美元稳定币 - 美国维持美元霸权的战略棋子

斯科特·贝森特(美国财政部长)原话:“我们将维护美元世界主导储备货币的地位,并通过稳定币来实现这一目标。”

作为美元在全球金融体系中影响力的延伸工具,美元稳定币如何巩固美元霸权?

绕过资本管制,扩大美元跨境影响力:根据国际清算银行(BIS)2023年数据,全球约有 60 个国家实施资本管制,以限制美元在其境内的流动

拓宽支付渠道,提升支付效率:传统跨境支付(如 SWIFT 系统)平均耗时3-5天,手续费高达交易额的1%-3%

推动美国国债需求,强化美元金融基础:美元稳定币的储备资产通常包括短期美国国债,如 USDC

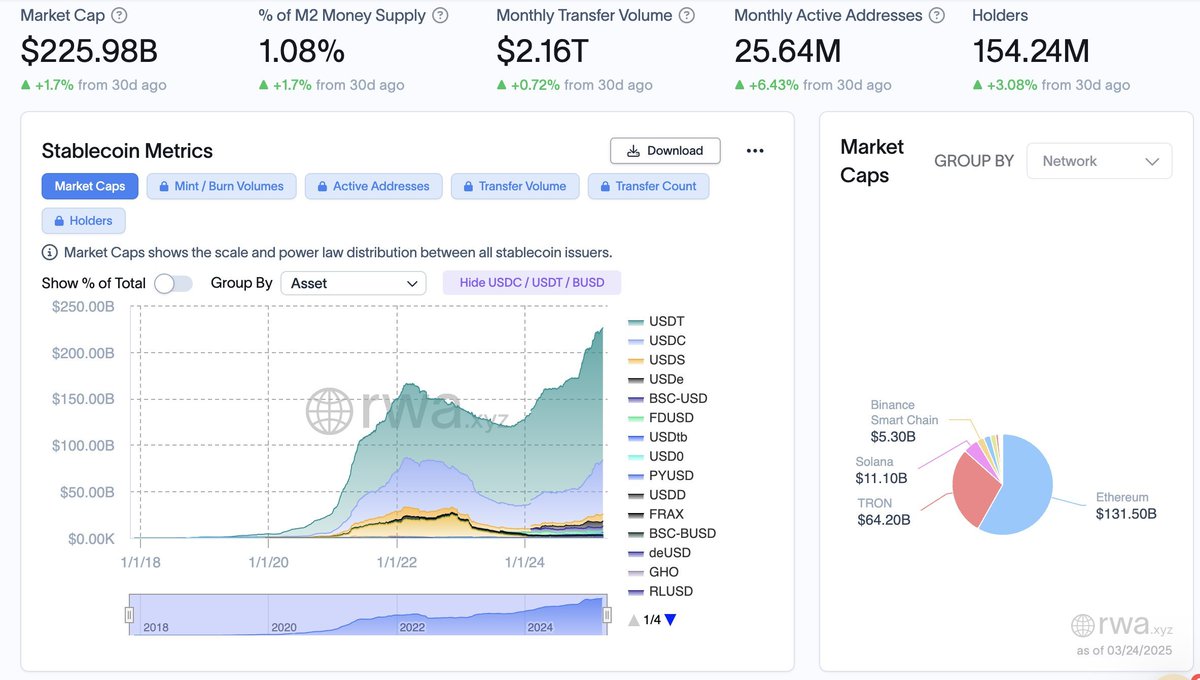

可以预见的是,由于政策上的强有力支持,特朗普任期内,整个 RWA 板块尤其是稳定币会迎来爆炸式增长。

MilkyWay 创始人 @jaybxyz 最近在 X 上提到的一些观点也令人印象深刻:

“2024 年,稳定币交易量超过了 Visa 和 Mastercard 的总和”。

“稳定币和 RWA 正在为下一个金融时代奠定基础”。

此前有数据显示, 2030 年 RWA 代币化可能解锁超过 10 万亿美元的链上价值,但现有解决方案缺乏适合机构采用的统一安全框架。错配即是机会,作为模块化生态中最大的流动质押与再质押协议,MilkyWay 也许可以考虑往 RWA 方向演进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。