Source: Cointelegraph Original: "{title}"

Xapo Bank in Gibraltar, a private bank and Bitcoin custodian, reported a surge in Bitcoin trading volume in the first quarter as its high-net-worth members bought large amounts of Bitcoin amid market turmoil.

Xapo Bank stated that trading volume in the first quarter increased by 14.2% compared to the fourth quarter of 2024, with the drop in Bitcoin prices helping to drive the increase in trading volume on its platform. The bank noted that during the price decline, its high-net-worth members were "actively buying," reflecting their "commitment" to Bitcoin's long-term potential.

In the first quarter of 2025, Bitcoin experienced its worst start since 2018, closing down 13% for the quarter.

This crypto-friendly bank became the first licensed bank in the UK to offer interest-bearing Bitcoin and fiat bank accounts in 2025 and launched Bitcoin-backed dollar loans of up to $1 million in March 2025.

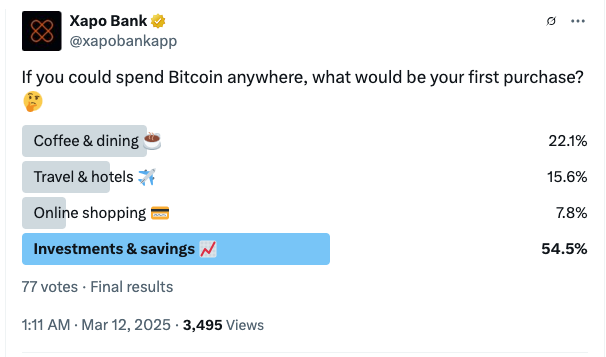

Xapo Bank's self-selected survey on X showed that respondents tend to use Bitcoin for savings and investment. Source: Xapo Bank

It also recorded a 50% increase in euro deposits during the quarter. "This rapid growth in trading volume occurred amid growing concerns about the future of the dollar's dominance and the threat of a U.S. economic recession, as the market prepared for Trump's planned 'Liberation Day' in April," the bank stated.

The stablecoin deposit patterns of Xapo members also saw significant changes, with USDC deposits increasing by 19.8% in the first quarter, while Tether (USDT) deposits fell by 13.4%. This change occurred as European cryptocurrency exchanges delisted Tether to comply with crypto asset market regulations.

"Data from Xapo Bank members indicates that despite facing short-term headwinds, the overall outlook for Bitcoin remains strong, and the current volatility has not diminished Bitcoin's significance," said Gadi Chait, Xapo Bank's investment director.

Chait added, "While global events paint a picture of volatility, the opportunity for Bitcoin has always been in its long-term performance rather than short-term fluctuations."

Cryptocurrency exchange Bitget's trading volume surged in the first quarter

Market turmoil also prompted digital currency exchange Bitget to undertake a series of activities, according to its transparency report for the first quarter of 2025.

Bitget's total trading volume reached $2.1 trillion in the first quarter of 2025, with spot trading volume increasing by 159% to $387 billion.

This surge in trading volume occurred as Bitget's total user base grew by nearly 20%, with the exchange adding 4.89 million users to its centralized exchange and 15 million users to its Bitget wallet app, bringing its total global user count to over 120 million.

Bitget's CEO Gracy Chen stated that the exchange will continue to "focus on institutional-grade infrastructure and double down on expanding its Web3 presence through our ecosystem."

In February, Bitget lent 40,000 Ethereum (ETH), worth about $100 million, to rival exchange Bybit after Bybit suffered a major hacking incident. The loan has been fully repaid by Bybit.

"No interest, no collateral—this was just to support a peer in need. I'm glad to see Bybit fully recover; we never doubted the repayment of the loan," Chen said.

Related articles: Will Bitcoin holders be the reason more countries impose wealth taxes?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。