撰文:Penny

自从 4 月 3 日特朗普宣布对包括中国、日本、越南等主要贸易伙伴加征「对等关税」,全球各股市就开始经历不同程度的跳水——美股史诗级大崩盘,政策宣布后,纳斯达克指数期货单日跌幅达 4.7%,标普 500 指数期货跌 5%,道琼斯期指一度重挫 1822 点,截至 4 月 9 日,标普 500 指数较 2 月高点累计下跌 18.9%,市值蒸发 5.8 万亿美元,创 1950 年以来最严重四日连跌纪录;科技股成了这次股灾的「重灾区」,苹果股价四日暴跌 23%,微软、英伟达等七大科技巨头市值合计蒸发 1.65 万亿美元,这一冲击直接源于供应链中断风险——苹果 75% 的零部件依赖亚洲生产,关税成本传导压力巨大;彭博社统计显示,全球股市总市值缩水 10 万亿美元,越南股市单日跌超 6%,日经 225 指数暴跌近 3%,欧洲三大股指跌幅均超 1%。

覆巢之下安有完卵,全球投资者痛心疾首之时,特朗普自己在这场全球性的大暴跌中也不能幸免于难。

个人财富被「反噬」5 亿美元

根据《福布斯》4 月 8 日的报道,4 月 2 日特朗普宣布征收大规模关税计划时,他的身价估计为 47 亿美元,然而不到一周,其资产跌至 42 亿美元,一周蒸发 5 亿美元。其个人财富损失最大部分出自其名下 Trump Media and Technology Group 公司,该公司股价自 4 月 3 日以来下跌了约 5%,特朗普持有 1.1475 亿股,仅此一项就蒸发掉了约 1.7 亿美元的总资产金额。

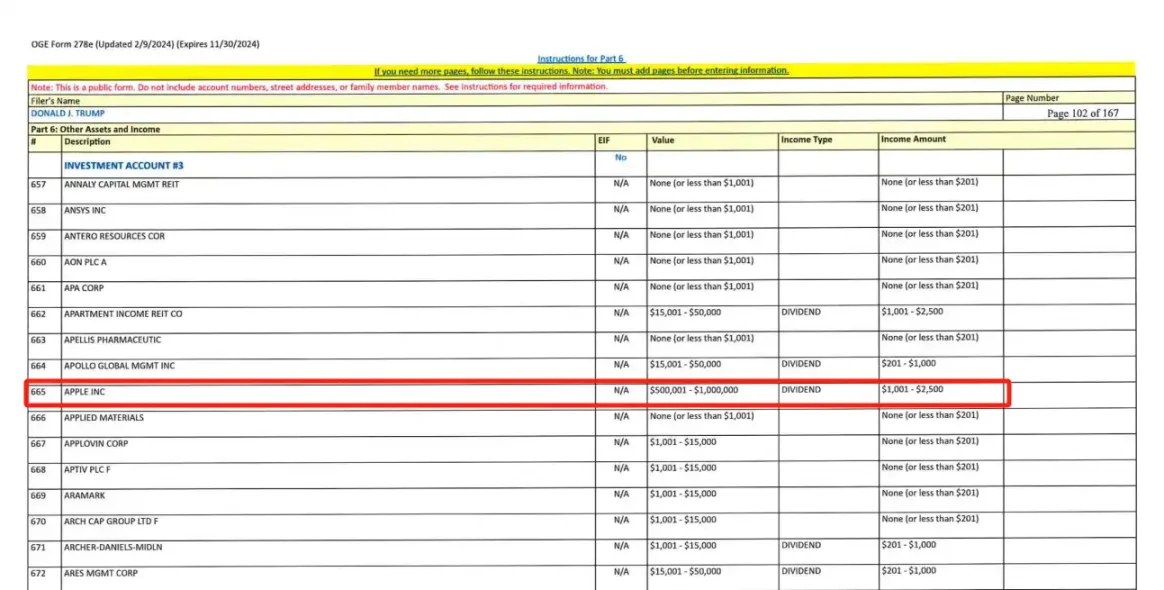

除此之外,特朗普还持有大量科技巨头股。根据联邦选举委员会(FEC)的规定,总统候选人必须在每年 5 月 15 日前提交个人财务披露报告,涵盖其资产、负债和收入来源,包括股票投资等,特朗普作为总统候选人,需遵守此规定进行披露。其最新披露的 2024 年报告显示,特朗普持有苹果、微软、英伟达、亚马逊、Alphabet(谷歌)、Meta Platforms、伯克希尔哈撒韦、百事可乐、摩根大通等股票,价值范围从 10 万美元到 100 万美元不等,其中苹果、微软和英伟达的持股价值均超过 50 万美元。仅上述股票价值总额就在 225 万到 475 万美元,若特朗普在披露后 8 个月内并未大幅变动股票仓位,暴跌将对其账面财富产生不小的冲击。

图源特朗普个人财务披露报告

此外,美国总统持有的房地产资产组合价值也在此期间从 6.6 亿美元缩水至 5.7 亿美元,减少了约 9000 万美元。其高尔夫相关资产也遭到损失,原因是专业店中售卖的许多高尔夫球、球杆及球衣均依赖进口。

除此之外,特朗普的家族加密项目 WLFI 也因交易 ETH 产生巨额亏损。4 月 9 日,据 Lookonchain 监测,疑似 WLFI 相关的钱包以均价 1,465 美元出售 5,471 枚 ETH,换得 801 万美元。该地址此前共花费约 2.1 亿美元买入 67,498 枚 ETH,均价 3,259 美元,当前账面浮亏已达约 1.25 亿美元。

世界首富人均亏损百亿起步

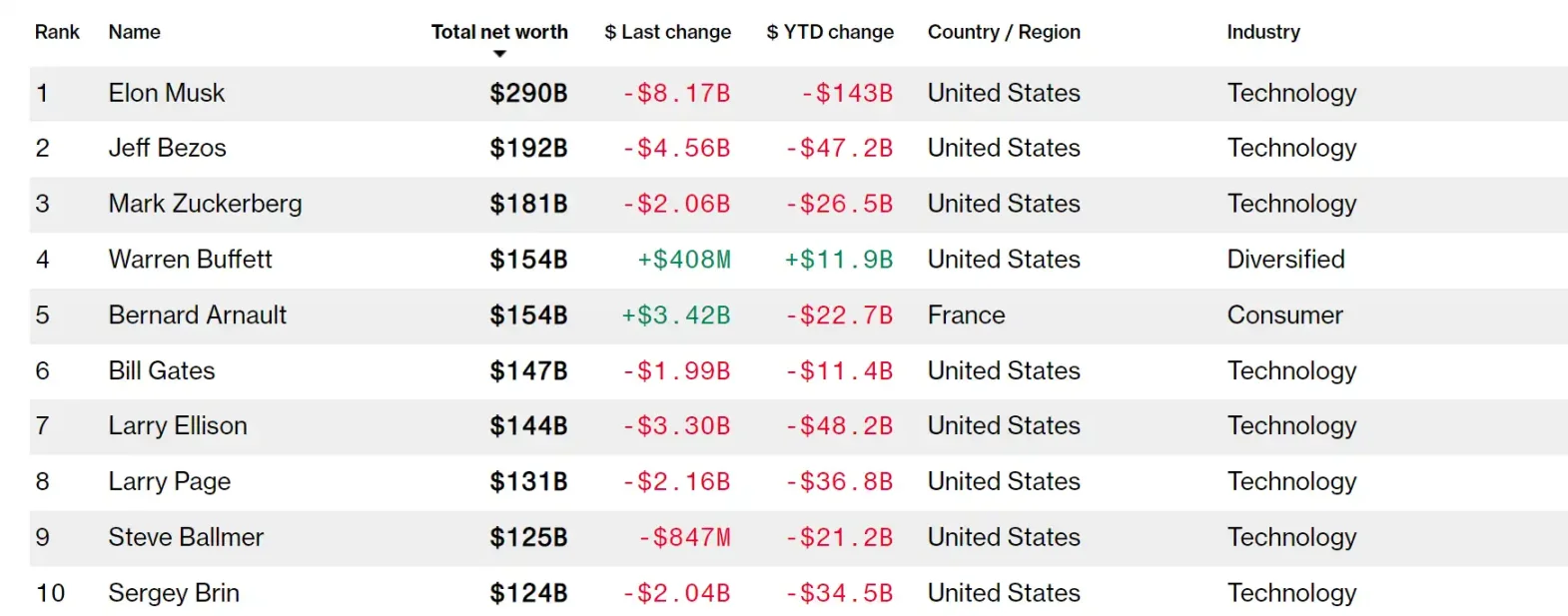

英国《卫报》报道称,自特朗普 4 月 3 日宣布加征关税后,截至 4 月 4 日收盘,全球 500 位富豪在股市交易的前两天共损失 5360 亿美元,是彭博亿万富翁指数有史以来记录的最大两天财富损失。其中,支持特朗普或参加特朗普 1 月就职典礼的几位富豪的财富都不同程度地缩水了,首当其冲的就是埃隆·马斯克、马克·扎克伯格等人。下图为彭博亿万富翁实时排行榜(截至 4 月 9 日)。

图为 4 月 9 日彭博亿万富翁排名

全球首富、特斯拉首席执行官马斯克在成为特朗普政府中备受瞩目和争议的人物后,其财富已大幅缩水,受到的打击最为严重,随着股价暴跌,到上周五收盘,马斯克的净资产蒸发了 310 亿美元。从今年年初到现在,马斯克的财富已经缩水了约 1430 亿美元,但他仍然稳坐世界首富宝座,净资产达 2900 亿美元。

Facebook 创始人兼 Instagram 和 WhatsApp 所有者扎克伯格的损失位居第二,达 270 多亿美元。这位全球第三大富豪的净资产估计为 1810 亿美元,因 Meta 市值暴跌而受到重创。由于关税战对科技公司打击尤为严重,该公司股价在两天内下跌近 14%。全球许多最大的公司都依赖亚洲市场进行制造、计算机芯片和 IT 服务,而亚洲市场是特朗普征收关税最严厉的国家之一。扎克伯格在特朗普上任几周前对 Meta 进行了一次引人注目的「特朗普转变」,今年迄今为止,他的个人财富已蒸发逾 265 亿美元。

亚马逊创始人兼华盛顿邮报所有者杰夫·贝佐斯的两天损失位居第三,达 235 亿美元。作为全球领先的进口商品销售商,亚马逊的市值今年已缩水数千亿美元。中国卖家占据了亚马逊第三方市场 50% 以上的份额,其云服务业务也主要依赖于亚洲地区制造商生产的技术。今年 2 月,贝索斯的 100 亿美元气候和生物多样性基金停止了对世界上最重要的气候认证组织之一的资助,一些人认为此举是向特朗普及其反对气候行动的立场「屈服」。贝佐斯是世界第二大富豪,净资产估计为 1920 亿美元,今年以来他的财富已蒸发 472 亿美元。

尽管经历了两天的暴跌,但并非所有亿万富翁的净资产都出现了缩水。巴菲特,这位精明的投资公司伯克希尔哈撒韦公司的董事长兼最大股东,今年的财富已增至 1540 亿美元。在为期两天的股市崩盘中,他的财富确实损失了 25.7 亿美元,但今年迄今为止,他的净资产已增加 119 亿美元。

特朗普的关税政策是一场将个人政治诉求与金融市场深度绑定的高风险实验。特朗普及世界其他首富在短短几天内财富巨量蒸发,不仅暴露了政策制定者与资本市场的利益冲突,更揭示了全球化时代「保护主义」的自我悖论——当政客试图用关税筑墙时,最先坍塌的往往是自己的财富帝国。对于投资者而言,这场风暴再次验证了一个铁律:在高度联动的全球市场,没有谁能真正独善其身。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。