撰文:深潮 TechFlow

从华尔街到区块链,“老鼠仓”并不是啥新鲜词汇。

只是,过去遮遮掩掩,老鼠们还是有些许羞愧之心,如今彻底摊牌,不装了。

2025 年初,特朗普发行 Meme 币,并以“加密战略储备”之名操弄市场。如今,特朗普挥舞关税大棒,玩起了川剧,反复变脸,将这场权力与资本的合谋推向了历史性高点。

当总统化身操盘手,监管沦为遮羞布,世界俨然成了巨型老鼠仓的竞技场——而你我,皆是局中猎物。

白宫变赌场:特朗普的变脸术

“由于超过 75 个国家已联系美国愿意谈判,且在我强烈建议下未以任何方式、形式或形态对美国进行报复,我已授权暂停 90 天,并在此期间大幅降低对其他国家的对等关税至 10%,立即生效。”

美股盘中,特朗普的这段社媒发言,让此前惴惴不安的美股三大指数大逆转,全线暴涨。

道指大涨超 2900 点,涨幅达 7.87%,创下自 2020 年 3 月 25 日以来的最大涨幅;标普 500 指数大涨 9.52%,为 2008 年 10 月 29 日以来的最大涨幅;纳指更是飙升 12.16%,创下历史第二大单日涨幅。

美股“科技七巨头”全线暴涨,总市值在短短一天内增加了 1.85 万亿美元(约合人民币 13.4 万亿元),而这一切仅发生在几小时之内。

令人玩味的是,特朗普本人在美股开盘后不久,便在其社交媒体平台 Truth Social 上发文称:“现在是买入的绝佳时机”。他还鼓励粉丝们“冷静点”,并预测“一切都会顺利解决”。

这番言论在当时看来似乎是对市场的鼓励,但结合后续发生的一切,不禁让人产生更多联想。

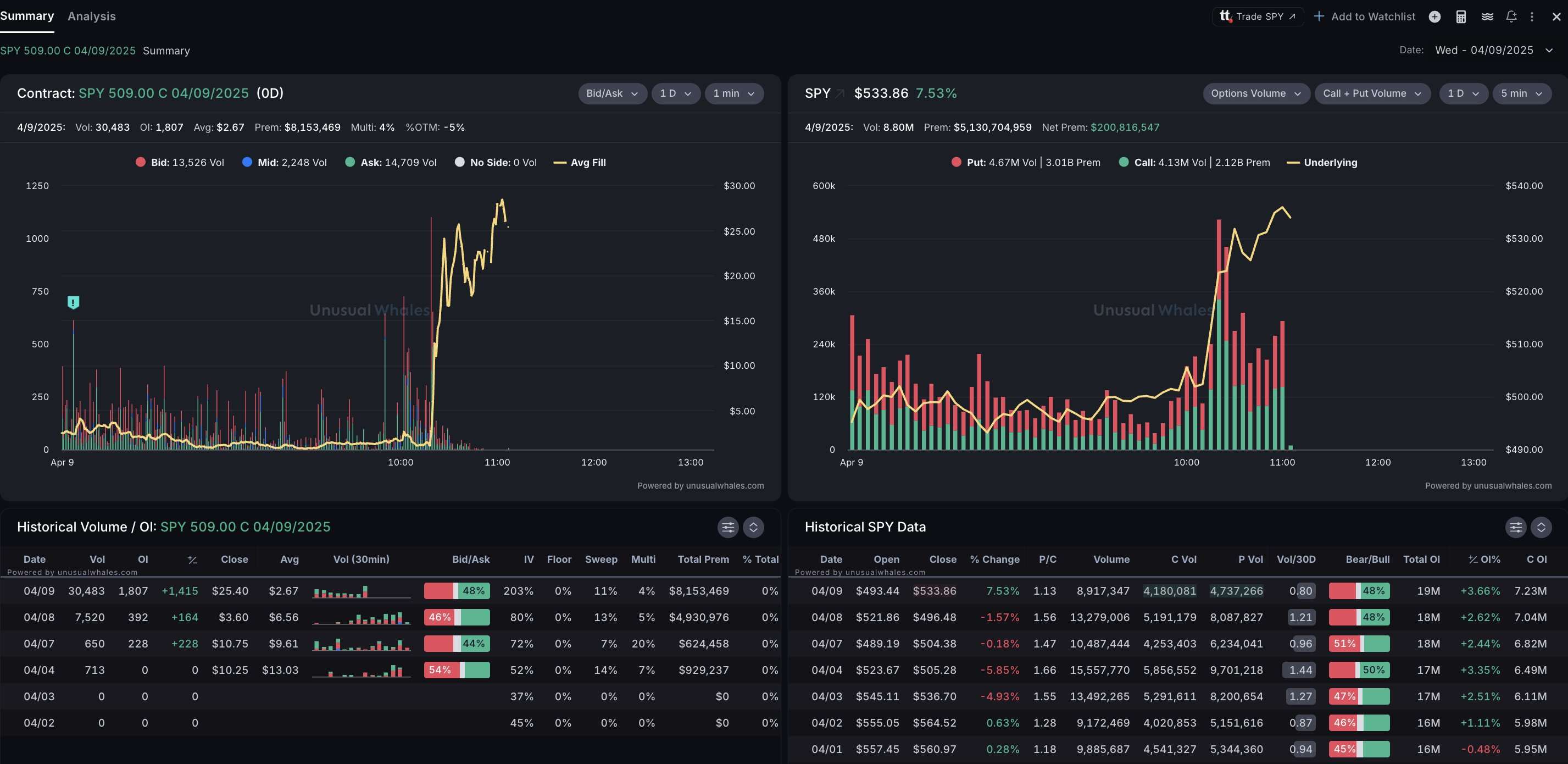

根据 Unusual Whales 披露的市场数据显示,在特朗普发布这条“买入”建议之前,就已经有交易者大量开设 $QQQ、$TQQQ 和 $SPY 看涨期权。更令人震惊的是,就在关税暂停消息公布前的关键时刻,有人开设了当日到期的 $SPY 509 看涨期权,这些期权在短短一小时内暴涨了惊人的 2100%!

所有交易量都是在当天新开仓的,这在当时市场波动率指数(IVR)高达 82、隐含波动率(IV)极高的情况下显得尤为反常。交易者们似乎对市场走向胸有成竹,坚定地进行了方向性押注。

使用净溢价数据追踪,可以清晰地看到,在这些开仓操作之后,更多投资者纷纷跟进,大量加载看涨期权,押注市场反转。这一切都指向一个令人不安的结论:有人提前知道了这一重大政策转变。

在 X 上,不少人对比表示不满却又无可奈何。

“特朗普利用总统职位为他的家人和朋友赚取数百万美元。”

“市场就像一个关系户的赌场,而我们只是赌桌上的傻瓜。”

更具讽刺意味的是,早在几天前,CNBC 就报道称特朗普正考虑对部分国家暂停征收 90 天关税。当时,白宫新闻秘书卡罗琳·莱维特迅速出面辟谣,称之为“假新闻”。

几天后,这则“谣言”竟变成了“遥遥领先的预言”。

特朗普玩弄币圈

这并不是特朗普今年第一次操纵金融市场,此前曾 2 次戏耍币圈。

2025 年 3 月 2 日,特朗普在社交媒体宣布将建立“加密货币战略储备”,直接推动 XRP、SOL、ADA 等代币暴涨。

正当大家好奇为什么不提 BTC,ETH,特朗普再度在社区媒体发文,称“很明显,BTC 和 ETH,以及其他有价值的加密货币,将处于储备的核心。我也喜欢比特币和以太坊”。

以太坊应声上涨。

不过,这些举措和动作更像是特朗普儿子的杰作,次子埃里克·特朗普在社交媒体上叫好:

我喜欢在周日宣布战略储备的天才之举,因为那时传统市场休市,华尔街也沉睡。散户投资者首次获胜。传统金融最好赶上来,否则很快就会灭绝。世界不再是周一到周五,早上 9 点到下午 5 点运转。

针对此次“喊单”,加密行业嘘声一片,也质疑特朗普家族成员或有大量老鼠仓行为参与其中。

2025 年 1 月,在特朗普 Meme 币的发行过程中,同样潜藏大量老鼠仓。

数据分析平台 Bubblemaps 指出,某 6QSc2 开头地址在 TRUMP 代币发布前 4 小时就已获得资金,并在代币发布的第一分钟,斥资 100 万美元购入 590 万枚 TRUMP。

随后该地址将全数 TRUMP 转出至 ff.sol 地址,接著又分发至 10 个地址,分批出售,套现数千万美元。

这仅仅只是老鼠仓的“冰山一角”,特朗普家族通过 $TRUMP 等 Meme 币已公开套现上亿美元,在本身缺乏监管的加密市场,特朗普更加肆无忌惮。

对于熟悉特朗普的人或许并不感到诧异,因为他在上一个任期也曾被质疑利用自己制造的内幕消息参与谋利。

2019 年,美国杂志《名利场》曾发表独家报道称,在特朗普一系列看似混乱的中美关税表态中,藏着一个利润极其丰厚的老鼠仓秘密。

以 6 月 28 日为例,在那一天最后 30 分钟的交易时间里,有人大手笔做多标普期货合约。

随后,特朗普在日本大阪宣布中美恢复谈判。在利好消息的刺激下,美股出现大涨。这笔大力做多的神秘资金,由此一周获利近 18 亿美元。

天下乌鸦一般黑,不仅是特朗普,白宫其他官员大多也是在金融市场叱咤风云的高手。

比如,民主党前议长佩洛西有着“国会山股神”的美誉,有着诸多傲人战绩:

2021 年 1 月,在拜登政府宣布向电动车提供补贴前,佩洛西丈夫保罗购买了价值百万美元的特斯拉股票;

2021 年 3 月,微软公司获得了美国国防部一笔 220 亿美元的 AR 作战头盔订单,股价暴涨前,保罗以低价买入了微软股票;

2021 年 7 月,在对美国大型科技公司进行反垄断调查之际,保罗做多谷歌,谷歌最终没受影响,股价大涨,保罗赚得盆满钵满;

2022 年 7 月,美国国会就一项芯片制造业补贴法案进行表决,该法案旨在向美国芯片产业提供 520 亿美元补贴,而保罗在数周前就已购入英伟达价值 100 万至 500 万美元的股票。

据 OpenSecrets 统计,2021 年,佩洛西夫妇的投资回报率高达 56.15%,2024 年,佩洛西的投资组合盈利了 70.9%,大大超过了标普 500 指数 25%的涨幅,也超过“股神”巴菲特(回报率 26%)、华尔街“精算之王”David Shaw、“量化投资之父”Jim Simons 等一众投资名将。

权力的傲慢:金融市场的终极霸凌

为什么我们如此讨厌老鼠仓?

因为这是特权阶层对遵守规则的普通人的霸凌。

在金融市场中,普通投资者辛勤研究、承担风险,追求的无非是:公平、公平还是公平。

当一国元首可以随心所欲地通过政策宣告来操纵市场,并让自己的亲信提前布局获利时,这已不仅仅是内幕交易的问题,而是权力对市场机制的彻底扭曲。

传统意义上的老鼠仓大多依靠内幕信息牟利,行事遮遮掩掩,至少还知道自己行为不光彩。

而如今,特朗普不仅直接创造内幕信息,更是公开宣扬,毫不遮掩,展现出一种“你们能奈我何”的姿态。

在这个被权力与资本深度绑架的时代,如果连最基本的市场公平都无法保证,那么所谓的全球化和自由市场经济,不过是权力精英们的一场独角戏罢了。

或许,这就是当代资本主义的终极形态——权力直接操控市场,精英阶层公然收割全球财富,而大多数人只能在这场巨大的老鼠仓游戏中充当无知的棋子

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。