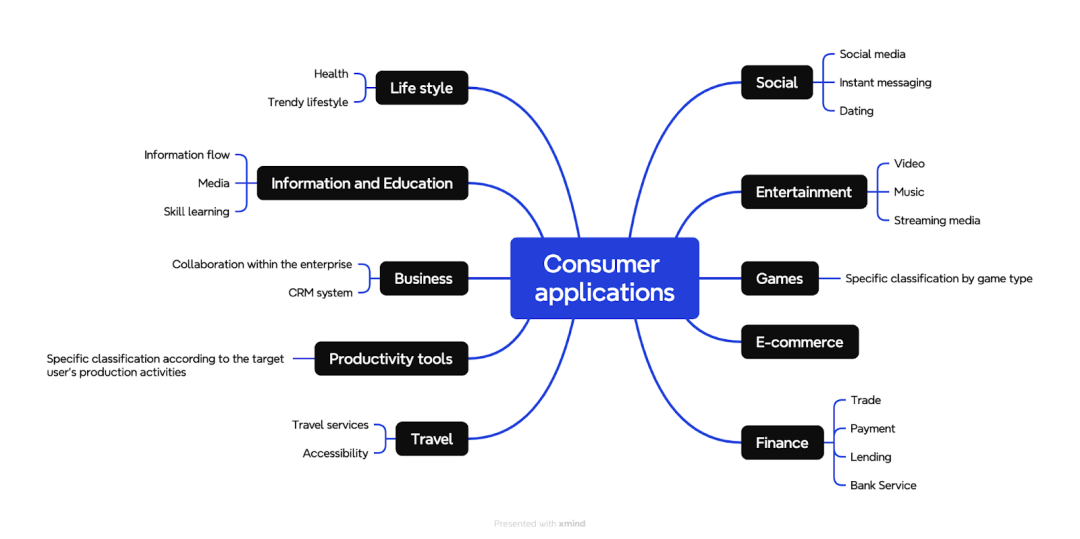

所谓的消费者应用,也就是中文语境下的To C应用,这就意味着你的目标用户是大多数普通消费者,而非企业级用户。打开你的App Store,里面所有的应用都属于这一范畴。而Web3消费者应用则指的是那些具有Web3特征的面向消费者的软件应用。

通常情况下,按照大多数App Store中的分类,我们可以将整个消费者应用赛道大致分为以下10个类别,并且每个类别又会有不同的细分。当然随着市场的成熟,很多新型产品为找到各自的差异性卖点,都会在一定程度上组合多个特征,不过我们仍可以按照各自的核心卖点做简单的归类。

Web3消费者应用范式及其机遇和挑战

根据对Allinance DAO投资理念的分析以及自身的观察,笔者认为存在三种常见的Web3 消费者应用的范式:

1. 利用Web3基础设施的技术特点,优化某些传统消费者应用存在的问题:

这是一个比较常见的范式,我们知道Web3行业大量的投资都围绕在基础设施建设上,而采用这种范式的应用创建者希望利用Web3基础设施的技术特性,增强自身产品的竞争优势,或提供新的服务。通常我们可以将这些技术创新方向带来的好处归为以下两类:

极致的隐私保护和数据主权:

机会点:隐私赛道一直是Web3基础设施创新的主旋律,从最初非对称加密算法的身份确认系统,逐渐整合了众多软硬件技术,例如ZK、FHE到TEE等。Web3中的一众技术大咖似乎秉持着极端的性恶论,旨在创建一个完全不依赖第三方信任的网络环境,并为其中的用户提供信息或价值交互的能力。而这种技术特点最直接的好处是为用户带来了数据主权,个人隐私信息可以直接托管在本地可信的软硬件设备中,避免了隐私信息的泄露。而针对这个技术特点优化的Web3 消费者应用很多,任何标榜自己是去中心化XX的项目均属于此类范式,例如去中心化的社交媒体平台、去中心化的AI大模型、去中心化的视频网站等等。

难点:经过多年的市场验证,可以说依此作为核心卖点在市场竞争中并没有观察到明显的优势,原因有二,其一消费者用户对隐私的重视是建立在发生大规模的隐私泄露与侵权事件的基础上,但在大部分情况下,通过更完善的法律法规的制定,是可以有效缓解该方面问题,因此若对隐私的保护是建立在更复杂的产品体验或更昂贵的使用成本上时,其竞争力将明显不足。其二我们知道,当前大部分的消费者应用的商业模式是建立在大数据提取价值之上,例如精准营销等。过度强调隐私保护会动摇主流的商业模式,因为用户数据将分散在一批数据孤岛中,这就为设计可持续商业模式带来了难度,若最终只能依赖于所谓“Tokenomics”,则不得不为产品引入不必要的投机属性,这一方面分散了团队的资源与精力,用于应对此属性对产品造成的影响,另一方面对于寻找PMF是不利的,在下文将具体分析。

低成本的全球全天候的可信执行环境:

机会点:众多L1和L2的出现为应用开发者们提供了一个全新的、全球化、全天候运行的多方可信的程序执行环境。通常情况下,传统的软件服务商独立维护自身的程序,例如运行在自己的服务器集群或云上,这自然在涉及多方协作的业务,特别是多方之间实力或规模处于均势,或涉及的数据特别敏感和关键时带来了信任成本,而这种信任成本通常都会转换成极大的开发成本和用户的使用成本,例如跨境支付等场景。而利用Web3带来的执行环境,可以有效降低开着此类服务的相关成本。稳定币就是此类应用的一个很好的例子。

难点:从降本增效的角度来讲,这的确是一个具有竞争力的优势,不过对应用场景的挖掘是比较困难的。如上文所说,只有在某个服务中,涉及多方协作,且相关主体各自独立,规模处于均势,且涉及的数据特别敏感,使用该执行环境才带来了好处,这是个比较苛刻的条件。目前看来,此类应用场景大部分集中在金融服务领域。

2. 利用加密资产,设计新的市场营销策略、用户忠诚度计划或商业模式:

与第一点类似,采用这种范式的应用开发者也是希望通过引入Web3属性,在一个相对成熟的、得到市场验证的场景中,为自己的产品增加竞争优势。只不过这部分应用开发者更看中通过引入加密资产,并利用加密资产的极高的金融属性,设计更好的营销策略、用户忠诚度计划、商业模式。

我们知道任何投资标的都有两种价值,商品属性和金融属性,前者与该标的在某个实际场景中的使用价值有关,例如房地产资产的可居住属性,而后者则与其在金融市场中的交易价值有关,这种交易价值在加密资产领域通常来源于可流通、高波动带来的投机场景。而加密资产正是一种金融属性远高于商品属性的资产类别。

而在大多数此类应用开发者眼中,引入加密资产,通常可以带来三个方面的好处:

通过Airdrop等基于Token的市场营销活动,降低获客成本:

机会点:对于大部分消费者应用来说,如何在项目早期,低成本的获客是一个关键问题。而Token凭借极高的金融属性,且又是凭空创造的资产,可以显著降低早期项目的风险,毕竟相比于直接用真金白银买流量,做曝光,用零成本创造的Token做用户捕获的确是一个性价比更高的选择,从某种角度上讲,此类Token类似于一种广告Token。采用这一范式的项目不在少数,例如大部分的TON生态项目、小游戏均属此范畴。

难点:这种获客手段主要面临两方面的问题,其一借此获取的种子用户转化成本极高,我们知道此方案吸引来的用户大部分都是加密货币投机者,所以这部分用户对项目本身的关注并没有那么强,更多的是冲着奖励潜在的金融属性参与进来,况且当前存在大量的职业空投猎人,或撸毛工作室,这就为后期将其转化成真正的产品使用者带来了极大的困难。而且有可能会造成项目对PMF的误判,从而造成在错误方向上的过度投入。其二随着此类模式的大量应用,利用Airdrop获客的边际收益缩小,这就意味着若想要在加密货币投机者群体中建立足够的吸引力,成本逐步垫高。

基于X to Earn的用户忠诚度计划:

机会点:留存促活,是另一个消费者应用关注的问题,如何保证用户持续使用你的产品,需要耗费很大的精力与成本。与市场营销类似,利用Token的金融属性,降低留存促活的成本,也成为大多数此类项目的选择。比较有代表性的模式就是X to Earn,对预先设定的关键用户行为基于Token的奖励,以此为基础建立用户忠诚度计划。

难点:依赖用户赚取收益的动机促活,会使用户对产品的关注点从产品功能本身转移到收益率上,因此如果潜在收益率下降,用户的关注度也将快速流失,这对消费者应用,特别是一些依赖大量UGC的产品来说,是极大的伤害。而收益率若建立在自己发行Token的价格之上的话,就对项目方产生了市值管理的压力,特别在熊市阶段,不得不承担高昂的维护成本。

利用Token的金融属性直接变现:

机会点:对于传统消费者应用来说,最常见的商业模式有两种,其一是免费使用,利用大规模采用后的平台流量价值变现,其二是付费使用,若想使用产品中的某些Pro服务,需要支付一定的费用。然而前者前者周期较长,后者难度较大。因此Token带来了一种新的商业模式,即利用Token的金融属性直接变现,也就是项目直接卖币套现。

难点:可以很明确地说,这是一种不可持续的商业模式,原因在于当项目发展度过早期高成长阶段后,由于缺乏增量资金流入,这种零和博弈的模式将不可避免的让项目方的利益站在用户利益的对立面,加速用户流失,若不主动套现,由于缺乏健壮的现金流营收,项目方只能依赖融资获取资金维护团队或业务扩展,而这又会陷入眼中依赖市场环境的窘境中。

3. 完全服务于Web3原生用户,解决该部分用户的独特痛点:

最后一种范式,指的是那些完全服务于Web3原生用户的消费者应用。按照创新方向划分可大致分成两类:

构造新的叙事,围绕Web3原生用户的某些未被挖掘的价值元素,进行货币化设计,创造新的资产类别:

机会点:通过为Web3原生用户提供新的投机标的(例如SocialFi赛道),其好处在于,在项目初始阶段即拥有了对某种资产的定价权,从而获得垄断利润,而这在传统行业中需要经过激烈的市场竞争,构建起强劲的竞争壁垒后才可以达到。

难点:坦率的说,这种范式比较依赖团队资源,即是否可以获得在Web3原生用户中,具备极强号召力,或者说具备加密资产“定价权“的人或机构的认可和支持。这就带来两方面困难:其一随着市场的发展,加密资产的定价权是在不同群体间动态转移的,例如从最初的Crypto OG,让渡给了加密VC、再到CEX、再到加密KOL、最后到传统政客、企业家或者名人。在这个过程中,是否能够在每次权力过渡时识别趋势,与新贵建立合作,对团队资源和市场敏感度产生了极大的要求。其二为了与“定价者“建立合作关系,通常需要付出极大的成本与代价,因为在这个市场中,你并不是在某个应用赛道中,与其他对手争夺更大的市场份额,而是与其他所有加密资产创建者,共同竞争“定价者“的偏好,而这是一个竞争非常激烈的游戏。

通过提供新的工具化产品,服务于Web3原生用户在参与市场的过程中未被满足的需求。或从用户体验角度为这部分用户提供更好、更方便的产品:

机会点:随着加密货币的逐步普及,该部分用户群体总体基数将逐步扩大,这为用户细分带来了可能。且由于聚焦于某一用户群体真实需求,此类产品往往比较容易达到PMF,从而建立更健壮的商业模式,例如一些交易相关数据分析平台、Trading Bot、资讯平台等。

难点:由于回归到真正的用户需求,产品的发展路径虽然更健壮,但建设周期要比其他范式项目更长,且由于此类项目非叙事驱动,而是具体需求驱动,产品的PMF比较容易验证,在项目早期通常无法获得大额的融资,因此在纷繁复杂的“发币“或高估值融资带来的财富神话中保持耐心,坚守初心,是一件很难的事情。

对Web3消费者应用投资理论的思考

接下来介绍一下我们对Web3消费者应用赛道投资理论的思考,大致可以分为五个核心观点:

1. 如何超越投机周期是Web3消费者应用首要考虑的问题

作为上一轮周期内最成功的Web3消费者应用之一,Friend.Tech的发展路径可以给我们很大的启示。根据Dune的数据,Friend.Tech目前累计Protocol Fee达到$24,313,188。累计用户(Trader)总数达到918888个。对于一个Web3应用来说,这个数据表现是十分亮眼的。

然而目前这个项目的发展却遭遇了比较大的挑战,究其原因是多方面的。首先在产品设计,Friend.Tech引入Bonding Curve的设计,为社交应用引入了投机的属性,短期内依靠财富效应吸引了大批用户的使用。然而从中长期来看,这种做法也提高了用户进入社区的门槛,这与目前大部分Web3项目或KOL依赖公域流量建立影响力的做法相悖。除此之外,Friend.Tech将代币与产品的实用性做了过度的捆绑,导致其产品中Web3投机用户过多,让用户脱离对产品的实用性的关注,最终导致现在的局面。

因此对于大部分Web3消费者应用来说,在累计大量用户之后,需要仔细思考如何找到PMF,保持用户参与度,帮助项目超越投机周期,并构建可持续的商业模式。如果可以有效解决这些问题,Web3消费者应用才能获得真正的Mass Adoption。

2. 在投资过程中,如何评估Web3消费者应用?

总的来说,对Web3消费者应用的投资评估主要从两个方面入手,第一个方面是从产品的运营数据分析其市场潜力。大致可以分为两个维度:

- 用户数据:对于大部分消费者应用来说,用户数据永远是最重要的,因为充足的用户群体是消费者应用探索商业模式的前提。因此与大部分传统的Web2消费者应用评估类似,我们可以从活跃用户数、用户增长率、用户留存率等传统的评估指标,以判断其是否找到PMF。除此之外对于不同类别、不同阶段的Web3消费者应用,其侧重点也会有所不同。以Web3 Social类应用为例,用户留存率会显得更为重要。投资人普遍会从niche market入手,当发现一个应用在具有独特特征的用户范围内具备极强的留存率时,则说明其具有投资价值。当然在评估过程中也需要仔细甄别数据中的水分,以避免bot用户对PMF的误判。

- 转化数据:除了用户数据外,也需要通过转化数据来判断其潜在商业价值,例如AUM和User spend等。如果项目拥有很多用户,但是AUM较小,或单个用户的平均花费较小,则说明商业化价值比较有限。当然并非所有营收数据都一样,收入质量也会有很大差异,如果营收结构是建立在真实收入的基础之上,则表明这里的用户是在为他们提供的产品付费,而不是为了挖掘他们的代币,这样的商业模式会更具可持续性。

第二个方面则是对团队的判断,主要聚焦三个方面,首先是团队的技术实力,这是他们能够建立产品护城河,从而形成竞争优势的核心。其次是团队需要有极强的市场嗅觉,且具有强大的开放性,能够及时识别市场机会,哪些用户的需求未得到满足,并及时调整业务方向。最后团队资源也是比较重要的,例如与其他应用的合作关系,与KOL的合作关系等,这决定了发行过程的成功率。

3. 如何定义一款成功的Web3消费者应用

从投资者的角度来看,如何定义一款成功的Web3消费者应用也是一个有趣的问题,或者说Web3消费者应用的成功究竟是营收驱动还是代币价格驱动?总的来讲,这两者是相互联系的,假设一个项目无法持续产生收入,那么到最后,其发行的代币就没有多少未来。但这个评估标准也主要取决于你的投资期限,如果整体投资期限较短,则对代币价格的判断更为重要,此时对代币经济学的判断。而如果是长期价值投资,则从营收数据表现,以及营收结构的可持续性则更为重要。

4. “应用工厂模式“或许是Web3消费者应用更具确定性的经营策略

参考中国的Web2行业发展,字节跳动开发了很多成功的消费者应用,他们的经营策略是不断试错,开发大量不同类型的产品,由市场选择几个成功的方向,并继续投入资源,扩展其业务。而对于他们来说,这种策略成功的关键是他们已经累计了大量的用户资源,降低了其试错成本。而这个经验是可以被应用到Web3行业的。

因此从这个角度来说,Friend.Tech等类似的项目在这个周期还是有机会的,至少他在短期内呈现出了吸引力,吸引了大量用户,且拥有不错的营收能力,这些将帮助他们成为Web3应用工厂,因此其后续的发展也是值得关注的。

5. 下一个成功的Web3消费者应用具备哪些特征?

我们认为下一个周期内,成功的Web3消费者应用会以以下三种范式出现,首先第一种范式是首先是凭借着产品的趣味性,优先吸引一些加密KOL的采用,再利用KOL自身的影响力,将其粉丝带入平台,帮助项目完成冷启动。这一范式比较具有代表性的就是Kaito,团队通过极强的技术能力,以及创新的激励机制,使其控制了加密社区中的大量mindshare,帮助他们在不同社区中具有良好的渗透力,与此同时其切中了Web3项目在市场营销过程中如何有效获取用户的痛点,在累计了大量的C端用户,并通过mindshare为每个用户建立了精准的用户画像,帮助Web3企业通过Kaito平台进行精准营销,这将使其商业模式更加具有可持续性,摆脱短期投机周期。

第二种范式是从Web3用户的真实需求出发,依靠产品力直接赢得市场。由于没有过早引入Token,则将使其在PMF的过程中摆脱投机用户的干扰,建立更高的用户留存率,例如Polymarket、Chomp等。

第三种范式则是商业模式的创新。在这一点上Grass给了我们很大的启示,其利用用户的闲置计算资源,帮助他们在人工智能等领域找到价值捕获来源,并利用代币将其货币化。虽然从业务模式上,Grass更多的是偏向2B模式,但这种“共享经济“的思维也可以被用于Web3消费者应用的设计中。

6. 哪些类别的项目更容易成为加密行业中第一批找到PMF的Web3消费者应用

目前结合市场趋势与投资人偏好来看,接下来最容易找到PMF的Web3消费者应用可能会从以下几个类别中出现:

首先Web3社交类应用仍然被市场看好,我们知道Web3项目大都非常看重并依赖社交媒体进行市场营销,且相比于传统投资者来说,加密货币投资者也更喜欢利用社交媒体获取信息并形成价值网络。因此Web3社交类应用的重要性便不言自明。通过资产化或小众市场需求的发掘,并吸取friend.tech的经验教训,引入更加可持续性的商业模式以及更强的用户留存率,将帮助Web3社交类应用摆脱过度投机的质疑,找到PMF。

其次链上交易工具类应用也具备不错的潜力,随着MEME的持续发展,投资者对链上交易的关注度也越来越大,OKX Wallet、GMGN等链上交易工具的爆火证明了市场对此需求的旺盛。而伴随着主流交易工具的大规模采用,同质化交易策略的收益率将出现下降的趋势,因此用户的定制化需求将不断增高。如果能够为这部分用户提供差异性链上交易工具或投资策略,相关产品的市场潜力也是不错的。

支付类应用也是未来值得期待的类目之一。随着前段时间支付型稳定币相关法案的通过。支付类应用在之前所承载的监管压力得到释放。因此我们有理由相信。在未来一段时间内,Web3支付类应用将凭借着区块链技术带来的低成本、高结算效率等优势,在跨境支付、闲置资金理财等场景构建竞争壁垒。

最后DeFi的发展也值得关注,首先作为为数不多目前找到PMF的场景之一,DeFi已经成为Web3行业中不可或缺的一个类别。我们从Hyperliquid的成功可以看出用户对去中心化属性仍具有需求,随着基础设施的日益完善,以往去中心化应用的性能限制将被突破。在具备高频交易等对执行效率有较高要求的金融应用场景中,DeFi将带来与CeFi产品一样的性能表现,因此我们有机会看到会有更多类似Hyperliquid的产品,冲击原有CeFi体系。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。