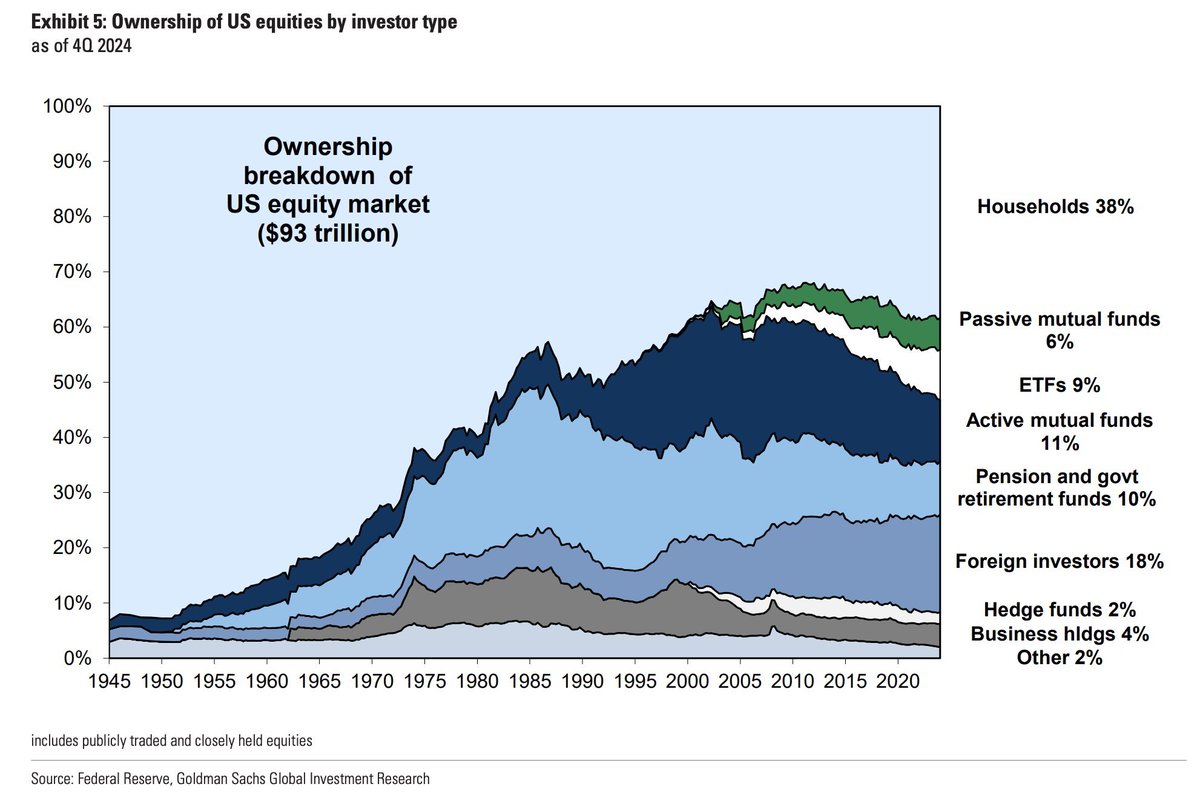

This is an interesting Goldman Sachs report that points out the distribution of various types of investors in the $93 trillion U.S. stock market.

• Households: 38% (largest shareholders)

• Passive mutual funds: 6%

• ETFs (Exchange-Traded Funds): 9%

• Active mutual funds: 11%

• Pensions and government retirement funds: 10%

• Foreign investors: 18%

• Hedge funds: 2%

• Corporate holdings: 4%

• Others: 2%

There are a few interesting changes, which may also reflect what the crypto market is experiencing:

1️⃣ Long-term decline of household investors (de-retailization)

• 1945: Households accounted for over 90%

• 2024: Only 38% remain

• "Institutionalization" marks the beginning of all financial markets transitioning from grassroots to regulation, with household investors no longer dominating the market, and the influence of institutions and funds significantly increasing.

2️⃣ Increase in foreign investor share

• The proportion of foreign investment grew from less than 5% in the 1980s to nearly 18% in 2024

• The globalization of capital and trade is an inevitable outcome of any economic prosperity and development.

3️⃣ Decline in active fund proportion

• Once dominant for decades, now only 11% remain

• Active management is increasingly struggling to outperform indices, leading investors to prefer low-fee passive products, such as various types of ETFs.

However, under the current backdrop of unstable policies and severe breaches of trust, foreign capital and household investors are also becoming major factors influencing market instability and high volatility. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。