撰文:KarenZ,Foresight News

在南亚次大陆的西北部,一个拥有 2.41 亿人口、年轻化程度极高的国家——巴基斯坦,正悄然孕育着一场有关加密货币的变革。

尽管在巴基斯坦加密货币市场目前仍游走于「灰色地带」,但随着用户基数的持续增长与监管框架的逐步明晰,这片土地有望崛起为南亚地区加密经济的重要枢纽。

4 月 7 日,赵长鹏宣布加入巴基斯坦加密货币委员会(Pakistan Crypto Council,简称 PCC)担任战略顾问。这一举措不仅凸显了赵长鹏在全球加密货币行业的影响力,也预示着巴基斯坦在加密货币领域将迈出里程碑式的一步。作为 PCC 官方战略顾问,赵长鹏将在监管框架、基础设施、教育普及和应用推广等方面提供指导,并与巴基斯坦政府及私营部门紧密合作,共同构建合规、包容且具备全球竞争力的加密生态系统。

借此契机,让我们深入了解巴基斯坦加密委员会的结构以及该国在加密货币领域的监管现状和采用情况。

巴基斯坦加密货币委员会架构

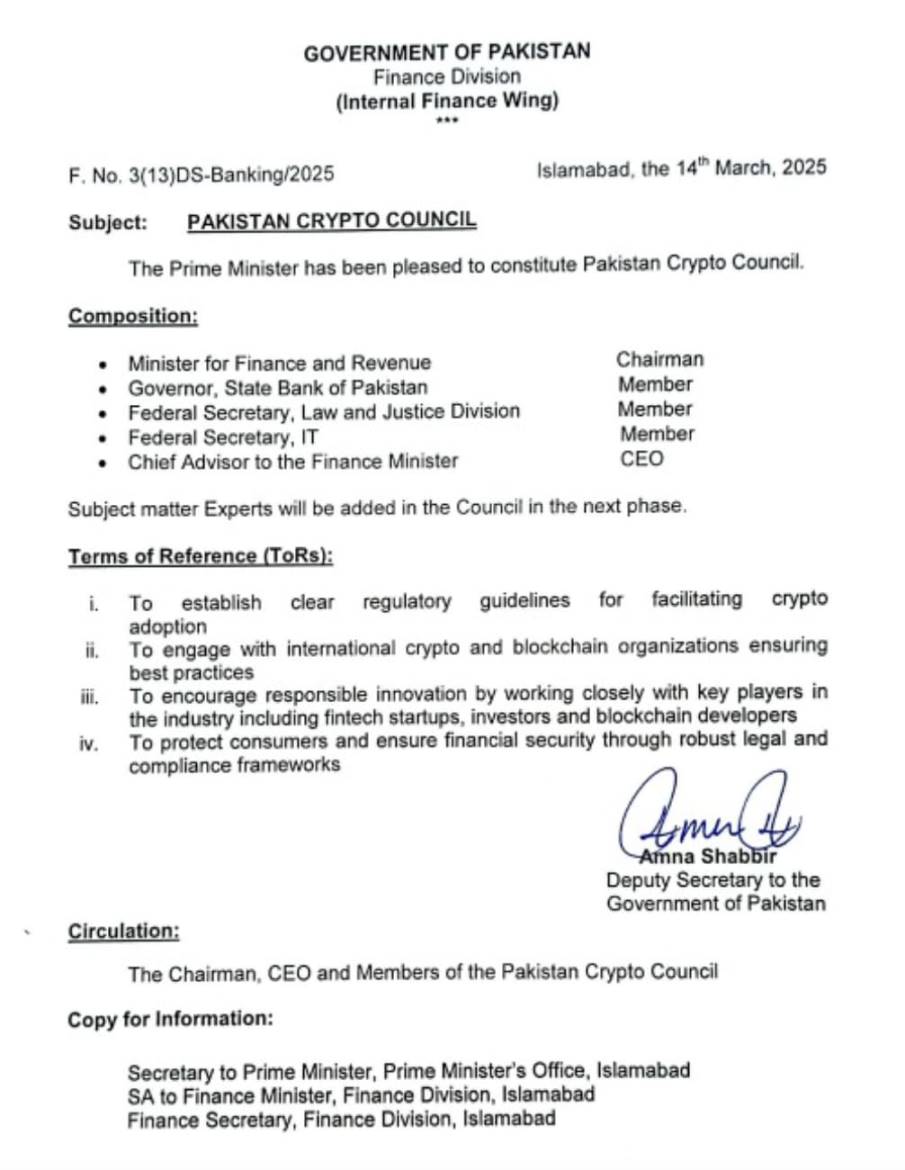

巴基斯坦加密货币委员会(PCC)于 2025 年 2 月由财政部提议设立,隶属于财政部,于 3 月正式宣布成立,主要职责是监督区块链技术和数字资产在该国金融领域的整合和采用。

该委员会的重点不仅限于监管,还旨在创造一个区块链和数字金融能够蓬勃发展的环境,避免因监管空白导致的市场乱象。此外,PCC 还致力于促进负责任的创新,在保护消费者和确保金融安全的前提下,推动加密货币技术在巴基斯坦的创新应用。PCC 组织架构如下:

财政部长 Muhammad Aurangzeb 担任该委员会主席,表明巴基斯坦政府对不断发展的数字经济的承诺。担任该委员会 CEO 的 Bilal bin Saqib 也是委员会财政部长的首席顾问。Bilal bin Saqib是一位来自伦敦的企业家,拥有伦敦政治经济学院(LSE)的社会创新与创业硕士学位,还曾入选福布斯 30 岁以下精英榜单 。在 Web3 领域,Bilal bin Saqib 是巴基斯坦 Web3 社区 Web3 Pak 创始人,还在非洲数字资产平台 Busha 是担任过增长顾问,也经常在一些加密相关活动上担任演讲者,分享区块链社会影响的经验。 除了在金融科技领域的工作之外,Bilal bin Saqib 此前还获得第 1632 届光点奖(英国首相授予为社区做出杰出贡献的个人的奖项),共同创立了非营利组织 Tayaba(为巴基斯坦水资源匮乏社区提供清洁水解决方案),并推出了 H2O Wheel(减轻农村社区负担的创新型水上运输设备)。2023 年,其因在新冠疫情期间的人道主义努力而被授予 MBE 勋章。

PCC 的直属董事会成员包括巴基斯坦国家银行行长、巴基斯坦证券交易委员会 (SECP) 主席、联邦法律部长和联邦信息技术部长。这种多元化的组合确保了监管监督、金融稳定、法律框架和技术进步等方面能与巴基斯坦的加密生态系统紧密契合。

巴基斯坦财政部长兼 PCC 主席 Muhammad Aurangzeb 表示,「我们正在向世界传递明确信号,巴基斯坦正敞开创新之门。随着 CZ 的加入,我们将加速实现将巴基斯坦打造成为 Web3、数字金融和区块链驱动发展的区域强国的愿景。」

巴基斯坦概括

巴基斯坦位于南亚次大陆西北部,南濒阿拉伯海,北枕喀喇昆仑山和喜马拉雅山, 东、北、西三面分别与印度、中国、阿富汗和伊朗接壤,是连接南亚、中东和中亚交汇处的关键国家。

巴基斯坦国土面积为 79.6 万平方公里。在人口结构方面,该国人口红利显著,是全球第五大人口大国,30 岁以下群体占到总人口的 60% 以上,自然地,劳动力数量在世界上也名列前茅。

根据巴基斯坦国家统计局 2024 年 7 月公布的第七次全国人口普查报告,巴基斯坦总人口已达约 2.41 亿,与 2021 年第六次人口普查时相比增长了 15.87%,年均人口增长率为 2.55%。约 79% 的人口未满 40 周岁, 其中 15 岁以下儿童占总人口的 40.56%,15 至 29 岁的青年占 26%。

在经济方面,巴基斯坦经济目前面临高通胀、外债危机、货币贬值等多重挑战,不过政府正通过国际援助、结构性改革和数字化发展寻求突破。

教育方面,巴基斯坦实行中小学免费教育,但学校数量不足,教育普及率均较低,再加之基础设施不足以及社会经济因素共同制约了教育进步。根据来自联合国儿童基金会的数据,目前,巴基斯坦失学儿童数量居世界第二位,约有 2500 万儿童(5-16 岁)无法上学,占该年龄段总人口的 44%。这种情况尤其在农村地区和女童中更为突出和严重。

基础设施方面,电力短缺和互联网普及率低(约 50%)限制了技术发展。值得一提的是,巴基斯坦的国教为伊斯兰教,伊斯兰教徒占全国人口总数的 97%。

巴基斯坦加密监管演进三部曲

巴基斯坦的加密监管目前处于从禁止向探索监管过渡的阶段。虽然法律上仍不明朗,但政府态度的缓和、国家加密货币委员会的成立、国际合作以及民间较高的采用率表明,该国可能会尽快出台更清晰的政策框架。

禁止阶段(2018 年到 2021 年):2018 年 4 月,巴基斯坦国家银行(SBP)发布的一项禁令显示:「虚拟货币不是巴基斯坦政府发行或担保的法定货币。建议所有银行、开发金融机构、小额信贷银行 / 公共服务组织 / 公共服务供应商等不要处理、使用、交易、持有、转移价值、推广和投资虚拟货币,也要求银行 / 开发金融机构 / 小额信贷银行不要协助其客户 / 账户持有人进行虚拟货币 /ICO 代币交易。任何此类交易应立即作为可疑交易报告给金融监控部门(FMU)。」该禁令也建议公众为了自身利益保持谨慎,不要参与与虚拟货币挖掘、交易、兑换、价值转移、推广和投资有关的活动,以避免任何潜在的财务损失和法律影响,但并未明确限制个人持有或 P2P 交易,但已将加密货币置于法律灰色地带。之后不久,巴基斯坦比特币交易平台 Urdubit 完全关闭。

探索阶段(2022 年至 2024 年):加密货币规模的不断扩张促使世界各地的中央银行和金融监管机构对加密生态系统展开研究与分析。2022 年,巴基斯坦国家银行(SBP)发布《加密资产——潜在风险和机遇以及全球的监管方法》报告,虽然重申了此前的虚拟货币禁令,但也指出加密资产因其便利性、匿名性、投机性等优势,在全球部分群体中越来越受到欢迎,并列举了加密资产面临的多项挑战,包括对货币政策的影响、对外汇制度和资本外逃的影响、金融稳定、被用于洗钱和恐怖主义融资、逃税等的风险等。

同年(2022 年)2 月份,根据巴基斯坦国家银行前行长 Reza Baqir 于 2022 年 2 月 6 日发表的《数字货币的崛起与未来之路》演讲,巴基斯坦正在经历从现金向数字支付的快速转变,拥有庞大的移动用户基础(1.89 亿电信用户、1.08 亿 3G/4G 用户等),为数字化提供了有利条件。巴基斯坦积极拥抱数字化转型,视其为金融体系发展的重大机遇,不过对私人数字货币却持审慎态度,认为虚拟货币的风险大于收益。同时,Reza Baqir 对 CBDC 持乐观看法,认为其可能助力包容性、创新及跨境支付。Reza Baqir 还呼吁监管机构不仅要制定规则,还要主动创新并推动金融生态发展。

不过在,2023 年 3 月份,巴基斯坦政府打算暂停该国网上提供的加密货币服务,以防止数字资产的非法交易。巴基斯坦前财政部国务部长 Aisha Ghaus Pasha 透露,巴基斯坦「永远不会将加密货币合法化」。

2023 年 6 月份,巴基斯坦国家银行宣布计划推出央行数字货币。2024 年 11 月份,联邦政府提议修改《巴基斯坦国家银行法》,使(央行发行的)数字货币在巴基斯坦合法化。新修正案还提出了对未经授权发行数字货币的处罚。任何被发现非法发行数字货币的人将被处以相当于非法发行价值两倍的罚款。

破冰阶段(2025):进入 2025 年,巴基斯坦对数字货币的态度发生了实质性转变,计划为加密货币交易创建法律框架,以吸引国际投资。今年 3 月份,巴基斯坦正式成立巴基斯坦加密货币委员会(PCC。该委员会 CEO Bilal Bin Saqib 提议利用该国的多余能源来推动比特币挖矿。

值得注意的是,2018 年巴基斯坦被金融行动特别工作组(FATF)列入「需加强监控的司法管辖区」(即灰名单),正因如此,政府和央行对加密货币的合法性与潜在风险进行审视。随着 2022 年 FATF 将巴基斯坦移出「灰名单」以及全球加密市场的繁荣发展,改善后的国际金融环境或许会为加密货币市场带来新机遇,但同时也伴随着更为严格的监管预期。Bilal bin Saqib 曾表示,PCC 还在探索诸如 RWA 和建立监管沙盒等举措,同时确保遵守 FATF 标准。PCC 的首要任务是建立一个强大且透明的监管框架,要求所有加密活动符合 KYC 和 AML 规定。

巴基斯坦加密货币采用情况

近年来,巴基斯坦加密货币的采用率显著增长,主要受经济不稳定、货币贬值、资本管制和年轻人口数字化程度高的推动。

巴基斯坦加密委员会 CEO Bilal bin Saqib 表示,巴基斯坦在全球加密货币采用率排名前十,估计拥有 2500 万以上活跃用户。巴基斯坦首先会对 BTC 挖矿、代币化和加密货币监管持乐观态度。Bilal bin Saqib 表示,该国正在就区块链技术以简化汇款流程。

Chainalysis报告也显示,巴基斯坦在加密货币采用率方面排名全球第九,印度、尼日利亚、印度尼西亚排名前三。

其次,巴基斯坦是全球第五大汇款接收国(2024 年约 330 亿美元),但传统渠道手续费高,这使得加密跨境汇款工具比较流行。

据 BeInCrypto 汇总,在巴基斯坦最流行的五个加密交易平台包括币安、Bitget、Bisq、OKX 和 Paxful(均支持 P2P 交易)。由于银行禁止直接进行加密货币交易,巴基斯坦用户通常会选择在 P2P 平台上广泛接受的替代支付方式,包括移动钱包和金融科技解决方案,如 JazzCash、Easypaisa 和 Redot Pay 等。

小结:机遇与挑战并存

加密货币有可能成为巴基斯坦对抗通胀、优化跨境支付的有力工具。此外,该国年轻且数字化倾向明显的人口结构,为加密货币和 Web3 技术的推广提供了天然优势。加密委员会的设立或许将通过教育普及和基础设施建设,加速这一进程。

值得一提的是,赵长鹏表示,其创立的 Web3 教育平台 Giggle Academy 可以向巴基斯坦失学儿童提供学习机会。除此之外,巴基斯坦加密委员会的成立可能会推动通过加密与区块链教育项目培训本地 Web3 人才,提升民众对加密货币的认知和接受度,还可能为巴基斯坦培养一批数字经济从业者。

除此之外,赵长鹏在加密行业拥有深厚经验,尤其是在应对全球监管挑战方面,可能推动 PCC 制定更清晰的监管政策,既能吸引外资,又能平衡风险。此外,此举本身就是向全球加密社区发出的信号——该国正积极拥抱 Web3 和数字金融,从而可能吸引国际资本关注巴基斯坦市场,并刺激巴基斯坦本地 Web3 创业生态的发展。

然而,巴基斯坦农村地区人口占比依然较高,互联网普及率和金融素养较低,电网相对陈旧,断电频繁,这可能成为推广加密货币的阻碍。

综上,巴基斯坦的加密货币采用正处于关键转折点。政府的积极信号表明其可能会尽快推出初步监管框架。若成功,这将释放巨大的市场潜力,尤其是在汇款和金融包容性方面。然而,基础设施改善和国际合规仍是关键挑战。此外,若巴基斯坦成功构建合规的加密生态,可能影响孟加拉国、伊朗等类似经济体的政策。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。