Source: Cointelegraph Original: "{title}"

On April 3, as concerns grew among investors about the global trade war and a weakening dollar, U.S. long-term government debt yields fell to their lowest level in six months. The 10-year Treasury yield briefly touched 4.0%, down from 4.4% a week earlier, indicating strong buyer demand.

U.S. 10-Year Treasury Yield (left) vs. Bitcoin/USD (right). Source: TradingView / Cointelegraph

At first glance, the increased risk of economic recession seems unfavorable for Bitcoin (BTC). However, the decline in fixed-income investment returns encourages allocations to alternative assets, including cryptocurrencies. Over time, traders may reduce their exposure to bonds, especially in the context of rising inflation. Therefore, the path for Bitcoin to reach a new all-time high in 2025 remains viable.

One might argue that the recently announced U.S. import tariffs negatively impact corporate profitability, forcing some companies to deleverage, thereby reducing market liquidity. Ultimately, any measures that increase risk aversion tend to have a negative impact on Bitcoin in the short term, especially considering its strong correlation with the S&P 500 index.

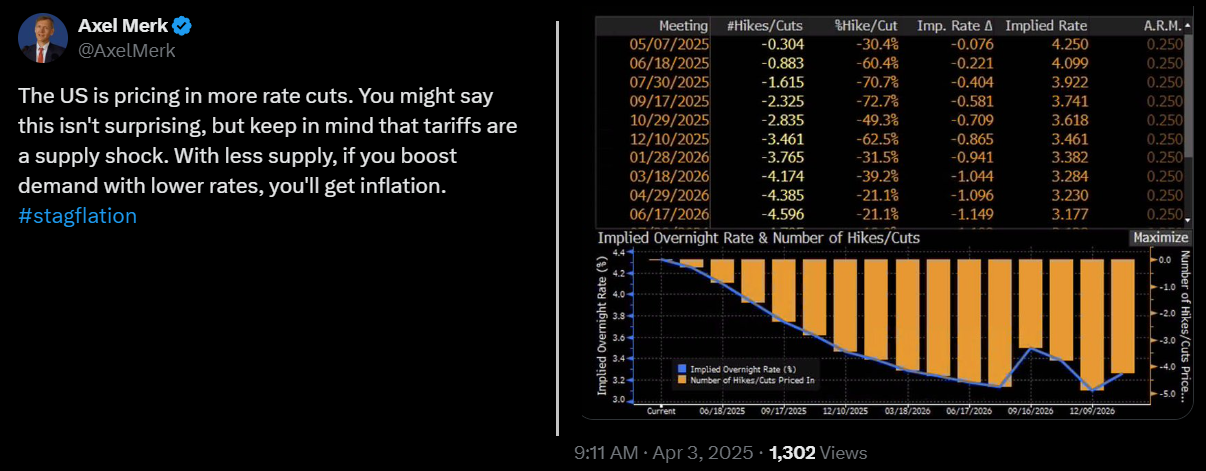

Axel Merk, Chief Investment Officer and Portfolio Manager at Merk Investments, stated that tariffs create a "supply shock," meaning that the availability of goods and services is reduced relative to demand due to rising prices. If interest rates decline, this effect could be amplified, potentially paving the way for inflationary pressures.

Source: X/ AxelMerk

Even for those who do not view Bitcoin as a hedge against inflation, the attractiveness of fixed-income investments would significantly diminish in this scenario. Additionally, if 5% of the $140 trillion global bond market seeks higher returns, the potential influx of funds into stocks, commodities, real estate, gold, and Bitcoin could reach $7 trillion.

The gold market's market capitalization has soared to $21 trillion, continuously setting new historical highs, and still has significant price appreciation potential. Higher prices allow previously unprofitable mining operations to resume and encourage further investment in exploration, mining, and refining. As production expands, the growth in supply will naturally limit the long-term bullish trend of gold.

Regardless of the trend in U.S. interest rates, the U.S. dollar has weakened against a basket of foreign currencies, as measured by the DXY index. On April 3, the index fell to 102, marking its lowest level in six months. Relatively speaking, the decline in confidence in the dollar may encourage other countries to explore alternative stores of value, including Bitcoin.

Dollar Index (DXY). Source: TradingView / Cointelegraph

This shift will not happen overnight, but the trade war may lead to a gradual move away from the dollar, especially among countries feeling pressure on the dollar's dominance. While no one expects a return to the gold standard or Bitcoin to become a significant component of national reserves, any movement away from the dollar strengthens Bitcoin's long-term upside potential and solidifies its position as an alternative asset.

From a macro perspective, Japan, China, Hong Kong, Macau, and Singapore collectively hold $2.63 trillion in U.S. Treasury bonds. If these regions choose to retaliate, bond yields could reverse their trend, increasing the cost of new debt issuance by the U.S. government and further weakening the dollar. In this scenario, investors may avoid increasing their risk exposure to stocks, ultimately favoring scarce alternative assets like Bitcoin.

It is nearly impossible to accurately gauge the market bottom for Bitcoin, but despite increasing global economic uncertainty, the support level at $82,000 remains strong, which is a positive sign of its resilience.

This article is for general informational purposes only and does not constitute and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed in the text are solely those of the author and do not necessarily reflect or represent the views and positions of Cointelegraph.

Related: Cryptocurrency stocks surge significantly as U.S. stock market rebounds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。