本新栏目为 Odaily 编辑部成员真实投资经历分享,不接受任何商务广告,不构成投资建议(因为本司同事都很擅长亏钱),旨在为读者扩充视角、丰富信源,欢迎加入Odaily社群(微信@Odaily2018,Telegram交流群,X官方账号)交流吐槽。

本文涉及Meme价格、市值、持仓等相关数据均来自GMGN。

推荐人:南枳(X:@Assassin_Malvo)

简介:链上玩家,数据分析师,除了 NFT 什么都玩

分享:

1. 由上个月的持U+SOL配JLP中性对冲改为了偏空头策略,做空了一系列VC代币,包括VANA、SEI、ZK、MOVE等,并且逐步购入BTC现货作为空头回补。做空哪个代币可能更划算近期将出一篇文章,目前在推上有整理一个初步数据。

2.1 推荐大家在正常交易的时候考虑一下Backpack(不论是赚还是亏),只要不是故意刷量,应该能够得到有效的补贴,这与之前的在特定场景中使用UniversalX拿空投补贴逻辑相同,具体为费用等效、流动性(交易深度)等效并且明牌空投,但注意仅适用于交易几个主流币,其他代币实际上价差非常显著。

2.2 为何Backpack不刷量详见近期文章,关键结论为“盈亏金额/交易额是一个与积分获取效率高度正相关的因素”,刷量将显著降低该数值,从而将反撸与否完全交到项目方手中。

3. Meme开始重新回来玩Sol,titcoin到RFC到REMUS,重新呈现慢金的效应。BSC已全面跑路,资金上清仓BNB,主要基于UniX用U打多链,留下少部分SOL打内盘(基于dbot API的自编程低费用版)。

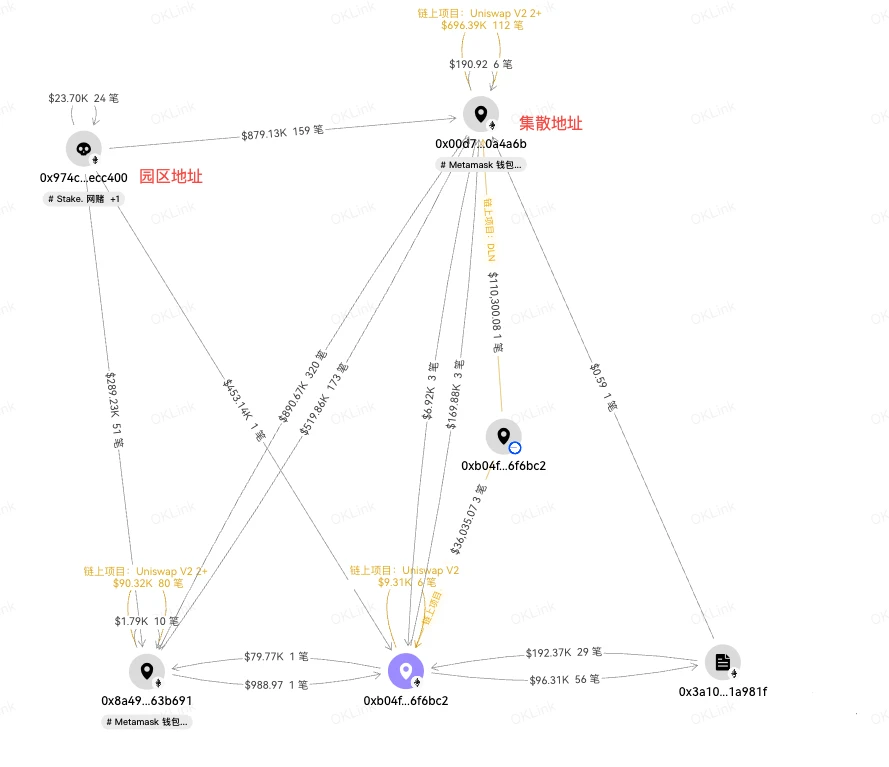

4. 与别人交流时,发现此前重点关注的一个地址实际上是菠菜相关,或许是找地址的一个好方案,但这个功能没有通用公开工具,随缘等交流。

推荐人:秦晓峰(X:@QinXiaofeng888)

简介:期权疯狗,Meme 接盘侠

分享:最近RFC热度起来了,这一波吃到了一些利润。

简单复盘一下操作,我是在3月31日上车RFC,当时市值已经1000万美元,但我研究了一圈后发现,这项目有很多名人关注,包括马斯克和Eric Trump,而且马斯克互动频次特别高。直觉告诉我,RFC可能是下一个Troll(巨魔),我也在推特和社群分享,按着头让几个朋友买了,最后大家也获得不错的收益。我个人是在4200万市值下车,本来计划波段一下,没想到直接起飞到6000万市值,最后无奈高点接回来了半仓。

对RFC的未来预期——1亿市值肯定没问题,短期目标应该是5亿美元,如果马斯克能持续不断地奶,冲破10亿美元市值也没问题。但是我并不看好它会成为第二个DOGE,RFC天花板大概在10亿美元左右。

另外,如果市场FOMO情绪起来或者币安上现货以及合约,可能会再助推一波,毕竟当下其实没什么大的叙事,RFC代表的智障亚文化算是不错的热点。

往期记录

推荐阅读

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。