一、引言

特朗普重返白宫后,迅速兑现其竞选期间关于关税的强硬承诺,掀起了一场前所未有的关税风暴,被外界形容为挑起了“关税战2.0”,引发了传统金融市场和加密货币市场的剧烈震荡。比特币与整个加密货币市场在此重压下经历大幅回落,众多加密项目面临着艰难的考验。本文将剖析特朗普关税新政的具体措施、宏观传导机制、美国关税政策后续走向以及其对加密市场造成的深远影响,帮助投资者全面洞察其中的风险与机遇。

二、特朗普重返白宫以来的关税政策

2月:抛出关税大棒

(1)针对北美:2月1日,美国宣布对所有来自加拿大和墨西哥的进口商品加征25%的关税(其中对加拿大的能源资源征收10%关税),以施压两国加强边境安全、移民控制和打击毒品走私。加拿大随即宣布对数十亿美元的美国产品加征25%的报复性关税,墨西哥也计划出台报复措施。

(2)针对中国:同日特朗普宣布对所有中国输美商品加征10%关税,2月4日生效。这一举措被宣称是为向中国施压,要求其采取行动遏制芬太尼等毒品走私进入美国。特朗普还签署行政令,取消了原本针对中国和香港低价值商品(低于800美元)的免税政策,即这些小额包裹也需缴纳新的10%关税。这些初步措施标志着特朗普政府新关税政策的开始。

3月:关税谈判拉锯

(1)NAFTA关税风波:3月4日,特朗普政府对墨西哥和加拿大生产的所有商品正式开征25%关税。加拿大立即宣布对美国产品同步加征关税回应,墨西哥也表示将制定报复措施,这引发了新一轮贸易战担忧。仅一天后,3月5日,特朗普又暂时豁免了对加拿大、墨西哥汽车的关税一个月,以缓解美三大车企的压力。3月6日,特朗普签署行政令,将针对墨加两国的关税全面推迟至4月2日实施,以便继续谈判。加拿大和墨西哥因此暂缓了原定的反制计划。尽管出现短暂缓和,3月7日特朗普转而威胁对加拿大木材和乳制品征收新关税,批评加拿大长期对美国农产品课征高关税,并表示美国将以对等关税回应。特朗普直言“未来关税方面会有更多变化和调整”,这一系列反复举措凸显了特朗普政府关税政策的激进和多变,在短时间内动摇了北美自由贸易关系的稳定基础。

(2)钢铝关税回归:特朗普政府还于3月恢复了对全球钢铁和铝产品的高关税。3月12日起,美国重新对进口钢铁加征25%、铝加征10%的关税(基于232条款的国家安全理由),这实际上是特朗普第一任期曾实施措施的“卷土重来”。作为回应,欧盟自4月1日起对美国产钢铝产品实施了4.4%至50%不等的报复性关税。

4月:关税战升级

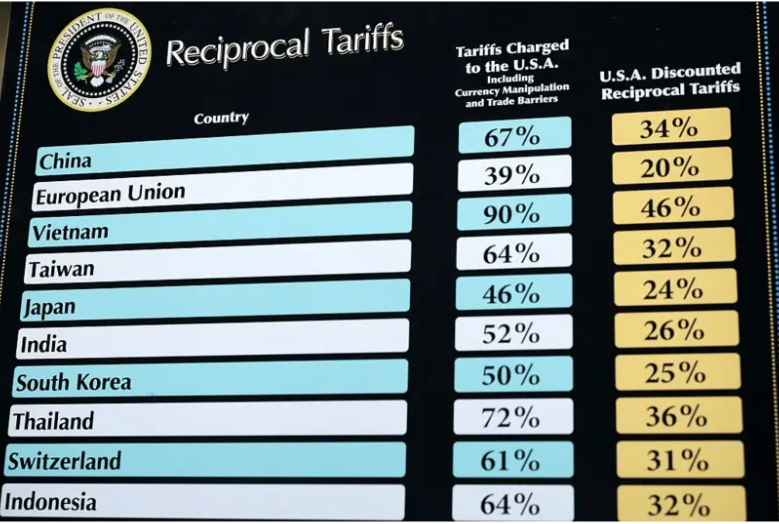

“解放日”普遍关税:4月2日,特朗普在白宫宣布了新一轮强硬的关税措施,被称为“解放日”关税。他签署两项关于“对等关税”的行政令:

(1)普遍征税:自4月5日起对全球185个国家的所有进口商品一律额外征收10%的“普适性”关税。这意味着除少数豁免外,美国对绝大多数进口产品都增加了10%的从价税。美墨加协定(USMCA)伙伴加拿大、墨西哥暂时被豁免这10%普遍关税,小额电商包裹(<800美元)也暂缓征税,以减少对日常消费的冲击。

(2)对等加税:对于与美国存在巨大贸易逆差的经济体,美国在10%基础上施加更高的对等关税税率,自4月9日起生效。具体国家和税率包括:中国34%、欧盟20%、日本24%、韩国25%、中国台湾32%、印度26%、泰国36%等。同时,对所有进口汽车及零部件额外征收25%的关税,自4月3日起实施,旨在推动汽车产业“回流”美国。本轮关税几乎将全球主要贸易国一网打尽,范围之广、税率之高前所未有,被形容为投下了“关税核弹” 。

如此剧烈的关税攀升无疑在全球范围内引发强烈震荡,各国纷纷表态反制:4月3日,欧盟、加拿大明确表示“准备好采取报复措施”,日本则急欲寻求豁免;4月4日中国宣布征收34%关税进行对等反制。随后,特朗普威胁额外再加50%,再加上此前征收的20%,总额上升到104%。中国同日再宣布反制措施,4月10日起将对所有美国进口商品再加50%关税,加征关税税率提高到84%。美国与以中国为代表的主要经济体间形成了你来我往的全面贸易冲突局面。

距离美国正式对数十个贸易伙伴征收高额对等关税不到24小时,特朗普突然改变了立场。4月9日特朗普表示鉴于超过 75 个国家已致电美国的代表机构进行磋商,宣布暂停实施新关税90天,在此期间,普遍关税将降至 10%,暂停措施立即生效。90 天关税暂停不适用于美国针对墨西哥和加拿大的关税。同时将把对中国商品的关税从104%提高到125%。

三、关税政策影响加密市场的传导机制

特朗普的新关税政策不仅改变了国际贸易格局,也通过多重宏观经济渠道影响着比特币等加密货币市场。关税作为重要的宏观政策工具,会在经济增长、通胀、资本流动、汇率以及市场情绪等方面产生连锁反应,进而传导到加密资产价格。具体机制如下:

经济减速与通胀担忧:大规模关税相当于对进口商品加税,直接推高了企业和消费者的成本。这将抬升通胀压力并拖累经济增长。通胀预期走高叠加经济减速,对市场而言是危险信号,投资者往往转向传统避险资产。事实证明,在关税不确定性上升的情况下,今年以来投资者更青睐黄金而非比特币等新兴资产:4月初国际金价一度突破每盎司3,150美元的历史高位。虽然比特币被视为抗通胀“数字黄金”,然而市场表现显示,其投机属性暂时压倒了避险属性,通胀引发的避险需求主要流向了黄金等传统资产 。

美元流动性收紧与变现需求:贸易战扰乱全球供应链和贸易往来,可能导致美元流动性趋紧。进出口下滑会减少贸易项下的美元供给,而贸易不确定性令企业和投资者更倾向于持有现金,提高美元需求。这种情况下,部分机构和投资者可能被迫变现资产来筹措美元现金。,身处股市大跌环境中的一些投资者可能会抛售加密货币持仓换取现金。这样的抛压加剧了币价下行。避险情绪也可能推高美元汇率,令以美元计价的比特币价格承压。目前来看,关税冲击下市场预期美联储将更早降息以支撑增长,这推动美债收益率急跌(美国10年期国债利率在关税消息后下降了20个基点)。利率预期的变化也影响资金配置偏好:避险资金流入债市和美元资产,相对削弱了对高风险资产的配置意愿。

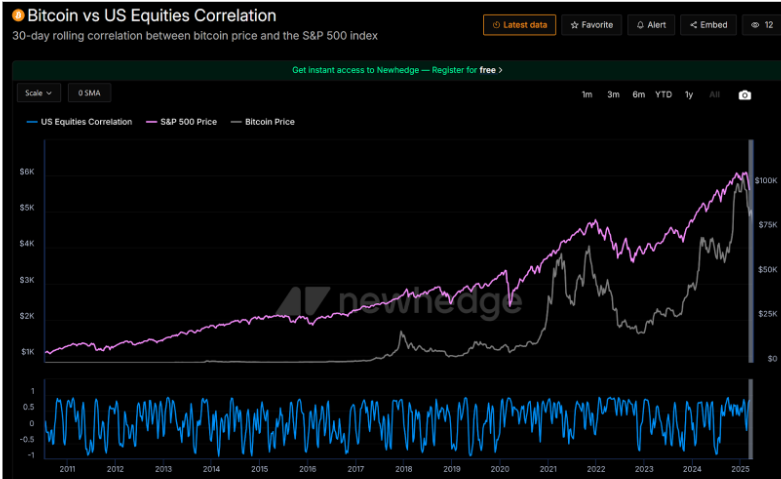

市场风险偏好与情绪转变:大规模关税被视为重大利空消息,直接动摇了全球投资者的风险偏好。特朗普关税政策引发的贸易紧张使市场不确定性飙升,投资者倾向“先卖出观望”,股市下跌与比特币下跌呈现出高度正相关,根据TradingView数据显示,比特币价格与S&P500指数的相关系数高达0.66,这表明在剧烈的风险冲击下,比特币目前被市场视作风险资产而非避风港。关税政策带来的不确定性还削弱了此前市场中的乐观情绪。特朗普在竞选和上任初期一度释放对加密货币的友好信号,使比特币在2024年底飙升至约109,000美元的高位。但关税战阴云迅速笼罩,随着贸易前景恶化、经济下行压力增大,市场的风险厌恶情绪占据上风,加密资产此前的上涨动能明显衰减。

来源:https://newhedge.io/bitcoin/us-equities-correlation

历史走势与加密资产定位的改变:加密市场对贸易冲突的反应与几年前相比有所不同。2018年特朗普首次发动贸易战时,一些投资者将比特币视作对冲不确定性的工具,曾推动其价格从当年低点约3,700美元飙升至13,000美元,上演了“逆风而上”的行情。然而当下的市场更加成熟且与主流市场联动更强。在2025年的这轮关税冲击中,比特币并未重复2018年的走强表现,反而与股票一同下跌。这表明比特币的投资者结构和市场定位正发生变化:机构投资者占比提高,交易行为更像科技股等风险资产,而非完全独立运行。这一变化也凸显了加密市场在全球金融体系中的融合度提升。

四、关税政策出台后加密市场表现分析

2025年第一季度比特币和加密市场的走势与特朗普关税政策的节奏高度相关,成交量和资金流的变化也反映出投资者情绪从乐观转向谨慎,在这样的宏观压力下,加密市场短期内进入低迷调整阶段。

2月乐观情绪降温:2024年年底至2025年初,在特朗普当选及宣称支持数字资产的利好下,比特币延续上一年的牛市行情,一度站上10万美金关口。然而,随着2月初关税消息的陆续传出,比特币价格迅速转向下跌,加密货币市场整体开始大幅下挫。至2月底,比特币价格相较1月高点已下跌约28%,跌入技术性熊市区间。整个2月,全球加密货币总市值缩水了超过1万亿美元。可以说,加密市场在第一轮关税风波中遭遇了“降温”。

3月震荡整理:进入3月,特朗普政府对墨西哥、加拿大和钢铝产品的关税政策一波三折,市场情绪随之反复。3月上旬北美关税一度生效又被推迟的消息传出后,比特币在8万美元出头的价位附近反复拉锯。一方面,暂缓对盟友关税的举措给市场带来些许安慰,风险资产出现短暂反弹;另一方面,特朗普频繁的强硬表态令投资者不敢大举进场。在整个3月,比特币价格总体在$75,000-$90,000区间宽幅震荡。

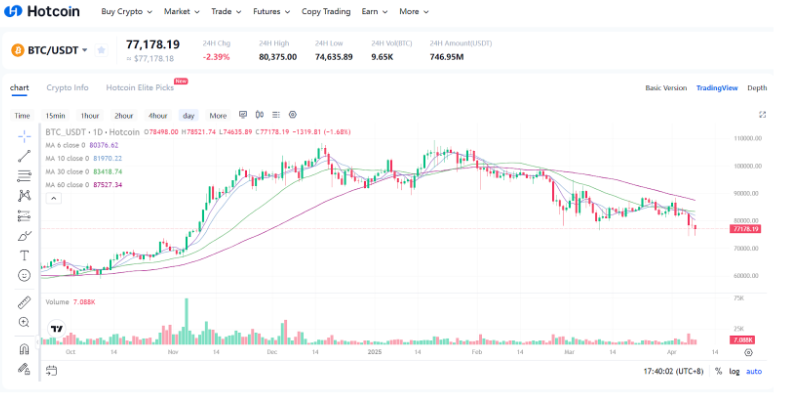

“解放日”关税引发4月剧震:4月初,特朗普正式签署全面关税行政令的消息成为导火索,引爆新一轮市场剧烈波动。4月2日全面关税方案公布当日,比特币价格先是短线异动——一度瞬间拉升至约$87,400,似乎有部分资金将其误读为通胀利好推动的买盘,但随后急转直下,最低跌至$82,000附近,日内振幅超过6%。截至4月9日,比特币延续跌势,价格一度大幅下探至$74,508,创下今年以来最低点。

来源:https://www.hotcoin.com/en_US/trade/exchange

根据CoinMarketCap数据,4月2日关税宣布当日,全球加密货币相关投资产品(如ETF)出现了约86亿美元的净流出,其中比特币ETF单日资金净流出高达87亿美元。这显示机构资金在消息公布时迅速撤离避险。另外,整个加密货币市场在关税消息扰动的这一周内市值蒸发了约5,000亿美元。同时,CME比特币期货持仓量下降,暗示部分机构投资者降低了风险敞口。以上迹象都表明,在关税政策引发的避险环境中,资金正从加密市场阶段性流出,场内流动性趋于紧张。

五、关税政策走向与加密市场行情展望

2025年初,世界经济本已处于增长放缓和通胀回落交织的局面。美国在经历2024年的加息周期后通胀有所降温,但增长动能减弱,欧洲经济徘徊在滞涨边缘,中国等新兴市场努力复苏。此时全面贸易战的爆发,无异于给脆弱的复苏前景再添阴霾。

5.1 未来美国关税政策走向

特朗普可能利用极限施压作为谈判筹码,在迫使贸易伙伴让步后,适度降低部分关税以换取政治成果。例如,对加拿大、墨西哥的关税可能在双方就移民毒品问题达成协议后取消或降低;对欧盟的汽车关税也许通过新的贸易谈判被搁置;对华关税或许在中国扩大采购或开放市场的交换下进行某些“阶段性取消”。

特朗普政府强调关税收入可以用于支持国内产业和基础设施,最终可能通过谈判对部分商品的关税略作回调,但在如新能源、半导体等关键领域的高关税预计将长期固化。如果经济在2025年下半年显著恶化,不排除特朗普政府被迫调整关税策略。

5.2 美国关税政策对货币政策的影响

在关税冲击下,增长前景恶化被认为将迫使美联储比原计划更早放松政策。投资者预计美联储可能在2025年下半年开始降息。摩根大通私人银行的分析指出,市场预期美联储年底前将利率降至3.5%左右,并认为增长风险将压倒通胀风险成为压低收益率的主要驱动因素。然而,一方面贸易战引发衰退担忧,另一方面关税推升的通胀又限制了央行放松的空间。这种政策两难增加了市场前景的不确定性。

假如关税长期维持,高企的进口税相当于美国对自身经济施加了一次滞胀冲击。若所有关税落实,由此推升的物价可能使美联储陷入两难:降息可能刺激通胀和资产泡沫,不降息经济又下行压力巨大。如果贸易谈判出现进展、关税部分解除,则有望改善增长预期,减轻通胀压力,美联储降息空间将打开,那时流动性改善将利好包括比特币在内的各类资产.

5.3 未来美国关税政策走向与对加密市场的潜在影响

如果贸易紧张能够在短期获得缓解,全球风险偏好回升,加密货币也可能迎来新一轮上涨行情。尤其是如果美联储得以顺利降息甚至重新扩表释放流动性,那么经历深度调整的比特币和以太坊有望重新走强。鉴于特朗普个人及其团队对加密货币相对友好的立场,如果经济向好,特朗普可能更愿意拥抱加密技术来吸引投资,例如推动数字资产监管改革、批准更多合规产品上市等。

相反,如果贸易战持久僵持甚至恶化,全球经济可能陷入衰退,传统金融市场低迷。在这种环境下,加密货币短期仍将与风险资产同跌。但经历洗礼后,比特币有机会在动荡中重新证明其价值储藏功能。当各国开启竞争性宽松、法币信用受损时,比特币作为不受央行滥发影响的稀缺资产,可能获得新一轮资金青睐。

六、结论

短期内,关税政策对加密市场的影响偏负面,市场在避险情绪中艰难寻底;中期来看,影响将取决于贸易战的演变路径和宏观对冲政策的效力,加密市场可能维持高波动、震荡筑底格局;长期而言,将推动全球经济金融体系向新的方向发展,在此过程中,比特币及整体加密资产或将获得意外的战略机遇。

无论结果如何,本轮关税冲击为加密行业提供了一次检验自身韧性的机会:比特币是否真能成为“数字黄金”,将在更长周期内接受考验。如果全球经济因保护主义而趋向碎片化,比特币有潜力成为连接各经济体系的价值锚和对冲工具。

关于我们

Hotcoin Research 作为 Hotcoin 生态的核心投研中枢,专注为全球加密资产投资者提供专业深度分析与前瞻洞察。我们构建"趋势研判+价值挖掘+实时追踪"三位一体的服务体系,通过加密货币行业趋势深度解析、潜力项目多维度评估、全天候市场波动监测,结合每周双更的《热币严选》策略直播与《区块链今日头条》每日要闻速递,为不同层级投资者提供精准市场解读与实战策略。依托前沿数据分析模型与行业资源网络,我们持续赋能新手投资者建立认知框架,助力专业机构捕捉阿尔法收益,共同把握Web3时代的价值增长机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。