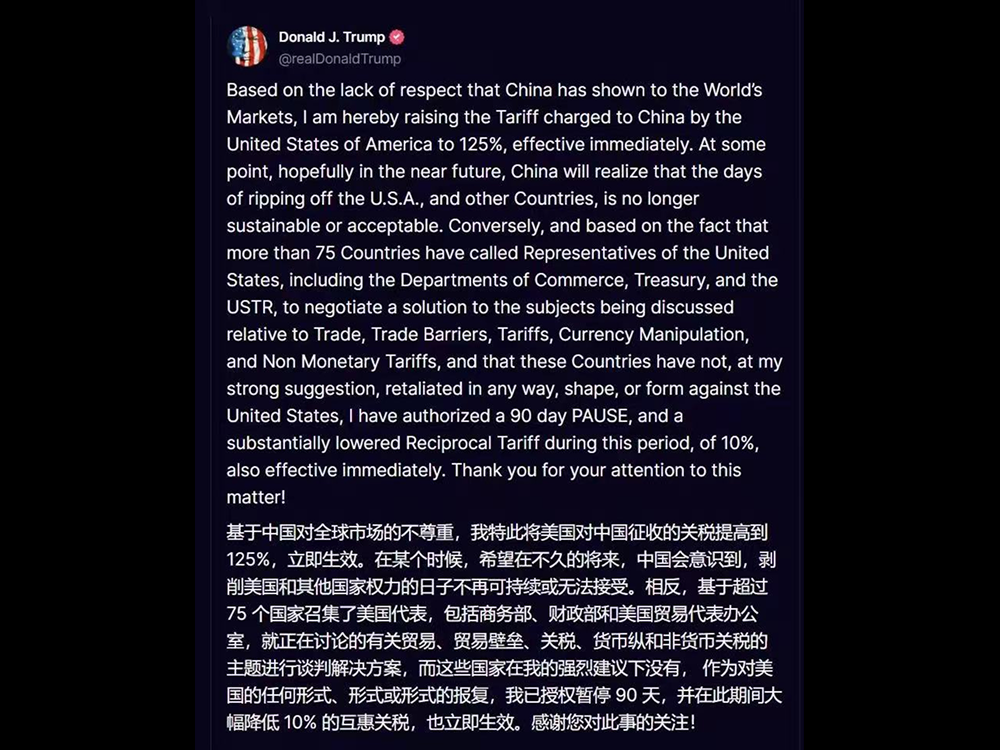

2025年4月10日凌晨,特朗普总统突然宣布将对中国的关税提高至125%,这一措施将立即生效,旨在惩罚中国“对全球市场的不尊重”,并为未来重新谈判贸易条款铺路。与此同时,美国政府决定对其他所有国家暂停新关税90天,且对等关税水平将下降10%。特朗普关税宣布后,比特币市场迅速上涨,24小时内上涨超过8%,突破82,000美元关口。

比特币K线分析:回撤后的强势反弹

根据AiCoin的比特币K线图,当前价格已经突破了前期的76,000美元区域,重新接近83,000美元。

K线形态分析:

比特币在4月10日凌晨的K线形成了一根强势阳线,收盘价大幅突破了前期的压力区(79,000美元),显示出明显的反弹动能。

Bollinger带:随着价格突破上轨,比特币短期内的波动性有所放大,显示出强烈的市场买盘力量。若能持续维持在布林带上轨附近,可能会进一步加大上涨空间。

量能与成交密集区:

从图中的成交密集区来看,价格刚刚突破了83,000美元的区域,意味着市场出现了新的支撑区域。这一突破表明,资金有流入迹象,且较为稳定的买盘支撑了当前的上涨。重要支撑位出现在77,391美元,如果价格下探该水平并有效支撑,市场有望迎来新一轮上涨。

技术指标分析:

- MACD:MACD的DIF线已突破DEA线,并且MACD柱状图逐渐增大,显示出上行动能的增强。当前MACD为多头排列,这是一个强烈的买入信号。

- RSI:RSI(14)目前位于66.51,接近超买区间,但尚未达到极限,显示出上涨动能仍有空间,市场尚未过热。

- OBV(能量潮):OBV显示资金持续流入,比特币的反弹得到了资金的支持。资金流入加速表明当前上涨趋势可能持续。

支撑与阻力:

- 支撑位:根据VPVR图表,当前支撑位在77,391美元,这是近期较为密集的成交区,预计价格如果回调至此,将面临较强的支撑。

- 阻力位:上方阻力较大,尤其是85,000美元区间,是比特币短期内的重要压力位。如果价格突破该区间,可能开启新的上涨浪潮。

市场情绪与资金流向:特朗普政策的影响

特朗普的关税政策无疑增加了市场的不确定性,但对比特币来说,更多的资金流入是一个利好信号。美国宣布暂停对其他国家的新关税,并降低对等关税水平,意味着全球贸易环境或将逐步恢复平稳。投资者的避险需求增强,资金流入比特币等数字资产,从而助推其价格上涨。此外,大额资金异动的迹象越来越明显。

今日走势预测

1. 短期预期:

如果比特币继续维持在83,000美元以上,并且未跌破77,391美元支撑位,则有可能挑战85,000美元的下一个阻力位。

预计今日(4月10日)的价格波动将在82,000美元至85,000美元区间内震荡整理。若突破85,000美元,将开启新一轮上涨,目标可看向90,000美元。

2. 中期展望:

中期内,比特币仍有上涨潜力,尤其是考虑到全球贸易环境的变化,以及技术指标的正面信号。如果价格持续维持在当前水平并突破阻力,可能会在接下来的几天内测试新的高点。

本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。

AiCoin官网:aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。